Press Releases

UK betting technology supplier 20SHOTS accelerate funding with £400,000 raise at £5m valuation

-

20SHOTS have geared up for the new football season in the UK by securing additional investment in a second funding round, including securing the backing of US VC Animal Capital

-

New season will see new product rollout for popular Fantasy5 free-to-play fantasy football game, covering Champions League, Europa League and other European top flights

-

Current growth trajectory sees Fantasy5 on course to recruit half a million players this season

20SHOTS, the UK technology supplier behind fast-growing free-to-play fantasy football game Fantasy5, have secured an additional £400,000 of investment at a £5 million valuation, with backers including Gen-Z focused US Venture Capital fund Animal Capital.

The American fund that counts social media stars Josh Richards, Griffin Johnson and Noah Beck focus on products that reach a new generation of customers. They have invested an undisclosed sum in 20SHOTS for the new football season, which will see the platform roll out its largest range of products added to its Fantasy5 game to date.

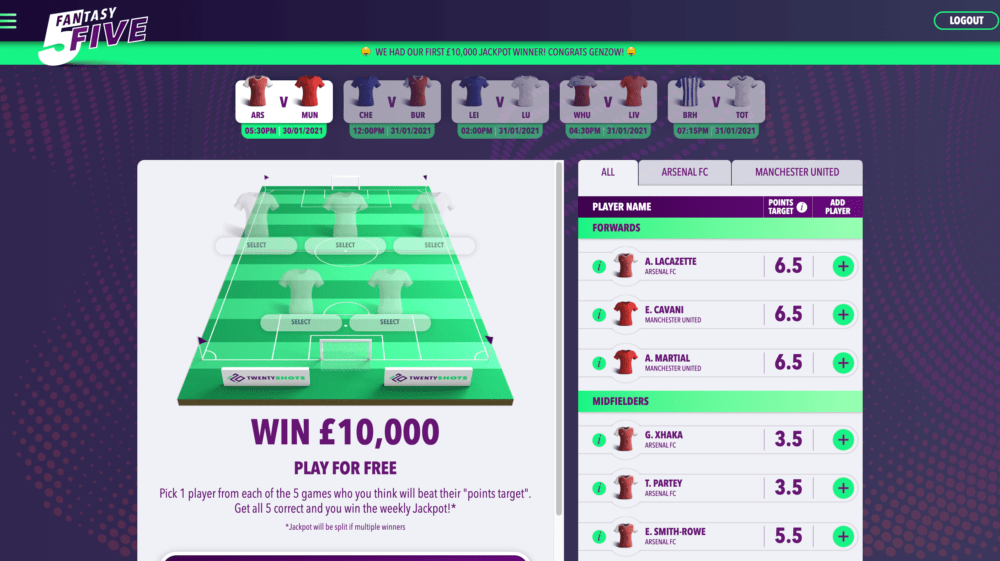

Fantasy5’s Premier League product, which uses a unique points system developed in-house based on fantasy football, offers cash prizes to winners who can successfully predict how well players will perform per gameweek.

Using their own risk management system and algorithmic trading software, the company will now look to supplement this with additional games covering the Champions League, Europa League and other top European leagues.

The roll out of additional leagues coupled with Fantasy5’s existing growth – bolstered last season by the recruitment of BoyleSports as its first tier one UK & Ireland bookmaker partner – keeps the game on course to break the 500,000 player mark.

Prizes for the additional leagues will remain at the standard £10,000 mark, as offered to Premier League players, and offer partners an increase in engagement and retention. 83% of players who played in the last four rounds last season have made an entry in the first two weeks. The investment in Fantasy5 also comes in advance of the Government’s highly-anticipated White Paper review of the gambling industry, which is likely to see traditional marketing practices come under scrutiny, creating additional need for operators to engage customers beyond traditional channels.

Jacob Kalms, co-founder and CEO of 20SHOTS said: “We’re pleased to welcome Animal Capital as investors as part of our most recent founding round which has raised £400,000 in capital.

“As demand grows in the ultra-competitive free-to-play space, we’re investing in our ability to quickly and seamlessly roll out products and games on a white label basis for a number of different partners across multiple divisions and competitions – with the ultimate objective of using the technology seamlessly across the most popular sports worldwide.

“Our growth model forecasts we will break the half a million player mark this season, with our scaling driving down the cost of acquisition for partners whilst maintaining our engagement, dwell and retention rates considerably above industry averages.”

He added: “Operators should also be considering how free-to-play and softer marketing funnels like those offered by games like Fantasy5 will help them navigate any changes thrust upon them by the upcoming gambling review. Whilst our audience is ultimately commercially valuable to any operator or affiliate, Fantasy5 remains a sustainable way to build a loyal audience over time.”

Marshall Sandman, Managing Partner of Animal Capital said: “In a crowded market of fantasy, free to play, and pay-to-play sports betting, 20SHOTS distinguishes itself with a best in class team and direction that has allowed the product to stand out distinctly and early.

“Their flagship game Fantasy5 is an early hit, their B2B relationships are uniquely positioned to make this an exciting asset and their ability to resonate and be sticky with a younger audience are all reasons why we were excited to be on the journey.

“Jacob the CEO and his team have conviction and direction, and they will continue to prove why they deserve to be big fish in this pond!”

Powered by WPeMatico

B2B iGaming solutions

Soft2Bet twice recognised by EGR Europe Awards 2026

iGaming powerhouse Soft2Bet has been honored with two prestigious accolades at the EGR Europe Awards 2026, taking home the European Casino Platform Supplier and European Acquisition and Retention Partner awards.

These awards highlight the company’s innovation, operational excellence, and measurable impact throughout 2025.

The European Casino Platform Supplier award reflects Soft2Bet’s philosophy of building its core stack in-house. The platform is fully modular, supporting seamless integration across game providers, payment services, KYC, and AML systems, while enabling partners to scale and localize operations across multiple jurisdictions. Judges also praised the MEGA Engine, Soft2Bet’s flagship technology, for solving operator challenges, accelerating licensing, and facilitating sustainable growth.

Andrew Cochrane, CCO of Soft2Bet, stated: “These awards are a testament to the relentless innovation and execution of our teams. Our platform is designed to launch brands efficiently and scale them sustainably in regulated markets, combining design-led delivery with measurable performance.”

The European Acquisition and Retention Partner award celebrates Soft2Bet’s ability to convert engagement into tangible results. Anchored by the MEGA (Motivational Engineering Gaming Application) product, the platform merges iGaming mechanics with casual and mobile gaming patterns, creating structured sessions via missions, challenges, and quests to drive repeat play and emotional engagement. EGR judges noted that “MEGA by Soft2Bet sets a benchmark for acquisition and retention in Europe, combining entertainment-first engagement with measurable results.”

These latest accolades crown a period of strong growth and industry leadership for Soft2Bet, following multiple awards throughout 2024 and 2025 for data-driven innovation, turnkey platform solutions, and B2B excellence.

Soft2Bet continues to set the standard for iGaming technology, platform scalability, and player retention strategies in Europe and beyond.

The post Soft2Bet twice recognised by EGR Europe Awards 2026 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Cheltenham Festival

Richard Johnson and Hayley Moore to join Press Box PR’s Cheltenham Festival preview event in Gibraltar

Two-time Gold Cup-winning jockey Richard Johnson and Sky Sports Racing presenter Hayley Moore will headline a Cheltenham Festival Preview evening hosted by Press Box PR in Gibraltar next month.

Taking place on Thursday, March 5, at Ivy Sports Bar & American Grill in Ocean Village, the event will bring together professionals from across the gambling and racing industries for an exclusive preview of the Cheltenham Festival 2026, which begins on March 10.

Johnson, widely regarded as one of the most accomplished jump jockeys of his era, will share expert insight into the key races, leading contenders, and the demands of competing on racing’s biggest stage. He will be joined by Moore, who will offer analysis of the major storylines, form trends, and narratives shaping this year’s Festival.

The evening will be hosted by racing presenter and writer Kitty Waddell, who will moderate the discussion and lead a live audience Q&A with the panel.

Guests attending the event can expect:

• Detailed previews and tips for the Festival’s headline races

• Behind-the-scenes insights from Johnson’s career at the top level of jump racing

• Expert commentary from Moore on form, trends, and key contenders

• A live Q&A session with the panel

• Networking opportunities alongside complimentary food and drinks

Attendees will also have the chance to win prizes during the evening.

With offices in London and Manchester, Press Box PR — winner at the European iGaming Awards 2026 — is a PR agency specialising in securing media coverage across iGaming, sport, consumer, finance, hospitality, and catering sectors. The agency also supports brands in achieving visibility within AI citations and LLM-driven recommendations.

Jack Mansell, Managing Director of Sport at Press Box PR, said:

“The Cheltenham Festival is the highlight of the jump racing calendar and a huge moment for many of the brands we work with across betting and gaming. We wanted to create an event that gives industry colleagues genuine insight from people who have competed at – and covered – the very highest level of the sport.

“Richard and Hayley bring an incredible depth of knowledge and experience, and we’re looking forward to welcoming clients, partners and friends of the industry for what should be an entertaining and informative evening in Gibraltar.”

The Cheltenham Festival Preview will run from 7pm to 10pm on Thursday, March 5, at Ivy Sports Bar & American Grill, Ocean Village, Gibraltar.

Industry professionals wishing to attend are invited to RSVP to [email protected] by Monday, March 2. Guests are asked to confirm numbers and share any dietary requirements when responding. Places are limited and will be allocated on a first-come, first-served basis.

The post Richard Johnson and Hayley Moore to join Press Box PR’s Cheltenham Festival preview event in Gibraltar appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Audio Description

Brøndby IF Launches Permanent Audio Description Service for Fans Inside and Outside the Stadium

Last night’s clash between Brøndby IF and Sønderjyske in the 3F Superliga became the first match delivered through the club’s new permanent audio description service, designed for fans both in the stadium and at home. Developed in close partnership with the Danish Association of the Blind and main partner Betano, the initiative enables supporters with visual impairments to follow matches more fully from the stands or their living rooms.

Brøndby IF is now the first club in Denmark and across the Nordic region to introduce a permanent audio description service for every home fixture. Available via radio.brondby.com, the service provides real-time spoken narration of on-pitch action, player movement, atmosphere, and key visual moments. A specially trained commentator delivers detailed descriptions to help visually impaired fans experience matches more completely.

Thomas Skov, Marketing Director and Head of Fan Experience at Brøndby IF, said:

“Brøndby IF is a unique community that must be accessible to everyone. Therefore, we must open as many doors as possible into that community. With permanent audio description both at the stadium and for those listening from home, we are taking a very concrete step to make the matchday experience at our home games even more inclusive. As a Brøndby IF fan, you should feel welcome and part of the club’s community no matter what. As a club, we have a strong responsibility to remove barriers that may stand in the way.”

Partnerships in Action

To mark the launch, members of the Danish Association of the Blind attended the home fixture against Sønderjyske, with the initiative receiving strong recognition from the organisation.

Diana Stentoft, National Chair of the Danish Association of the Blind, commented:

“Audio description is about equal access to the community, and it means that even more people can experience football – including those who cannot follow the game visually. Audio description makes a significant difference for blind and visually impaired people, as they are no longer dependent on random radio excerpts or constantly asking others what is happening on the pitch. We are therefore pleased that Brøndby IF is offering audio description at its home matches and thereby improving the opportunity for blind and severely visually impaired fans to follow the club’s games.”

Alongside the Danish Association of the Blind, Betano played a central role in supporting and developing the permanent service. The launch represents the first step in a broader ambition shared by Brøndby IF and Betano to reduce accessibility barriers in football.

Kresten Hougaard, Country Manager for Betano in Denmark, said:

“Inclusion is a key priority for Betano, as we strongly believe that everyone should have equal opportunities to enjoy the game. As the main partner of Brøndby IF, it is important for us to turn our commitments into action. We are proud to have participated in the development of a service that gives fans with visual impairments better access to the full football experience.”

Benefiting All Fans — Beyond the Stadium

The solution at Brøndby Stadium is the first permanent system of its kind in the Nordic region and can be accessed from anywhere.

At the stadium, fans can listen live via their smartphones and headphones through radio.brondby.com. At home, the same commentary can be synchronised with live TV broadcasts, allowing supporters to follow the match in real time from anywhere.

Thomas Skov added:

“The reach of Brøndby IF’s new audio description service extends beyond people with visual impairments. Fans who, for various reasons, are unable to attend the stadium can now follow the match on the go or from home and thereby be part of the club’s community.”

The software powering the service is provided by German technology company Mycrocast, which delivers similar solutions to clubs in the Bundesliga and Ajax Amsterdam.

Lead audio description commentator Selver Elezovic will front coverage of Brøndby IF’s matches. He previously provided commentary for Danish fixtures, including at EURO 2024, and will be joined at Brøndby’s home games by former player Joel Kabongo.

The post Brøndby IF Launches Permanent Audio Description Service for Fans Inside and Outside the Stadium appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming7 days ago

Big Daddy Gaming7 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Dan Brown6 days ago

Dan Brown6 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Brais Pena Chief Strategy Officer at Easygo7 days ago

Brais Pena Chief Strategy Officer at Easygo7 days agoStake Goes Live in Denmark Following Five-Year Licence Approval