Canada

The US Online Sport Betting and iGaming markets – choosing the right partner for a brighter future

In the United States, Online Gaming* has grown in popularity over the last year, increasing customers base and gaming revenue. The US Online Gaming market is valued at 2B USD and the forecast is to grow further and reach 8.5B USD GGR by 2025, representing a CAGR of over 15%.

*Online Gaming is referring to iGaming (aka internet casino/poker gaming) and online Sports Betting (aka Mobile Sports Wagering)

Circa one-third of states already legalized at least one form of online gaming and others are in the process. I It is clear the growth potential is massive after the pandemic put the entire online industry on steroids. Struggling brick-and-mortar organizations realized that online presence is not just good, but a must-have. It is estimated that the portion of the online gaming revenues from the total gambling revenue in the US is now 20% and it is predicted to double by 2023, on account of additional skins going live, enlarged customers base and more states legalizing online gaming. In 2020, the total GGR from Online Gaming in four of the states- Delaware, New Jersey, West Virginia and Pennsylvania reached over 1.5B USD, representing 200% Y2Y growth. New Jersey with share out of it is almost $1B and Pennsylvania above $500m. New Jersey is currently the largest market for regulated online gambling in the United States. In March this year, the New Jersey operators scooped up 113.7m USD 21%+ M2M. Pennsylvania is the fastest growing market in the US and it attracts operators and providers even though the tax rates – Video Slots 54%, Table games 34% and Poker 16%.

Enjoying the politician support, giving additional state tax revenues from GGR and licensing, increasing in-state employment and decreasing illegal betting through a regulated framework, the online gaming market will continue to thrive. Online Gaming holds a broader potential than the immediate market operators and providers. There is an entire ecosystem of providers in many fields like KYC automation, Anti-fraud and AML systems, AI and machine learning systems, CRM, BI, Gamification tools, payment processors and many more. In other words this means more indirect taxation and more jobs. Seeing the potential, operators can also take advantage of the growing interest of venture capital organizations and investment banks which have started investing their time, effort and money in the industry. Apart from Tennessee, the regulator has given advantage to the brick-and-mortar establishments, which should remove some of the fear of losing revenues. As online regulation will cannibalize land based establishment revenues, mainly from the younger demographic (under 50 years old), going online is a necessity. Not doing so would simply mean that potential online customers will seek to do business elsewhere.

The potential to boost land-based establishments with online gaming revenues comes from the fact that online availability is 24/7, richer products and betting options. It is easily accessible on mobile devices and it extends the business, geographically, throughout the given state boundary

The twelve years between the Unlawful Internet Gambling Enforcement Act of 2006 and the supreme court ruling in New Jersey in 2018 have created an online gaming knowledge gap that US gambling professionals are steadily catching up with by self-learning or/and M&A deals with European technology companies which already have the know-how. The Black Friday in 2011 has left a strong impression that things have changed and being compliant is crucial. Land-based establishments which wish to go online are required to close the gaps regarding online gaming products as well as having better understanding of the regulatory framework requirements of each state and implement technologies which are quite different from the land-based ones. As the payment processing options are richer, player acquisition and retention techniques are various, CSD will also need to be brought up in line with the changes. Unlike the players in Europe who were gradually introduced to new services, products and functionalities over the last decade, the US players are getting almost complete product in one step.

While the potential is clear, the road to success is not without hurdles, starting with skin licensing, liquidity allocation and financing. A crucial challenge on hand is to identify the right provider to partner up with. Some Casino owners will look for complete control over the new B2C operation, while others may be reluctant to obtain the know-how and would like to hand the operation to a trusted and experienced 3rd party to run it for them, or to “sell” one of their skins, if multiple skins are allowed. Some states allow just one skin per license, while others do not specify a limit. For instance, PGCB in Pennsylvania offers unlimited skins for iGaming licenses, but only one for Sports Betting licenses. Seven jurisdictions are now allowing iGaming and 22 legalized online sports betting. The multi-skin approach is crucial to maintain the diverse and healthy competition. Consumers will be empowered and enjoy better service, and online offering as many more operators are in a given state

Running an iGaming and/or Sports Betting operation is a complex task. Some land-based Casinos are familiar with only running a slot and table games business. With only five states legalizing online casinos, the know-how of Sports Betting is critical; therefore, partnering with the right Sports Betting and Casino partner, like Delasport, is vital. Choosing the right partner can put the land base organizations in the best position to capitalize on Casino and Sports Betting’s opportunities.

Delasport brings to the table the right ingredients to support the local brick-and-mortar establishment. We offer not just technology but also many years of experience in running successful online Sports Betting and Casino operations from the ground up. We support both strategies of turnkey solutions, allowing operators to run their brand and fully managed solutions while we run the day-to-day operations.

Powered by WPeMatico

Bragg Gaming Group

Bragg Gaming Announces Resignation of Chief Financial Officer

Bragg Gaming Group Inc., a global B2B gaming technology and content provider, announced that Chief Financial Officer (CFO), Ronen Kannor, has notified Bragg’s board of directors (Board) that he will resign from his position to pursue other career opportunities, effective June 3, 2024. The Company confirms that the search for a replacement CFO has commenced.

Matevž Mazij, Chief Executive Officer and Chair of the Board, commented: “We thank Ronen for his dedication and commitment to Bragg over the past four years and for his unwavering service as a pivotal member of the leadership team.

“During his tenure as CFO, the Company has undergone huge positive transformation including being uplisted to the Toronto Stock Exchange, dual listed on the NASDAQ and successfully completing two acquisitions, all while reporting consecutive years of revenue, gross profit and adjusted EBITDA growth. We wish Ronen all the very best in his future endeavors.”

Ronen Kannor commented: “It has been an honor to be part of the Bragg team which has successfully navigated many challenges and continued to deliver consistent growth over the past four years. I thank the Board for their support throughout my time with Bragg, and I am now fully focused on ensuring a smooth handover to my successor.

“Special thanks goes to my finance team, who work tirelessly to deliver the positive change and financial growth that the Company continues to achieve. I wish them and all of my colleagues continued success with Bragg now and in the future.”

Canada

Rivalry Reports Preliminary Fourth Quarter and Year-End 2023 Results

- Betting handle of $423.2 million in FY 20231 increased 82% year-over-year, while reducing marketing spend 15%.

- Revenue of $35.7 million in FY 2023 increased 34%.

- Gross profit of $16.2 million in FY 2023, up 66% year-over-year.

- FY23 sets all-time records for average handle per customer, up nearly 30% year-over-year, average revenue per customer up 38% year-over-year, and record low cost of customer acquisition, down 15% year-over-year.

- Total player registrations eclipsed 2 million in FY23 while extending Gen Z market leadership.

- FY24 off to a strong start as the capital raised late Q4 is being effectively deployed – delivering strong KPIs, supported by betting margin trending toward a more than 20% increase over the average of FY23.

- To meet growing consumer demand the Company is adding greater support for cryptocurrency and exploring implementation of adjacent crypto-enabled technologies.

- Rivalry is seeing a rise in demand to license its in-house casino games, accelerating the advancement of its B2B vertical.

- Company re-affirms guidance, anticipates achieving profitability in H1 2024.

Rivalry Corp. (the “Company” or “Rivalry”) (TSXV: RVLY) (OTCQX: RVLCF) (FSE: 9VK), the leading sportsbook and iGaming operator for Gen Z, today announced preliminary and unaudited financial results for the three and 12-month periods ended December 31, 2023. All dollar figures are quoted in Canadian dollars.

“Rivalry exited 2023 as an increasingly diversified company – both geographically and across our product suite,” said Steven Salz, Co-Founder and CEO of Rivalry. “Last year we gained meaningful traction in new segments such as traditional sports, casino, and fantasy, which is widening our opportunity set and positioning us for sustainable growth in the medium- to long-term. We’re happy to have finished the year with all-time high customer economics, diversified revenue streams, and a reinforced competitive moat around Gen Z betting entertainment and experiences.”

“During Q1 we have been strategically deploying capital from our fourth quarter investment in areas that are driving customer acquisition and revenue – such as amplifying proven marketing strategies, releasing higher margin products, and developing proprietary betting experiences – that we expect will begin materializing in our results throughout the first half of 2024 and beyond,” added Salz.

“Our operational excellence across product and brand marketing last year are seen across positive KPI trends and continued year-over-year growth. Ultimately, we are proving that we can acquire and retain a coveted Gen Z demographic through an entertainment-led product set, culturally relevant brand, and a team unafraid of pushing past a long-standing industry status quo.”

Preliminary Full-Year 2023 Highlights2

- Betting handle was $423.2 million in the year ended December 31, 2023, an increase of $190.4 million or 82% from $232.8 million in 2022.

- Revenue was $35.7 million in 2023, an increase of $9.0 million or 34% compared to $26.6 million in the previous year.

- Gross profit was $16.2 million in 2023, an increase of $6.4 million or 66% from $9.8 million of gross profit in 2022.

- The Casino segment was a significant driver of growth in 2023, with revenues of $6.4 million up 92% from 2022, and representing 52% of betting handle in the year.

- The Company expanded its casino offering significantly during 2023, including the release of a new original game Cash & Dash in September, entry into the slots category in October, and the launch of its iOS mobile app in Ontario, enhancing the mobile casino experience and its accessibility.

- Diversified revenue streams through new segments including traditional sports, which has grown by 60% since FY22, and fantasy, highlighting the elasticity of Rivalry’s brand among Gen Z and broadening TAM.

- Total operating expenses of $38.9 million in 2023 decreased by $1.0 million year-over-year. The decrease was driven by a reduction in marketing expense, offsetting increases in general & administration and technology & content expense incurred to support the growth of the business.

- Net loss was $24.3 million for 2023, a reduction of 22% or $6.9 million from the net loss of $31.1 million in 2022.

Fourth Quarter 2023 Highlights

- Betting handle for the three-month period ended December 31, 2023 was $85.2 million, an increase of $1.2 million or 1.5% from $83.9 million in the fourth quarter of 2022 while marketing spend decreased by 32%.

- Revenue was $6.5 million in the Q4 2023, representing a decrease of $3.0 million or 32% from $9.4 million of revenue in Q4 2022 due to less favorable sportsbook outcomes compared against an abnormally favorable result experienced in Q4 2022. The Company notes that revenue as a percentage of betting handle was near the average achieved throughout FY23, highlighting the abnormally favorable margin outcome in the comparable quarter, Q4 2022.

- Gross profit was $3.0 million in Q4 2023, a decrease of $2.0 million or 40% from $5.0 million of gross profit in Q4 2022. The year-over-year decline follows the relative margin impact noted previously. Gross profit as a percentage of betting handle in Q4 2023 was equal to the average in FY23. Rivalry is also pleased to note that its ongoing efforts to stabilize and improve margin are yielding results, with Q1 2024 trending toward a more than 20% improvement over the average in FY23.

- Net loss was $9.0 million in Q4 2023, a reduction of $3.3 million compared to a net loss of $12.3 million in Q4 2022. Net loss adjusting for accruals, other non-cash items, and one-time expenses, would have been approximately $7.0 million.

- On November 15, 2023, Rivalry strengthened its balance sheet with the announcement of a private placement offering of $14 million principal amount senior secured convertible debentures to scale several strategic verticals across marketing, product development, and geographic expansion.

- Released Rivalry Ultimate Fan, a free-to-play NBA fantasy app, to acquire new users and engage existing customers within the product suite.

- First-party game ‘Cash & Dash’ released in September demonstrated next generation appeal as it became the fifth most-played casino game on our platform and among the top ten highest-grossing by revenue with momentum carrying into Q1, creating downstream licensing opportunities for Rivalry’s IP.

Outlook

“The year ahead is rife with new, innovative product releases arriving in Q2 and continuing throughout 2024,” Salz added. “In addition to the strength of our core roadmap, we are in the process of unlocking what we believe to be two of the most material developments to our business model since launching Rivalry in 2018. The first is a B2B vertical to license our in-house developed games, and the second is exploration and development within the crypto ecosystem – each representing an impactful growth catalyst on our path to profitability this year.”

“I have never had more confidence in our product roadmap and what Rivalry is building this year. Apart from new products, original games, and proprietary features, we have been working to dial-up the overall feel and entertainment value of our core product to provide a tech-savvy, next generation customer with a tailored experience that is well-differentiated within the larger sports betting marketplace.”

Investor Conference Call

Management will host a conference call at 10:00 a.m. EDT on Friday, April 5, 2024 to discuss the Company’s preliminary unaudited year-end and fourth quarter 2023 financial results.

| Dial-in: | 800-717-1738 (toll free) or (+1) 289-514-5100 (local or international calls) | |

| Webcast: A live webcast can be accessed from the Events section of the Company’s website | ||

| A replay of the webcast will be archived on the Company’s website for one year. | ||

Rivalry expects to file its audited financial statements and management discussion and analysis for the period ended December 31, 2023 by the end of April 2024. The documents will be available on SEDAR+ at sedarplus.ca, and on the Company’s website.

Related Party Transaction

On April 17, 2022 the Company entered into a secured demand loan (the “Loan”) with Kevin Wimer, the Chief Operating Officer and a Director of the Company. Pursuant to the terms of the Loan, the Company loaned Mr. Wimer US$385,000 which amount bears interest at 3.2% per annum and was repayable on demand by the Company and in any event by April 17, 2024 (the “Maturity Date”). The Loan was entered into to assist Mr. Wimer with the funding of certain tax obligations and is secured by a pledge of Mr. Wimer’s subordinate voting shares of the Company. The Company announces today that it has entered into an amendment to the Loan (the “Loan Amendment”) to extend the Maturity Date to April 17, 2026. The Loan Amendment was approved by the non-interested directors of the Company.

Mr. Wimer is a “related party” of the Company within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). As a result, the Loan Amendment is considered to be a “related party transaction” as such term is defined by MI 61-101. The Company is relying on an exemption from the minority shareholder approval requirement set out in MI 61-101 as the fair market value of the transaction does not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101. The Company did not file a material change report more than 21 days before entering into the closing of the Loan Amendment as the details of the Loan Amendment were not settled until shortly prior to the entering into thereof.

Arthur Paikowsky

Playtech Supports ICRG’s Research on the Impact of Gambling on Under-served Groups in the US and Canada

Playtech has provided support for the International Center for Responsible Gaming’s (ICRG) research program. The ICRG, a global pioneer and leader in gambling disorder research and education, has been conducting stringent competitions for research grants since 1996.

The ICRG, overseen by an independent Scientific Advisory Board comprising leading addiction specialists, has recently invited applicants to participate in research focused on the impact of gambling on under-served groups in the US or Canada. The strategic initiative aims to ensure funding for high-quality research in this critical area.

Playtech has actively supported this effort by funding research to better understand the impact of gambling on under-served groups in the US and Canada. This research will also help researchers, policymakers, regulators and the industry better understand how best to strengthen and enhance player protection amongst the groups in scope for the study.

Arthur Paikowsky, President of ICRG, said: “We are immensely grateful for Playtech’s donation, which marks a significant step towards improving our understanding of gambling-related health issues among indigenous communities in the US and Canada. This contribution will greatly enhance the effectiveness of responsible gambling measures and Playtech’s commitment to this cause is commendable and will undoubtedly make a substantial impact in the field of gambling research.”

Jonathan Doubilet, VP of US Business Operations at Playtech, said: “Playtech is committed to creating a safer gambling environment and is a strong supporter of research that helps reduce gambling related harm and enhance player protection measures. We are delighted to be able to support the ICRG’s research that will help advance player protection for vulnerable groups in the US and Canada.”

-

Baltics6 days ago

Baltics6 days agoHacksaw Gaming and TOPsport are on TOP of their game with new partnership announcement in Lithuania

-

Compliance Updates7 days ago

Compliance Updates7 days agoDGA: Three orders and two reprimands to Skill on Net Ltd for breach of the Anti-Money Laundering Act

-

Central Europe7 days ago

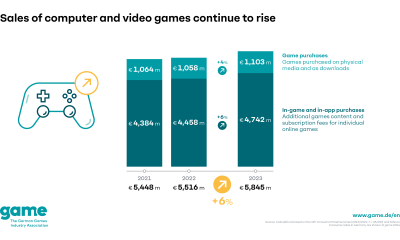

Central Europe7 days agoGerman games market in 2023: strong development in turbulent times

-

Baltics6 days ago

Baltics6 days agoHIPTHER Invites You to Recognize Gaming Excellence at the Baltic & Scandinavian Gaming Awards 2024 – Online Voting Session is Now Open!

-

Baltics6 days ago

Baltics6 days agoWazdan expands in Lithuania with Twinsbet deal

-

Latest News6 days ago

Latest News6 days agoSvenska Spel Appoints Gustav Georgson to Lead Public Affairs

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoAltenar becomes General Sponsor of EEGS 2024

-

Balkans6 days ago

Balkans6 days agoESA Gaming unveils Balkan Bet collaboration