Industry News

STICPAY: the Solution for Online Gambling Services to Achieve Fast and Secure Disbursements

As part of its award-winning e-wallet solution, the UK-based fintech company STICPAY has partnered with local banks in multiple countries to provide fast, secure, and convenient withdrawals on online gambling platforms. This way, service providers can improve the expectations of their customers a lot.

To eliminate fraud, comply with local regulations, and protect our users, STICPAY only provides merchant services to licensed online gambling solutions that operate according to the relevant regulatory laws and measures.

With several stores closing down and governments introducing lockdowns globally to slow the spread of the COVID-19 pandemic, online gambling services have seen a significant rise in user activity.

However, many customers feel that they are let down as disbursement options are not meeting user expectations.

As players are betting more and everyday activities are shifting from offline to online, users are demanding faster withdrawals and secure payments from online gambling services, with similar speeds they normally experience in the retail industry.

The customer experience is not as engaging as it should be, which could drive users away from service providers due to the withdrawal issues of online gambling solutions.

Issues Amid the Coronavirus-Fueled Online Gambling Growth

The global gambling industry is growing at a fast rate. From 2019’s $58.9 billion, the online gaming market is expected to grow to $66.7 billion in 2020 at a Compound Annual Growth Rate (CAGR) of 13.2%.

According to the researchers, a great share of the increase could be attributed to COVID-19 as consumers are increasingly using online gambling services while staying at home during the lockdown. Based on the findings of the report, the online gaming sector could reach $92.9 billion by 2023 at a CAGR of 11.64%.

The coronavirus-fueled rise in online gambling activity is also significant in Asia and Australia. Even though such activities are banned in multiple Asian countries, the APAC region is the industry’s second-largest market, representing a global share of 11.72% in 2017.

According to a joint study of the Australian organizations Illion and Alphabeta, online gaming activity has increased by 67% in early April in the Oceanic nation.

Despite the increase in online gaming, service providers are struggling to satisfy customer needs. While consumers are already used to fast payments processing in the e-commerce and the retail industries, gamblers have to wait several days to withdraw their funds from online gaming platforms.

Since slow disbursements prevent online gambling service providers from meeting customer needs, their users are becoming less engaged with their solutions. As a result, they may decide to choose a competitor platform that offers quick payouts to gamers.

STICPAY to Offer Faster and Secure Deposits and Withdrawals to Online Gambling Services

The London-based fintech company STICPAY has identified the disbursement issue of online gambling services, seeking to solve their problems with rapid payments as part of its award-winning e-wallet solution.

STICPAY considers Asia as one of its key markets. With a Year-Over-Year (YoY) growth of 300% and availability in 200+ nations, over 60% of STICPAY transactions come from Asian users, with the average monthly growth rate of transactions in the continent being 28%.

STICPAY has partnered with local banks in several countries – including China, the Philippines, Indonesia, Malaysia, Singapore, Japan, Australia, and Canada, with support for more nations coming soon – to provide cost-efficient, fast, and convenient payments to both its merchants and end-users.

As a result, STICPAY users could take advantage of local bank wires to withdraw their funds from online gambling services much faster – it takes an average of one business day to withdraw funds from STICPAY using a local bank wire – than at regular payment gateways and competitor e-wallet solutions.

In addition to local bank transfers, STICPAY customers can use a wide variety of payment methods to withdraw and deposit funds. This includes Visa, MasterCard, UnionPay China, local and international bank wires, and cryptocurrencies (Bitcoin, Ethereum, Litecoin, and Tether).

Furthermore, STICPAY users can use the prepaid STIC Card to withdraw or spend their balances even more conveniently. The STIC Card is available to end-users in 200+ countries after submitting the relevant Know Your Customer (KYC) documents.

Besides fast and convenient payments, online gambling merchants and their customers could benefit from STICPAY’s advanced security features.

Apart from strict KYC and Anti-Money Laundering (AML) monitoring, STICPAY stores customer funds in segregated accounts – with uninterrupted user access and the ability to withdraw them to external accounts anytime – while uses a set of anti-fraud measures to protect both service providers and end-users.

As a result, there is no chargeback risk for merchants, as all funds received via STICPAY are 100% secure and indemnified.

“Many online gambling services provide a wide variety of payment methods to their users so they can choose the one that best fits their needs. However, with the current coronavirus-fueled rise in online gambling, offering faster and secure disbursements are becoming more crucial to fulfilling customer needs. Therefore, the traditional payment gateways where it takes three to five business days to withdraw funds are unable to satisfy the rising demands of online gamblers. With STICPAY, online gamblers can withdraw funds quicker, conveniently, and securely while leveraging our local partnerships with banks to initiate fast payouts in and out of the platforms that take one business day on average to execute. STICPAY grows at a rapid 300% Year-Over-Year rate, especially in the Asian region, where the average monthly growth of transactions is 28%. We are committed to leveraging this development to offer the best services to the online gambling industry.”

Powered by WPeMatico

Industry News

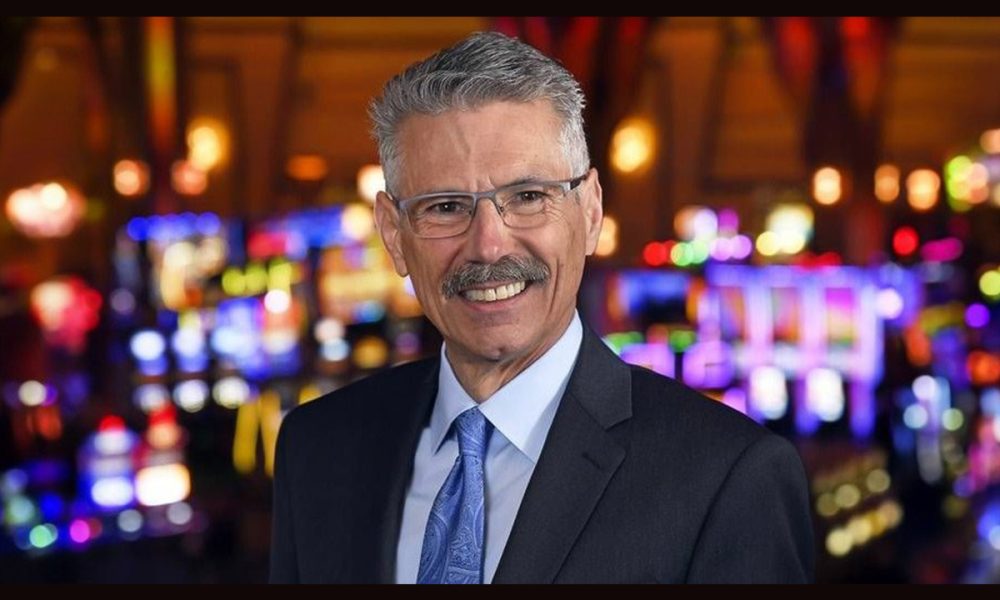

Mohegan Appoints Joseph J. Hasson as Interim COO

Mohegan Tribal Gaming Authority, known globally for its renowned integrated entertainment resorts, has appointed Joseph J. Hasson as interim Chief Operating Officer. Jody Madigan, the current COO, has resigned effective August 1, 2024, and will be taking a leave of absence pending his departure.

Joseph J. Hasson will serve as interim COO and retain his current role as General Manager of Mohegan Casino at Virgin Hotels Las Vegas, subject to necessary regulatory filings or approvals. Mr. Hasson was an obvious choice for the Management Board, given his prior experience as the former Chief Operating Officer of Station Casinos LLC and Red Rock Resorts Inc. Joe brings considerable expertise to the executive team with a consistent track record of operating excellence and success over more than 40 years’ experience in the gaming and hospitality industry. Mr. Hasson will report to Ray Pineault, President and Chief Executive Officer of Mohegan.

“Joseph J. Hasson’s deep understanding of the gaming and hospitality industry makes him exceptionally qualified to maintain our high service and operational excellence standards. We are confident that Joe’s extensive experience and proven leadership will ensure continuity in our operations and guest experience,” Ray Pineault, President and CEO of Mohegan, said.

Industry News

Jennifer Shatley Joins ROGA as Executive Director

Jennifer Shatley, a recognized expert in the field and a highly sought speaker and advisor, has joined the Responsible Online Gaming Association (ROGA) as Executive Director.

Shatley has had 25+ years worth of experience, working closely with the treatment community, academics, researchers, government bodies, state councils, and gaming industry representatives to promote responsible gaming.

“Many of America’s largest legal mobile gaming operators will be establishing a framework that helps to aid in responsible gaming education and awareness. By coming together with a clear set of objectives, ROGA and our members will work to enhance consumer protections and help provide easier and more efficient access to responsible gaming tools for consumers to enjoy the entertainment of online gaming,” Shatley said.

Industry News

IDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution

IDnow, a leading identity verification provider in Europe, has unveiled VideoIdent Flex, a new version of its expert-led video verification service that blends advanced AI technology with human interaction. The human-based video call solution, supported by AI, has been designed and built to boost customer conversion rates, reduce rising fraud attempts, increase inclusivity, and tackle an array of complex online verification scenarios, while offering a high-end service experience to end customers.

The company’s original expert-led product, VideoIdent, has been a cornerstone in identity verification for over a decade, serving the strictest requirements in highly regulated industries across Europe. VideoIdent Flex, re-engineered specifically for the UK market, represents a significant evolution, addressing the growing challenges of identity fraud, compliance related to Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes and ensuring fair access and inclusivity in today’s digital world outside of fully automated processes.

As remote identity verification becomes more crucial yet more challenging, VideoIdent Flex combines high-quality live video identity verification with hundreds of trained verification experts, thus ensuring that genuine customers gain equal access to digital services while effectively deterring fraudsters and money mules. Unlike fully automated solutions based on document liveness and biometric liveness features, this human-machine collaboration not only boosts onboarding rates and prevents fraud but also strengthens trust and confidence in both end users and organisations. VideoIdent Flex can also serve as a fallback service in case a fully automated solution fails.

Bertrand Bouteloup, Chief Commercial Officer at IDnow, said: “VideoIdent Flex marks a groundbreaking advancement in identity verification, merging AI-based technology with human intuition. In a landscape of evolving fraud tactics and steady UK bank branch closures, our solution draws on our decade’s worth of video verification experience and fraud insights, empowering UK businesses to maintain a competitive edge by offering a white glove service for VIP onboarding. With its unique combination of KYC-compliant identity verification, real-time fraud prevention solutions, and expert support, VideoIdent Flex is a powerful tool for the UK market.”

Whereas previously firms may have found video identification solutions to be excessive for their compliance requirement or out of reach due to costs, VideoIdent Flex opens up this option by customising checks as required by the respective regulatory bodies in financial services, mobility, telecommunications or gaming, to offer a streamlined solution fit for every industry and geography.

Bouteloup added: “Identity verification is incredibly nuanced; it’s as intricate as we are as human beings. This really compounds the importance of adopting a hybrid approach to identity – capitalising on the dual benefits of advanced technology when combined with human knowledge and awareness of social cues. With bank branches in the UK closing down, especially in the countryside, and interactions becoming more and more digital, our solution offers a means to maintain a human relationship between businesses and their end customers, no matter their age, disability or neurodiversity.

“VideoIdent Flex is designed from the ground up for organisations that cannot depend on a one-size-fits-all approach to ensuring their customers are who they say they are. In a world where fraud is consistently increasing, our video capability paired with our experts adds a powerful layer of security, especially for those businesses and customers that require a face-to-face interaction.”

The post IDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution appeared first on European Gaming Industry News.

-

Central Europe5 days ago

Central Europe5 days agoNolimit City Announces Partnership with win2day

-

Compliance Updates5 days ago

Compliance Updates5 days agoRomania Bans Gambling Venues in Small Towns and Villages

-

Latest News5 days ago

Latest News5 days agoNetBet Casino Partners with Nolimit City

-

Compliance Updates4 days ago

Compliance Updates4 days agoDGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act

-

Asia4 days ago

Asia4 days agoChina’s CBA League Extends Global Broadcast and Integrity Partnership with Sportradar

-

BIG Brazil4 days ago

BIG Brazil4 days agoNeoGames partners with BIG Brazil for its Caesars Brazil brand ahead of market opening

-

eSports4 days ago

eSports4 days agoeSports in the CIS region , Q&A w/ Viktor Block, Senior Sales Manager/PandaScore

-

Compliance Updates5 days ago

Compliance Updates5 days agoSightline Selects GeoComply for Identity and Geolocation Compliance Services