Latest News

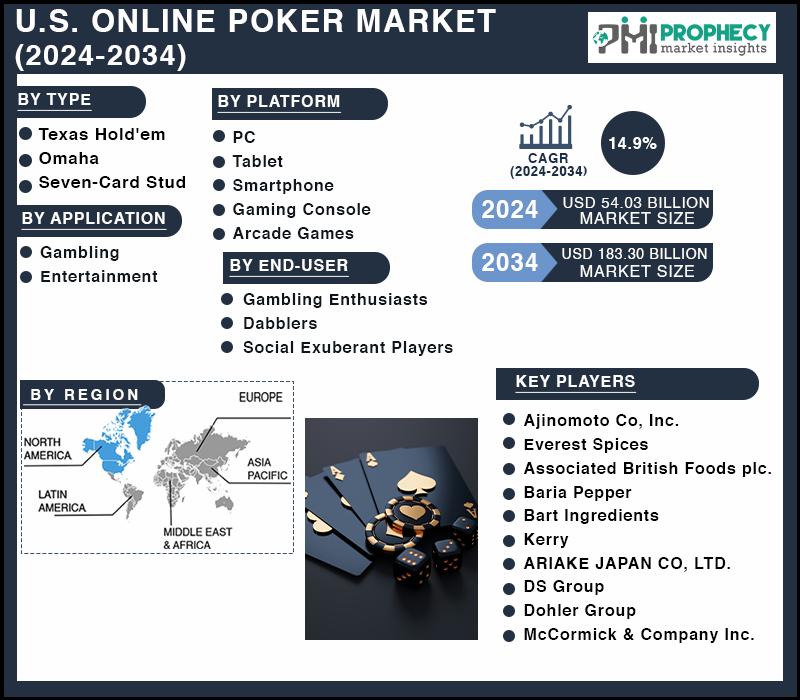

U.S. Online Poker (Gambling) Market Share Forecasted to Reach USD 183.30 Billion by 2034, at 14.9% CAGR: Prophecy Market Insights

| “U.S. Online Poker Market” from 2024-2034 with covered segments By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) Forecast, (2024-2034), which provides the perfect mix of market strategies, and industrial expertise with new cutting-edge technology to give the best experience. |

| Covina, Aug. 05, 2024 (GLOBE NEWSWIRE) — According to Prophecy Market Insights, the U.S. online poker market size and share is projected to grow from USD 54.03 Billion in 2024 and is forecasted to reach USD 183.30 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 14.9% during the forecast period (2024 – 2034).

U.S. Online Poker Market Report Overview In the game of online poker, a player gets to play against other opponents across the globe. This game requires one not only to choose among the several varieties of poker available, like Texas Hold’em, Omaha, and Seven-Card Stud, but also to log in to some websites that deal with online poker. Bets are made according to the strength of the hand with virtual chips. At the end of every round, the best hand collects the pot. Apart from anonymity, speed, convenience, and the number of tables, a player can play from anywhere with an internet connection, and many platforms allow a person to play at many different tables. The legal landscape of the U.S. online poker market has changed dramatically over the years. Big poker operators such as PokerStars and Full Tilt Poker used to be bigger players until legal complications and regulatory changes came hard on the industry after the events of Black Friday in 2011. The United States adopted state-by-state online gambling regulation, where certain states passed bills to legalize online poker and others were vehemently opposed. Today’s market is fragmented because only a few states allow regulated online poker. Other significant challenges include variations of the legislation among states, market fragmentation, pressure from new entrants and social gaming products, and fewer players. Still, potential growth might come out of the prospective legalization that is being considered by other states.

Our Free Sample Report includes:

Competitive Landscape: The U.S. online Poker Market is characterized by rapid growth, technological innovation, and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive. Some of the Key Market Players:

Analyst View: In the U.S. market, operators like PokerStars and Full Tilt Poker used to be small entities, but since Black Friday in 2011, a fragmentation process began, with legislation very different from one country to another, added pressure from new entrants, and social gaming products pressing on the industry. Improved technology has increased the reach of online poker to younger demographics, especially those who love mobile gadgets with user-friendly applications and responsive websites. Demographic changes at a rapid pace, like urbanization and lifestyle changes, have also significantly shifted people’s interest in these online gambling activities. Trends affecting the U.S. online poker market include changing laws and regulations that have enabled operators to invest, innovate, and develop their businesses around uniformity and clarity. The promulgation of specific licensing rules, consumer protection, and dispute resolution procedures has resulted in a more respectable and trustworthy sector for players regarding the integrity and fairness of the games. Market Dynamics: Drivers: Involvement of Technology

Demographical changes

Market Trends: Changes in Law and Regulation

Segmentation: U.S. online Poker Market is segmented based on Type, Application, and Region. Type Insights

Application Insights

Recent Development:

Regional Insights

The North American online poker market is complex and dynamic; the United States itself is a nascent yet potential jackpot in its entirety. It is characterized by state-by-state regulation against the patchy backdrop of laws and the 2011 “Black Friday” crackdown. Barring all odds, online poker has been legalized by a few states, and it is slowly gaining its lost glory. Some of the important states representing the market are New Jersey, Nevada, Delaware, Michigan, and Pennsylvania. Such challenges include regulatory uncertainty, market fragmentation, and black markets. Another challenge to the operators and players is the inconsistent regulatory environment from state to state. A contributing factor to this market fragmentation is the lack of interstate poker agreements that hold back player pools, killing competition in its tracks. Illegal online poker sites remain in operation, tainting the legal marketplace. Browse Detail Report on “U.S. Online Poker Market Size, Share, By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) – Trends, Analysis, and Forecast till 2034” with complete TOC @ prophecymarketinsights.com/market_insight/u-s-online-poker-market-5338

|

casino operator growth

Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators

Groove, the award-winning iGaming platform and aggregator, has emerged from ICE Barcelona 2026 as the definitive growth partner for ambitious operators in 2026.

The event marked a milestone for the brand, generating high-value partnerships and demonstrating strong market demand for an integrated, scalable, and commercially strategic platform.

Over the three-day summit, Groove positioned itself at the heart of strategic conversations with operators and providers seeking solutions for sustainable growth, market diversification, and deeper player engagement. With an unprecedented volume of meetings, a clear trend emerged: operators are moving beyond basic content access, seeking a collaborative, technology-driven partner to navigate global expansion.

“The energy and focus at ICE 2026 validated our core why: aggregation has evolved into a strategic growth discipline,” said Yahale Meltzer, Co-Founder and COO of Groove.

“Operators aren’t coming to us just for games—they are looking for a roadmap. They want a partner who can provide content, technology frameworks, and commercial tools, like Instant Tournaments, as a seamless growth engine. In a fragmented market, Groove’s integrated approach is not just an advantage—it’s a necessity for serious operators in 2026.”

Groove’s Strategic Edge: Global Content and Localized Growth

Groove’s unique ability to act as a single conduit for global content and localized strategy was a central theme at ICE. The platform’s agility enables operators to thrive in established regulated markets while tapping into high-potential verticals such as Sweepstakes and Crypto gaming. This differentiation empowers operators to diversify portfolios, increase revenue, and streamline operational efficiency.

“We engaged with operators who have concrete 2026 plans, from new entries in Latin America to strategic European expansions,” explained Giusy Campo, Business Development Director at Groove.

“My role is to translate platform capabilities into commercial velocity. At ICE, we moved decisively from concept to pipeline execution. The market recognizes Groove as a partner that delivers with precision.”

Partnerships and Collaboration: Driving Innovation

Groove strengthened its global network by connecting with game studios and exploring exclusive content and technical collaborations designed to deliver innovative gaming experiences faster.

“ICE is ultimately about partnership in its truest sense,” said Rachel Tourgeman, Head of Partnerships at Groove.

“The quality of dialogue with existing and potential partners was exceptional, covering hyper-localized game curation, tournament tools, and strategies for player retention. Groove’s model of acting as an extension of our partners’ teams—providing tools and strategic insight—is exactly what the market needs now.”

Looking Ahead: Defining Growth for 2026

Groove exits ICE Barcelona 2026 not merely as a platform provider, but as the go-to growth partner for the iGaming industry. With a fortified pipeline, strategic market mandate, and a focus on turning aggregation into accelerated growth, Groove is set to define the iGaming landscape in 2026, helping operators expand globally and engage players meaningfully.

For more information, visit groovetech.com.

The post Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

betting app engagement

Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games

During the latest NFL season, one of the most valuable arenas for sports betting engagement wasn’t online or at home—it was inside the stadium itself. Using insights from GeoComply Edge Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

From the season opener at Lincoln Financial Field in Philadelphia to the final Wildcard Weekend matchup at Acrisure Stadium in Pittsburgh on January 12, GeoComply analyzed in-stadium activity across every NFL venue located in US states with legal sports betting. The findings provide a clear, data-driven picture of how live attendance influences digital betting behavior.

The result is a uniquely detailed view into in-stadium engagement, customer acquisition, and long-term bettor value, offering operators critical insight into where and when fans are most likely to engage.

GeoComply Edge Stadium Data: Visibility Others Don’t Have

GeoComply Edge is purpose-built to measure fan acquisition and betting engagement within precise stadium-level geofences. This advanced location intelligence allows sportsbooks and operators to identify which teams, games, and venues generate the strongest engagement, turning live events into actionable growth opportunities.

Rather than tracking generic app usage, GeoComply Edge delivers insights into:

- Which NFL games drive the highest in-stadium betting activity

- How frequently fans check betting apps during live action

- Where new sportsbook accounts are created inside stadiums

- How engagement varies by venue, team performance, and market maturity

This season-long data view highlights how in-person fandom directly translates into digital wagering behavior, offering a deeper understanding of the customer journey.

Growth Leaders: Stadiums Where Betting Engagement Is Accelerating

Five NFL stadiums stood out for year-over-year growth in geolocation checks and active betting accounts—two strong indicators of in-stadium betting engagement.

In many cases, increased engagement closely followed on-field success. Teams such as the Denver Broncos, Pittsburgh Steelers, New England Patriots, and Carolina Panthers returned to playoff contention after turnaround seasons, reigniting fan excitement and digital interaction.

The Las Vegas Raiders emerged as a notable outlier. Allegiant Stadium continues to function as a destination venue, attracting traveling fans from across the country and creating a uniquely strong in-stadium betting environment, independent of team performance.

Engagement Rate Leaders: Quality Over Volume

While total geolocation volume remains important, the most telling metric this season was engagement rate—the percentage of fans inside the stadium actively using betting apps during games.

Top-performing venues recorded 10% to 13% engagement, meaning nearly one in every eight fans accessed a sports betting app at least once while attending a live NFL game. This highlights the growing normalization of in-game wagering as part of the live sports experience.

New User Acquisition: Stadiums as Sportsbook Growth Engines

One of the most compelling insights from GeoComply Edge data is the consistent creation of brand-new betting customers inside NFL stadiums.

Leading venues generated new sportsbook sign-ups at rates between 0.2% and 0.7% of total attendance per game. For a typical 65,000-seat stadium, that translates to 130 to 450 new accounts per game.

GEHA Field, home of the Kansas City Chiefs, led all venues in new customer creation, benefiting from Missouri’s launch of mobile sports betting on December 1, 2025, during the Chiefs’ final three home games.

Reducing Friction with Compliant Onboarding

GeoComply supports operators at every stage of the customer journey. Through IDComply®, the company enables a fully compliant KYC process that delivers 95%+ onboarding success rates, while GeoComply Edge pinpoints where and when these high-value acquisition moments occur.

This dual approach allows sportsbooks to engage fans in a way that is timely, targeted, and non-intrusive, enhancing both compliance and customer experience.

Doing More With “Where” at Live Sporting Events

NFL stadiums have evolved into digital engagement hubs, where live entertainment, mobile technology, and sports betting intersect in real time.

GeoComply Edge Stadium Data brings clarity to this intersection by providing:

- Actionable insights into in-stadium betting behavior

- Clear visibility into acquisition and engagement trends

- A season-long perspective beyond single-game analysis

As the NFL continues to grow and fan experiences become increasingly digital, one conclusion is unmistakable: the future of sports betting is already unfolding inside the stadium.

The post Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

betting brand marketing

Esportes da Sorte Secures Major Sponsorship for FIFA World Cup 2026 Broadcasts on SBT and N Sports

Leading Brazilian iGaming brand Esportes da Sorte has announced a high-profile sponsorship agreement for the FIFA World Cup 2026 broadcasts on SBT and N Sports, reinforcing its presence during one of the most influential sporting events in the world.

The partnership includes extensive brand activations throughout the entire tournament, spanning television, streaming, and digital media.

The sponsorship package delivers wide national exposure through SBT’s free-to-air broadcasts, simulcast coverage, the +SBT streaming platform, and the N Sports pay-TV channel. In addition to traditional broadcast placements, Esportes da Sorte will activate across the broadcasters’ digital ecosystems, including official websites, YouTube channels, and other owned digital platforms.

According to Marcela Campos, Vice President of the Esportes Gaming Brasil Group, which owns the Esportes da Sorte brand, the initiative strategically aligns the company with one of the largest moments of audience engagement in global sport. The FIFA World Cup represents a unique opportunity to amplify brand recall, increase engagement frequency, and strengthen emotional connections with football fans.

“The World Cup is a global event that concentrates attention, conversation, and excitement on an unparalleled scale. In Brazil, it represents one of the most powerful moments of sports audience mobilisation. Maintaining a consistent and high-frequency presence on SBT’s broadcasts allows us to expand our brand positioning and deepen Esportes da Sorte’s connection with the football fan experience,” Campos explained.

On television, Esportes da Sorte will feature prominently through promotional spots, opening and closing idents, commercial break placements, and video inserts. The agreement also includes sponsorship of a dedicated FIFA World Cup 2026 programme, airing throughout the competition, alongside integrated editorial content within the broadcasters’ schedules.

Digitally, the brand will be embedded within the official World Cup broadcasts on SBT and N Sports, while also appearing in additional content initiatives produced by both channels. This multi-platform strategy ensures comprehensive coverage of the tournament, maximising visibility and engagement across broadcast and online audiences.

With this partnership, Esportes da Sorte further cements its position as a major player in Brazil’s regulated iGaming market, leveraging the cultural power of football and the global reach of the FIFA World Cup to strengthen brand equity and long-term consumer affinity.

The post Esportes da Sorte Secures Major Sponsorship for FIFA World Cup 2026 Broadcasts on SBT and N Sports appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global7 days ago

Games Global7 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

Asia7 days ago

Asia7 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Compliance Updates7 days ago

Compliance Updates7 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda

-

BetPlay3 days ago

BetPlay3 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape

-

Latest News7 days ago

Latest News7 days agoALL THE ACTION, ALL THE DATES, POKERSTARS OPEN PHILADELPHIA SCHEDULE RELEASED