Latest News

9 Aspects to Look For in a Top iGaming Payment Provider

There are hundreds of iGaming payment providers out there. Which one will meet your demands? Many businesses ask this question. Not many get the right answer.

With the global online gaming market expected to reach $127 billion by 2027, getting the right iGaming payment services is paramount. Simply put, the better provider you have, the more customers you can serve, the faster payments will be, and the higher your income you will have.

Yet, choosing the right provider can be challenging, especially with the unique needs of high-risk industries like iGaming. In this piece, we will go through a nine-point checklist. These steps ensure you enter a pool of top iGaming payment providers.

So, buckle up.

1. Verify If an iGaming Software Provider is High-Risk Friendly

iGaming is a high-risk industry. That means higher fees and more scrutiny. Choose a provider specialising in high-risk sectors to avoid disruptions and reduce transaction rejections.

Keep note: Not all payment providers are willing to work with high-risk industries, leading to potential delays or increased fees.

The right iGaming payment provider must have these aspects to be truly high-risk friendly:

- Have no volume restrictions

- Understand the industry to the bone

- Provide a dedicated account manager with expert knowledge of the sector

- Support licenses in different jurisdictions

2. Check How Long It Takes for an iGaming Payment Provider to Open a Business Account

Now, you narrowed down the list of best payment providers for iGaming. The next important question to ask:

How long will it take to open a business account?

In most cases, when you need to open a business account, you can expect two challenges:

- Lengthy approval process.

- A lot of documents to provide.

Many banks does not understand industries like iGaming. That is why they ask tons of unrelated questions and require documents you don’t simply have. As a result, getting a business account can take weeks or months.

A good provider opens a business account for you in several weeks. A great iGaming software solutions provider opens a business account in about 48 hours.

https://account.paydo.com/en/auth/business/sign-up

3. Make Sure an iGaming Payment Provider Has SWIFT In Their Arsenal

For international transactions, SWIFT is a must. This scheme allows for faster, more secure iGaming transactions. It reduces delays and ensures smooth processing of player deposits and withdrawals.

Without SWIFT, iGaming operators risk slower processing times and dissatisfied players. Yet, the rule of thumb dictates that the more payment schemes you have access to the better.

4. Does iGaming Payment Provider Offer Multiple Currencies?

This should be your next question. Even if an iGaming payment provider is high-risk friendly, opens a business account fast, and is connected to SWIFT, this does not mean you get many currencies to work with. You still need to pay contractors in their local currency.

Also, setting up a multicurrency account can come at a significant cost. Banks and EMIs impose additional charges for each extra currency you might need.

5. Check If an iGaming Payment Provider Offers Merchant Services

If you have a website accepting payments, you need a good checkout.

What constitutes a “good” checkout?

In most cases, the number of chargebacks, holds, rolling reserves, as well as payment methods available. Besides, you want a checkout that can be easily integrated.

6. What About Mass Payouts?

Every iGaming operator knows how hard it can be to send multiple payments to several customers. When you don’t have mass payments with your iGaming provider, every payment must be made one by one. Without saying, it will take a lot of your time and nerve.

.

7. Confirm Whether an iGaming Payment Provider Have Virtual and Physical Cards

Virtual and physical cards allow flexibility for both business payments and player withdrawals. They can be used for payouts, ad spending, or corporate expenses. Besides, having a personalised plastic card speaks volumes about your brand.

8. Compliance With Global and Local Regulations

After going through the arsenal of services of a chosen best iGaming payment provider, the next logical step is to look at compliance. You must be sure a selected provider has the legal right to provide certain services and operate in partnership destinations.

To illustrate, as an iGaming payment provider, one should have at least these:

- The Financial Conduct Authority (FCA).

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

As an add-on, a good iGaming payment provider should have an Authorised Electronic Money Institution (UAB) license. This one allows the platform to issue electronic money and offer related financial services within the European Union (EU) and European Economic Area (EEA).

9. Double-Check the Security Measures an iGaming Payment Provider Implements

For top iGaming payment providers these security measures are non-negotiable:

- Built-in anti-fraud.

- PCI-DSS Level 1 compliance.

- 3D-Secure (3DS) technology.

- Anti-money laundering (AML) protocols.

- Automated KYC.

PayDo—All Payment Solutions in One Place

While all roads lead to Rome, all aforementioned aspects lead to platforms like PayDo.

PayDo is a payment ecosystem. It made sure all the aspects we talked about were covered. Namely, the platform is:

1. High-risk friendly:

-

- No volume restrictions.

- No hidden fees

- No minimal commitments

- No minimal balances

- No nonsense requirements

- All iGaming licenses (Curacao included).

- In-depth understanding of high-risk industries.

- Curacao and other licenses supported

- A dedicated account manager with extensive experience in iGaming

- Momentary payouts

- Scheduled payments

- 140+ destinations

2. Business account opening:

-

- Takes about 48 hours.

- Completely remote.

- Requires a standard package of documents.

- Onboarding is as quick as verification.

3. Nine payment schemes:

-

- SEPA

- SEPA instant

- Fedwire

- Target 2

- FasterPayments

- Chaps

- BACS

- Kronos2

4. Multicurrency:

-

- Dedicated IBAN with 35+ currencies and 150 countries.

- Personal account with 12+ currencies.

- No extra charges for currencies.

5. Checkout:

-

- Zero chargebacks

- No holds or rolling reserve

- Easy API integration

- 350+ payment methods

- Localization

- Instant settlements

- Conversion rate > 98%

- Unlimited websites

6. Mass Payouts:

-

- Automatic payouts without any manual inputs.

- Customers receive their funds without fees.

7. Virtual and Physical Cards:

-

- Offer employees personalized cards.

- Improve corporate expense management.

- No limit on issuance.

8. Compliance and Security:

1.Licensed by:

-

-

- FCA.

- FINTRAC

- UAB.

-

2.Security measures:

-

-

- Built-in anti-fraud.

- PCI-DSS Level 1 compliance.

- 3D-Secure (3DS) technology.

- Anti-money laundering (AML) protocols.

- Automated KYC.

- Encryption.

- Safeguarding.

-

Besides, recently PayDo was nominated for the Payment Innovation of the Year award at a

reputable iGaming-focused SBC 2024 convention.

Finally, PayDo have become a SWIFT Direct Participant. Now the platform can send and receive messages directly through the SWIFT network without intermediary banks.

For PayDo clients, it means faster transaction speed and fewer delays.

Conclusion

When choosing a payment provider for iGaming, check these aspects:

- High-risk friendly;

- Business account opening;

- SWIFT availability;

- Multiple currencies;

- Merchant services;

- Mass payouts;

- Virtual and physical cards;

- Compliance;

- Security measures.

The list is that long because top iGaming payment providers like PayDo work hard to develop a solution that will stand out in a competitive market. With PayDo, you get the services of 8-9 payment providers in one place and under one contract.

Don’t hesitate to open an account right now. We are ready when you are!

The post 9 Aspects to Look For in a Top iGaming Payment Provider appeared first on European Gaming Industry News.

Latest News

Bagelmania Backroom Comedy night lineup announced for Thursday, Feb. 26

The iconic Jewish delicatessen Siegel’s Bagelmania has announced the comedic line up that will leave guests “laughing their bagels off” at the next Bagelmania Backroom Comedy night on Thursday, Feb. 26.

Hosted monthly by Las Vegas-based and nationally touring comedian couple Noah Gardenswartz and Ester Steinberg, the event Thursday night will welcome Chris Clarke as the headliner along with acclaimed comics Kristeen Von Hagen, Gabe Quire and Lauren Rochelle.

Clarke, known as a high-energy and imaginative comedian, now tours the country with veteran comedian Rob Schneider. He also has amassed more than 40 million views on his popular YouTube channel “Csnacks,” where he tastes food and snacks from the front seat of his car. His hilarious and unique way of describing different flavors led to national commercials for Checkers and Rally’s, a one-hour special on the Cooking Channel titled Baby Got Snack, and an appearance as a food critic judge on Beat Bobby Flay.

Siegel’s Bagelmania will offer a special Backroom Comedy menu of its signature delicatessen cuisine as well as a full bar so guests can enjoy great comedy, dinner, and drinks in a unique, relaxed setting.

The Bagelmania Backroom is open to attendees 18 and older. Doors open for drinks and dinner at 7 p.m. Show time is 8 p.m. Tickets for Bagelmania Backroom are on sale for $20 online at https://siegelsbagelmania.com/backroomcomedy/ and will be sold at the door while supply lasts.

The post Bagelmania Backroom Comedy night lineup announced for Thursday, Feb. 26 appeared first on Americas iGaming & Sports Betting News.

Latest News

ACR Poker OSS XL Returns With $50M GTD

ACR Poker has officially announced the return of its flagship Online Super Series (OSS) XL, running from March 1 to March 23, 2026, with a massive $50 million in guaranteed prize pools.

Following the success of its recent Dual Venom tournaments, which paid out more than $11 million, ACR Poker is once again delivering high-value online tournament action designed for players of all skill levels and bankroll sizes.

Three Main Events With $5 Million Guaranteed

The headline events of OSS XL include three major Main Events launching March 15:

- $2,650 buy-in – $2 million guaranteed

- $1,050 buy-in – $2 million guaranteed

- $215 buy-in – $1 million guaranteed

These marquee tournaments anchor the series, offering players high-stakes competition alongside accessible mid- and low-stakes opportunities.

Phil’s Thrill XXL and Multi-Flight Action

Kicking off the series on March 1 is Phil’s Thrill XXL, featuring a $1.5 million guarantee and a $10,300 buy-in. Players can qualify for as little as $95 through ACR’s Road to the Big One promotion.

The schedule also includes a $630 buy-in Multi-Flight Event with $1.5 million guaranteed, with Day 1 flights beginning March 1 and Day 2 set for March 23.

For bounty hunters, OSS XL offers five Mystery Bounty Multi-Flight tournaments, including:

- Three $500,000 guaranteed events ($109 buy-in)

- A $150,000 guaranteed event ($33 buy-in)

- A $100,000 guaranteed event ($5.50 buy-in)

These tournaments provide dynamic prize opportunities and strong value across all buy-in tiers.

$65,000 Leaderboard Contest

To enhance engagement, ACR Poker’s Leaderboard Contest returns with $65,000 in cash and tournament tickets across three buy-in tiers:

- High Stakes: $15,000 top prize

- Mid Stakes: $7,500 top prize

- Low Stakes: $4,000 top prize

According to ACR Pro Chris Moneymaker, OSS XL stands out for its inclusive structure, substantial guarantees and daily leaderboard incentives that reward consistent participation.

With $50 million guaranteed and a broad mix of Main Events, Mystery Bounties and multi-flight tournaments, OSS XL reinforces ACR Poker’s position as a major force in the global online poker tournament landscape.

The post ACR Poker OSS XL Returns With $50M GTD appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

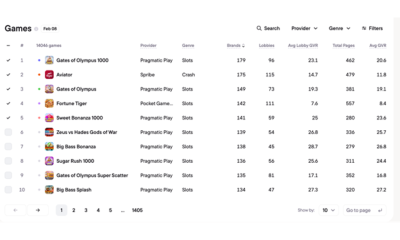

affiliate management system

Alanbase and Gamblers Connect announce new partnership

Gamblers Connect, the award-winning iGaming media and affiliate platform, has announced a new strategic partnership with Alanbase, a cloud-based SaaS “constructor” built to power advanced affiliate programme development.

The collaboration strengthens Gamblers Connect’s B2B Providers section, a curated hub designed to connect iGaming professionals with trusted, high-performance industry solutions. By integrating Alanbase into its ecosystem, Gamblers Connect enhances access to cutting-edge affiliate management technology tailored to competitive iGaming markets.

A Customizable SaaS Solution for iGaming Affiliates

Alanbase differentiates itself through its fully customizable SaaS architecture. Unlike traditional affiliate software, Alanbase allows operators to build dashboards, performance indicators and statistical tables using their own formulas. This “constructor” model ensures the platform adapts to each business workflow — not the other way around.

The cloud-based system also delivers high-speed data refresh capabilities, enabling operators to monitor player activity in near real time. This performance advantage provides deeper analytical insight and supports faster decision-making in fast-moving iGaming environments.

Gjorgje Ristikj, Founder of Gamblers Connect, highlighted that the partnership aligns with the platform’s mission to feature transparent, value-driven B2B providers. By adding Alanbase to its verified partner network, Gamblers Connect reinforces its commitment to showcasing tools that improve affiliate program scalability, operational efficiency and measurable growth.

Expanding the iGaming B2B Ecosystem

The partnership reflects growing demand for flexible affiliate SaaS platforms that prioritize customization, automation and performance tracking. As competition intensifies across global iGaming markets, data-driven affiliate management solutions are becoming a critical component of operator success.

With Alanbase now featured within Gamblers Connect’s B2B Providers hub, industry professionals gain streamlined access to enterprise-grade affiliate infrastructure designed for scalability and precision.

The post Alanbase and Gamblers Connect announce new partnership appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

ACMA5 days ago

ACMA5 days agoACMA Blocks More Illegal Online Gambling Websites

-

Aurimas Šilys5 days ago

Aurimas Šilys5 days agoREEVO Partners with Betsson Lithuania

-

CEO of GGBET UA Serhii Mishchenko5 days ago

CEO of GGBET UA Serhii Mishchenko5 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Canada4 days ago

Canada4 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News4 days ago

Latest News4 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe5 days ago

Central Europe5 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Firecracker Frenzy™ Money Toad™4 days ago

Firecracker Frenzy™ Money Toad™4 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™

-

Acquisitions/Merger4 days ago

Acquisitions/Merger4 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market