Latest News

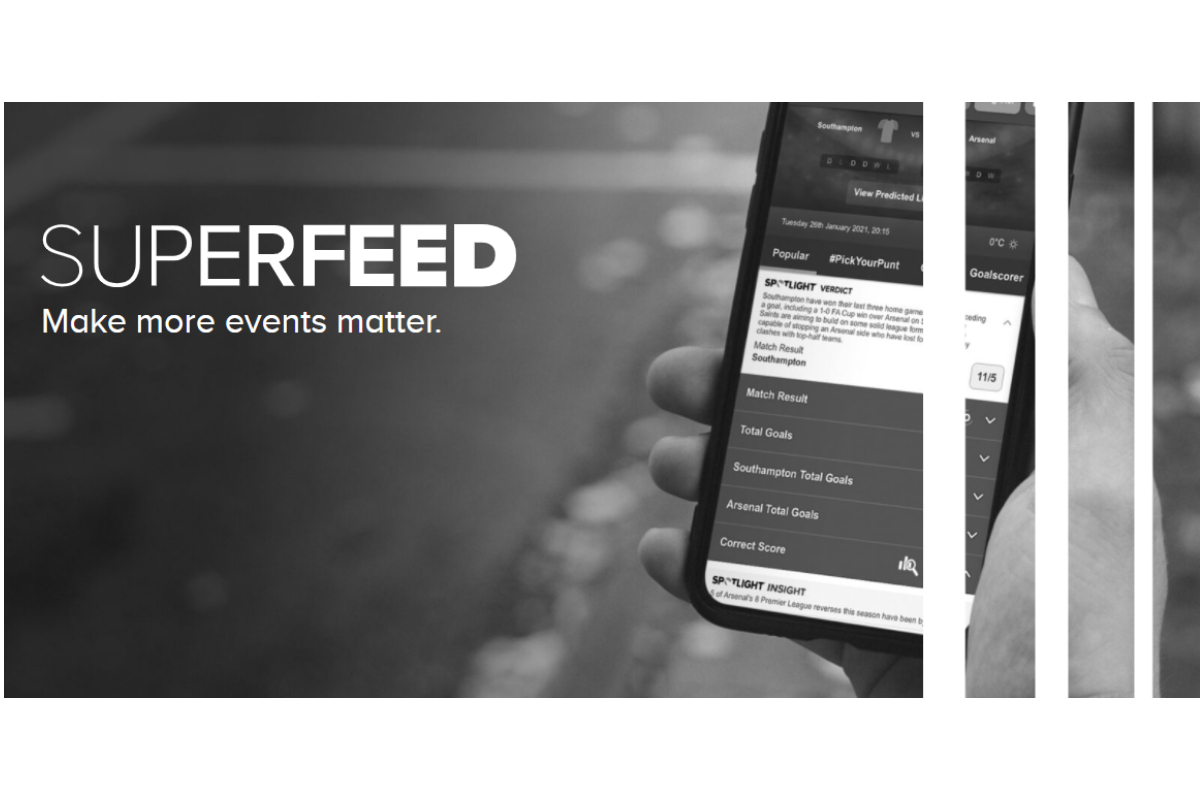

Spotlight Sports Group launch new Superfeed content engine

Spotlight Sports Group has launched Superfeed, a world-leading content engine that powers on-site engagement by delivering impartial expert betting insight. The innovation is delivered via full API integration or through an industry-leading widget.

Superfeed incorporates Spotlight Sports Group’s vast array of content into one product, delivering expert sports betting editorial and data on any sport in over 70 languages. The group’s data scientists and journalists produce editorial expertise that sits alongside relevant markets to engage customers for longer.

Included in the new Superfeed product are pre-match betting insights, verdicts and projections on all sports. When the event becomes live, Superfeed powers the revolutionary technology to provide real-time in-play tipping, reacting to on-field events and driven by historical data.

Also included in Superfeed is the industry-leading racing content from Racing Post. Covering 60,000 races across the world, Racing Post content delivers expert opinion on every horse in every race.

As Spotlight Sports Group continues to expand across the US, Superfeed now contains expert content covering all four major US sports including college sports totalling 7,000 events annually. The insight enhances the sports betting experience and user dwell time for US sportsbooks.

Discussing the launch of Superfeed, Chief Commercial Officer, Sam Houlding detailed the breadth of content and how Superfeed can make more events matter to customers.

‘Superfeed is the next exciting step for Spotlight Sports Group when it comes to the provision of content. The product contains more content across more sports and languages, than ever before. We’re now producing sports betting insights, verdicts and projections on 25,000 events a year. From our research, we know sports bettors bet on a range of up to 5% of sports events. With Superfeed you can now inform, empower and engage them on the other 95%, making more events matter to your customers.

Houlding continued: ‘With the feed also encompassing all relevant US sports, delivered from our localised US content experts as well as the much-loved Racing Post content, Superfeed is our most advanced content generation product to date. We’ve simplified integration by working with our partners and we’ve grown our data science and editorial team to produce the best sports betting content in the industry. We’re excited to see the full power of Superfeed in action, enriching sportsbooks with expert content.’

Superfeed is now live, to find out more about the content engine visit https://www.spotlightsportsgroup.com/superfeed/

Powered by WPeMatico

Latest News

Special Joker symbols refresh iconic series in Wazdan’s retro-inspired Magic Fruits Dice

Wazdan, the gain-focused developer, has introduced Magic Fruits Dice, a vibrant new entry in its successful Magic Fruit series, featuring special Joker symbols that enhance win potential in a nostalgic, retro-inspired slot experience.

Designed for fans of traditional slot gameplay, Magic Fruits Dice features a classic three-reel, five-payline format paired with a retro fruit theme reminiscent of land-based machines. With its straightforward structure and easy-to-follow rules, the game focuses on delivering simple yet engaging entertainment centered around one standout feature.

At the heart of the gameplay is the Joker symbol, which acts as the highest-paying icon in the game. The Joker can appear alongside the four lowest-paying symbols as an additional icon displayed in their corner. When three of these special symbols land on a payline, players receive the corresponding payout, creating a clear and rewarding gameplay mechanic.

The title also incorporates Wazdan’s customisable Volatility Levels , allowing players to adjust the gameplay experience to suit their preferred risk and reward style. This flexibility ensures the slot can appeal to different player profiles across a variety of regulated markets.

, allowing players to adjust the gameplay experience to suit their preferred risk and reward style. This flexibility ensures the slot can appeal to different player profiles across a variety of regulated markets.

By focusing on a single, recognisable feature, Magic Fruits Dice reflects Wazdan’s engagement-driven approach to game development, delivering a tailored player experience designed to perform consistently for operators.

Andrzej Hyla, Chief Commercial Officer at Wazdan, said:

“Magic Fruits Dice demonstrates our commitment to remaining an innovative supplier, even within the most classic of formats. As a team, we take great pride in evolving established series such as Magic Fruits while preserving the qualities that players value most.

“This release reflects our belief that the quality of the user’s experience is paramount. By combining a timeless three-reel structure with a distinctive Joker mechanic, we continue to go above and beyond for our partners, delivering games that are both familiar and capable of making a real impact across multiple markets.”

The post Special Joker symbols refresh iconic series in Wazdan’s retro-inspired Magic Fruits Dice appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Big Adventures Campaign

Evoplay wraps up record-breaking Big Adventures campaign with Maldives grand prize

Evoplay, the award-winning game development studio, has officially concluded its largest-ever network campaign, Big Adventures, with the grand prize winner revealed during a live draw held on March 12.

Running for nine months from June 2025 to February 2026, the promotion became one of Evoplay’s most ambitious engagement initiatives to date. The campaign featured a €2.5 million total prize pool, distributed more than 115,000 random prizes, and delivered 180 days of player activity across participating operator platforms.

Throughout the promotion, players competed in multiple tournament phases while unlocking additional rewards through interactive mechanics such as Prize Drops and Wheel of Fortune events.

Although thousands of prizes were awarded during the campaign, the highlight came with the announcement of the Grand Mega Prize: a VIP trip to the Maldives for two, including flights, premium accommodation, and a curated island experience organised by Evoplay.

The winner was selected through a live random draw among the Top 100 players on the final leaderboard, recognising those who performed best throughout the tournament stages.

The recording of the draw is available here: https://youtube.com/live/mpPQB0MSyZM

In addition to the main prizes, Big Adventures also rewarded loyal players through quarterly giveaways, where top participants received the latest iPhone Pro Max devices.

Beyond player engagement, the campaign was also designed to deliver strong value for operators. Built-in gamification tools — including leaderboard APIs, promotional assets, and integrated campaign widgets — allowed operators to promote the event seamlessly across their platforms.

Following the success of Big Adventures, Evoplay has already launched its next large-scale campaign, Four Seasons of Legends, beginning with the Spring edition. The new initiative offers operators another opportunity to participate in a network-wide promotion aimed at boosting player engagement and retention.

Diana Larina, Head of Marketing at Evoplay, said:

“Big Adventures has been a landmark campaign for Evoplay and our operator partners. Over the past nine months we’ve seen incredible engagement from players around the world, with thousands of prizes won and strong participation across every phase of the campaign.

“The live finale was the perfect way to close the campaign and celebrate the community that took part, and we’re already looking ahead to the next major campaign, which will give operators even more opportunities to engage their players.”

The post Evoplay wraps up record-breaking Big Adventures campaign with Maldives grand prize appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

Million Games Launches Piggy Rush with RushReel and Cash Collect Mechanics

Million Games has unveiled Piggy Rush, a new feature-packed 5×3 video slot that blends classic fruit-themed visuals with modern gameplay mechanics and fixed jackpot opportunities.

Created by Yugo Workshop, part of the Million Stars partner studio programme, Piggy Rush marks the eighth collaboration between the two companies.

At the center of the game is the RushReel, a bonus reel that can activate during any spin. When triggered, it awards multipliers or additional Piggy Symbols, enhancing both line wins and the Cash Collect Feature to dynamically increase win potential.

Piggy Symbols play a crucial role in the gameplay. At the end of each spin, all Piggy Symbols transform simultaneously, either becoming matching paying symbols or turning into Coins and Collector symbols that activate the Cash Collect mode.

During the Cash Collect Feature, players gather coin values while competing for three fixed jackpots:

-

Mega – 1000x base bet

-

Major – 200x base bet

-

Mini – 50x base bet

With medium volatility and a maximum payout of up to 5,000x the bet, Piggy Rush is designed to appeal to a broad audience while still offering strong win potential.

Thomas Nimstad, CEO of Million Games, said:

“Piggy Rush demonstrates how strong base mechanics combined with layered bonus features can create accessible yet engaging gameplay. It’s another strong addition to our growing portfolio and a testament to the strength of our Million Stars partner programme.”

Piggy Rush is now available globally through Million Games for operators and aggregators.

The post Million Games Launches Piggy Rush with RushReel and Cash Collect Mechanics appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News7 days ago

Latest News7 days agoNFL LEGEND ROB GRONKOWSKI TAKES ON HIGH-STAKES POKER PROS ON POKERSTARS BIG GAME ON TOUR IN LAS VEGAS

-

Animal Wellness Action4 days ago

Animal Wellness Action4 days agoGREY2K USA Worldwide and Animal Wellness Action Celebrate House Agriculture Committee Passage of a Ban on Greyhound Racing in America

-

AI4 days ago

AI4 days agoNew Videoslots app stars in AI-assisted “Stone Age” ad

-

Inferno Mayhem4 days ago

Inferno Mayhem4 days agoPG Soft cranks up the volume with electrifying Inferno Mayhem slot

-

Caesars Entertainment Windsor Limited4 days ago

Caesars Entertainment Windsor Limited4 days agoOLG and Caesars Sign Long-term Operating Agreement for Windsor Casino

-

Agilysys Inc3 days ago

Agilysys Inc3 days agoWinford Resort & Casino Manila Philippines Deploys Agilysys Hospitality Technology to Elevate Operations and Service

-

Gambling in the USA7 days ago

Gambling in the USA7 days agoDigicode at NEXT.io Summit NYC 2026: Driving the Future of iGaming Technology

-

Africa4 days ago

Africa4 days agoBlueprint Gaming Expands into South Africa Through Strategic Partnership with Hollywoodbets