Press Releases

IBIA Integrity Report: 183 betting integrity alerts reported in 2019

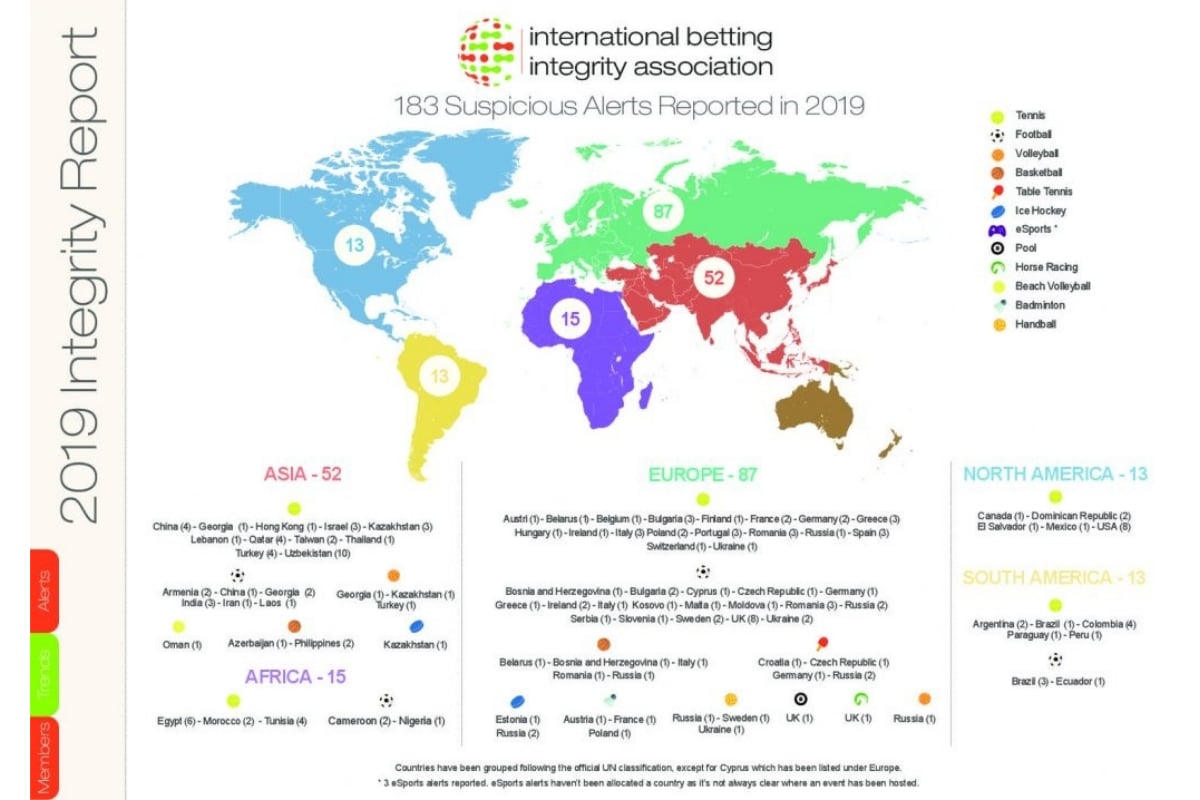

The International Betting Integrity Association (IBIA) reported 183 cases of suspicious betting to the relevant authorities during 2019, with 45 of those cases reported in the last quarter (Q4). The annual total represents a 31% fall in alerts from 2018, with tennis accounting for the vast majority of that decline. Tennis (101) and football (49) constituted 82% of all alerts reported during 2019, with Europe (48%) and Asia (28%) maintaining their positions as the primary locations of the sports events on which alerts were generated during that period.

Khalid Ali, CEO of IBIA, said: “The decline in alerts is very welcome, especially as this is primarily a result of an improved level of integrity in ITF tennis, which has been the subject of particular scrutiny in recent years. However, there remains a clear threat from criminals intent on manipulating sport to defraud operators. Such illicit organised and targeted action has an impact on the reputation and financial well-being of sports and reputable betting operators alike.”

He added: “We continue to work closely with sports and our members to reduce that threat and to identify and punish such corruption, utilising the world’s largest operator-run and customer data led integrity system. Our rebranding and global repositioning in 2019 has aided our expansion with operators increasingly recognising the value and business necessity of engaging in collective action to protect their products against the loss of revenue resulting from betting corruption.”

Other key data for 2019:

5 – new betting operators joined IBIA

12 – number of sports on which alerts were reported

43 – per cent fall in tennis alerts from 2018 to 2019

52 – per cent of alerts raised on sports outside of Europe

The International Betting Integrity Association is the leading global voice on integrity for the licensed betting industry. It is run by operators for operators, protecting its members from corruption through collective action. Its monitoring and alert platform is a highly effective anti-corruption tool that detects and reports suspicious activity on its members’ betting markets. The association has longstanding information sharing partnerships with leading sports and gambling regulators to utilise its data and prosecute corruption. It represents the sector at high-level policy discussion forums such as the IOC, UN, Council of Europe and European Commission.

The association publishes quarterly and annual reports covering the integrity alerts reported through its monitoring and alert platform. The 2019 report can be viewed on the IBIA website here along with previous reports. The association can be contacted via [email protected].

Latest News

Bagelmania Backroom Comedy night lineup announced for Thursday, Feb. 26

The iconic Jewish delicatessen Siegel’s Bagelmania has announced the comedic line up that will leave guests “laughing their bagels off” at the next Bagelmania Backroom Comedy night on Thursday, Feb. 26.

Hosted monthly by Las Vegas-based and nationally touring comedian couple Noah Gardenswartz and Ester Steinberg, the event Thursday night will welcome Chris Clarke as the headliner along with acclaimed comics Kristeen Von Hagen, Gabe Quire and Lauren Rochelle.

Clarke, known as a high-energy and imaginative comedian, now tours the country with veteran comedian Rob Schneider. He also has amassed more than 40 million views on his popular YouTube channel “Csnacks,” where he tastes food and snacks from the front seat of his car. His hilarious and unique way of describing different flavors led to national commercials for Checkers and Rally’s, a one-hour special on the Cooking Channel titled Baby Got Snack, and an appearance as a food critic judge on Beat Bobby Flay.

Siegel’s Bagelmania will offer a special Backroom Comedy menu of its signature delicatessen cuisine as well as a full bar so guests can enjoy great comedy, dinner, and drinks in a unique, relaxed setting.

The Bagelmania Backroom is open to attendees 18 and older. Doors open for drinks and dinner at 7 p.m. Show time is 8 p.m. Tickets for Bagelmania Backroom are on sale for $20 online at https://siegelsbagelmania.com/backroomcomedy/ and will be sold at the door while supply lasts.

The post Bagelmania Backroom Comedy night lineup announced for Thursday, Feb. 26 appeared first on Americas iGaming & Sports Betting News.

Latest News

GGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

On 17 February in Kyiv, GGBET UA organized a media event for players of the legendary Ukrainian club and representatives of Ukraine’s top sports media. Journalists trained with footballers in Dynamo’s first team under the guidance of the team’s coaches, played a short match in mixed squads, and took part in a Q&A session.

As the team’s title sponsor, GGBET UA took a creative approach to the organization of the event and went beyond a regular media briefing. A joint training session for the journalists and star players, and a practice match in mixed squads, put both the journalists and players in good spirits, and created a cool, informal atmosphere. After the game, a Q&A session took place, where FC Dynamo’s winter training camp and preparation for the second half of the season in the Ukrainian Premier League, led by the team’s new coach, Ihor Kostyuk, were discussed.

In Ukraine, where football is one of the most popular sports, playing with the players of renowned clubs is a chance to go through your own unique experience: to live out your childhood dream, remember your sporting background, get up close to legends, and more. This is part of the cultural code that is close to GGBET UA and a reference to one of the brand’s values: creating events that blur the lines between beloved teams and their audiences.

The collaboration between GGBET UA and Dynamo started in 2024, when the Ukrainian bookmaker became the club’s official partner in European cup matches and the official sponsor of its winter training camp. In 2025, GGBET UA became the club’s title sponsor for three years.

The post GGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications appeared first on Americas iGaming & Sports Betting News.

Latest News

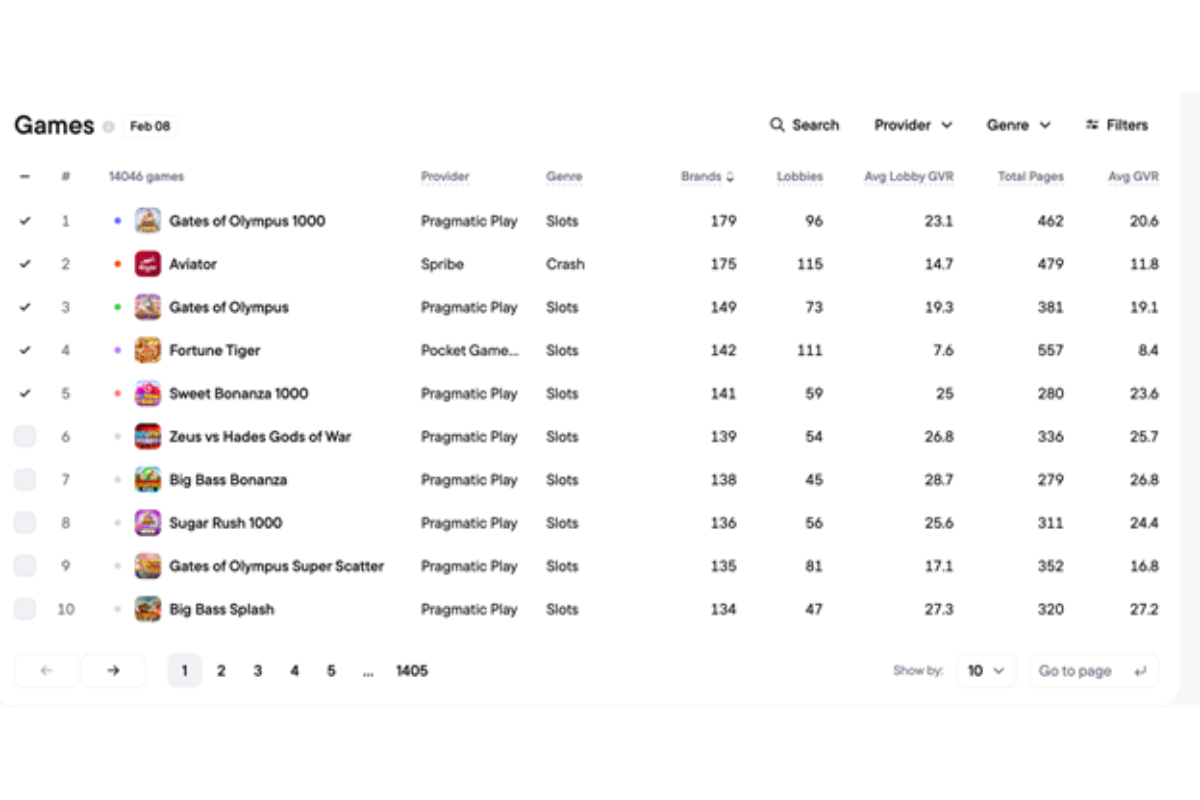

Slots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals

Slots account for 85% of online casino titles in Brazil, with more than 11,700 games competing for visibility across 500+ platforms, according to a new report from Blask. While slots dominate lobby space, player attention is far more concentrated.

Measured by Share of Interest, which tracks organic search demand, a small number of games capture the majority of attention. Fortune Tiger alone generates nearly 30% of total player interest across all categories.

Crash games remain limited in supply, with just 225 titles in the ecosystem, yet they consistently rank among the most searched and prominently placed games. Demand within the category is uneven, however. JetX leads crash-game search interest despite appearing less frequently in prime lobby positions, suggesting player familiarity and peer influence outweigh operator promotion.

Live casino games maintain steady but modest demand, led by Blackjack and Crazy Time, while instant win titles show minimal traction, with only three games registering measurable interest.

Across the market, the top 10 games capture nearly two-thirds of total player attention, leaving hundreds of titles to compete for the remainder. The findings highlight a defining trend in Brazil’s iGaming sector: understanding player attention is becoming more important than expanding game inventories.

The analysis is based on Blask Games technology, which tracks lobby placement through computer vision and maps player search behaviour across regulated and offshore operators. A full report is available here.

The post Slots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

ACMA5 days ago

ACMA5 days agoACMA Blocks More Illegal Online Gambling Websites

-

Aurimas Šilys5 days ago

Aurimas Šilys5 days agoREEVO Partners with Betsson Lithuania

-

CEO of GGBET UA Serhii Mishchenko5 days ago

CEO of GGBET UA Serhii Mishchenko5 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Canada4 days ago

Canada4 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News4 days ago

Latest News4 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe5 days ago

Central Europe5 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

AI5 days ago

AI5 days ago2026 Rewards AI Capability, Not AI Talk – HIPTHER Prague Summit Unveils the Next-Era HIPTHER Academy

-

Firecracker Frenzy™ Money Toad™4 days ago

Firecracker Frenzy™ Money Toad™4 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™