Latest News

Gambling.com Group Publishes Q2 2020 Interim Report

Q2 Interim Report | 3 months ended 30 June 2020

APR-JUNE 2020 (COMPARED WITH APR-JUNE 2019)

- Revenues totalled EUR 5.69 (4.42) million, an increase of 29%.

- Adjusted EBITDA excluding non-recurring costs totalled EUR 3.25 (0.99) million, corresponding to an adjusted EBITDA margin of 57 (23)%.

- EBITDA totalled EUR 3.14 (0.94) million, corresponding to an EBITDA margin of 55 (21)%.

- Net cash generated from operating activities was EUR 2.93 (1.62) million.

- New Depositing Customers (NDCs) totalled 24,986 (19,487).

JAN-JUNE 2020 (COMPARED WITH JAN-JUNE 2019)

- Revenues totalled EUR 9.46 (9.67) million, a decrease of 2%.

- Adjusted EBITDA excluding non-recurring costs totalled EUR 3.99 (2.75) million, corresponding to an adjusted EBITDA margin of 42 (28)%.

- EBITDA totalled EUR 3.70 (2.70) million, corresponding to an EBITDA margin of 39 (28)%.

- Net cash generated from operating activities was EUR 2.98 (2.67) million.

- New Depositing Customers (NDCs) totalled 41,082 (46,752).

SIGNIFICANT EVENTS DURING THE SECOND QUARTER 2020

- Colorado Approval | The Group received approval from the Colorado Limited Gaming Control Commission to provide marketing services to licensed gaming operators in the state.

- The American Gambling Awards | An Honorary American Gambling Award was presented to Rep. Brandt Iden of Michigan. A full program was postponed until 2021 in view of the COVID-19 pandemic.

- COVID-19 Pandemic | As anticipated, the spread of the COVID-19 virus forced postponements or cancellations of sporting events worldwide negatively affecting sports revenue in the second quarter. Online casino and other non-sports games saw increased demand.

- Publication of Annual Report | The 2019 Annual Report and Consolidated Financial Statements was published on April 24, 2020 and is available on the official website of the Group (www.gambling.com/corporate).

- Trading Update | The Group published a trading update on June 26, 2020.

- The Annual General Meeting | Gambling.com held the annual general meeting on June 22, 2020. The annual report was approved and the directors and auditors re-elected.

SIGNIFICANT EVENTS AFTER THE REPORTING PERIOD

- Launch of SlotSource.com on the US market | Gambling.com Group launched SlotSource.com in regulated US states to empower American online slot players.

- Sweden deposit and bonus limitations | The Swedish government temporarily introduced deposit and bonus limitations for gambling operators from July 2 to December 31, 2020.

“The Group delivered a record performance in Q2 in terms of revenue, EBITDA, casino NDCs and earned NDCs despite pausing media buying and virtually no sporting events. Our strategy to scale OPEX to invest in superior products and best-in-class technology clearly bore fruit in the quarter with significant improvements in search performance, monetization and operational efficiency.” – Charles Gillespie, Chief Executive.

Powered by WPeMatico

David Nilsen Editor-in-Chief at Kongebonus

Kongebonus Awards 2025 Winners Announced

Kongebonus, the premier provider of iGaming news and all things casino and betting in Norway, has revealed the winners of the Kongebonus Awards 2025, with this year’s outcomes disclosed alongside ICE Barcelona.

The Kongebonus Awards, the sole iGaming awards from Norway, are determined by a mix of votes from actual players nationwide and editorial assessments, with this year’s edition reflecting a noticeable change in both reach and participation. The awards garnered a total of 1,192 verified votes, reflecting a 25% rise from the previous year, highlighting their increasing significance for players and industry stakeholders.

Among those rejoicing in triumph this year, Print Studios earned the prestigious Best New Slot award for Uncle Profit. Filip Wargeus, Chief Commercial Officer at Print Studios, stated: “This is incredibly meaningful to us. It’s a genuine reflection of the entire team that our efforts are succeeding and are valued by fans, players, and communities.

ELK Studios was acknowledged as the Most Innovative Game Developer, obtaining 24.75% of the votes, with Jacob Nordwall, Head of Marketing at ELK Studios, stating: “Winning the Most Innovative Game Provider award in 2025 from the Kongebonus Awards is significant for us, particularly since it is solely determined by the Norwegian player community. This strongly shows that our efforts are valued and genuinely connect with players in Norway, and that our commitment to remaining innovative and advancing the industry is being acknowledged.”

Other significant winners featured Push Gaming, recognized as Best Game Developer 2025, while Pragmatic Play’s Gates of Olympus earned the Readers’ Hall of Fame accolade. In contrast to the other categories, the Hall of Fame honors games that have established enduring popularity and attained legendary status throughout time.

David Nilsen, Editor-in-Chief at Kongebonus, said: “The purpose of the Kongebonus Awards is to showcase which studios, games and suppliers have genuinely stood out over the past year. We are not only looking at commercial success, but at quality, innovation and how well experiences are delivered to players. Because the results are shaped by open voting from Norwegian players, the awards reflect what truly resonates with the community while still maintaining a strong industry perspective.”

The post Kongebonus Awards 2025 Winners Announced appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

155.io

155.io Breaks the Mold Again, Introducing the CCTV Game Genre via Rush Hour

155.io, the live content studio transforming real-world games, has launched CCTV.Game, an innovative genre created entirely from live CCTV footage collected worldwide. The category debuts with its inaugural title, Rush Hour. The live game operates around the clock to convert real-life traffic into immediate viewing and wagering entertainment.

The CCTV Game signifies a new path for 155.io, broadening its chaos-oriented philosophy into completely live, real-world settings. Created using numerous live CCTV feeds from around the globe, the game transforms everyday activities into quick, engaging, and immediately bettable entertainment.

Running nonstop, Rush Hour enables players to wager on straightforward, distinct results during rounds lasting under a minute – such as the number of cars that cross a junction or the quantity that turns left or right within a specified timeframe. Each round is dynamic, spontaneous, and influenced by the organic rhythms of the world, instead of standard RNG methods.

Rush Hour’s live recordings feature diverse locations such as Sydney, Swindon, Arizona, and Taipei, as well as landmarks like Patong Beach in Thailand and Abbey Road in London. From everyday crossroads to landmark locations, the entire world transforms into the game board. Crafted for mobile devices, Rush Hour is immediately comprehensible and genuinely engaging, providing a much-needed option to conventional casino formats. CCTV Game embodies 155.io’s fundamental philosophy: chaotic reality, straightforward games, and entertainment designed primarily for mobile.

The launch enhances 155.io’s attraction to the upcoming player generation, merging live-stream culture with instant betting features.

CCTV Game and Rush Hour can now be accessed via Hub88 or through direct integration.

Sam Jones, Founder & CEO of 155.io, commented: “Rush Hour is the first expression of our CCTV Game genre – think Big Brother blended with Polymarket. It’s completely live, and the world is now our studio. CCTV.game takes real-world chaos and turns it into something instantly playable and genuinely entertaining – this is content the next generation will queue up to try.”

He added: “Once you realise the entire world can be a live game feed, there are no boundaries. Live traffic content is just the start – from live wildlife to iconic sporting locations – we’re only just setting off on our journey of what real-world chaos entertainment can be.”

The post 155.io Breaks the Mold Again, Introducing the CCTV Game Genre via Rush Hour appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

MGA Games Launches Poseidon’s Orb Slot Featuring Sticky Wilds and Free Spins

MGA Games, a prominent Spanish firm specializing in content creation for international casino operators, will debut Poseidon’s Orb on January 28, its latest video slot for the .com markets. This title encourages players to join an explorer on an epic quest to find the legendary city of Atlantis.

The game is a Video Slot with 5 reels and 3 rows, offering 10 paylines, and includes Wild and Scatter symbols that activate Free Spins. A remarkable aspect is the Sticky Wilds mechanic in the Free Spins round—an inventive element that boosts thrill and raises winning possibilities. It additionally includes an optional purchase of Free Spins, adjustable for each operator.

The theme of Poseidon’s Orb, drawn from global myths and legends, aims to attract a diverse audience of players. Its stunning visuals and film-inspired score further guarantee an engaging experience brimming with thrills and rewards.

Classified under popular themes like “Adventure,” “Mythology,” “Treasures,” and “Fantasy,” this latest MGA Games Video Slot serves as a valuable enhancement to any operator’s collection, improving player retention and profits, while the Free Spins purchase feature offers an extra revenue opportunity.

The post MGA Games Launches Poseidon’s Orb Slot Featuring Sticky Wilds and Free Spins appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt7 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt7 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

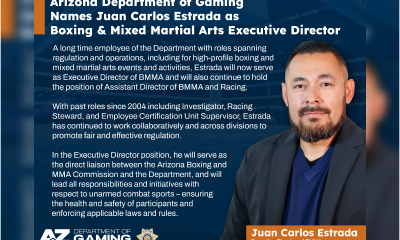

ADG7 days ago

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anton Ivannikov CPO at Playson7 days ago

Anton Ivannikov CPO at Playson7 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale7 days ago

Battle Royale7 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Attorney General Andrea Joy Campbell7 days ago

Attorney General Andrea Joy Campbell7 days agoAG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts