Gambling in the USA

Golden Nugget Online Gaming To Become Public

Landcadia Holdings II, Inc. to Acquire Golden Nugget Online Gaming

Tilman J. Fertitta and Landcadia Holdings II, Inc. announced today that Landcadia II has entered into a Purchase Agreement to acquire Golden Nugget Online Gaming, Inc. (“GNOG”), a US online real money casino owned by Tilman Fertitta, recognized by both its peers and customers alike as the industry leading online casino that brought Live Dealer to the US market place. Landcadia II is a publicly traded special purpose acquisition company co-sponsored by Fertitta Entertainment, Inc. and Jefferies Financial Group Inc.

GNOG will become only the second pure publicly traded online casino company in the US. The transaction is expected to close in the third quarter of this year. Upon closing, Landcadia II intends to change its name to Golden Nugget Online Gaming, Inc. and its Nasdaq trading symbol to GNOG.

“GNOG is one of the best positioned companies to capitalize on this massive online gaming opportunity in the US,” said Rich Handler, Co-Chairman of Landcadia II and CEO of Jefferies LLC. “We at Jefferies couldn’t be more thrilled to partner with Tilman and bring this great opportunity to the public markets.”

Golden Nugget is a household name throughout the United States and its iGaming business is a well-established leader in New Jersey, the largest online gaming market in North America. GNOG has obtained market access, subject to regulatory approval, to Pennsylvania and Michigan and anticipates launching its online casino brand in each of those new markets in early 2021.

GNOG is known among its industry peers as the preeminent operator in the US online gaming market, having won the EGR North America Top Operator Award for three consecutive years. GNOG is known for its innovation, including initiating Live Dealer, Live Casino Floor gambling and a number of exclusive slot machine games to mobile devices, tablets and computers throughout New Jersey, as well as its top-notch 24/7 customer support.

Tilman J. Fertitta will remain GNOG’s Chairman and CEO, and Thomas Winter, who was brought in to develop Golden Nugget’s online gaming business, will continue to serve as GNOG’s President. During the seven years since Thomas Winter started Golden Nugget’s iGaming business in New Jersey, revenues and profitability have grown each year despite facing competition with greater financial resources. According to Mr. Fertitta, “Golden Nugget is one of the most time-honored brands in the gaming business today. When customers hear the name Golden Nugget, they know they are dealing with a trusted online gaming business. Thomas and his team have done a remarkable job, are the best in the industry, and with this transaction, will have access to growth capital to allow for the rapid expansion of the business.”

GNOG Highlights

- Started operation in New Jersey Q4 2013

- Became profitable in 2016

- First online gaming company to launch Live Dealer in the US

- Won Industry award as top operator 3 years in a row

- First to launch Live Casino Floor in US

- Net Income of over $11 million in 2019

Key Transaction Terms

The transaction values the combined company at an anticipated pro forma enterprise value of approximately $745 million, or 6.1x GNOG’s estimated 2021 revenue of $122 million. The consideration payable to the parent entity of GNOG will consist of a combination of cash and rollover equity in Landcadia II. Upon completion of the transaction, Tilman J. Fertitta, Chairman and CEO, will, through the parent entity of GNOG, hold a controlling economic interest (through an Up-C structure described below) and a controlling voting interest in the combined company. The combined company will have a dual-class share structure with super voting rights for Mr. Fertitta.

Landcadia II will be assuming $150 million of GNOG debt of and will pay down at closing an additional $150 million of its debt, plus pay prepayment fees, transaction fees and expenses. Subject to redemptions, there is approximately $321 million currently held in Landcadia II’s trust account. Upon payment of the purchase price, debt repayment and transaction fees and expenses, the combined company will have at least $80 million on its consolidated balance sheet at closing and an anticipated pro forma equity market capitalization of nearly $700 million.

The transaction will be structured as an Up-C where an entity indirectly owned by Mr. Fertitta will retain common units of a partnership managed by the combined company and an equal number of non-economic voting shares in the combined company. The combined company will also enter into a customary tax receivable arrangement with such entity indirectly owned by Mr. Fertitta, which will provide for the sharing of tax benefits relating to certain pre-combination tax attributes, as well as tax attributes generated by the transaction and any subsequent sales or exchanges by the entity indirectly owned by Mr. Fertitta of their equity interests, as those attributes are realized by the combined company.

The transaction has been unanimously approved by the Board of Directors of Landcadia II, upon the unanimous recommendation of a committee comprised solely of Landcadia II’s disinterested independent directors (the “Committee”). The transaction will require the approval of a majority of the outstanding shares of Landcadia II, excluding shares beneficially owned by Tilman J. Fertitta and Jefferies Financial Group, and is subject to customary closing conditions, including certain regulatory approvals. Jefferies LLC is acting as exclusive financial and capital markets advisor to Landcadia II. Haynes and Boone LLP is acting as legal advisor to GNOG. White & Case LLP is acting as legal advisor to Landcadia II. Houlihan Lokey, Inc. is serving as financial advisor to the Committee of Landcadia II.

SOURCE Landcadia Holdings II, Inc.

Powered by WPeMatico

BetMGM Casino

BetMGM Reveals 2025’s Most Searched Casino Games

Key Findings

- Nevada recorded the highest combined casino game search interest nationally, achieving a perfect 500/500 score in 2025, the only state to do so.

- Home to Las Vegas—the world-renowned center of casino gaming and entertainment—Nevada recorded casino game searches 181% above the national average last year, reinforcing the city’s dominance in gambling culture.

- Michigan led all legal online casino states for overall search interest across major casino game categories.

- The most-searched casino games nationwide were slots.

- Search interest across legal online casino states was closely matched last year, led by Michigan.

- The District of Columbia showed the lowest search interest, searching 38% below the national average.

Casino Game Online Search Results

| Game | Score

*Maximum 5,100 |

Search Interest |

| Slots | 2831 | 31.2% |

| Casino | 1717 | 18.9% |

| Roulette | 1607 | 17.7% |

| Poker | 1594 | 17.6% |

| Blackjack | 1329 | 14.6% |

Legal Online Casino States Where BetMGM Operates

| Legal Online Casino States | Casino Game Search Interest Score (Out of a total of 500) | National Ranking |

| Michigan | 172 | 20 |

| West Virginia | 171 | 21 |

| Pennsylvania & New Jersey | 169 | 22 |

Key Insights from Legal Online Casino States

Here are a few of the key findings from this research:

1. Slots Dominate Regulated Markets

Slots are the top-searched casino game in every legal online casino state except New Jersey, reinforcing slots as the primary driver of online casino interest in regulated U.S. markets.

2. New Jersey Stands Out with Roulette-Led Interest

New Jersey is the only legal online casino state where roulette outranked slots as the most searched game in 2025. This indicates a more diversified player base with a stronger interest in live dealer and table games.

3. Search Interest is Tightly Clustered Across Legal States

Michigan, West Virginia, Pennsylvania, and New Jersey all ranked closely together nationally (positions 20–22), with very similar search interest scores.

Methodology

BetMGM Casino analysed Google search trends to assess nationwide interest in casino games over a 12-month period, covering January 1 to December 31, 2025.

Search interest was measured across five core casino game categories:

- Casino

- Slots

- Poker

- Blackjack

- Roulette

Only the generic category terms (for example, “slots”, “poker”, and “casino”) were analyzed. No modifiers such as “online”, “real money”, or brand-specific keywords were included. This approach ensures the data reflects overall interest in casino games, rather than being influenced by regulatory differences, platform availability, or other variables in individual states. It is critical to note Google Trends is strongest when you compare high-volume, generic terms.

Google Trends scores were used to compare relative search interest by state, with values scaled from 0 to 100 per category, where 100 represents the highest level of search interest observed during the period analysed.

This methodology allows for a consistent, like-for-like comparison of casino game popularity across the United States, highlighting regional interest patterns and broader gambling trends rather than online-only behavior.

Play Your Favorite Online Casino Games at BetMGM

Whether you search for online slots, casino table games, or live dealer casino game experiences, you can find your favorite online casino games at BetMGM Casino.

When you sign up to enjoy any of these great games, you’ll also get access to great ongoing and limited-time promotions, as well as the BetMGM Rewards loyalty program that offers both online and in person benefits for BetMGM players.

The post BetMGM Reveals 2025’s Most Searched Casino Games appeared first on Americas iGaming & Sports Betting News.

Gambling in the USA

Teamsters at Rio Hotel Ratify Strong Contract, Avert Strike

Workers at Rio Hotel and Casino, represented by Teamsters Local 986, have overwhelmingly ratified a strong four-year collective bargaining agreement. The group of 62 front desk workers, laborers, warehouse workers, and valet attendants secured higher wages, improved benefits, and stronger workplace protections.

“Our members stood strong, and management had no other choice but to deliver. This win belongs to every worker who refused to be ignored, and it proves that when we fight as one, we secure real improvements,” said Tim Vera, President of Local 986.

The four-year deal delivers a 15% wage increase, improved vacation policies, and continued coverage under the Teamsters Health and Welfare plan. The contract also includes job protections against technology and an option for workers to enroll into the Teamsters 401(k) plan.

“All we asked for was a fair contract that allows us to do our job without worrying. We didn’t want to strike, but we were ready if it came to that. Now we can come to work knowing that management listened and that our labor is respected,” said Malinda Zarcone, a front desk worker and steward at Local 986.

The agreement was reached after workers voted to authorize a strike on Nov. 10 over unfair labor practices. The vote followed nearly two years of stalled negotiations by Dreamscape, the property’s owner.

“Management dragged out negotiations and our members held them accountable. We don’t tolerate delays and disrespect toward our members. We’re always prepared to take action and win,” said Tommy Blitsch, Director of the Teamsters Convention, Trade Show, and Casino Division.

The post Teamsters at Rio Hotel Ratify Strong Contract, Avert Strike appeared first on Americas iGaming & Sports Betting News.

Gambling in the USA

MONOPOLY Table Games Progressive from Galaxy Gaming debuts at the Plaza Hotel & Casino

MONOPOLY Table Games Progressive brings the beloved classic to life in the casino pit, transforming every round into a dynamic and rewarding experience. Mr. Monopoly is the star of the show, randomly selecting hands and providing exciting multipliers up to 10x, keeping players engaged and on the edge of their seats.

Details

Designed to deliver high energy and volatility without compromising house edge, the MONOPOLY Table Games Progressive is unlike anything the industry has seen. With nostalgic animations and familiar visuals, this theme adds a fresh layer of excitement to the table—and best of all, it’s compatible with nearly any Galaxy Gaming progressive.

.png)

The post MONOPOLY Table Games Progressive from Galaxy Gaming debuts at the Plaza Hotel & Casino appeared first on Americas iGaming & Sports Betting News.

-

Latest News3 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global3 days ago

Games Global3 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Birgit Wimmer6 days ago

Birgit Wimmer6 days agoBirgit Wimmer Named Chairwoman as NOVOMATIC AG Reshapes Supervisory Board

-

Compliance Updates5 days ago

Compliance Updates5 days agoDabble introduces GeoComply’s digital identity platform, achieving 90%+ KYC pass rates and gaining deeper fraud visibility through device and location intelligence

-

Africa5 days ago

Africa5 days agoSun International Appoints Nomzamo Radebe as COO

-

EMEA ESPORTS6 days ago

EMEA ESPORTS6 days agoMOVEMBER TEAMS UP WITH RIOT GAMES EMEA ESPORTS

-

Asia5 days ago

Asia5 days agoInsurgence Gaming Company Expands Grassroots Vision with MOBA Legends 5v5 Discord Play-Ins

-

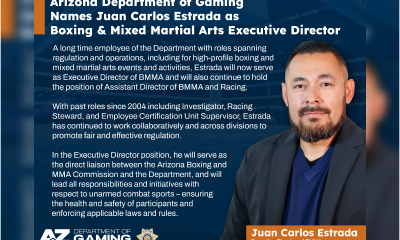

ADG4 days ago

ADG4 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director