Latest News

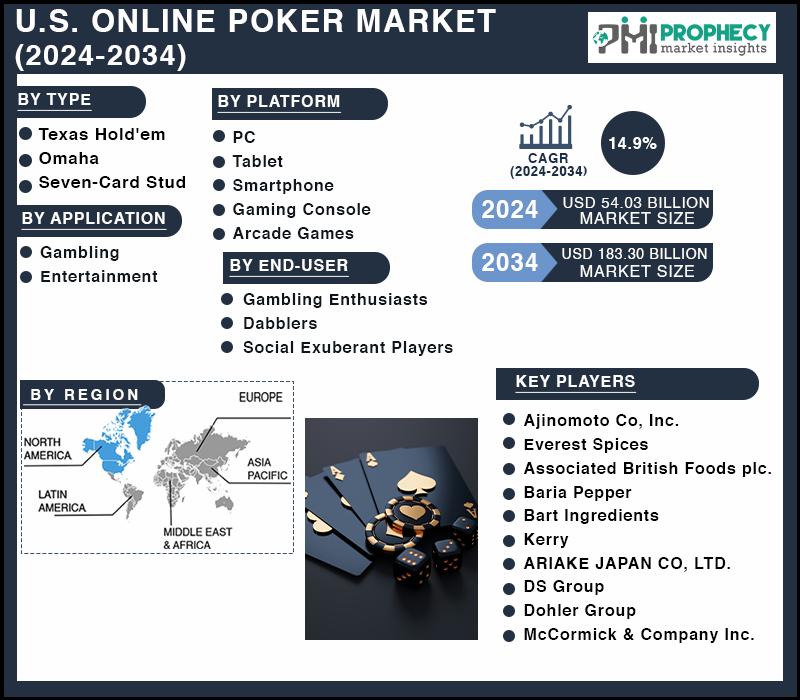

U.S. Online Poker (Gambling) Market Share Forecasted to Reach USD 183.30 Billion by 2034, at 14.9% CAGR: Prophecy Market Insights

| “U.S. Online Poker Market” from 2024-2034 with covered segments By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) Forecast, (2024-2034), which provides the perfect mix of market strategies, and industrial expertise with new cutting-edge technology to give the best experience. |

| Covina, Aug. 05, 2024 (GLOBE NEWSWIRE) — According to Prophecy Market Insights, the U.S. online poker market size and share is projected to grow from USD 54.03 Billion in 2024 and is forecasted to reach USD 183.30 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 14.9% during the forecast period (2024 – 2034).

U.S. Online Poker Market Report Overview In the game of online poker, a player gets to play against other opponents across the globe. This game requires one not only to choose among the several varieties of poker available, like Texas Hold’em, Omaha, and Seven-Card Stud, but also to log in to some websites that deal with online poker. Bets are made according to the strength of the hand with virtual chips. At the end of every round, the best hand collects the pot. Apart from anonymity, speed, convenience, and the number of tables, a player can play from anywhere with an internet connection, and many platforms allow a person to play at many different tables. The legal landscape of the U.S. online poker market has changed dramatically over the years. Big poker operators such as PokerStars and Full Tilt Poker used to be bigger players until legal complications and regulatory changes came hard on the industry after the events of Black Friday in 2011. The United States adopted state-by-state online gambling regulation, where certain states passed bills to legalize online poker and others were vehemently opposed. Today’s market is fragmented because only a few states allow regulated online poker. Other significant challenges include variations of the legislation among states, market fragmentation, pressure from new entrants and social gaming products, and fewer players. Still, potential growth might come out of the prospective legalization that is being considered by other states.

Our Free Sample Report includes:

Competitive Landscape: The U.S. online Poker Market is characterized by rapid growth, technological innovation, and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive. Some of the Key Market Players:

Analyst View: In the U.S. market, operators like PokerStars and Full Tilt Poker used to be small entities, but since Black Friday in 2011, a fragmentation process began, with legislation very different from one country to another, added pressure from new entrants, and social gaming products pressing on the industry. Improved technology has increased the reach of online poker to younger demographics, especially those who love mobile gadgets with user-friendly applications and responsive websites. Demographic changes at a rapid pace, like urbanization and lifestyle changes, have also significantly shifted people’s interest in these online gambling activities. Trends affecting the U.S. online poker market include changing laws and regulations that have enabled operators to invest, innovate, and develop their businesses around uniformity and clarity. The promulgation of specific licensing rules, consumer protection, and dispute resolution procedures has resulted in a more respectable and trustworthy sector for players regarding the integrity and fairness of the games. Market Dynamics: Drivers: Involvement of Technology

Demographical changes

Market Trends: Changes in Law and Regulation

Segmentation: U.S. online Poker Market is segmented based on Type, Application, and Region. Type Insights

Application Insights

Recent Development:

Regional Insights

The North American online poker market is complex and dynamic; the United States itself is a nascent yet potential jackpot in its entirety. It is characterized by state-by-state regulation against the patchy backdrop of laws and the 2011 “Black Friday” crackdown. Barring all odds, online poker has been legalized by a few states, and it is slowly gaining its lost glory. Some of the important states representing the market are New Jersey, Nevada, Delaware, Michigan, and Pennsylvania. Such challenges include regulatory uncertainty, market fragmentation, and black markets. Another challenge to the operators and players is the inconsistent regulatory environment from state to state. A contributing factor to this market fragmentation is the lack of interstate poker agreements that hold back player pools, killing competition in its tracks. Illegal online poker sites remain in operation, tainting the legal marketplace. Browse Detail Report on “U.S. Online Poker Market Size, Share, By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) – Trends, Analysis, and Forecast till 2034” with complete TOC @ prophecymarketinsights.com/market_insight/u-s-online-poker-market-5338

|

Free Ticket Drops

GGPoker Brings Back WSOP Super Circuit with Record $180M Guarantee

GGPoker, the world’s largest online poker platform, is set to host the highly anticipated 2026 WSOP Super Circuit online tournament series, running from March 1 to March 31.

This year’s edition features an unprecedented $180 million in guaranteed prizes, solidifying GGPoker’s reputation as the premier global poker destination.

Players will compete across 18 WSOP Gold Ring events, offering the chance to win one of poker’s most prestigious trophies and significant cash prizes.

Key Events & Highlights:

- #5: $525 Mystery Millions [Final Stage] – March 9, $525 buy-in, $10M GTD ($1M Top Bounty)

- #13: WSOP Super Circuit MAIN EVENT [Day 2] – March 23, $1,700 buy-in, $15M GTD

- #18: GGMillion$ High Roller [Day 2] – March 30, $10K buy-in, $10M GTD

Exclusive Champion Perks

Winners of all 18 Gold Ring events receive:

- A $5K WSOP Paradise package

- Recognition on the official WSOP Rankings leaderboard

$3 Million in Free Ticket Drops

Participants in any WSOP Super Circuit event can win WSOP Express tickets, $5K Ring Passes, or $10K Bracelet Passes. Tickets will be awarded randomly throughout the series, totaling $3 million in free prizes.

Live Coverage

Final tables for the Main Event (#13) and High Roller (#18) will be streamed live on GGPoker.TV and YouTube, hosted by Jeff Gross, with commentary by Daniel Negreanu for the High Roller.

Player and Ambassador Excitement

Daniel Negreanu said: “The 2026 WSOP Super Circuit at GGPoker is absolutely massive. With $180M in total guarantees, including $15M Main Event and $10M Mystery Millions, it’s the perfect time to compete for record-breaking prizes.”

The post GGPoker Brings Back WSOP Super Circuit with Record $180M Guarantee appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Casino Bonus Features

PopOK Gaming Unveils Macaco Millionario Dual-Grid Slot

PopOK Gaming has launched Macaco Millionario, a vibrant online slot inspired by Chinese symbolism and designed with an innovative double-grid bonus feature.

Rich red and gold visuals, lucky symbols, and a playful Macaco character combine to deliver a visually engaging and rewarding gaming experience.

The game features a 5×3 layout with 30 fixed paylines and two types of Wilds, including Double Wilds that count as two symbols for higher winning potential. The Double Fortune Free Spins round introduces an extra 5×3 reel set, allowing players to spin two grids simultaneously. Wins across both grids trigger multipliers up to x20, and retriggers extend the bonus for bigger payouts.

With a maximum multiplier of x1,732, Macaco Millionario delivers exciting bonus features, including Free Spins, Double Free Spins, Double Win Multipliers, Extra Spins, and a jackpot option. The game offers an RTP of 96.56% and supports bets from EUR 0.02 to EUR 100, fully optimized for web and mobile play. Multi-language support includes English, Brazilian Portuguese, Spanish, Chinese, and Hindi.

“Macaco Millionario blends cultural familiarity with a unique bonus structure that delivers thrilling moments in every spin,” said Tsovinar Elchyan, Head of Partnerships at PopOK Gaming. “The double-grid feature sets it apart from traditional slots, offering operators and players something truly innovative.”

The slot is now live and available for integration across all platforms supporting PopOK Gaming content. Operators interested in adding Macaco Millionario to their portfolios can contact PopOK Gaming directly.

The post PopOK Gaming Unveils Macaco Millionario Dual-Grid Slot appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

AI in lottery

Scientific Games Appoints Rich Wasserman as Senior Vice President of Product Engineering

Scientific Games has appointed Rich Wasserman as Senior Vice President of Product Engineering, reinforcing its commitment to advancing lottery systems technology and digital innovation.

Based in Atlanta, the global lottery provider continues to expand its technology leadership as one of the fastest-growing suppliers of retail and digital lottery solutions worldwide.

Leadership Experience from Amazon, Facebook and Stitch Fix

Wasserman brings more than 20 years of experience leading engineering, data science and product teams across high-performance technology platforms.

He previously held senior leadership roles at:

- Amazon

- Stitch Fix

At Stitch Fix, he served as Vice President of Engineering and Data Science, leading automation, AI-driven systems and platform optimization initiatives. Wasserman holds a Ph.D. in Electrical Engineering and a Computer Science degree from the University at Buffalo.

Driving Innovation Across Global Lottery Platforms

In his new role, Wasserman will oversee Product Engineering across Scientific Games’ global portfolio serving more than 150 government-regulated lotteries. His responsibilities include advancing:

- Retail lottery systems

- Digital lottery platforms

- Hardware and software innovation

- Data analytics and AI capabilities

- Consumer engagement technologies

CEO Pat McHugh stated that Wasserman’s experience scaling AI-powered platforms at world-class technology firms will help accelerate innovation and deliver next-generation lottery solutions focused on sustainable growth.

Strengthening Lottery Technology Leadership

Scientific Games continues to invest in technology, analytics and digital transformation to enhance consumer experiences across retail and online lottery channels. The appointment underscores the company’s strategy to integrate advanced analytics and machine learning into its global lottery ecosystem.

The post Scientific Games Appoints Rich Wasserman as Senior Vice President of Product Engineering appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Blueprint Gaming5 days ago

Blueprint Gaming5 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming7 days ago

Big Daddy Gaming7 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Brais Pena Chief Strategy Officer at Easygo7 days ago

Brais Pena Chief Strategy Officer at Easygo7 days agoStake Goes Live in Denmark Following Five-Year Licence Approval

-

Dan Brown5 days ago

Dan Brown5 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™