casino

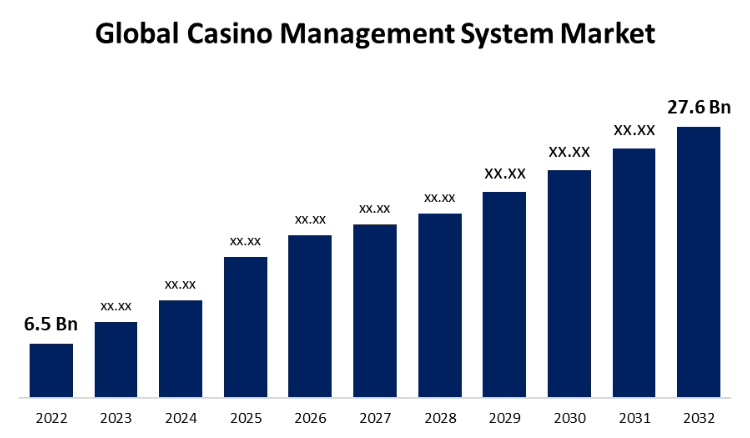

Global Casino Management System Market Size To Exceed USD 27.6 Billion By 2032 | CAGR of 15.5%

The Global Casino Management System Market Size is to Grow from USD 6.5 Billion in 2022 to USD 27.6 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 15.5% during the projected period.

With growing concerns over theft and fraud, the risk landscape in contemporary casinos is always shifting. Since casinos have a variety of entry and departure points as well as daily sizable amounts of financial transactions, it is challenging to maintain security generally at these establishments. On busy evenings, a lot of individuals walk through the doorways, making it difficult for security staff to keep track of everyone’s movements. The market is expected to grow due to current gaming security systems that are better and a tendency toward better management in casinos.

A casino management system is a tool or software application that controls and manages casino operations. The organization of gaming device operations is made easier by this technology, which also enhances visitor services. A casino management system divides the workforce among multiple workstations to ensure that each division has enough staff. Due to casino management systems, slot machines, bookmakers, and bingo parlors may all be simply maintained. Because of growing concerns about theft and fraud, the risk climate in contemporary casinos is always changing. Since casinos have a variety of entry and departure points as well as daily sizable amounts of financial transactions, it is challenging to maintain security generally at these establishments. On busy evenings, a lot of individuals walk through the doorways, making it difficult for the security staff to keep track of everyone’s movements. The market is expected to grow due to current gaming security systems that are better and a tendency toward better management in casinos. During the anticipated term, the popularity of online gambling is likely to have an impact on revenue at conventional casinos. Due to the accessibility of online platforms, users may log in and play anytime they want from the comfort of their homes. With an easy-to-use mobile device like a smartphone or tablet and an internet connection, you may skip the headache of casino gambling.

The table games segment dominates the market with the largest revenue share over the forecast period.

Slot machines, table games, and other games are the segments of the worldwide casino management system market based on modules. The market leader among these is the sector for table games, which is expected to have the highest revenue share over the projected period. The growth in popularity of table games including baccarat, roulette, red dog, blackjack, and craps across all regions is one reason for the segmental expansion. Demand for the category will rise as more young people engage in table gaming.

The analytics segment is witnessing significant CAGR growth over the forecast period.

The market for casino management systems is divided into accounting, security & surveillance, player monitoring, marketing & promotions, analytics, and others based on the application. Among them, the accounting segment is expected to experience a considerable CAGR increase. The various financial transactions that take place in casinos have led to an increase in the adoption of security and monitoring systems. To help owners stop fraud, theft, and cheating on game club floors, these systems incorporate many technology, such as facial recognition, license plate readers, and other analytics. Companies that provide casino management systems are constantly looking to create and incorporate new technology to address security challenges. Ensuring a secure gaming environment is one of the primary causes driving the adoption of security and surveillance in CMS.

The resorts segment is expected to hold the largest share of the global casino management System market during the forecast period.

The hotels and resorts, casino resorts, and other end-users segments make up the global market for casino management systems. Among them, the resorts sector is anticipated to account for the greatest market share for casino management systems during the anticipated time frame. The category of resort casinos is anticipated to dominate the market for casino management systems. During the projected period, developing casino resort facilities in well-known tourist destinations and increased consumer spending on leisure activities are expected to produce a significant percentage of the market for casino resorts. A large portion of the market for casino resorts is also predicted to come from the several governments who have established well-known places for gaming and leisure travel.

North America dominates the market with the largest market share over the forecast period.

North America dominates the market with the largest market share during the forecast period. The oversaturated casino business and the proliferation of technology are the two key issues preventing the development of casino management systems in the region. Rising CMS use to improve operational performance, retain customers, and gain a competitive edge will fuel market expansion. In North America, the online gaming market has been expanding quickly. A substantial number of gamers have been attracted to online casinos by their accessibility and ease. Many conventional casinos have created online platforms as well to capitalize on this expanding industry. On the other hand, Asia Pacific is anticipated to experience the quickest growth during the projection period. Furthermore, it is believed that relaxing regulatory restrictions to permit gambling clubs in Asia Pacific will promote regional growth. Throughout the projected period, benefits from tax payments are also expected to boost demand for casino management systems. The CMS market is growing throughout Europe and the rest of the world because of a variety of causes, including the quick rise in disposable income, shifting consumer preferences, and rising social acceptance of gambling clubs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Casino Management System Market include Ensico CMS d.o.o., WIN Technologies Limited, Novomatic, Apex Pro Gaming s.r.o., CT Gaming, Tangam Systems, Table Trac, Inc., Evona, Casinfo Systems, Agilysys NV LLC and among others.

Recent Developments

- In November 2022: In Lower Brule, South Dakota, Table Trac, Inc. collaborated with the Golden Buffalo Casino and Motel. As part of the collaboration, the developer and provider of casino information and management systems will roll out its specialized casino management system, CasinoTrac.

- In October 2022: The animated Wheel of Fortune 4D Collector’s Edition and Wheel of Fortune Cash Link 2 video slots are among the standout game titles in the Wheel of Fortune Slots Zone, which International Game Technology PLC has announced will open at the OYO Hotel & Casino in Las Vegas. The Wheel of Fortune Megatower, the largest IGT cabinet, is also located in this area.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global casino management system market based on the below-mentioned segments:

Casino Management System Market, Module Analysis

- Slot Games

- Table Games

- Others

Casino Management System Market, Application Analysis

- Accounting, Security & Surveillance

- Players Tracking

- Marketing & Promotions

- Analytics

- Others

Casino Management System Market, End-Users Analysis

- Hotel and Resorts

- Casino Resort

- Others

Casino Management System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Brazil

Brazil: Regulation, market dynamics and tax pressure shape a new phase for iGaming

The past week has clearly highlighted how the Brazilian iGaming and sports betting market is moving into a more structured, institutionalized and, at the same time, more demanding phase.

Decisions by the federal government, official data released by the Ministry of Finance, and private initiatives focused on regulatory intelligence point to an ecosystem that is leaving behind its experimental stage and entering a cycle of regulated consolidation.

More than isolated developments, recent events reveal a shift in posture by both public authorities and market participants.

Brazil is no longer treating the sector merely as a new source of tax revenue, but increasingly as an industry that requires governance, legal predictability, systemic oversight and clearly defined enforcement mechanisms.

This approach repositions the country on the international radar, bringing it closer to more mature jurisdictions and raising the level of responsibility for all stakeholders involved.

At the same time, the rapid expansion in the number of authorized operators, the broadening of the regulatory scope beyond B2C activities, and the advancement of the tax debate are creating a more competitive and selective environment.

Operating in Brazil continues to offer scale and growth potential, but it now requires strategic planning, robust compliance capabilities and continuous monitoring of the political and regulatory landscape.

The themes that defined the week help illustrate how Brazil is laying the foundations for its new phase in iGaming — one in which growth, institutional control, market intelligence and tax pressure move in parallel and begin to define who is truly prepared to remain and compete in the medium and long term.

Regulation moves beyond operators

One of the most relevant developments of the week was the launch of a public consultation by the Ministry of Finance to discuss regulatory requirements applicable to suppliers within the betting and iGaming sector.

The initiative is being led by the Secretariat of Prizes and Betting (SPA), the body responsible for implementing and supervising the regulated market, currently operating under the Ministry headed by Fernando Haddad.

Until now, Brazil’s regulatory process has been heavily focused on B2C operators.

With the new consultation, the scope expands to encompass the entire value chain that supports the ecosystem, including technology providers, gaming platforms, aggregators, betting systems, payment methods, KYC, AML, anti-fraud and compliance solutions.

In practical terms, the government is signaling its intention to establish minimum operating criteria, technical responsibilities and compliance standards for suppliers as well, reducing grey areas and operational risks.

The proposal

The proposal follows the logic adopted in more mature regulated markets, where oversight is not limited to consumer-facing offerings but extends to the technological and financial infrastructure behind the operation.

For supplier companies, this represents a significant structural shift.

In addition to increasing adaptation and compliance costs, regulation is likely to redefine commercial relationships, requiring closer alignment between licensed operators and their technology partners.

At the same time, it creates a more predictable environment, with clearer rules and lower exposure to regulatory risk in the medium and long term.

The move also reinforces a clear political message: Brazil does not intend to build its regulated market with a purely permissive or revenue-driven approach.

The expansion of the regulatory scope indicates a strategy of systemic control, aimed at sustainability, operational integrity and greater institutional credibility in the eyes of investors and international bodies.

Official operator list confirms accelerated expansion in Brazil

The publication by the Ministry of Finance of an official list of 184 platforms authorized to operate in Brazil’s regulated online betting market confirms the speed at which the sector has expanded since the new legal framework came into force.

The list, released by the Secretariat of Prizes and Betting (SPA), includes operators deemed eligible to operate in the country under the rules established by the federal government.

The figure is striking not only for its size, but for what it represents in terms of competitiveness and market maturity.

In just a few months, Brazil has moved from a largely unregulated landscape to a formally structured ecosystem, with authorization criteria, compliance requirements and centralized supervision.

According to the Ministry of Finance itself, the publication of the list aims to provide market transparency, guide consumers and signal which companies meet the legal requirements to operate while the licensing process is finalized.

It also serves as a tool to organize the sector at a time of transition from an informal market to a fully regulated model.

As the ecosystem becomes increasingly crowded, simply holding a license ceases to be a competitive advantage and becomes a minimum condition for remaining in the market.

Competition is likely to shift toward factors such as operational efficiency, financial robustness, brand positioning, cultural adaptation to the local audience and the ability to operate within a more stringent regulatory environment.

For international operators, the list also serves as a barometer of global appetite for the Brazilian market, now viewed as one of the most promising — and simultaneously most challenging — among newly regulated jurisdictions.

The full list of authorized platforms is available on the official federal government website.

Data and Intelligence take center stage

Oddsgate launches “Brasil On Track”, a strategic platform for Brazil’s regulated iGaming market

Oddsgate has announced the launch of “Brasil On Track”, a strategic platform designed to help operators and ecosystem participants navigate Brazil’s regulated iGaming market.

The initiative was presented on February 5, 2026, at a time when Brazilian regulation marks its first year under Law 14.790/2023, which introduced greater legal clarity, a defined tax structure and compliance requirements for the sector.

“Brasil On Track provides real-time monitoring of regulatory milestones, market indicators and operational requirements, connecting legal updates to direct business impact and linking directly to official sources,” Oddsgate stated in its launch announcement.

The platform was designed to transform regulatory complexity and legal obligations into a continuous, accessible intelligence framework.

Its features include:

- live tracking of regulatory updates and pending legislation; an operational map translating legal changes into practical compliance actions

- market intelligence on player demographics and key performance indicators

- visibility into tax structures, licensing stages and market entry requirements; and specific focus areas covering KYC (Know Your Customer), AML (Anti-Money Laundering), self-exclusion tools, consumer protection and responsible gaming.

According to Oddsgate’s Director of Regulatory Affairs, Valter Delfraro Jr., Law 14.790/2023 marked a milestone that “ended years of uncertainty and provided legal security and operational clarity.”

He emphasized that this new phase places Brazil’s gaming sector on equal footing with mature markets, increasing international competitiveness and attracting global investors.

“We have transformed regulation into a practical, ongoing guide to operating in Brazil with less risk and greater clarity,” added Wagner Fernandes, Oddsgate’s Chief Marketing Officer, noting that the platform is designed to equip teams entering, expanding or optimizing operations in the country.

The launch of “Brasil On Track” comes amid a rapidly evolving regulatory environment in Brazil, where, according to official data from the Ministry of Finance, the sector generated approximately BRL 36 billion in gross gaming revenue between January and September 2025, with BRL 3.3 billion collected in federal taxes during the same period — highlighting the scale and dynamism of the national market.

The arrival of this tool reflects a growing demand for structured market intelligence, indicating that operators and suppliers are seeking not only news and updates.

But solutions capable of integrating regulatory data with real-time operational and strategic insights.

Taxation moves to the center of the debate

While regulation advances and the market becomes more organized, the tax debate has emerged as one of the most sensitive issues of the moment, both for the government and for industry participants.

The possibility of a total tax burden of up to 42% on iGaming and sports betting is no longer merely theoretical; it is being actively discussed with direct political and economic implications — including in exchanges between Finance Minister Fernando Haddad and industry representatives.

Commenting on proposals to increase taxation, Pietro Cardia, legal director of the National Association of Games and Lotteries (ANJL), warned that tax hikes above international standards could undermine the economic performance of companies operating legally and compliantly in Brazil.

João Fraga, CEO of payment solutions provider Paag, highlighted that tax changes in such a young market could directly impact business strategies, particularly less than a year after operations began under the new regulatory framework.

Organized industry groups have also publicly reinforced the need to balance tax collection with the sector’s ability to compete in a market where illegal operators remain strong.

Organizations such as the Brazilian Institute for Responsible Gaming (IBJR) stress that if tax policy focuses solely on revenue generation without a parallel strengthening of enforcement against unlicensed operators, regulated players may lose ground to the informal market, increasing risk and eroding fiscal revenues.

This discussion returns to the center of the agenda at a time when the Ministry of Finance and the National Congress are debating broader fiscal adjustments in the country — debates in which betting taxation has been explicitly mentioned as part of wider revenue-raising proposals.

The weight of this tax burden is being assessed not only in numerical terms, but also in terms of its impact on investment in product development, technology, compliance and consumer protection, placing operators and suppliers in a dilemma that goes beyond a simple cost calculation.

A larger, clearer — and more demanding market

The week’s developments point to a common denominator: Brazil is rapidly moving toward a more structured, but also more rigorous, regulated market. There is greater legal clarity, stronger institutional control and increased competition, but also higher costs and far less room for improvisation.

For those monitoring Brazil as part of an international strategy, the moment calls for careful analysis. The country continues to offer scale and potential, but now demands regulatory maturity, fiscal planning and a long-term perspective.

The consolidation of iGaming in Brazil is entering a decisive phase.

The combination of broader regulation, growth in the number of operators, professionalization of market intelligence and rising tax pressure is shaping a more predictable — and at the same time more selective — environment.

Brazil is definitively leaving behind the status of a disorganized emerging market and operating under clearer rules and constant oversight.

For companies viewing Brazil as part of a global strategy, this is a moment that requires measured reading and well-calibrated decisions.

Scale potential remains high, but so do entry and operating costs, along with the need for compliance, efficiency and differentiation.

The market is likely to continue growing, but in a more rational manner, favoring players prepared to operate in a regulated, competitive and increasingly tax-intensive environment.

The post Brazil: Regulation, market dynamics and tax pressure shape a new phase for iGaming appeared first on Americas iGaming & Sports Betting News.

casino

PlayStar Expands New Jersey Casino Offering with Greentube Content Integration

PlayStar has expanded its online casino offering in New Jersey through a new content partnership with Greentube, the NOVOMATIC Digital Gaming and Entertainment division.

This fresh integration now makes a selection of the supplier’s top titles available on PlayStar, adding both recent releases and established games that have performed consistently across regulated US markets.

The launch is also an action of PlayStar’s ongoing strategy to broaden its content portfolio with suppliers that have a proven track record of success in the United States.

New additions to the PlayStar online casino include Greentube’s latest titles, such as Piggy Prizes : Wand of Riches

: Wand of Riches 2, Firecracker Frenzy

2, Firecracker Frenzy : Empress Wealth and Starlight Jackpots

: Empress Wealth and Starlight Jackpots : Odds of the Gods. These are complemented by several established games familiar to US players, including Charming Lady’s Boom, Silver Lux Big Win Spinner, and Thunder Cash

: Odds of the Gods. These are complemented by several established games familiar to US players, including Charming Lady’s Boom, Silver Lux Big Win Spinner, and Thunder Cash – Dolphin’s Pearl

– Dolphin’s Pearl .

.

The selected titles newly featured on the platform were ultimately chosen for their suitability to the New Jersey market and for their demonstrated performance with American audiences. Greentube has been active in the US since 2021, supplying localised content to a growing number of regulated jurisdictions.

For PlayStar, the agreement supports its focus on delivering a curated casino experience tailored to local player preferences, while maintaining a broad mix of recognised and newer titles. For Greentube, the launch marks further expansion of its US distribution footprint, this time in the Garden State.

Commenting on the collaboration, Director of Gaming Operations at PlayStar, Duncan Hamilton, said: “Greentube has built a strong reputation in the US for delivering high-quality, engaging titles, and we’re thrilled to bring their games to our players in New Jersey.

“This partnership supports our mission to provide a premium, curated casino experience, and we’re confident that Greentube’s content will be a standout addition to our portfolio.”

Patryk Igras, Sales and Key Account Manager at Greentube, said: “This strategic partnership marks a significant milestone in Greentube’s ongoing expansion in the US, bringing a diverse portfolio of trusted, high-quality online gaming content to PlayStar’s growing player base.

“Together, we aim to elevate the gaming experience in New Jersey by delivering innovative titles, seamless gameplay, and a strong commitment to responsible entertainment.”

The post PlayStar Expands New Jersey Casino Offering with Greentube Content Integration appeared first on Americas iGaming & Sports Betting News.

casino

SweepsPulse Arrives with Real Testing, Real Sweepstakes Casino Reviews, and Real Results

A new player-focused analysis platform is entering the sweepstakes casino arena with a promise that stands out in an industry often dominated by promotional language: real testing, real reviews, and real results. SweepsPulse officially launches as a transparency-driven resource at a time when players increasingly demand clarity, accuracy, and honest reporting about the platforms they choose to spend time on.

While sweepstakes casinos continue to attract millions of users, many players struggle to identify which operators deliver reliable performance, fair promotions, and smooth prize redemption. SweepsPulse aims to close that information gap by relying on a structured, hands-on testing model designed to mirror the complete player journey – from sign-up to redemption.

Covering Industry’s Need for Honest, Test-Based Coverage

The sweepstakes casino sector has grown exponentially in recent years, with new platforms emerging almost monthly. Game catalogs have expanded, reward systems have evolved, and promotional mechanics have become more complex. Yet despite this growth, one persistent issue remains: many players feel unsure about what to expect when they join a new platform.

Most sweepstakes review sites operate heavily within the industry’s affiliate ecosystem, often relying on operator-supplied descriptions rather than firsthand analysis. SweepsPulse was created to challenge that norm by offering evaluation methods grounded entirely in real user experience.

Its editorial mission is built around three simple commitments:

- No assumptions – only documented results

- No promotional shortcuts – only hands-on testing

- No vague opinions – only verifiable insights

This approach positions SweepsPulse as a reliable resource for players who want clarity before they spend hours evaluating platforms independently.

Real Testing That Mirrors the Full Player Journey

SweepsPulse’s defining feature is its commitment to actual, end-to-end testing. Every platform reviewed undergoes the same procedure, carried out by testers who interact with the site the way a normal player would.

This testing model includes:

- Registering an account to measure ease of onboarding

- Exploring promotions to confirm bonus accuracy and usability

- Playing across game categories to test stability, performance, and mobile optimization

- Submitting support inquiries to evaluate responsiveness and clarity

- Initiating prize redemptions to measure verification steps and real-world processing times

This data-backed methodology ensures that players receive insights rooted in fact, not theory. By documenting testing results with consistency and precision, SweepsPulse provides a reliable view of what players can genuinely expect.

Real Results: The Data That Powers SweepsPulse

SweepsPulse bases every review on measurable results rather than opinion. The platform tracks redemption approval times, verification delays, bonus-to-value conversion efficiency, multi-device game loading speeds, customer-support responsiveness, and the frequency of usability issues. These data points reveal the real patterns players experience.

One of the lead testers summarized the mission clearly:

“If the numbers don’t support it, we don’t publish it.”

Regular testing has shown that some operators process prize requests within hours, while others frequently require extra documentation that extends timelines significantly. This level of detail helps players make decisions based on real performance, not assumptions.

Key Data Points SweepsPulse Tracks

| Data Type | What It Reveals |

| Redemption approval times | How quickly operators process prize requests |

| Verification delays | When and why documentation is requested |

| Bonus-to-value efficiency | Whether promotions deliver meaningful progress |

| Game load performance | Stability across devices and sessions |

| Support responsiveness | Speed and accuracy of customer assistance |

| Platform errors | Frequency of interruptions or usability issues |

These insights form the foundation of SweepsPulse’s review model.

Helping Players Understand Promotion Mechanics

Promotion mechanics are one of the biggest sources of confusion in sweepstakes casinos. Players often struggle to distinguish between engagement-based rewards, prize-eligible bonuses, streak-driven incentives, daily claim systems, and coin economies. SweepsPulse breaks these systems down so players know which promotions offer real value and which exist mainly to increase activity.

The platform’s reviews explain how bonus coins convert to prize-eligible progress, which promos provide steady value, what restrictions affect new users, and why some attractive-looking bonuses yield limited results. By simplifying these mechanics, SweepsPulse helps players make more intentional choices.

How SweepsPulse Evaluates Promotions

| Promotion Type | What Players Learn |

| Engagement rewards | When they add value vs. when they don’t |

| Prize-eligible bonuses | How they affect progress toward redemption |

| Streak incentives | How reset rules impact rewards |

| Daily/weekly systems | What consistency players can expect |

| Coin-conversion mechanics | How coins translate into real progress |

These explanations help users distinguish high-value opportunities from low-impact distractions.

A Transparency-Driven Approach in an Often Confusing Market

Transparency remains a major problem in the sweepstakes space. Players routinely encounter unclear terms, inconsistent redemption rules, vague bonus descriptions, and shifting verification timelines. SweepsPulse works to reduce these issues by highlighting incomplete policies, reporting mismatches between advertised features and real testing results, evaluating communication clarity, and tracking operator rule changes.

This approach allows players to avoid surprises and choose platforms that communicate responsibly.

Tools and Features Designed to Support All Types of Players

SweepsPulse is rolling out player-focused tools including comparison charts, redemption dashboards, bonus-value filters, clarity scorecards, and mobile performance ratings. These tools make it easier for users to evaluate operators quickly without having to sort through lengthy promotional material.

Helping Players Stay Prepared for a Fast-Changing Industry

The sweepstakes industry changes constantly. Operators update prize-eligibility rules, modify verification requirements, introduce new bonus structures, expand game libraries, and adjust recurring promotional cycles. SweepsPulse monitors these changes so players remain prepared for how shifting mechanics may affect their progress.

By monitoring these trends, SweepsPulse ensures its reviews and recommendations stay relevant as the ecosystem develops.

With its launch, SweepsPulse brings a new level of rigor, transparency, and player advocacy to the sweepstakes casino landscape. Its commitment to real testing, real reviews, and real results sets it apart in a market where promotional noise often overshadows practical insights.

Players seeking clarity – whether they are exploring sweepstakes casinos for the first time or evaluating advanced features – now have a reliable guide built around accuracy, fairness, and user-focused evaluation.

Follow SweepsPulse:

The post SweepsPulse Arrives with Real Testing, Real Sweepstakes Casino Reviews, and Real Results appeared first on Americas iGaming & Sports Betting News.

-

ACMA6 days ago

ACMA6 days agoACMA Blocks More Illegal Online Gambling Websites

-

CEO of GGBET UA Serhii Mishchenko6 days ago

CEO of GGBET UA Serhii Mishchenko6 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Aurimas Šilys6 days ago

Aurimas Šilys6 days agoREEVO Partners with Betsson Lithuania

-

Canada5 days ago

Canada5 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News5 days ago

Latest News5 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe6 days ago

Central Europe6 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Acquisitions/Merger5 days ago

Acquisitions/Merger5 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™5 days ago

Firecracker Frenzy™ Money Toad™5 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™