eSports

Global Esports Market (2022 to 2030) – Size, Share & Trends Analysis Report

The “Global Esports Market Size, Share & Trends Analysis Report by Revenue Source (Sponsorship, Advertising, Merchandise & Tickets, Media Rights), by Region, and Segment Forecasts, 2022-2030” report has been added to ResearchAndMarkets’ offering.

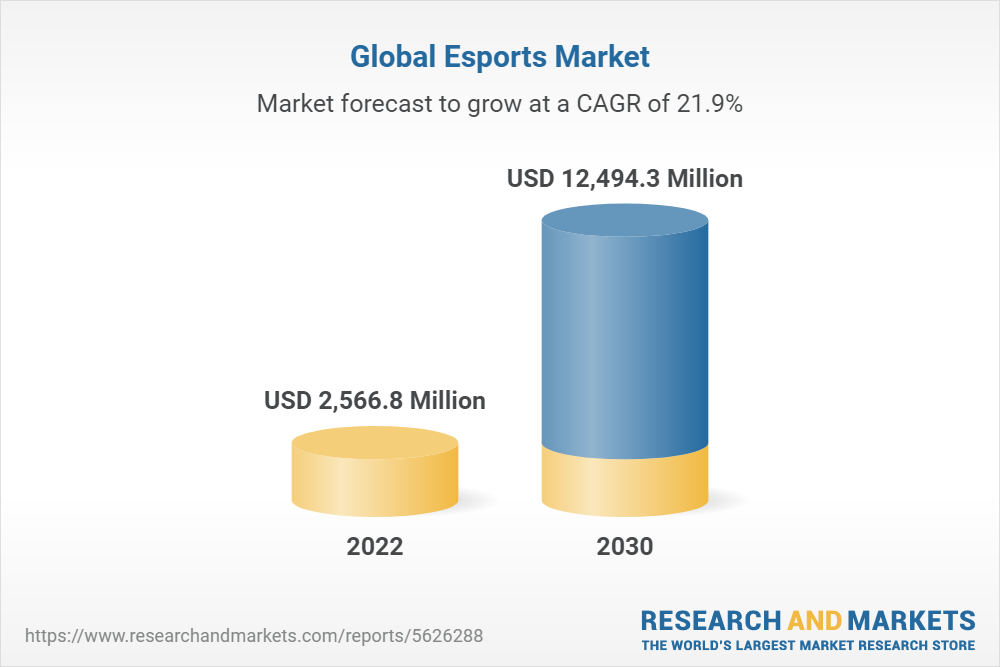

The global esports market size is expected to reach USD 12,494.3 million by 2030, registering a compound annual growth rate (CAGR) of 21.9% from 2022 to 2030. The increasing mobile usage in emerging countries, rising awareness regarding esports, and increasing popularity of video games are expected to fuel the market growth during the forecast period.

Consumers demand high-quality and interactive gaming content aligned with the dynamic entertainment industry. The alignment of entertainment and gaming will influence the growth of the entire sports industry, including online streamers and small and big-budget game developers. The increasing investments from commercial partners and substantial audience growth have resulted in revenue growth in the esports market. The industry has become more structured, with associations and league formats developing new competitive structures. Moreover, the growing partnerships, acquisitions, and mergers have projected strong growth in the esports market.

The streaming platforms, such as Twitch, have attracted viewers by streaming esports and gaming. The esports tournaments have fascinated athletes and celebrities and have drawn a broad audience’s attention. Additionally, esports and gaming make it easy to draw the attention of enthusiastic and young viewers who are hard to reach through traditional media channels. The ability to grab the attention of the young and enthusiastic audience has attracted many brands to invest in esports events in sponsorships and advertising. The interest of investors has increased with the centralization of an Esports team, rising audience, and the introduction of a more franchise-style league. The rising interest of brands in esports teams to reach potential customers is expected to drive market growth during the forecast period.

In addition to sponsorship, ticket sales and merchandise are essential revenue segments that drive the esports market’s growth. The franchisee is focusing on hosting local events that include fans in stadiums, generating significant revenue, thus contributing to the further development of the esports market. The Esports apparel market has witnessed substantial growth due to a growing fanbase, league-level merchandise deals, and increased retail presence.

The esports teams no longer have to rely on winning competitions as teams can independently sell their merchandise to their fans. For instance, Ralph Lauren partnered as the apparel partner for G2 Esports. One of G2 Esports’ famous players, Martin’ Rekkles’ Larsson, was featured in Ralph Lauren’s Wimbledon Campaign. G2 and Ralph Lauren partnered across several campaigns and events and produced a range of digital-first activations on Twitch and TikTok.

Esports Market Report Highlights

- The sponsorship segment held the largest share of esports market revenue in 2021, representing around 40.0%. Through sponsorships, brands can reach potential customers directly via online and offline media channels.

- The media rights segment, which generates significant revenue, is expected to expand at the highest CAGR of over 23.0% during the forecast period. The numerous leagues, championships, and events that usually occur on various streaming platforms are expected to generate considerable revenue from media rights.

- The Asia Pacific region is expected to gain a significant market share in the forecasted period. The countries such as China and South Korea are anticipated to play a vital role in developing the esports ecosystem in the region..

Key Topics Covered:

Chapter 1. Market Segmentation and Scope

Chapter 2. Executive Summary & Market Snapshot

Chapter 3. Esports Industry Outlook, Trends & Scope

3.1 Market Introduction

3.2 Esports-Market Size and Growth Prospects

3.3 Esports-Value Chain Analysis

3.4 Esports-Market Dynamics

3.4.1 Market Driver Analysis

3.4.1.1 Increasing mobile usage in the gaming industry

3.4.1.2 Increasing number of tournaments and prize pool

3.4.1.3 Franchise model: a big shift in Esports industry

3.4.2 Market Restraint Analysis

3.4.2.1 Cyberattacks

3.4.2.2 Threats in Esports gambling/betting

3.4.3 Market Opportunity Analysis

3.4.3.1 Cloud gaming enabling new opportunities

3.4.4 Market Challenges Analysis

3.4.4.1 Lack of standardization

3.4.4.2 Infrastructure concerned

3.5 Esports-Penetration & Growth Prospect Mapping

3.6 Business Environment Analysis Tools

3.6.1 Pest Analysis

3.6.2 Porter’s Five Force Analysis

3.7 Tencent Games: Gaining an Upper Hand In Esports Industry

3.8 Esports: A Long Term Business Opportunity For Brands

3.9 Major Esports tournaments in various regions

3.9.1 The Americas

3.9.2 Europe

3.9.3 Asia Pacific

3.9.4 Middle East & Africa

Chapter 4. Consumer Behaviour Analysis

4.1 Esports Demographics

4.1.1 Gender

4.1.2 Age

4.2 Media Consumption Habits

4.2.1 Streming Platform Analysis

4.3 Esports Audience Opportunity Analysis

Chapter 5. Esports Revenue Source Outlook

5.1 Market Size Estimates & Forecasts and Trend Analysis, 2018-2030 (Revenue, USD Million)

5.2 Esports Market: Revenue Source Movement Analysis

5.2.1 Sponsorship

5.2.1.1 Market estimates and forecast by region, 2018-2030 (USD Million)

5.2.2 Advertising

5.2.2.1 Market estimates and forecast by region, 2018-2030 (USD Million)

5.2.3 Merchandise & Tickets

5.2.3.1 Market estimates and forecast by region, 2018-2030 (USD Million)

5.2.4 Publisher Fees

5.2.4.1 Market estimates and forecast by region, 2018-2030 (USD Million)

5.2.5 Media Rights

5.2.5.1 Market estimates and forecast by region, 2018-2030 (USD Million)

Chapter 6. Regional Estimates & Trend Analysis

Chapter 7. Competitive Analysis

7.1 Key Global Players, Recent Developments & Their Impact on the Industry

7.2 Key Company Categorization (Sponsorship, Media Rights, and Esports Teams)

7.3 Key Company Analysis, 2021

Chapter 8. Competitive Landscape

8.1 Activision Blizzard, Inc.

8.1.1 Company overview

8.1.2 Financial performance

8.1.3 Product benchmarking

8.1.4 Recent developments

8.2 Electronic Arts Inc.

8.2.1 Company overview

8.2.2 Financial performance

8.2.3 Product benchmarking

8.2.4 Recent developments

8.3 Gameloft SE

8.3.1 Company overview

8.3.2 Financial performance

8.3.3 Product benchmarking

8.3.4 Recent developments

8.4 HTC Corporation

8.4.1 Company overview

8.4.2 Financial performance

8.4.3 Product benchmarking

8.4.4 Recent developments

8.5 Intel Corporation

8.5.1 Company overview

8.5.2 Financial performance

8.5.3 Product benchmarking

8.5.4 Recent developments

8.6 Modern Times Group (MTG)

8.6.1 Company overview

8.6.2 Financial performance

8.6.3 Product benchmarking

8.6.4 Recent developments

8.7 Nintendo of America Inc.

8.7.1 Company overview

8.7.2 Financial performance

8.7.3 Product benchmarking

8.7.4 Recent developments

8.8 NVIDIA Corporation

8.8.1 Company overview

8.7.2 Financial performance

8.8.3 Product benchmarking

8.8.4 Recent developments

8.9 Tencent Holdings Limited

8.9.1 Company overview

8.9.2 Financial performance

8.9.3 Product benchmarking

8.9.4 Recent developments

8.10 Valve Corporation

8.10.1 Company overview

8.10.2 Financial performance

8.10.3 Product benchmarking

Powered by WPeMatico

Brazilian Carnival

Esportes da Sorte transforms Carnival 2026 into a nationwide immersive experience

Leading Brazilian iGaming company Esportes da Sorte has transformed Carnival 2026 into a nationwide immersive experience, activating urban art installations, hydration stations and large‑scale attractions across nine cities in Brazil. As part of its expanded cultural engagement strategy, the brand is serving as an official sponsor in key Carnival locations and delivering experiential initiatives designed for revelers in the streets and major public spaces.

Esportes da Sorte’s nationwide platform builds on its history of investing in popular culture and public events, moving beyond traditional branding to create meaningful on‑site activations that enhance the urban environment and respond to the unique character of each city’s Carnival celebrations.

In Rio de Janeiro, the company’s efforts focus on the street Carnival experience with hydration points, cool zones and shaded areas in high‑traffic celebration routes. São Paulo’s megabloc circuits feature water trucks, hydration stations and on‑site urban support.

In Recife Antigo, one of Carnival’s cultural centers, Esportes da Sorte installed a standout Ferris wheel at Marco Zero, offering panoramic views of the festivities and historic landscape. Urban transformations like video mapping on iconic buildings and aerial installations along Rua Marquês de Olinda further blend public space with the Carnival experience.

Other cities such as Olinda and Salvador also feature tailored activations, including sensory design, refreshment tunnels and themed artistic displays that align with local traditions and festival dynamics.

In addition to physical structures, the initiative includes a robust communications strategy, sensory activations, public well‑being supports and content campaigns that amplify the carnival‑street experience across digital and traditional media.

According to Germana Casal, Production Coordinator at the Esportes Gaming Brasil Group, the goal is to “be present in a meaningful way at the country’s biggest popular celebration,” respecting each city’s identity and delivering initiatives that improve the Carnival experience for participants.

Esportes da Sorte’s Carnival 2026 project builds on the brand’s presence at more than 100 Carnival parties and street blocos in 2025, reinforcing its leadership role in Brazil’s largest cultural event and deepening its connection with urban celebration culture nationwide.

The post Esportes da Sorte transforms Carnival 2026 into a nationwide immersive experience appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

chess esports

Team Vitality announces E.Leclerc as new Main Partner

Team Vitality, one of France’s leading esports organizations, has announced a strategic new partnership with French retail giant E.Leclerc, naming the supermarket chain as the club’s Main Partner for 2026.

Under the agreement, E.Leclerc’s logo will feature prominently on Team Vitality’s international team jerseys, including rosters for League of Legends (LEC and LFL), Valorant (VCT EMEA), Rocket League, Rising Bees and Chess.

Shared Values and Fan Initiatives

The partnership aims to promote accessibility, wellness, and nutrition within the esports community, while bringing gaming culture into E.Leclerc retail spaces through immersive experiences, tournaments and activations designed to engage fans across France.

Team Vitality’s holistic wellbeing program, KARE, which supports performance, nutrition and mental health, aligns closely with E.Leclerc’s focus on responsible lifestyle initiatives. Together, they plan to champion inclusivity, provide unique gaming opportunities, and celebrate esports culture in both digital and physical environments.

With a global audience exceeding 10 million followers, Team Vitality’s influence in competitive gaming makes this partnership a landmark moment for both brands. E.Leclerc’s commitment to youth engagement and cultural connection positions the retailer as a significant non‑endemic supporter of the growing esports ecosystem.

Nicolas Maurer, CEO and Co‑Founder of Team Vitality, described the alliance as a historic milestone that will broaden esports’ reach across everyday life in France and reinforce its cultural legitimacy.

The post Team Vitality announces E.Leclerc as new Main Partner appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

AI chatbot esports

G2 Esports and Theta Labs Launch AI Agent Sami

G2 Esports has partnered with Theta Labs to launch “Sami,” a next-generation AI agent designed to enhance fan engagement across multiple competitive esports titles.

The AI-powered assistant will provide G2’s global fanbase with instant access to match schedules, player stats, team rosters, tournament standings, and real-time competitive updates. Sami supports major titles including League of Legends, Counter-Strike 2, VALORANT, Tom Clancy’s Rainbow Six Siege, and Call of Duty.

Accessible via the official G2 website and Discord starting February 17, Sami is built to deliver accurate, always-on responses to fan queries in natural language. From tournament updates to player performance metrics and G2-specific trivia, the AI agent reflects the organization’s unique brand voice and competitive culture.

AI-Powered Fan Engagement at Scale

Sami is trained and deployed using Theta EdgeCloud’s hybrid cloud-edge infrastructure, which integrates over 30,000 distributed edge nodes with cloud services from Google Cloud and Amazon Web Services. The system delivers approximately 80 PetaFLOPS of GPU compute power, enabling real-time processing and analysis at significantly reduced costs compared to traditional centralized cloud platforms.

The AI infrastructure dynamically assigns workloads to high-performance GPUs, including NVIDIA A100 and H100 cloud GPUs, as well as RTX 3090 and 4090 desktop GPUs, optimizing performance and cost efficiency. This decentralized architecture allows G2 to scale fan engagement globally while maintaining low latency and high reliability.

Strengthening Esports AI Innovation

Theta Labs has rapidly expanded its presence in the esports industry, powering AI-driven fan experiences for organizations such as Cloud9, FlyQuest, Evil Geniuses, NRG, Gen.G, Dignitas, 100 Thieves, Method, and Team Heretics.

According to Mitch Liu, CEO of Theta Labs, esports fans increasingly demand instant access to team data and competitive updates. AI agents like Sami enable organizations to provide 24/7 automated engagement while maintaining a unique community personality.

Sabrina Ratih, COO of G2 Esports, emphasized that Sami is more than a standard chatbot. Built to reflect G2’s playful and competitive tone, the AI assistant combines advanced machine learning with brand-driven communication to deliver both entertainment and functionality.

The Future of AI in Esports

The launch of Sami positions G2 Esports at the forefront of AI-driven fan engagement in competitive gaming. By leveraging decentralized GPU infrastructure and blockchain-powered cloud computing, the partnership with Theta Labs signals a broader industry shift toward scalable, cost-efficient AI solutions for esports organizations.

As AI integration becomes a competitive differentiator in esports, solutions like Sami are expected to redefine how teams interact with their global communities in real time.

The post G2 Esports and Theta Labs Launch AI Agent Sami appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

ACMA6 days ago

ACMA6 days agoACMA Blocks More Illegal Online Gambling Websites

-

CEO of GGBET UA Serhii Mishchenko6 days ago

CEO of GGBET UA Serhii Mishchenko6 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Aurimas Šilys6 days ago

Aurimas Šilys6 days agoREEVO Partners with Betsson Lithuania

-

Latest News5 days ago

Latest News5 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Canada5 days ago

Canada5 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Central Europe6 days ago

Central Europe6 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Acquisitions/Merger5 days ago

Acquisitions/Merger5 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™5 days ago

Firecracker Frenzy™ Money Toad™5 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™