Latest News

Worldwide Casino Gaming Equipment Industry to 2027 – Featuring Incredible Technologies, International Game Technology and Jackpot Digital Among Others

The “Casino Gaming Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027” report has been added to ResearchAndMarkets‘ offering.

The global casino gaming equipment market reached a value of US$ 11 Billion in 2021. Looking forward, the publisher expects the market to reach US$ 13.2 Billion by 2027, exhibiting a CAGR of 3.1% during 2022-2027. Keeping in mind the uncertainties of COVID-19, they are continuously tracking and evaluating the direct as well as the indirect influence of the pandemic. These insights are included in the report as a major market contributor

Casino gaming equipment are gaming machines and tools used for gambling and ensuring transparency in casino operations. Roulette wheels, gaming tables, shuffle machines, player tracking systems, slot machines, video poker machines and video lottery terminals are some of the commonly used casino gaming equipment.

These machines are used for playing poker, big six-wheel, baccarat, blackjack, craps and five-card draws. The equipment provides enhanced profitability, convenience, safety and cost-effectiveness. They are also utilized for analyzing player behavior and authenticating fake and original currency notes. As a result, casino gaming equipment is widely utilized in malls, casinos and gaming arenas

Casino Gaming Equipment Market Trends:

Significant growth in the commercial casino industry across the globe is creating a positive outlook for the market. Additionally, the shifting consumer preference from traditional casino tables to electronic gaming tables is favoring the market growth. These electronic gaming tables provide an exciting live stadium environment, control the gaming speed, require minimum bets and safeguard the player from betting frauds. In line with this, convenient access to online casinos that can be used through mobile phones is also contributing to the growth of the market.

Moreover, various technological advancements, such as the increasing adoption of the virtual reality (VR), artificial intelligence (AI) and Internet of Things (IoT) technologies in smart casinos, are providing a thrust to the market growth. These technologies aid in maintaining the transparency of gambling activities and provide an immersive experience to the player. They also aid in analyzing player-related data and recognizing symptoms of unhealthy gambling patterns in at-risk players.

Other factors, including the liberalization and cultural acceptance of gambling and casinos in various countries, along with the increasing expenditure capacities of consumers, are anticipated to drive the market toward growth

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global casino gaming equipment market, along with forecasts at the global, regional and country level from 2022-2027. Our report has categorized the market based on product type, installation, mode of operation and end user

Breakup by Product Type:

- Slot Machines

- Video Lottery Terminal

- Video Poker Machines

- Others

Breakup by Installation:

- Installed Inside Casino

- Installed Outside Casino

Breakup by Mode of Operation:

- Floor Mounted

- Portable

Breakup by End User:

- Casinos

- Malls

- Leisure Centers

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Abbiati Casino Equipment S.r.l., AGS LLC, Aristocrat Leisure Limited, Cammegh, Euro Games Technology OOD, Everi Holdings Inc., Incredible Technologies Inc., International Game Technology PLC, Jackpot Digital Inc., Konami Holdings Corporation, Novomatic, Scientific Games Corporation and TCS John Huxley Ltd. (Victoria Holdings Ltd.)

Key Questions Answered in This Report:

- How has the global casino gaming equipment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global casino gaming equipment market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the installation?

- What is the breakup of the market based on the mode of operation?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global casino gaming equipment market and who are the key players?

- What is the degree of competition in the industry?

Key Topics Covered:

1 Preface

2 Scope and Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Casino Gaming Equipment Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Slot Machines

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Video Lottery Terminal

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Video Poker Machines

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Installation

7.1 Installed Inside Casino

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Installed Outside Casino

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Mode of Operation

8.1 Floor Mounted

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Portable

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by End User

9.1 Casinos

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Malls

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Leisure Centers

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Region

11 SWOT Analysis

12 Value Chain Analysis

13 Porters Five Forces Analysis

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Abbiati Casino Equipment S.r.l.

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.2 AGS LLC

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.3 Aristocrat Leisure Limited

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.3.3 Financials

15.3.3.4 SWOT Analysis

15.3.4 Cammegh

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.5 Euro Games Technology OOD

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.6 Everi Holdings Inc.

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.7 Incredible Technologies Inc.

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.8 International Game Technology PLC

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.9 Jackpot Digital Inc.

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.9.3 Financials

15.3.10 Konami Holdings Corporation

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.10.3 Financials

15.3.10.4 SWOT Analysis

15.3.11 Novomatic

15.3.11.1 Company Overview

15.3.11.2 Product Portfolio

15.3.12 Scientific Games Corporation

15.3.12.1 Company Overview

15.3.12.2 Product Portfolio

15.3.12.3 Financials

15.3.12.4 SWOT Analysis

15.3.13 TCS John Huxley Ltd. (Victoria Holdings Ltd.)

15.3.13.1 Company Overview

15.3.13.2 Product Portfolio

Powered by WPeMatico

eSports

eSports in the CIS region , Q&A w/ Viktor Block, Senior Sales Manager/PandaScore

Esports has long been popular in the CIS region, with various top-tier teams and players all calling it home. How has the landscape evolved over the last few years? Have any particular trends emerged that have surprised you at all?

Esports boomed in the CIS region in 2008 when Multiplayer Online Battle Arena (MOBA) games became really popular. While esports had been a thing as far back as 2003, the rise of games such as Counter-Strike and DOTA2 was a major catalyst for the upward trajectory the sector has been riding ever since. In recent years, the infrastructure needed to support esports has improved drastically across the CIS region, including the construction of the Pixel Esports Arena in Minks, Belarus, and the Cyberspace Arena in Almaty, Kazakhstan, both of which hold top-flight contests. Internet connectivity has also improved, while support from local and international sponsors such as Monster Energy, Red Bull and War Gaming have provided funds for further investment while also driving awareness. Ultimately, this has seen the landscape evolve into a thriving industry with lots of opportunities for further growth.

In terms of trends, and especially relating to esports betting, I’ve been surprised by the high demand for betting on console games – we call them eBattles and they include disciplines such as eSoccer and eBasketball. I think this is just a natural development that has occurred off the back of strong demand for video game content, which is often the bridge between traditional sports and esports.

What factors have contributed to esports’ growth in the CIS over the past few years?

One of the biggest factors for me is that teams have become more professional and are now training and playing in well-run clubs. This takes place in dedicated buildings and rooms, set up with high-speed internet and the absolute best gaming equipment. Player salaries have also gone up, which has increased the calibre of players taking part in contests across the region, taking competitiveness to the next level. Today, many CIS players now play for high-ranked teams such as Virtus.pro, Team Spirit, Betboom or Na`Vi which compete on the international stage. This in turn is helping esports grow across the CIS region.

Given how many countries are in the CIS region, can you walk us through some of the biggest regulatory differences when it comes to betting on esports? And how does PandaScore navigate these changes?

The legality of betting and esports betting differs from country to country within the CIS region. Some are super strict or even prohibit gambling, while others take a more liberal approach, regulating the activity and licensing operators. Let’s take a look at some of the biggest markets and their approach.

In Ukraine, esports has been recognised as a sport since 2018 and in 2020 the country regulated and licensed gambling for the first time. The law focuses mostly on standard betting – sports and casino – but is likely to also include esports betting given that esports is a recognised sport in the country with tier-one Ukraine sportsbooks like Favbet and Parimatch offering it to their players.

Kazakhstan has a growing gambling industry with betting shops and casinos operating in major cities such as Almaty and Nur-Sultan. Gambling is regulated by the Ministry of Culture and Sports and while the regulatory framework is somewhat restrictive, sports betting – which is likely to include esports betting – is permitted.

Navigating the constant changes in betting regulation across the CIS region can be challenging, so we make sure to keep up to speed with the latest developments by monitoring legislative updates and amendments to regulatory guidelines. We also track industry trends and best practices to anticipate regulatory changes ahead of time, allowing us to adapt quickly if needed. This can involve benchmarking against competitors, attending conferences and networking with key stakeholders.

In your view, are there any unique opportunities for the expansion of esports and esports betting within the CIS region? And how does this differ to other regions?

It’s important to understand that CIS, especially Ukraine and Kazakhstan, play by their own rules. By that I mean they are very different to other esports markets, so don’t think what works in Italy will work in Ukraine. For example, while League of Legends is very popular in Europe, in CIS, it’s Dota 2 that takes the top spot. But for those who can understand the region and each market, there are plenty of opportunities to explore.

Let me elaborate. Dota 2 is thriving in the broader CIS, with regular tournaments and events attracting large audiences both offline and online. teams like Natus Vincere (Na’Vi), Virtus.pro and Team Spirit have achieved significant success in Dota 2 competitions, contributing to the game’s popularity in the region. While Dota 2 is big, other video games also enjoy significant popularity, including CS2, World of Tanks and Fortnite among others.

Operators need to consider this when deciding their markets and odds, marketing strategies and plans for player engagement.

What would you say is the key to creating a successful esports product for a CIS audience?

Understanding layer preferences in each market and delivering an experience that exceeds their expectations. For the CIS region, this means focusing on Dota 2 – this is a game that offers deep and strategic gameplay requiring teamwork, communication and skilful execution of plans and strategies. Its competitive nature appeals to gamers as they enjoy the challenge of multiplayer experiences – this goes back to the original MOBAs back in 2008. These factors must be present in the esports betting experience offered to players – at PandaScore, this means a comprehensive Dota 2 offering that covers markets such as Kills, Towers, Roshans and Barracks, with players able to challenge themselves in a betting competition against others.

Support is also key to delivering a quality player experience. We offer round-the-clock assistance and are regularly rolling out updates to improve the experience players receive when betting on esports at sportsbooks using our data, odds and betting tools such as our Bet Builder. We are always working hard to expand our offering to cover the most in-demand games including CS2, Valorant, Call of Duty and many more.

What trends or developments do you anticipate shaping the future growth of esports in the CIS region over the next few years?

The industry will continue to grow and become more professional. Esports is different to traditional sports and it still lacks recognition in some markets, even though it is considered an official sport in a growing number of countries across the CIS region. I think as it evolves, more governments will provide more support for esports as it brings tremendous economic, cultural and social benefits. This could include funding for esports initiatives, rolling out regulatory frameworks, helping to foster partnerships with esports organisations or simply recognising it as a sport.

The continued proliferation of smartphones across the region will be a further catalyst for esports growth. Titles such as PUGB Mobile, Free Fire and Mobile Legends: Bang Bang will attract large audiences and provide new opportunities for teams, players, sponsors and other stakeholders to explore. This is a really exciting time for esports and esports betting in the CIS region, and PandaScore is thrilled to be part of it.

The post eSports in the CIS region , Q&A w/ Viktor Block, Senior Sales Manager/PandaScore appeared first on European Gaming Industry News.

Latest News

Gaming Corps signs up first Swiss client with Gamanza Group distribution deal

Gaming Corps – a publicly-listed game development company based in Sweden – will bring its premium games portfolio to players in Switzerland after agreeing a partnership with technology provider Gamanza Group.

Gamanza is renowned for offering an innovative suite of iGaming products, and powered the first legal online casino in Switzerland. The provider is backed by Stadtcasino Baden AG; one of the largest leisure and entertainment groups in Switzerland.

This is the first partnership Gaming Corps has agreed in Switzerland, and marks significant progress in the territory in a short space of time, with Gamanza providing a turn-key platform solution to multiple licensed operators in the Swiss online gaming market.

Gamanza’s player account management platform, “Core” will now house Gaming Corps’ full suite of games, made up of Crash, Mine, Table, Slot and Plinko titles. Gamanza’s operator partners will be able to offer some of Gaming Corps’ recent smash hits such as Rampage and Piggy Smash from the Smash4Cash™ series, Wild Woof, Raging Zeus Mines and Lobster Hotpot, as well as some of Gaming Corps’ revered games series including Jet Lucky and Coin Miner.

Mats Lundin, Gaming Corps’ Director of Sales, said: “Gamanza is a well-known, popular and respected provider in the Swiss online gaming market, so we are extremely privileged to be able to offer our games via Gamanza’s Core platform.

“We are very excited to provide our first-class games to Gamanza’s partners, and we are pleased to secure such widespread distribution of our titles to players across Switzerland in the early stages of our journey in the country.”

Robert Civill, Chief Commercial Officer at Gamanza said: “We will always champion innovation and variety at Gamanza, and Gaming Corps provides a quality mix of crash games and other fast game concepts, alongside an array of thrilling slots.

Gamanza is delighted to work with Gaming Corps and I’m sure they will prove to be incredibly popular with our partners, so very much a welcome addition to our ever-evolving portfolio!

The post Gaming Corps signs up first Swiss client with Gamanza Group distribution deal appeared first on European Gaming Industry News.

Compliance Updates

DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act

On April 10th, 2024, the Danish Gambling Authority has issued three orders to Mr. Green Limited for breaching the Anti-Money Laundering Act, on risk assessment, on procedures for internal controls and for failing to ensure that controls are carried out.

On April 10th, 2024, the Danish Gambling Authority has also given Mr. Green Limited a reprimand for breaching the rules on notification in the Anti-Money Laundering Act.

The reactions have been given in connection with the Danish Gambling Authority’s inspection of Mr. Green Limited’s materials that Mr. Green Limited has provided for compliance with the Anti-Money Laundering Act.

Order for insufficient risk assessment

Order (a) is issued because Mr. Green’s risk assessment is insufficient, as no separate risk assessment has been made of the individual identified risks associated with Mr. Green’s business model, including payment solutions, and the risk factors associated with it. It follows from section 7(1) of the Anti-Money Laundering Act that undertakings subject to the Act must identify and assess the risk that the undertaking may be misused for money laundering or terrorist financing. The Danish Gambling Authority’s assesses that the risk assessment must include a separate assessment of the risk of the individual payment solutions and delivery channels, as well as a separate risk assessment of the risk factors associated with these. Thus, Mr. Green did not comply with the risk assessment obligation.

Order for insufficient and lack of business procedures

Order (b) is issued because Mr. Green Limited does not have adequate procedures for internal controls, as these do not describe the interval at which controls should be performed. The order has also been given because Mr. Green Limited does not have written procedures on how to monitor that controls are carried out. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must have adequate written business procedures, which must include internal control. The business procedures should describe how the listed areas are handled in practice. The requirement for internal control also means that there must be controls of whether the controls are being carried out – in other words, that the controls are being checked. Mr. Green Limited has not sufficiently complied with the commitments on business procedures for controls.

Order for lack of documentation of controls

Order (c) is issued because Mr. Green Limited has not documented that controls have been carried out to verify that the internal controls have been performed. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must document the controls that have been carried out. Thus, Mr. Green Limited has not complied with the obligations to perform controls to ensure that the internal controls are performed.

Reprimand for not making an immediate notification

Reprimand (a) is given because Mr. Green Limited has in two cases not complied with the requirement for immediate notification to the Money Laundering Secretariat. According to section 26(1) of the Anti-Money Laundering Act, an undertaking must immediately notify the Money Laundering Secretariat if the undertaking knows, suspects or has reasonable grounds to suspect that a transaction, funds or activity is or has been related to money laundering or terrorist financing. Mr. Green has not complied with the notification obligations, as there has been no immediate notification.

Duty to act

The orders entail an obligation to act on the part of Mr. Green Limited. Mr. Green Limited must submit a revised risk assessment within June 10th, 2024.

Mr. Green must also within June 10th, 2024, submit a revised business procedure for internal controls and submit prepared business procedures for how the implementation of controls is monitored.

Mr. Green Limited must also submit documentation within October 10th, 2024, that it has been controlled that the controls have been carried out.

The reprimand does not entail any obligation to act on the part of Mr. Green Limited as the breach no longer exists.

The post DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act appeared first on European Gaming Industry News.

-

Baltics6 days ago

Baltics6 days agoHacksaw Gaming and TOPsport are on TOP of their game with new partnership announcement in Lithuania

-

Brazil7 days ago

Brazil7 days agoCounting Down: A Roundtable Preview of Brazil’s iGaming Era

-

Central Europe6 days ago

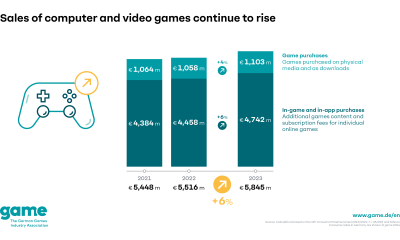

Central Europe6 days agoGerman games market in 2023: strong development in turbulent times

-

Compliance Updates6 days ago

Compliance Updates6 days agoDGA: Three orders and two reprimands to Skill on Net Ltd for breach of the Anti-Money Laundering Act

-

Baltics6 days ago

Baltics6 days agoHIPTHER Invites You to Recognize Gaming Excellence at the Baltic & Scandinavian Gaming Awards 2024 – Online Voting Session is Now Open!

-

Baltics6 days ago

Baltics6 days agoWazdan expands in Lithuania with Twinsbet deal

-

Latest News6 days ago

Latest News6 days agoSvenska Spel Appoints Gustav Georgson to Lead Public Affairs

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoAltenar becomes General Sponsor of EEGS 2024