Nasdaq:FLL

Full House Resorts Announces Second Quarter Results and Provides Construction Updates for Its Growth Projects

- Construction of Company’s Two Major Growth Projects Continues, with Significant Progress in the Quarter

- Erection of the Sprung Structure is Nearly Complete at The Temporary in Waukegan, Illinois

- Casino Opening Anticipated in the Fourth Quarter of 2022

- Tower One of Chamonix Casino Hotel in Cripple Creek, Colorado, has Topped Off

- Second Hotel Tower Will Top Off Within a Few Weeks

- Last Hotel Tower is Beginning to Rise from its Foundations, as Scheduled

- Opening is Anticipated in Mid-2023

- Erection of the Sprung Structure is Nearly Complete at The Temporary in Waukegan, Illinois

- Management is Confident that its Existing Cash On-Hand and Other Existing Resources are Sufficient to Complete Both The Temporary and Chamonix

- Agreement Reached with Circa Sports for Internet and On-site Sports Wagering in Illinois

- Operating Results Compared Well to Pre-Pandemic Results, but Lagged Prior-Year Results Principally due to Absence of Stimulus Spending, Construction Disruption in Colorado and Increased Property Insurance Costs

LAS VEGAS, Aug. 02, 2022 (GLOBE NEWSWIRE) — Full House Resorts, Inc. (Nasdaq: FLL) today announced results for the second quarter ended June 30, 2022, including a construction update for its two major new casinos.

“We made significant progress on our growth projects during the second quarter,” said Daniel R. Lee, President and Chief Executive Officer of Full House Resorts. “Our casino site in Waukegan, Illinois, has been transformed, with the Sprung structure now nearly complete. We are now installing utilities within the structure for items like bathrooms, bars, and slot machines, and expect to pour the floor slab within the next month. We have identified and are placing orders for The Temporary’s approximately 1,000 slot machines, have hired much of the management team for the property, and have begun hosting job fairs for positions throughout the casino. When The Temporary opens, as anticipated, in the fourth quarter of 2022, it will be the only casino in Lake County, Illinois, which has a population of approximately 700,000 and ranks as one of the wealthiest counties in the U.S.

“At our Chamonix project in Cripple Creek, Colorado, construction also continues at a swift pace,” continued Mr. Lee. “The central tower, which anchors the casino and includes the spa, has topped out. The parking garage is complete, and the guest rooms above the garage are starting to take shape. Foundations for the final guest room tower are currently being completed. Brick and glass are now being installed on the facade. When complete, Chamonix will be one of the larger casino hotels in Colorado and easily the largest and most luxurious casino hotel in Cripple Creek, which is the primary casino destination for the Colorado Springs market. Cripple Creek is approximately one hour from the roughly one million people who live in the Colorado Springs MSA and two hours from the approximately four million people who reside in the Denver area. Chamonix is currently anticipated to open in mid-2023.”

For project renderings and live construction webcams, please visit www.AmericanPlace.com and www.ChamonixCO.com.

“Our anticipated opening dates have slipped a few weeks, reflecting supply issues and normal construction challenges. Our anticipated investment in each project, however, remains within budgets,” added Lewis Fanger, the Company’s Chief Financial Officer.

“The Temporary is expected to cost in the neighborhood of $100 million, which consists largely of the Sprung structure; slot machines, decor and facilities within the Sprung structure; surrounding site work; preopening costs; and an estimated $33 million of upfront license fees. A significant portion of the $100 million budget, including payments for the purchase of slot machines, will not be due until after the opening of The Temporary. We anticipate some additional investments for storm sewers and other site infrastructure that is required for construction of the permanent casino, which is planned to be built on land adjoining The Temporary. The permanent American Place casino is anticipated to open by late 2025, within three years of the opening of The Temporary.”

Continued Mr. Fanger, “The construction cost of Chamonix is still estimated to be within its budget of $250 million, including contingencies. This does not include refurbishment of the adjoining, existing Bronco Billy’s casino. We are currently doing a light remodel of certain portions of Bronco Billy’s, estimated to cost approximately $2 million. While we have plans for a more extensive refurbishment of Bronco Billy’s, we have decided to defer such potential project until after the opening of Chamonix.

“At June 30, 2022, we had $298.4 million of cash and equivalents, including $190.2 million of cash that is reserved for the completion of Chamonix. We also have a $40 million credit facility, which is currently unutilized except for a $1 million standby letter of credit. We are confident that our existing cash, credit line availability and cash flows from operations will be sufficient to complete both The Temporary and Chamonix.

“Eventually, we anticipate requiring additional financing for construction of the permanent American Place facility,” concluded Mr. Fanger. “The costs of planning and construction for the early stages of that project are relatively modest. Some of those costs are being incurred now, with the construction of The Temporary, as mentioned previously. Management does not anticipate needing to arrange the balance of the financing for the permanent American Place until 2024, after both The Temporary and Chamonix have been open for some period of time. At that point, we anticipate that our leverage will be lower than historical leverage ratios in the gaming industry. With our existing bonds, which have a fixed rate and comprise most of our debt, becoming callable in February 2024, we anticipate arranging the additional debt financing needed for construction of the permanent American Place as part of the refinancing of those bonds. Finally, note that if the financial markets at that time are unfavorable, we still have in place a back-up financing arrangement with a major financial institution.”

On a consolidated basis, revenues in the second quarter of 2022 were $44.4 million, a decrease from $47.4 million in the prior-year period. Net loss for the second quarter of 2022 was $(4.4) million, or $(0.13) per diluted common share, which includes $1.6 million of preopening and development costs related to the Company’s growth projects. In the prior-year period, net income was $5.5 million, or $0.15 per diluted common share, including $126,000 of project development costs. Adjusted EBITDA(a) in the 2022 second quarter was $12.1 million versus $14.9 million in the prior-year period, largely due to planned construction disruptions at Bronco Billy’s; the launch of online sports wagering in Louisiana, which adversely affected Silver Slipper’s sports wagering revenues; and increases in certain costs. The prior-year’s second quarter was the Company’s strongest in recent years, having benefited from customers receiving government subsidy payments due to the COVID-19 pandemic.

Second Quarter Highlights and Subsequent Events

- Mississippi. Silver Slipper Casino and Hotel’s revenues were $21.1 million in the second quarter of 2022, versus $24.2 million in the prior-year period. The prior-year period was the best second quarter in the property’s history, having benefited from customers receiving government stimulus payments due to the COVID-19 pandemic, and thus making for a difficult comparison. The revenue decline also reflects the competitive launch of online sports wagering within nearby Louisiana, with sports wagering revenues declining from $0.5 million to $0.1 million in the second quarter of 2022. Adjusted Segment EBITDA was $5.3 million, reflecting the revenue declines noted above, as well as a $0.6 million increase in normal operating expenses, primarily property insurance and food costs. Adjusted Segment EBITDA was $9.0 million in the prior-year period.

Reportedly due to high damage claims in recent years, the cost of property insurance has risen significantly in recent years, both for our Company and, reportedly, in general. Property insurance costs at the Silver Slipper, for example, have increased from $2.5 million in 2020 to $3.2 million in 2021 and are anticipated to be $4.9 million in 2022. The increase in such costs in the second quarter was $0.4 million over the prior-year period. Management believes that such costs will improve in future years, at least relative to our operations. First, we believe the cost of insurance tends to go in cycles, with today’s high pricing potentially attracting more companies to the property insurance market, increasing competition. Second, the new properties that we are currently building are larger, in many respects, than our existing properties and are not located in hurricane zones. We believe that diversity should allow us to negotiate better terms for our insurance. Finally, as the Silver Slipper becomes a smaller portion of the Company’s overall financial position, we may reexamine the appropriate terms of the property insurance for that asset.

- Indiana. Rising Star Casino Resort’s revenues were $11.8 million in the second quarter of 2022, an 11.5% increase from $10.6 million in the second quarter of 2021. The increase was the result of the sale of “free play,” which resulted in $2.1 million of revenue and income in the second quarter of 2022. Rising Star also sold its “free play” for $2.1 million during 2021, although not until the third quarter. Excluding the free play sale, segment revenues declined in the second quarter of 2022, as Rising Star benefited from customers receiving government stimulus payments in the prior-year period. Adjusted Segment EBITDA was $3.9 million in the second quarter of 2022, up 46.1% from the prior-year period. The free play sale, as well as a $0.1 million reduction in normal operating expenses, helped offset a decline in total casino revenue.

- Colorado. This segment includes Bronco Billy’s Casino and Hotel and, upon its opening, will include Chamonix Casino Hotel. The Colorado gaming market, including Cripple Creek, has shown significant growth since betting limits were eliminated in May 2021. Nevertheless, due to significant construction disruption, revenues and Adjusted Segment EBITDA declined in the second quarter of 2022 versus the prior-year period. These disruptions include the temporary loss of all of the property’s on-site parking and all on-site hotel rooms, as well as the temporary loss of major portions of the casino. To alleviate the lack of on-site parking, Bronco Billy’s currently offers complimentary valet parking and a free shuttle service to an off-site parking lot, both of which resulted in increased operating expenses. The casino has also maintained much of its payroll, despite reduced activity levels, anticipating the need for the larger workforce required to open and operate Chamonix. Nevertheless, some expenses, such as gaming taxes and costs of food and beverages, vary with activity levels. Revenues were $4.1 million in the second quarter of 2022, versus $6.4 million in the prior-year period. Adjusted Segment EBITDA was $0.2 million, versus $1.8 million.

- Nevada. This segment consists of the Grand Lodge Casino, which is located within the Hyatt Regency Lake Tahoe luxury resort in Incline Village, and Stockman’s Casino, which is located in Fallon, Nevada. Revenues were $5.2 million in the second quarter of 2022, an increase from $4.7 million in the prior-year period. Both properties in this segment benefitted in the prior-year period from customers receiving federal stimulus checks. Grand Lodge, moreover, also benefitted from a gradual recovery from the pandemic, such that the recent quarter achieved more normal levels of operation than did the year-ago quarter. Adjusted Segment EBITDA for both quarters was $1.4 million, with the increase in revenue offset by an increase in labor costs.

- Contracted Sports Wagering. This segment consists of the Company’s on-site and online sports wagering “skins” (akin to websites) in Colorado, Indiana and, upon launch, Illinois. Revenues and Adjusted Segment EBITDA were both $2.2 million in the second quarter of 2022, an increase from $1.5 million in the prior-year period. These results reflect an acceleration of deferred revenue for two agreements that ceased operations in May 2022, when one of the Company’s contracted parties ceased operations. We anticipate entering into new agreements for the utilization of such skins, one each in Indiana and Colorado, but there can be no assurance that we will be able to replace these agreements on similar or better terms as our existing agreements, or at all.

In May 2022, the Company entered into an agreement whereby affiliates of Full House and Circa Sports will jointly develop and manage on-site sportsbooks at both The Temporary and American Place. Circa Sports currently operates at Circa Resort & Casino in Las Vegas, and offers online sports wagering in several states. In addition to the on-site sportsbook, Circa Sports will utilize Full House’s expected mobile sports skin in Illinois to conduct Internet sports wagering throughout the state, subject to customary regulatory approvals. In exchange for such rights, the Company received a market access fee of $5 million in May 2022 and will also receive payments based on a percentage of sports betting revenues, with a minimum annualized payment of $5 million. The term of the agreement is for eight years, followed by two four-year extension opportunities at the option of Circa Sports.

Liquidity and Capital Resources

As of June 30, 2022, the Company had $298.4 million in cash and cash equivalents (including $190.2 million of cash reserved to complete the construction of Chamonix) and $410.0 million in outstanding senior secured notes due 2028. As of August 2, 2022, there were no drawn amounts under the Company’s $40 million credit facility and an outstanding standby letter of credit of $1 million related to the American Place project.

Conference Call Information

The Company will host a conference call for investors today, August 2, 2022, at 4:30 p.m. ET (1:30 p.m. PT) to discuss its 2022 second quarter results. Investors can access the live audio webcast from the Company’s website at www.fullhouseresorts.com under the investor relations section. The conference call can also be accessed by dialing (888) 220-8451 or, for international callers, (323) 794-2588.

A replay of the conference call will be available shortly after the conclusion of the call through August 16, 2022. To access the replay, please visit www.fullhouseresorts.com. Investors can also access the replay by dialing (844) 512-2921 or, for international callers, (412) 317-6671 and using the passcode 2259060.

(a) Reconciliation of Non-GAAP Financial Measure

The Company utilizes Adjusted Segment EBITDA, a financial measure in accordance with generally accepted accounting principles (“GAAP”), as the measure of segment profitability in assessing performance and allocating resources at the reportable segment level. Adjusted Segment EBITDA is defined as earnings before interest and other non-operating income (expense), taxes, depreciation and amortization, preopening expenses, impairment charges, asset write-offs, recoveries, gain (loss) from asset disposals, project development and acquisition costs, non-cash share-based compensation expense, and corporate-related costs and expenses that are not allocated to each segment. The Company also utilizes Adjusted EBITDA (a non-GAAP measure), which is defined as Adjusted Segment EBITDA net of corporate-related costs and expenses.

Although Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with GAAP, the Company believes this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity. The Company utilizes this metric or measure internally to focus management on year-over-year changes in core operating performance, which it considers its ordinary, ongoing and customary operations and which it believes is useful information to investors. Accordingly, management excludes certain items when analyzing core operating performance, such as the items mentioned above, that management believes are not reflective of ordinary, ongoing and customary operations.

A reconciliation of Adjusted EBITDA is presented below. However, you should not consider this measure in isolation or as a substitute for operating income, cash flows from operating activities, or any other measure for determining our operating performance or liquidity that is calculated in accordance with GAAP. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that, in the future, we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

FULL HOUSE RESORTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except per share data)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Revenues | ||||||||||||||||

| Casino | $ | 29,488 | $ | 34,647 | $ | 58,572 | $ | 66,711 | ||||||||

| Food and beverage | 6,933 | 7,440 | 13,444 | 13,541 | ||||||||||||

| Hotel | 2,407 | 2,510 | 4,586 | 4,721 | ||||||||||||

| Other operations, including contracted sports wagering | 5,555 | 2,845 | 9,204 | 4,677 | ||||||||||||

| 44,383 | 47,442 | 85,806 | 89,650 | |||||||||||||

| Operating costs and expenses | ||||||||||||||||

| Casino | 10,106 | 11,087 | 19,981 | 21,426 | ||||||||||||

| Food and beverage | 6,752 | 5,928 | 13,320 | 11,288 | ||||||||||||

| Hotel | 1,197 | 1,140 | 2,268 | 2,196 | ||||||||||||

| Other operations | 545 | 551 | 1,007 | 946 | ||||||||||||

| Selling, general and administrative | 14,184 | 14,007 | 29,577 | 28,420 | ||||||||||||

| Project development costs | 17 | 126 | 182 | 173 | ||||||||||||

| Preopening costs | 1,534 | — | 2,320 | — | ||||||||||||

| Depreciation and amortization | 1,834 | 1,829 | 3,626 | 3,629 | ||||||||||||

| (Gain) loss on disposal of assets, net | (5 | ) | 568 | 3 | 672 | |||||||||||

| 36,164 | 35,236 | 72,284 | 68,750 | |||||||||||||

| Operating income | 8,219 | 12,206 | 13,522 | 20,900 | ||||||||||||

| Other (expense) income | ||||||||||||||||

| Interest expense, net of capitalized interest | (6,988 | ) | (6,670 | ) | (13,387 | ) | (11,126 | ) | ||||||||

| (Loss) gain on modification and extinguishment of debt, net | (19 | ) | 30 | (4,425 | ) | (6,104 | ) | |||||||||

| Adjustment to fair value of warrants | — | — | — | (1,347 | ) | |||||||||||

| (7,007 | ) | (6,640 | ) | (17,812 | ) | (18,577 | ) | |||||||||

| Income (loss) before income taxes | 1,212 | 5,566 | (4,290 | ) | 2,323 | |||||||||||

| Income tax provision (benefit) | 5,567 | 82 | (45 | ) | 284 | |||||||||||

| Net (loss) income | $ | (4,355 | ) | $ | 5,484 | $ | (4,245 | ) | $ | 2,039 | ||||||

| Basic (loss) earnings per share | $ | (0.13 | ) | $ | 0.16 | $ | (0.12 | ) | $ | 0.07 | ||||||

| Diluted (loss) earnings per share | $ | (0.13 | ) | $ | 0.15 | $ | (0.12 | ) | $ | 0.06 | ||||||

| Basic weighted average number of common shares outstanding | 34,364 | 34,156 | 34,313 | 30,776 | ||||||||||||

| Diluted weighted average number of common shares outstanding | 34,416 | 36,628 | 34,358 | 33,156 | ||||||||||||

Full House Resorts, Inc.

Supplemental Information

Segment Revenues, Adjusted Segment EBITDA and Adjusted EBITDA

(In thousands, Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Revenues | ||||||||||||||||

| Mississippi | $ | 21,139 | $ | 24,239 | $ | 42,450 | $ | 46,596 | ||||||||

| Indiana | 11,797 | 10,577 | 20,432 | 19,167 | ||||||||||||

| Colorado | 4,112 | 6,382 | 8,347 | 12,286 | ||||||||||||

| Nevada | 5,166 | 4,715 | 9,577 | 9,083 | ||||||||||||

| Contracted Sports Wagering | 2,169 | 1,529 | 5,000 | 2,518 | ||||||||||||

| $ | 44,383 | $ | 47,442 | $ | 85,806 | $ | 89,650 | |||||||||

| Adjusted Segment EBITDA(1) and Adjusted EBITDA | ||||||||||||||||

| Mississippi | $ | 5,255 | $ | 8,983 | $ | 11,206 | $ | 16,613 | ||||||||

| Indiana | 3,894 | 2,666 | 5,033 | 3,799 | ||||||||||||

| Colorado | 236 | 1,839 | (86 | ) | 3,548 | |||||||||||

| Nevada | 1,448 | 1,412 | 2,277 | 2,636 | ||||||||||||

| Contracted Sports Wagering | 2,196 | 1,500 | 4,964 | 2,477 | ||||||||||||

| Adjusted Segment EBITDA | 13,029 | 16,400 | 23,394 | 29,073 | ||||||||||||

| Corporate | (943 | ) | (1,472 | ) | (2,911 | ) | (3,376 | ) | ||||||||

| Adjusted EBITDA | $ | 12,086 | $ | 14,928 | $ | 20,483 | $ | 25,697 | ||||||||

__________

(1) The Company utilizes Adjusted Segment EBITDA as the measure of segment operating profitability in assessing performance and allocating resources at the reportable segment level.

Full House Resorts, Inc.

Supplemental Information

Reconciliation of Net Income (Loss) and Operating Income (Loss) to Adjusted EBITDA

(In Thousands, Unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Net (loss) income | $ | (4,355 | ) | $ | 5,484 | $ | (4,245 | ) | $ | 2,039 | |||||

| Income tax provision (benefit) | 5,567 | 82 | (45 | ) | 284 | ||||||||||

| Interest expense, net of amounts capitalized | 6,988 | 6,670 | 13,387 | 11,126 | |||||||||||

| Loss (gain) on modification and extinguishment of debt, net | 19 | (30 | ) | 4,425 | 6,104 | ||||||||||

| Adjustment to fair value of warrants | — | — | — | 1,347 | |||||||||||

| Operating income | 8,219 | 12,206 | 13,522 | 20,900 | |||||||||||

| Project development costs | 17 | 126 | 182 | 173 | |||||||||||

| Preopening costs | 1,534 | — | 2,320 | — | |||||||||||

| Depreciation and amortization | 1,834 | 1,829 | 3,626 | 3,629 | |||||||||||

| (Gain) loss on disposal of assets, net | (5 | ) | 568 | 3 | 672 | ||||||||||

| Stock-based compensation | 487 | 199 | 830 | 323 | |||||||||||

| Adjusted EBITDA | $ | 12,086 | $ | 14,928 | $ | 20,483 | $ | 25,697 | |||||||

Full House Resorts, Inc.

Supplemental Information

Reconciliation of Operating Income (Loss) to Adjusted Segment EBITDA and Adjusted EBITDA

(In Thousands, Unaudited)

| Three Months Ended June 30, 2022 | |||||||||||||||||||||||

| Adjusted | |||||||||||||||||||||||

| Segment | |||||||||||||||||||||||

| Operating | Depreciation | Gain on | Project | Stock- | EBITDA and | ||||||||||||||||||

| Income | and | Disposal | Development | Preopening | Based | Adjusted | |||||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Costs | Compensation | EBITDA | |||||||||||||||||

| Reporting segments | |||||||||||||||||||||||

| Mississippi | $ | 4,561 | $ | 694 | $ | — | $ | — | $ | — | $ | — | $ | 5,255 | |||||||||

| Indiana | 3,307 | 587 | — | — | — | — | 3,894 | ||||||||||||||||

| Colorado | (781 | ) | 353 | (5 | ) | — | 669 | — | 236 | ||||||||||||||

| Nevada | 1,277 | 171 | — | — | — | — | 1,448 | ||||||||||||||||

| Contracted Sports Wagering | 2,196 | — | — | — | — | — | 2,196 | ||||||||||||||||

| 10,560 | 1,805 | (5 | ) | — | 669 | — | 13,029 | ||||||||||||||||

| Other operations | |||||||||||||||||||||||

| Corporate | (2,341 | ) | 29 | — | 17 | 865 | 487 | (943 | ) | ||||||||||||||

| $ | 8,219 | $ | 1,834 | $ | (5 | ) | $ | 17 | $ | 1,534 | $ | 487 | $ | 12,086 | |||||||||

| Three Months Ended June 30, 2021 | |||||||||||||||||||

| Adjusted | |||||||||||||||||||

| Segment | |||||||||||||||||||

| Operating | Depreciation | Loss on | Project | Stock- | EBITDA and | ||||||||||||||

| Income | and | Disposal | Development | Based | Adjusted | ||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Compensation | EBITDA | ||||||||||||||

| Reporting segments | |||||||||||||||||||

| Mississippi | $ | 7,742 | $ | 675 | $ | 566 | $ | — | $ | — | $ | 8,983 | |||||||

| Indiana | 2,073 | 593 | — | — | — | 2,666 | |||||||||||||

| Colorado | 1,452 | 385 | 2 | — | — | 1,839 | |||||||||||||

| Nevada | 1,274 | 138 | — | — | — | 1,412 | |||||||||||||

| Contracted Sports Wagering | 1,500 | — | — | — | — | 1,500 | |||||||||||||

| 14,041 | 1,791 | 568 | — | — | 16,400 | ||||||||||||||

| Other operations | |||||||||||||||||||

| Corporate | (1,835 | ) | 38 | — | 126 | 199 | (1,472 | ) | |||||||||||

| $ | 12,206 | $ | 1,829 | $ | 568 | $ | 126 | $ | 199 | $ | 14,928 | ||||||||

Full House Resorts, Inc.

Supplemental Information

Reconciliation of Operating Income (Loss) to Adjusted Segment EBITDA and Adjusted EBITDA

(In Thousands, Unaudited)

| Six Months Ended June 30, 2022 | |||||||||||||||||||||||

| Adjusted | |||||||||||||||||||||||

| Segment | |||||||||||||||||||||||

| Operating | Depreciation | Loss (gain) on | Project | Stock- | EBITDA and | ||||||||||||||||||

| Income | and | Disposal | Development | Preopening | Based | Adjusted | |||||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Costs | Compensation | EBITDA | |||||||||||||||||

| Reporting segments | |||||||||||||||||||||||

| Mississippi | $ | 9,813 | $ | 1,385 | $ | 8 | $ | — | $ | — | $ | — | $ | 11,206 | |||||||||

| Indiana | 3,866 | 1,167 | — | — | — | — | 5,033 | ||||||||||||||||

| Colorado | (1,445 | ) | 695 | (5 | ) | — | 669 | — | (86 | ) | |||||||||||||

| Nevada | 1,960 | 317 | — | — | — | — | 2,277 | ||||||||||||||||

| Contracted Sports Wagering | 4,964 | — | — | — | — | — | 4,964 | ||||||||||||||||

| 19,158 | 3,564 | 3 | — | 669 | — | 23,394 | |||||||||||||||||

| Other operations | |||||||||||||||||||||||

| Corporate | (5,636 | ) | 62 | — | 182 | 1,651 | 830 | (2,911 | ) | ||||||||||||||

| $ | 13,522 | $ | 3,626 | $ | 3 | $ | 182 | $ | 2,320 | $ | 830 | $ | 20,483 | ||||||||||

| Six Months Ended June 30, 2021 | |||||||||||||||||||

| Adjusted | |||||||||||||||||||

| Segment | |||||||||||||||||||

| Operating | Depreciation | Loss on | Project | Stock- | EBITDA and | ||||||||||||||

| Income | and | Disposal | Development | Based | Adjusted | ||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Compensation | EBITDA | ||||||||||||||

| Reporting segments | |||||||||||||||||||

| Mississippi | $ | 14,690 | $ | 1,335 | $ | 588 | $ | — | $ | — | $ | 16,613 | |||||||

| Indiana | 2,590 | 1,209 | — | — | — | 3,799 | |||||||||||||

| Colorado | 2,732 | 732 | 84 | — | — | 3,548 | |||||||||||||

| Nevada | 2,359 | 277 | — | — | — | 2,636 | |||||||||||||

| Contracted Sports Wagering | 2,477 | — | — | — | — | 2,477 | |||||||||||||

| 24,848 | 3,553 | 672 | — | — | 29,073 | ||||||||||||||

| Other operations | |||||||||||||||||||

| Corporate | (3,948 | ) | 76 | — | 173 | 323 | (3,376 | ) | |||||||||||

| $ | 20,900 | $ | 3,629 | $ | 672 | $ | 173 | $ | 323 | $ | 25,697 | ||||||||

Cautionary Note Regarding Forward-looking Statements

This press release contains statements by Full House and our officers that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “expect,” “future,” “should,” “will” and similar references to future periods. Some forward-looking statements in this press release include those regarding our expected construction budget, estimated commencement and completion dates, expected amenities, and our expected operational performance for Chamonix and American Place, including The Temporary; our expectations regarding our ability to receive regulatory approvals for American Place and The Temporary; and our expectations regarding our ability to replace any terminated sports wagering contracts in Colorado and Indiana and the success of any new sports wagering contracts in Colorado, Indiana or Illinois. Forward-looking statements are neither historical facts nor assurances of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Such risks include, without limitation, our ability to repay our substantial indebtedness; inflation and its potential impacts on labor costs and the prices of food, construction, and other materials; the effects of potential disruptions in the supply chains for goods, such as food, lumber, and other materials; general macroeconomic conditions; the potential for additional adverse impacts from the COVID-19 pandemic, including the emergence of variants, on our business, construction projects, indebtedness, financial condition and operating results; potential actions by government officials at the federal, state or local level in connection with the COVID-19 pandemic, including, without limitation, additional shutdowns, travel restrictions, social distancing measures or shelter-in-place orders; our ability to effectively manage and control expenses as a result of the pandemic; our ability to complete Chamonix, American Place, and The Temporary on-time and on-budget; various approvals that are required to lease the primary American Place site from the City of Waukegan, including approvals from the Illinois Gaming Board; the successful entry into replacement sports wagering contracts in Colorado and Indiana; changes in guest visitation or spending patterns due to COVID-19 or other health or other concerns; construction risks, disputes and cost overruns; dependence on existing management; competition; uncertainties over the development and success of our expansion projects; the financial performance of our finished projects and renovations; effectiveness of expense and operating efficiencies; and regulatory and business conditions in the gaming industry (including the possible authorization or expansion of gaming in the states we operate or nearby states). Additional information concerning potential factors that could affect our financial condition and results of operations is included in the reports we file with the Securities and Exchange Commission, including, but not limited to, Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the most recently ended fiscal year and our other periodic reports filed with the Securities and Exchange Commission. We are under no obligation to (and expressly disclaim any such obligation to) update or revise our forward-looking statements as a result of new information, future events or otherwise. Actual results may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

About Full House Resorts, Inc.

Full House Resorts owns, leases, develops and operates gaming facilities throughout the country. The Company’s properties include Silver Slipper Casino and Hotel in Hancock County, Mississippi; Bronco Billy’s Casino and Hotel in Cripple Creek, Colorado; Rising Star Casino Resort in Rising Sun, Indiana; Stockman’s Casino in Fallon, Nevada; and Grand Lodge Casino, located within the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. The Company is currently constructing The Temporary at American Place, a new casino in Waukegan, Illinois; and Chamonix Casino Hotel, a new luxury hotel and casino in Cripple Creek, Colorado. For further information, please visit www.fullhouseresorts.com.

Contact:

Lewis Fanger, Chief Financial Officer

Full House Resorts, Inc.

702-221-7800

www.fullhouseresorts.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3aad0307-fbf4-4142-bec7-b8676d7a93e4

https://www.globenewswire.com/NewsRoom/AttachmentNg/14e9637d-49e7-4d02-bfb9-9a64ba492e34

https://www.globenewswire.com/NewsRoom/AttachmentNg/49ea26ce-b4f5-4e5f-9059-fa2caa760d02

https://www.globenewswire.com/NewsRoom/AttachmentNg/5a9365de-48ed-4461-9cda-0c91cb28dab3

Powered by WPeMatico

Nasdaq:FLL

Full House Resorts Announces Fourth Quarter and Full-Year Results

– Revenues Increased 66.4% to $60.0 Million in the Fourth Quarter of 2023;

Annual Revenues Grew 47.6%

– Chamonix Casino Hotel Began Its Phased Opening on December 27, 2023

– Approvals Received to Operate American Place in Its Temporary Configuration Until August 2027

LAS VEGAS, March 05, 2024 (GLOBE NEWSWIRE) — Full House Resorts, Inc. (Nasdaq: FLL) today announced results for the fourth quarter and year ended December 31, 2023.

“After several years of construction, we are entering a new phase for our company,” said Daniel R. Lee, President and Chief Executive Officer of Full House Resorts. “We opened two new casinos during 2023: American Place in Waukegan, Illinois, and Chamonix, in Cripple Creek, Colorado. Our first new casino – American Place – celebrated its one-year anniversary a few weeks ago. As expected, it continues to ramp up its operations. In December 2023, American Place reached a new monthly gaming revenue record of $8.2 million, as reported by the Illinois Gaming Board. It subsequently set a new monthly all-time record for revenues in February 2024, despite it being a short month. We expect American Place’s gaming revenues to continue to grow in 2024, with the property’s high-end North Shore Steaks & Seafood now open and overall awareness continuing to improve. American Place is currently in a temporary facility, built in less than one year after being chosen by the Illinois Gaming Board to develop this newly-created license. We recently received the necessary approvals to operate the temporary facility until August 2027, providing us with meaningful additional time before the anticipated opening of the permanent American Place facility.

“On December 27, we welcomed guests to our newest casino, Chamonix Casino Hotel in Cripple Creek, Colorado, which is less than one hour from Colorado Springs and approximately two hours from Denver. By design, it was a soft opening, with the casino, meeting rooms, and approximately 40% of the property’s guest rooms initially open. Over the past few weeks, we have continued the rollout of the property’s amenities, including completion of the destination’s remaining hotel rooms and its parking garage. We are currently putting the finishing touches on 980 Prime, Chamonix’s high-end steakhouse led by famed chef Barry Dakake. We expect it to open in late March. Chamonix was designed to be the most beautiful casino in the state of Colorado, and we look forward to the completion of all of its amenities over the next few months.”

On a consolidated basis, revenues in the fourth quarter of 2023 were $60.0 million, a 66.4% increase from $36.1 million in the prior-year period. These results primarily reflect the February 2023 opening of American Place. Net loss for the fourth quarter of 2023 was $12.5 million, or $(0.36) per diluted common share, which includes $3.1 million of preopening and development costs, primarily related to the phased opening of our Chamonix project, and significant depreciation and amortization charges related to the temporary American Place facility. In the prior-year period, net loss was $7.0 million, or $(0.20) per diluted common share, reflecting $4.8 million of preopening and development costs. Adjusted EBITDA(a) rose 87.4% in the fourth quarter of 2023 to $7.3 million, compared to $3.9 million in the prior-year period.

For the full year, revenues in 2023 were $241.1 million, a 47.6% increase from $163.3 million in the prior year. These results reflect the February 2023 opening of American Place, as well as $5.8 million of accelerated revenue under two of our sports wagering agreements with third-party operators that ceased operations during the third quarter of 2023. Net loss in 2023 was $24.9 million, or $(0.72) per diluted common share, which includes $15.7 million of preopening and development costs, primarily related to our Chamonix construction project, and significant depreciation and amortization charges related to the temporary American Place facility. For 2022, net loss was $14.8 million, or $(0.43) per diluted common share, reflecting $9.8 million of preopening and development costs. Adjusted EBITDA was $48.6 million in 2023, rising 51.1% from $32.1 million in the prior-year period, reflecting the items mentioned above.

“Our Company recently reached an inflection point,” noted Mr. Lee. “In 2023, our total cash interest expense was approximately $38.4 million and Adjusted EBITDA, as noted, was $48.6 million, despite construction disruptions in Colorado and the gradual ramp-up of operations at American Place. Our debt during that period included substantially all of the funding for Chamonix, which did not open until year-end. While some construction continues at Chamonix, the bulk of our capital expenditures for these projects is behind us. This fact, along with expected future earnings from these new facilities, should result in the generation of significant free cash flow over the next few years. Also, recognize that we continue to have significant tax-loss carryforwards and we benefit, for tax purposes, from accelerated depreciation related to our new developments.”

Added Mr. Lee, “Regarding American Place, the State of Illinois recently passed legislation allowing us to operate our temporary facility until August 2027. This was because a tribal entity that operates a competing casino in Wisconsin filed a lawsuit against the City of Waukegan and the Illinois Gaming Board, alleging that the tribe was not provided due consideration in its effort to obtain the Waukegan gaming license. We were chosen for that license after a robust public process, whereby an independent consultant hired by the City of Waukegan rated the tribal proposal as being inferior in most respects to all four of the other proposals, including that of Full House Resorts. We believe the lawsuit is without merit. The City and the Illinois Gaming Board have sought review of the dispute by the Illinois Supreme Court, which has agreed to hear the case. We anticipate a ruling by that court by early 2025.”

Concluded Mr. Lee, “We estimate that construction of the permanent American Place facility will require approximately two years, with a significant portion of the project’s capital expenditures not expected until the second half of 2026 and during 2027. We believe that the Company’s operating cash flows should be able to fund significant portions of the construction cost for the permanent American Place facility between now and its anticipated opening in 2027. For the remaining balance, we remain highly confident in our ability to fund it entirely in the debt capital markets at the appropriate time.”

Fourth Quarter Highlights and Subsequent Events

- Midwest & South. This segment includes Silver Slipper Casino and Hotel, Rising Star Casino Resort, and American Place. Revenues for the segment were $49.1 million in the fourth quarter of 2023, a 78.8% increase from $27.5 million in the prior-year period. Adjusted Segment EBITDA rose to $7.2 million, a 57.9% increase from $4.6 million in the prior-year period. These results reflect the February 17, 2023 opening of American Place, our casino located in Waukegan, Illinois. In the fourth quarter of 2023, American Place generated $22.4 million of revenue and $3.9 million of Adjusted Property EBITDA. American Place’s results reflect some winter seasonality, as well as elevated marketing expenses related to a marketing campaign that is expected to benefit the casino in the longer-run.

For the full year, this segment similarly benefited from the opening of American Place in February 2023. Revenues increased 60.4% from $120.0 million to $192.4 million, and Adjusted Segment EBITDA grew 48.0% from $26.4 million to $39.0 million. Of such amount, American Place contributed $77.0 million and $18.4 million to the segment’s revenues and Adjusted Segment EBITDA, respectively.

- West. This segment includes Grand Lodge Casino (located within the Hyatt Regency Lake Tahoe resort in Incline Village), Stockman’s Casino, Bronco Billy’s Casino and Hotel, and Chamonix Casino Hotel, which opened on December 27, 2023. Revenues for the segment rose 14.0% to $8.6 million in the fourth quarter of 2023, versus $7.5 million in the prior-year period. Adjusted Segment EBITDA of $(0.1) million in the fourth quarter of 2023 compares to $(0.3) million in the prior-year period. Results in both periods reflect the temporary loss of all on-site parking and on-site hotel rooms at Bronco Billy’s to accommodate the construction of neighboring Chamonix. With Chamonix now open, Bronco Billy’s is benefiting from its integration with Chamonix, including its new parking garage and approximately 300 on-site guest rooms.

For the year, revenues and Adjusted Segment EBITDA were $35.9 million and $2.4 million in 2023, respectively. In 2022, such amounts were $36.1 million and $4.2 million, respectively. As noted above, construction-related disruptions at Bronco Billy’s are expected to dissipate in 2024 with the return of on-site guest rooms and on-site parking.

- Contracted Sports Wagering. This segment consists of our on-site and online sports wagering “skins” (akin to websites) in Colorado, Indiana, and Illinois. Revenues and Adjusted Segment EBITDA in the fourth quarter of 2023 were $2.3 million and $1.3 million, respectively. These results reflect the contractual launch of our permitted Illinois sports skin in August 2023, as well as a provision for credit losses on sports wagering receivables of $1.0 million, which negatively affected Adjusted Segment EBITDA. For the fourth quarter of 2022, both revenues and Adjusted Segment EBITDA were $1.1 million.

For the year, this segment’s revenues grew 78.1%, from $7.2 million in 2022 to $12.8 million in 2023, and Adjusted Segment EBITDA rose 63.6%, from $7.1 million to $11.7 million. Results for 2022 reflect the acceleration of revenues under two of our sports wagering agreements with third-party operators that ceased operations in May 2022. In 2023, results increased due to the launch of our Illinois sports skin noted above, the launch of a replacement operator in Colorado in March 2023, and accelerated revenues related to two other sports wagering agreements with operators that ceased operations during the third quarter of 2023. Additionally, the $1.0 million provision for credit losses, as mentioned, negatively affected Adjusted Segment EBITDA during 2023.

The Company is currently permitted to operate three sports skins in Colorado, three in Indiana, and one in Illinois. Of such permitted skins, two sports skins are currently live in Colorado, one in Indiana, and one in Illinois. Under our agreements with various third parties to operate such skins, we receive a percentage of revenues, as defined in the contracts, subject to an annualized minimum amount that currently totals $8 million. We continue to evaluate whether to operate our remaining idle skins ourselves or to have other third parties operate them. However, there is no certainty that we will be able to enter into agreements with replacement operators or successfully operate the skins ourselves.

Liquidity and Capital Resources

As of December 31, 2023, we had $73.8 million in cash and cash equivalents, including $37.6 million of cash reserved under our bond indentures to complete the construction of Chamonix. Our debt consisted primarily of $450.0 million in outstanding senior secured notes due 2028, which became callable at specified premiums in February 2024, and $27.0 million outstanding under our revolving credit facility.

Conference Call Information

We will host a conference call for investors today, March 5, 2024, at 4:30 p.m. ET (1:30 p.m. PT) to discuss our 2023 fourth quarter results. Investors can access the live audio webcast from our website at www.fullhouseresorts.com under the investor relations section. The conference call can also be accessed by dialing (201) 689-8470.

A replay of the conference call will be available shortly after the conclusion of the call through March 19, 2024. To access the replay, please visit www.fullhouseresorts.com. Investors can also access the replay by dialing (412) 317-6671 and using the passcode 13744400.

(a) Reconciliation of Non-GAAP Financial Measures

Our presentation of non-GAAP Measures may be different from the presentation used by other companies, and therefore, comparability may be limited. While excluded from certain non-GAAP Measures, depreciation and amortization expense, interest expense, income taxes and other items have been and will be incurred. Each of these items should also be considered in the overall evaluation of our results. Additionally, our non-GAAP Measures do not consider capital expenditures and other investing activities and should not be considered as a measure of our liquidity. We compensate for these limitations by providing the relevant disclosure of our depreciation and amortization, interest and income taxes, and other items both in our reconciliations to the historical GAAP financial measures and in our consolidated financial statements, all of which should be considered when evaluating our performance.

Our non-GAAP Measures are to be used in addition to, and in conjunction with, results presented in accordance with GAAP. These non-GAAP Measures should not be considered as an alternative to net income, operating income, or any other operating performance measure prescribed by GAAP, nor should these measures be relied upon to the exclusion of GAAP financial measures. These non-GAAP Measures reflect additional ways of viewing our operations that we believe, when viewed with our GAAP results and the reconciliations to the corresponding historical GAAP financial measures, provide a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. Management strongly encourages investors to review our financial information in its entirety and not to rely on a single financial measure.

Adjusted Segment EBITDA. We utilize Adjusted Segment EBITDA as the measure of segment profitability in assessing performance and allocating resources at the reportable segment level. Adjusted Segment EBITDA is defined as earnings before interest and other non-operating income (expense), taxes, depreciation and amortization, preopening expenses, certain impairment charges, asset write-offs, recoveries, gain (loss) from asset disposals, project development and acquisition costs, non-cash share-based compensation expense, and corporate-related costs and expenses that are not allocated to each segment.

Same-store Adjusted Segment EBITDA. Same-store Adjusted Segment EBITDA is Adjusted Segment EBITDA further adjusted to exclude the Adjusted Property EBITDA of properties that have not been in operation for a full year. Adjusted Property EBITDA is defined as earnings before interest and other non-operating income (expense), taxes, depreciation and amortization, preopening expenses, certain impairment charges, asset write-offs, recoveries, gain (loss) from asset disposals, project development and acquisition costs, non-cash share-based compensation expense, and corporate-related costs and expenses that are not allocated to each property.

Adjusted EBITDA. We also utilize Adjusted EBITDA, which is defined as Adjusted Segment EBITDA, net of corporate-related costs and expenses. Although Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with GAAP, we believe this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity. We utilize this metric or measure internally to focus management on year-over-year changes in core operating performance, which we consider our ordinary, ongoing and customary operations, and which we believe is useful information to investors. Accordingly, management excludes certain items when analyzing core operating performance, such as the items mentioned above, that management believes are not reflective of ordinary, ongoing and customary operations.

Full House Resorts, Inc. and Subsidiaries

Consolidated Statements of Operations (Unaudited)

(In thousands, except per share data)

| Three Months Ended | Year Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 |

2022 |

2023 |

2022 |

|||||||||||||

| Revenues | ||||||||||||||||

| Casino | $ | 45,347 | $ | 25,583 | $ | 176,933 | $ | 113,876 | ||||||||

| Food and beverage | 8,561 | 6,239 | 33,980 | 26,494 | ||||||||||||

| Hotel | 2,376 | 2,206 | 9,428 | 9,282 | ||||||||||||

| Other operations, including contracted sports wagering | 3,745 | 2,054 | 20,719 | 13,629 | ||||||||||||

| 60,029 | 36,082 | 241,060 | 163,281 | |||||||||||||

| Operating costs and expenses | ||||||||||||||||

| Casino | 18,290 | 9,515 | 68,061 | 39,788 | ||||||||||||

| Food and beverage | 8,425 | 6,238 | 33,240 | 26,372 | ||||||||||||

| Hotel | 1,229 | 1,282 | 4,840 | 4,806 | ||||||||||||

| Other operations | 1,620 | 574 | 3,498 | 2,168 | ||||||||||||

| Selling, general and administrative | 23,923 | 14,911 | 85,746 | 59,706 | ||||||||||||

| Project development costs, net | 8 | 195 | 53 | 228 | ||||||||||||

| Preopening costs | 3,051 | 4,644 | 15,685 | 9,558 | ||||||||||||

| Depreciation and amortization | 8,610 | 1,918 | 31,092 | 7,930 | ||||||||||||

| Loss on disposal of assets | — | 39 | 7 | 42 | ||||||||||||

| 65,156 | 39,316 | 242,222 | 150,598 | |||||||||||||

| Operating (loss) income | (5,127 | ) | (3,234 | ) | (1,162 | ) | 12,683 | |||||||||

| Other (expense) income | ||||||||||||||||

| Interest expense, net | (6,658 | ) | (3,763 | ) | (22,977 | ) | (22,988 | ) | ||||||||

| Loss on modification of debt | — | — | — | (4,530 | ) | |||||||||||

| Gain on settlements | — | — | 384 | — | ||||||||||||

| (6,658 | ) | (3,763 | ) | (22,593 | ) | (27,518 | ) | |||||||||

| Loss before income taxes | (11,785 | ) | (6,997 | ) | (23,755 | ) | (14,835 | ) | ||||||||

| Income tax expense (benefit) | 697 | (15 | ) | 1,149 | (31 | ) | ||||||||||

| Net loss | $ | (12,482 | ) | $ | (6,982 | ) | $ | (24,904 | ) | $ | (14,804 | ) | ||||

| Basic loss per share | $ | (0.36 | ) | $ | (0.20 | ) | $ | (0.72 | ) | $ | (0.43 | ) | ||||

| Diluted loss per share | $ | (0.36 | ) | $ | (0.20 | ) | $ | (0.72 | ) | $ | (0.43 | ) | ||||

| Basic weighted average number of common shares outstanding | 34,588 | 34,401 | 34,520 | 34,355 | ||||||||||||

| Diluted weighted average number of common shares outstanding | 34,588 | 34,401 | 34,520 | 34,355 | ||||||||||||

Full House Resorts, Inc. and Subsidiaries

Supplemental Information

Segment Revenues, Adjusted Segment EBITDA and Adjusted EBITDA

(In thousands, Unaudited)

| Three Months Ended | Year Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2023 |

2022 |

2023 |

2022 |

|||||||||||||

| Revenues | ||||||||||||||||

| Midwest & South | $ | 49,094 | $ | 27,451 | $ | 192,358 | $ | 119,950 | ||||||||

| West | 8,588 | 7,534 | 35,888 | 36,135 | ||||||||||||

| Contracted Sports Wagering | 2,347 | 1,097 | 12,814 | 7,196 | ||||||||||||

| $ | 60,029 | $ | 36,082 | $ | 241,060 | $ | 163,281 | |||||||||

| Adjusted Segment EBITDA(1) and Adjusted EBITDA | ||||||||||||||||

| Midwest & South | $ | 7,198 | $ | 4,560 | $ | 39,028 | $ | 26,376 | ||||||||

| West | (130 | ) | (287 | ) | 2,408 | 4,220 | ||||||||||

| Contracted Sports Wagering | 1,290 | 1,079 | 11,663 | 7,127 | ||||||||||||

| Adjusted Segment EBITDA | 8,358 | 5,352 | 53,099 | 37,723 | ||||||||||||

| Corporate | (1,063 | ) | (1,459 | ) | (4,542 | ) | (5,589 | ) | ||||||||

| Adjusted EBITDA | $ | 7,295 | $ | 3,893 | $ | 48,557 | $ | 32,134 | ||||||||

__________

(1) The Company utilizes Adjusted Segment EBITDA as the measure of segment operating profitability in assessing performance and allocating resources at the reportable segment level.

Full House Resorts, Inc. and Subsidiaries

Supplemental Information

Same-store Revenues and Adjusted Segment EBITDA

(In thousands, Unaudited)

| Three Months Ended | Year Ended | ||||||||||||||||||||

| December 31, | Increase / | December 31, | Increase / | ||||||||||||||||||

| Reporting segments | 2023 |

2022 | (Decrease) | 2023 | 2022 | (Decrease) | |||||||||||||||

| Midwest & South | |||||||||||||||||||||

| Midwest & South same-store total revenues(1) |

$ | 26,744 | $ | 27,451 | (2.6 | ) | % | $ | 115,371 | $ | 119,950 | (3.8 | ) | % | |||||||

| American Place | 22,350 | — | N.M. | 76,987 | — | N.M. | |||||||||||||||

| Midwest & South total revenues | $ | 49,094 | $ | 27,451 | 78.8 | % | $ | 192,358 | $ | 119,950 | 60.4 | % | |||||||||

| Midwest & South same-store Adjusted Segment EBITDA(1) |

$ | 3,280 | $ | 4,560 | (28.1 | ) | % | $ | 20,619 | $ | 26,376 | (21.8 | ) | % | |||||||

| American Place | 3,918 | — | N.M. | 18,409 | — | N.M. | |||||||||||||||

| Midwest & South Adjusted Segment EBITDA |

$ | 7,198 | $ | 4,560 | 57.9 | % | $ | 39,028 | $ | 26,376 | 48.0 | % | |||||||||

| Contracted Sports Wagering | |||||||||||||||||||||

| Contracted Sports Wagering same-store total revenues(2) |

$ | 841 | $ | 1,097 | (23.3 | ) | % | $ | 4,773 | $ | 5,555 | (14.1 | ) | % | |||||||

| Accelerated revenues due to contract terminations(3) |

— | — | N.M. | 5,794 | 1,641 | 253.1 | % | ||||||||||||||

| Illinois | 1,506 | — | N.M. | 2,247 | — | N.M. | |||||||||||||||

| Contracted Sports Wagering total revenues |

$ | 2,347 | $ | 1,097 | 113.9 | % | $ | 12,814 | $ | 7,196 | 78.1 | % | |||||||||

| Contracted Sports Wagering same-store Adjusted Segment EBITDA(2) |

$ | (140 | ) | $ | 1,079 | (113.0 | ) | % | $ | 3,717 | $ | 5,486 | (32.2 | ) | % | ||||||

| Accelerated revenues due to contract terminations(3) |

— | — | N.M. | 5,794 | 1,641 | 253.1 | % | ||||||||||||||

| Illinois | 1,430 | — | N.M. | 2,152 | — | N.M. | |||||||||||||||

| Contracted Sports Wagering Adjusted Segment EBITDA |

$ | 1,290 | $ | 1,079 | 19.6 | % | $ | 11,663 | $ | 7,127 | 63.6 | % | |||||||||

__________

N.M. Not meaningful.

(1) Same-store operations exclude results from American Place, which opened on February 17, 2023.

(2) Same-store operations exclude results from Illinois, which contractually commenced on August 15, 2023. For enhanced comparability, we also excluded accelerated revenues due to contract terminations from same-store operations.

(3) For enhanced comparability, we also excluded accelerated revenues due to contract terminations from same-store operations. Such adjustments reflect two sports skins that ceased operations in the third quarter of 2023, and two sports skins that ceased operations in the second quarter of 2022.

Full House Resorts, Inc. and Subsidiaries

Supplemental Information

Reconciliation of Net Loss and Operating Income (Loss) to Adjusted EBITDA

(In thousands, Unaudited)

| Three Months Ended | Year Ended | ||||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2023 |

2022 |

2023 |

2022 |

||||||||||||

| Net loss | $ | (12,482 | ) | $ | (6,982 | ) | $ | (24,904 | ) | $ | (14,804 | ) | |||

| Income tax expense (benefit) | 697 | (15 | ) | 1,149 | (31 | ) | |||||||||

| Interest expense, net | 6,658 | 3,763 | 22,977 | 22,988 | |||||||||||

| Loss on modification of debt | — | — | — | 4,530 | |||||||||||

| Gain on settlements | — | — | (384 | ) | — | ||||||||||

| Operating (loss) income | (5,127 | ) | (3,234 | ) | (1,162 | ) | 12,683 | ||||||||

| Project development costs, net | 8 | 195 | 53 | 228 | |||||||||||

| Preopening costs | 3,051 | 4,644 | 15,685 | 9,558 | |||||||||||

| Depreciation and amortization | 8,610 | 1,918 | 31,092 | 7,930 | |||||||||||

| Loss on disposal of assets | — | 39 | 7 | 42 | |||||||||||

| Stock-based compensation | 753 | 331 | 2,882 | 1,693 | |||||||||||

| Adjusted EBITDA | $ | 7,295 | $ | 3,893 | $ | 48,557 | $ | 32,134 | |||||||

Full House Resorts, Inc. and Subsidiaries

Supplemental Information

Reconciliation of Operating Income (Loss) to Adjusted Segment EBITDA and Adjusted EBITDA

(In thousands, Unaudited)

| Three Months Ended December 31, 2023 | ||||||||||||||||||||

| Adjusted | ||||||||||||||||||||

| Segment | ||||||||||||||||||||

| Operating | Depreciation | Project | Stock- | EBITDA and | ||||||||||||||||

| Income | and | Development | Preopening | Based | Adjusted | |||||||||||||||

| (Loss) | Amortization | Costs | Costs | Compensation | EBITDA | |||||||||||||||

| Reporting segments | ||||||||||||||||||||

| Midwest & South | $ | (894 | ) | $ | 7,953 | $ | — | $ | 139 | $ | — | $ | 7,198 | |||||||

| West | (3,669 | ) | 627 | — | 2,912 | — | (130 | ) | ||||||||||||

| Contracted Sports Wagering | 1,290 | — | — | — | — | 1,290 | ||||||||||||||

| (3,273 | ) | 8,580 | — | 3,051 | — | 8,358 | ||||||||||||||

| Other operations | ||||||||||||||||||||

| Corporate | (1,854 | ) | 30 | 8 | — | 753 | (1,063 | ) | ||||||||||||

| $ | (5,127 | ) | $ | 8,610 | $ | 8 | $ | 3,051 | $ | 753 | $ | 7,295 | ||||||||

| Three Months Ended December 31, 2022 | |||||||||||||||||||||||

| Adjusted | |||||||||||||||||||||||

| Segment | |||||||||||||||||||||||

| Operating | Depreciation | Loss on | Project | Stock- | EBITDA and | ||||||||||||||||||

| Income | and | Disposal | Development | Preopening | Based | Adjusted | |||||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Costs | Compensation | EBITDA | |||||||||||||||||

| Reporting segments | |||||||||||||||||||||||

| Midwest & South | $ | (1,035 | ) | $ | 1,318 | $ | 39 | $ | — | $ | 4,238 | $ | — | $ | 4,560 | ||||||||

| West | (1,260 | ) | 567 | — | — | 406 | — | (287 | ) | ||||||||||||||

| Contracted Sports Wagering | 1,079 | — | — | — | — | — | 1,079 | ||||||||||||||||

| (1,216 | ) | 1,885 | 39 | — | 4,644 | — | 5,352 | ||||||||||||||||

| Other operations | |||||||||||||||||||||||

| Corporate | (2,018 | ) | 33 | — | 195 | — | 331 | (1,459 | ) | ||||||||||||||

| $ | (3,234 | ) | $ | 1,918 | $ | 39 | $ | 195 | $ | 4,644 | $ | 331 | $ | 3,893 | |||||||||

Full House Resorts, Inc. and Subsidiaries

Supplemental Information

Reconciliation of Operating Income (Loss) to Adjusted Segment EBITDA and Adjusted EBITDA

(In thousands, Unaudited)

| Year Ended December 31, 2023 | |||||||||||||||||||||||

| Adjusted | |||||||||||||||||||||||

| Segment | |||||||||||||||||||||||

| Operating | Depreciation | Loss on | Project | Stock- | EBITDA and | ||||||||||||||||||

| Income | and | Disposal | Development | Preopening | Based | Adjusted | |||||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Costs | Compensation | EBITDA | |||||||||||||||||

| Reporting segments | |||||||||||||||||||||||

| Midwest & South | $ | 428 | $ | 28,593 | $ | 7 | $ | — | $ | 10,000 | $ | — | $ | 39,028 | |||||||||

| West | (5,654 | ) | 2,377 | — | — | 5,685 | — | 2,408 | |||||||||||||||

| Contracted Sports Wagering | 11,663 | — | — | — | — | — | 11,663 | ||||||||||||||||

| 6,437 | 30,970 | 7 | — | 15,685 | — | 53,099 | |||||||||||||||||

| Other operations | |||||||||||||||||||||||

| Corporate | (7,599 | ) | 122 | — | 53 | — | 2,882 | (4,542 | ) | ||||||||||||||

| $ | (1,162 | ) | $ | 31,092 | $ | 7 | $ | 53 | $ | 15,685 | $ | 2,882 | $ | 48,557 | |||||||||

| Year Ended December 31, 2022 | ||||||||||||||||||||||||

| Loss / | Adjusted | |||||||||||||||||||||||

| (gain) | Segment | |||||||||||||||||||||||

| Operating | Depreciation | on | Project | Stock- | EBITDA and | |||||||||||||||||||

| Income | and | Disposal | Development | Preopening | Based | Adjusted | ||||||||||||||||||

| (Loss) | Amortization | of Assets | Costs | Costs | Compensation | EBITDA | ||||||||||||||||||

| Reporting segments | ||||||||||||||||||||||||

| Midwest & South | $ | 13,053 | $ | 5,150 | $ | 47 | $ | — | $ | 8,126 | $ | — | $ | 26,376 | ||||||||||

| West | 394 | 2,399 | (5 | ) | — | 1,432 | — | 4,220 | ||||||||||||||||

| Contracted Sports Wagering |

7,127 | — | — | — | — | — | 7,127 | |||||||||||||||||

| 20,574 | 7,549 | 42 | — | 9,558 | — | 37,723 | ||||||||||||||||||

| Other operations | ||||||||||||||||||||||||

| Corporate | (7,891 | ) | 381 | — | 228 | — | 1,693 | (5,589 | ) | |||||||||||||||

| $ | 12,683 | $ | 7,930 | $ | 42 | $ | 228 | $ | 9,558 | $ | 1,693 | $ | 32,134 | |||||||||||

Cautionary Note Regarding Forward-looking Statements

This press release contains statements by us and our officers that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “expect,” “future,” “should,” “will” and similar references to future periods. Some forward-looking statements in this press release include those regarding our expected construction budgets, estimated commencement and completion dates, expected amenities, and our expected operational performance for Chamonix and American Place; our expectations regarding the legal proceedings related to the process whereby we were granted the gaming license for American Place; our expectations regarding our ability to generate operating cash flow and to obtain debt financing on reasonable terms and conditions for the construction of the permanent American Place facility; and our expectations regarding the operation and usage of our available idle sports skins. Forward-looking statements are neither historical facts nor assurances of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Such risks include, without limitation, our ability to repay our substantial indebtedness; our ability to finance the construction of the permanent American Place facility; inflation and its potential impacts on labor costs and the price of food, construction, and other materials; the effects of potential disruptions in the supply chains for goods, such as food, lumber, and other materials; general macroeconomic conditions; our ability to effectively manage and control expenses; our ability to complete the amenities at Chamonix; our ability to complete construction at American Place, on-time and on-budget; legal or regulatory restrictions, delays, or challenges for our construction projects, including American Place; construction risks, disputes and cost overruns; dependence on existing management; competition; uncertainties over the development and success of our expansion projects; the financial performance of our finished projects and renovations; effectiveness of expense and operating efficiencies; cyber events and their impacts to our operations; and regulatory and business conditions in the gaming industry (including the possible authorization or expansion of gaming in the states we operate or nearby states). Additional information concerning potential factors that could affect our financial condition and results of operations is included in the reports we file with the Securities and Exchange Commission, including, but not limited to, Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the most recently ended fiscal year and our other periodic reports filed with the Securities and Exchange Commission. We are under no obligation to (and expressly disclaim any such obligation to) update or revise our forward-looking statements as a result of new information, future events or otherwise. Actual results may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

About Full House Resorts, Inc.

Full House Resorts owns, leases, develops and operates gaming facilities throughout the country. Our properties include American Place in Waukegan, Illinois; Silver Slipper Casino and Hotel in Hancock County, Mississippi; Chamonix Casino Hotel and Bronco Billy’s Casino and Hotel in Cripple Creek, Colorado; Rising Star Casino Resort in Rising Sun, Indiana; Stockman’s Casino in Fallon, Nevada; and Grand Lodge Casino, located within the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. For further information, please visit www.fullhouseresorts.com.

CONTACT: Contact: Lewis Fanger, Chief Financial Officer Full House Resorts, Inc. 702-221-7800 www.fullhouseresorts.com

Nasdaq:FLL

Full House Resorts Announces Fourth Quarter Earnings Release Date

LAS VEGAS, Feb. 09, 2024 (GLOBE NEWSWIRE) — Full House Resorts (NASDAQ: FLL) announced today that it will report its fourth quarter 2023 and full-year financial results on Tuesday, March 5, 2024, followed by a conference call at 4:30 p.m. ET (1:30 p.m. PT). Investors can access the live audio webcast from the Company’s website at www.fullhouseresorts.com under the investor relations section. The conference call can also be accessed by dialing (201) 689-8470.

A replay of the conference call will be available shortly after the conclusion of the call through March 19, 2024. To access the replay, please visit www.fullhouseresorts.com. Investors can also access the replay by dialing (412) 317-6671 and using the passcode 13744400.

Forward-looking Statements

This press release may contain statements by Full House Resorts, Inc. that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Additional information concerning potential factors that could affect our financial condition and results of operations is included in the reports we file with the SEC, including, but not limited to, our Form 10-K for the most recently ended fiscal year and our other periodic reports filed with the SEC. We are under no obligation to (and expressly disclaim any such obligation to) update or revise our forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Actual results may differ materially from those indicated in the forward-looking statements.

About Full House Resorts, Inc.

Full House Resorts owns, leases, develops and operates gaming facilities throughout the country. The Company’s properties include The Temporary by American Place in Waukegan, Illinois; Silver Slipper Casino and Hotel in Hancock County, Mississippi; Chamonix Casino Hotel and Bronco Billy’s Casino and Hotel, both in Cripple Creek, Colorado; Rising Star Casino Resort in Rising Sun, Indiana; Stockman’s Casino in Fallon, Nevada; and Grand Lodge Casino, located within the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. For further information, please visit www.fullhouseresorts.com.

CONTACT: Contact: Lewis Fanger, Chief Financial Officer Full House Resorts, Inc. (702) 221-7800 www.fullhouseresorts.com

Nasdaq:FLL

Chamonix, Colorado’s Newest and Most Luxurious Casino Hotel, Opens at Noon on Wednesday, December 27, 2023

Located in charming Cripple Creek, Chamonix is conveniently located less than an hour from Colorado Springs and approximately two hours from Denver

CRIPPLE CREEK, Colo., Dec. 26, 2023 (GLOBE NEWSWIRE) — Full House Resorts, Inc. (Nasdaq: FLL) today announced the opening details for its newest gaming destination – Chamonix Casino Hotel. Chamonix’s stylish new casino and luxurious 300-guestroom hotel effortlessly blend Colorado comfort with classic European elegance. It is located in historic Cripple Creek, approximately 45 miles from Colorado Springs and 80 miles from Denver’s southern suburbs. Chamonix is adjacent to – and integrated with – Bronco Billy’s Casino, also owned by Full House Resorts.

Chamonix features an elegant casino floor, with a wide variety of the newest slot machines, a high-limit slot salon, and the state’s most elegant table games area. Many of Chamonix’s hotel guestrooms and suites offer balconies and sweeping views of Cripple Creek, Pikes Peak and the spectacular Sangre de Cristo mountains.

On Wednesday at noon, Chamonix will open its entire casino, a portion of its 300-guestroom hotel, and its convenient valet, garage and surface parking. It will operate a temporary restaurant (Chamonix Bistro) and buffet in its elegant meeting room area. Within a week, the Company expects to open the balance of its guestrooms. In approximately one month, Chamonix plans to open its high-end 980 Prime restaurant, featuring the cuisine and supervision of Las Vegas celebrity chef Barry Dakake. Shortly thereafter, Chamonix will unveil Ore and Alloy, its freestanding jewelry and luxury retail store, and its opulent Chamonix Spa. The spa features a rooftop pool and deck; winter garden; large workout room with modern exercise equipment; eight massage rooms; and an assortment of saunas, steam rooms and other amenities. The spa also offers a full-service salon with hairdressers, barbers, and manicure and pedicure capabilities. In the spring, the adjoining Bronco Billy’s Casino will introduce its new Italian restaurant, Firenze.

Chamonix is named after the “Queen of Alpine” resorts in France, located at the foot of Mont Blanc and site of the first Winter Olympics in 1924. The name is particularly appropriate, as Colorado Springs is home to the U.S. Olympic Committee and Training Center. Our Chamonix destination in Colorado will add to the region’s century of high-end hospitality, which includes the world’s longest-running Forbes Five-Star and AAA Five-Diamond resort.

“Chamonix is a special place, unlike any other casino hotel in the state. It offers a high-end, Las Vegas experience in our beautiful Colorado mountain setting,” said Baxter Lee, General Manager of Chamonix Casino Hotel. “We are overjoyed to open Chamonix’s doors on December 27 and to welcome our friends from Colorado and beyond.”

For more information on Chamonix Casino Hotel or to reserve a room, please visit www.ChamonixCO.com.

About Full House Resorts, Inc.

Full House Resorts (Nasdaq: FLL) owns, leases, develops and operates gaming facilities throughout the country. Our properties include Chamonix Casino Hotel and Bronco Billy’s Casino and Hotel in Cripple Creek, Colorado; American Place in Waukegan, Illinois; Silver Slipper Casino and Hotel in Hancock County, Mississippi; Rising Star Casino Resort in Rising Sun, Indiana; Stockman’s Casino in Fallon, Nevada; and Grand Lodge Casino, located within the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. For further information, please visit www.fullhouseresorts.com.

Forward-looking Statements

This press release may contain statements by us and our officers that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “expect,” “future,” “should,” “will” and similar references to future periods. Some forward-looking statements in this press release include those regarding the opening timeline for Chamonix and its expected amenities. Forward-looking statements are neither historical facts nor assurances of future performance. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Information concerning potential factors that could affect our financial condition and results of operations is included in the reports we file with the Securities and Exchange Commission, including, but not limited to, Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the most recently ended fiscal year and our other periodic reports filed with the Securities and Exchange Commission. We are under no obligation to (and expressly disclaim any such obligation to) update or revise our forward-looking statements as a result of new information, future events or otherwise. Actual results may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

CONTACT: Media: Tyler Rabel Two by Four [email protected] (312) 445-4728 Investors: Lewis Fanger, Chief Financial Officer Full House Resorts, Inc. (702) 221-7800

-

Baltics6 days ago

Baltics6 days agoHacksaw Gaming and TOPsport are on TOP of their game with new partnership announcement in Lithuania

-

Compliance Updates6 days ago

Compliance Updates6 days agoDGA: Three orders and two reprimands to Skill on Net Ltd for breach of the Anti-Money Laundering Act

-

Central Europe6 days ago

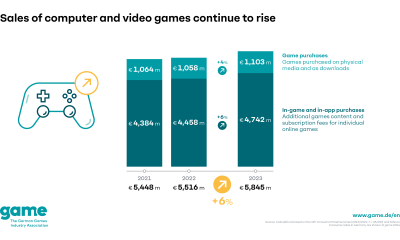

Central Europe6 days agoGerman games market in 2023: strong development in turbulent times

-

Baltics6 days ago

Baltics6 days agoHIPTHER Invites You to Recognize Gaming Excellence at the Baltic & Scandinavian Gaming Awards 2024 – Online Voting Session is Now Open!

-

Baltics6 days ago

Baltics6 days agoWazdan expands in Lithuania with Twinsbet deal

-

Latest News6 days ago

Latest News6 days agoSvenska Spel Appoints Gustav Georgson to Lead Public Affairs

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoAltenar becomes General Sponsor of EEGS 2024

-

Balkans6 days ago

Balkans6 days agoESA Gaming unveils Balkan Bet collaboration