Compliance Updates

Special Interview: A Conversation with Tom Farrell, CMO of ClearStake

Affordability is currently the word on everyone’s lips. Operators continue to face a ‘sustainability conundrum’ – they must fulfil their regulatory obligations and commitments to player protection, while ensuring their business remains profitable. For many, affordability can spell disaster, with up to 90% of customers lost when asked to prove they have the money they are wanting to spend. However, using Open Banking to carry out these financial checks as quickly as possible may be the answer to boosting retention and retaining otherwise lost revenues.

The DCMS recently published a public consultation on the UK gambling White Paper, while the Gambling Commission launched its own on financial risk checks, bringing their importance of affordability to the top of the agenda – but operators must now strike the balance between minimising harm and maximising revenue. Affordability checks that take too long risk sending customers to competitors, or worse, the black market.

One of the key remedies to the high level of churn experienced in the past is making sure financial risk checks can be carried out quickly and with as little friction as possible, so that customers can complete them with as much ease as approving a payment while online shopping. Operators have to reach a decision quickly because the longer players wait, the more likely it is they will go elsewhere while they’re waiting.

Of course, there are some people who under no circumstances will share financial data with someone like a gambling operator. There’s also a group of people who won’t share data because they know they are gambling beyond their means. This is of course the system working as it should and that’s a good thing. But there’s a third group of people for whom it’s too much effort. They’re asked to provide bank statements, at which point they go to a competitor, as the hoops they have to jump through are not worth it.

For a customer using Open Bank technology, such as ClearStake, what used to involve downloading and printing bank statements and a wait while the operator reviews the data, now takes just 30 seconds and a few clicks. A decision is recommended to the operator immediately and theoretically, the whole process can take less than a minute. Players click a link, and they are taken to a super slick and simple process where they press a couple of buttons and the relevant financial data is shared securely. They are always in control of their data and they can revoke permission at any time.

Our software categorises every transaction and we can calculate whatever the operator wants to see. It could be disposable income, net gambling spend, total income, or current balance on the account. Our software can also evaluate the rate of change so operators can see accelerating gambling spend or consistently declining savings and work out if the player’s gambling activity is still within the safe bounds of their current financial position.

Without responsible gaming and Enhanced Due Diligence (EDD) checks, gambling risks being over-regulated out of existence as the product will become unprofitable. To answer the sustainability conundrum many operators face, we need to find a middle ground. Sustainability means not letting people spend beyond their means. It means letting people have a bet if they can afford to, while not taking more money than they can spend.

Over the last two or three years, the Gambling Commission got strict on affordability checks. They asked operators how they know someone could afford to lose ‘x’ amount. The White Paper effectively agreed with the Gambling Commission and has clarified that if someone is losing £2,000 in the space of three months or £1,000 in one month, operators should be confident about the player’s financial situation. The headline was that affordability and EDD checks should be taking place.

This discussion around affordability is not only limited to the UK, and we are seeing lawmakers and regulators in several other countries considering measures in this area.

The industry therefore needs to be proactive as the problem will never go away if it keeps allowing people to bet money they don’t have. In the public mind, gambling will have the same fate as cigarettes which are currently being regulated out of existence.

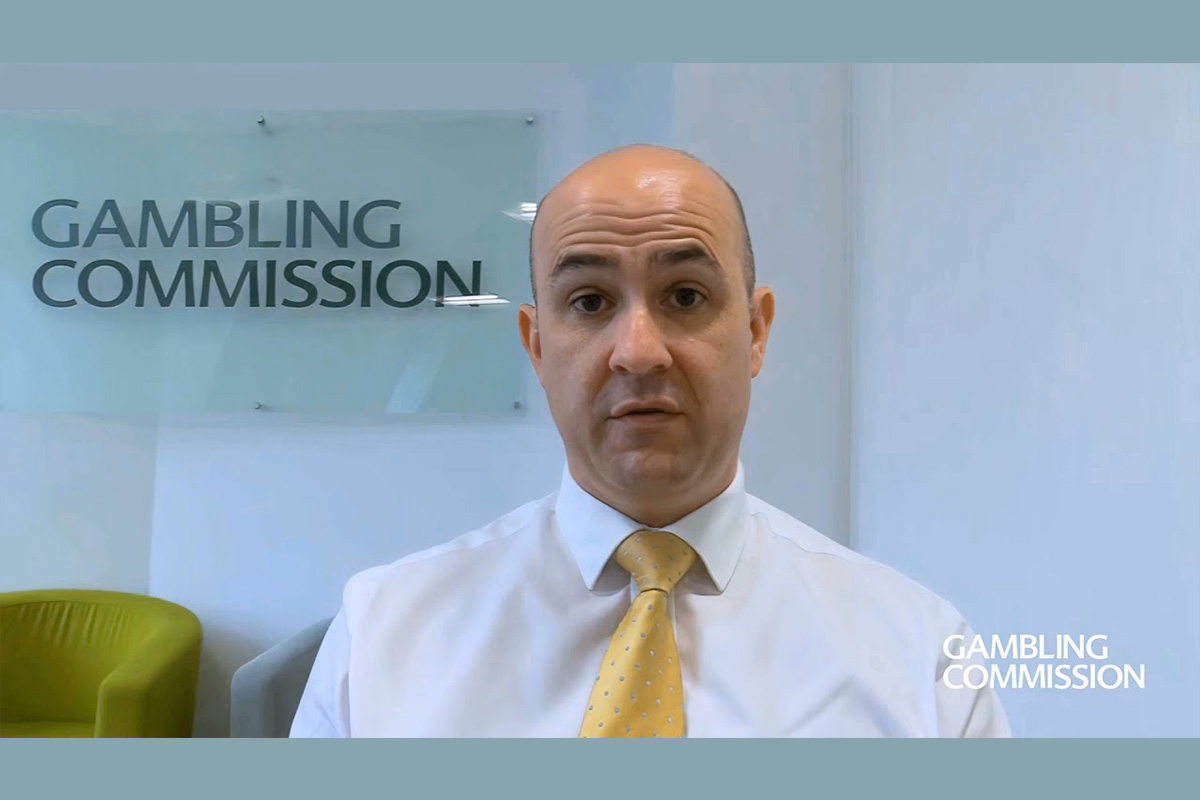

Andrew Rhodes

Andrew Rhodes to Step Down as CEO of UK Gambling Commission

The UK Gambling Commission has announced that Andrew Rhodes has decided to leave the Commission on 30 April 2026, to take up a new role, which will be announced in due course.

Andrew has provided outstanding leadership of the Commission for almost five years and has overseen a transformation of the Commission and how it regulates the gambling Industry.

Andrew has led the work required from the Commission to implement the Gambling Act Review, with a strong focus on consumer safeguards. This has included the introduction of financial vulnerability checks, reducing the intensity of online games, and banning potentially harmful marketing offers. He has also overseen the introduction of the Gambling Survey for Great Britain, now one of the largest surveys of gambling behaviour in the world.

Amongst his other achievements, Andrew oversaw the successful implementation of the Fourth National Lottery licence and transformed the Commission’s approach to regulation through more robust and outcome-focused strategies.

He said: “It has been a privilege to lead the Gambling Commission through such an important period of change. I am proud of the progress we have made to strengthen regulation, improve consumer protections, and ensure gambling is safer and fairer. I leave with confidence in the organisation, its people, and the work still to come.”

Charles Counsell, Interim Chair of the Gambling Commission, said: “Andrew has provided outstanding leadership for nearly five years and leaves a strong legacy. He has led the Commission through major reform, strengthened our regulatory approach, and ensured consumer protection has remained at the heart of our work. On behalf of the Board, I would like to thank Andrew for his dedication and wish him every success in the future.”

The Commission will shortly begin the process of recruiting a Chief Executive for an interim period. Deputy Chief Executive Sarah Gardner will step up as Acting Chief Executive to cover the areas of work that Andrew will step back from during this transitional period.

The post Andrew Rhodes to Step Down as CEO of UK Gambling Commission appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Colombia

Playson expands LatAm presence with Colombian market entry

Supplier goes live in Colombia with Tier-1 operator strengthening LatAm expansion strategy

Playson, the accomplished digital entertainment supplier, has officially entered the regulated Colombian iGaming market after securing full certification from Coljuegos, the country’s gambling regulator, and launching with leading operator Rush Street Interactive (RSI).

The milestone marks a significant step in Playson’s Latin American growth strategy, with Colombia becoming the latest regulated jurisdiction to welcome the supplier’s certified platform and portfolio. Going live with Rush Street Interactive – a Tier-1 operator with a strong footprint across the Americas – underlines Playson’s focus on expanding alongside established, trusted partners in key regulated markets.

Colombia is recognised as one of the most mature and demanding regulatory environments in LatAm, requiring suppliers to meet strict technical, security and reporting standards. Playson’s successful certification process confirms the robustness of its cloud-based infrastructure, designed to ensure low latency, stability and seamless performance for players across the region.

With the game suite now live, Colombian players gain access to a selection of Playson’s top-performing titles, known for their engaging mechanics, polished visuals and proven performance in regulated markets worldwide.

The launch further reinforces Playson’s commitment to regulated market expansion across LatAm, with Colombia joining a growing list of jurisdictions where the supplier has successfully deployed its technology.

Cristhian Zito, Head of LATAM at Playson, said: “Entering the Colombian market is an important milestone for Playson, and doing so alongside Tier-1 operator of the region makes it even more meaningful. Colombia is a highly respected regulated market, and completing the certification process reflects months of focused work to meet its stringent requirements.

“Partnering with the RSI allows us to introduce our content with confidence and sets a strong foundation for long-term growth in the region.”

The post Playson expands LatAm presence with Colombian market entry appeared first on Americas iGaming & Sports Betting News.

AGLC

Continent 8 set to back Alberta’s iGaming operators and suppliers

Continent 8 Technologies, a premier provider of advanced managed IT solutions tailored for the worldwide iGaming and online sports betting sector, announces its official launch in Alberta, Canada. This growth comes after the province unveiled its competitive iGaming regulatory framework and the Alberta Gaming, Liquor and Cannabis Commission (AGLC) issued comprehensive hosting and security requirements, representing another important milestone in Continent 8’s enduring dedication to the North American market.

With established operations in Ontario – where the company effectively introduced its Public Cloud solution in Toronto in direct response to the province’s launch of its iGaming market in 2022 – Continent 8 brings to Alberta the same level of regulatory insight, technical expertise, and customer-focused innovation that has positioned it as a reliable partner throughout Canada.

Alberta’s iGaming regulations outline specific hosting and data management responsibilities for suppliers and operators. For instance, every data centre utilized by licensees must obtain AGLC approval, which includes data residency, cross-border transfers, and encryption key management.

The province requires fully operational disaster recovery infrastructure and unalterable, encrypted backups, along with stringent conditions for quarterly testing and offsite storage—fields where Continent 8’s expertise offers instant benefits.

Besides hosting requirements, Alberta implements some of the most thorough security standards in the nation, such as mandatory MFA, compliance with SOC 2 and ISO 27001, yearly penetration testing, and extensive log retention mandates.

“Our heritage means we understand the rigorous regulatory expectations, and the operational challenges operators and suppliers face when entering new markets,” said Michael Tobin, CEO and Founder of Continent 8 Technologies. “Alberta’s standards are comprehensive, particularly around disaster recovery, backups, and security. We have built our solutions so customers can meet these requirements confidently from day one. We are excited to support customers as Alberta opens its market and continues Canada’s growth story.”

The post Continent 8 set to back Alberta’s iGaming operators and suppliers appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Brasil on Track6 days ago

Brasil on Track6 days agoODDSGATE LAUNCHES “BRASIL ON TRACK”, A STRATEGIC PLATFORM FOR NAVIGATING BRAZIL’S REGULATED IGAMING MARKET

-

0006 days ago

0006 days agoCash Pig 2 Debuts from Booming Games with 15,000 Top Prize

-

40 Glossy Hot6 days ago

40 Glossy Hot6 days agoAmusnet Releases “40 Glossy Hot”

-

Amusnet5 days ago

Amusnet5 days agoWeek 6/2026 slot games releases

-

BETANO6 days ago

BETANO6 days agoPlaybook Fusion launches with Betano in Brazil

-

Digitain6 days ago

Digitain6 days agoDigitain Earns Double Nomination at SiGMA Eurasia Awards 2026

-

Finland6 days ago

Finland6 days agoData-Driven Analysis of Finnish Gamblers’ Preferences and Behavior

-

AGLC6 days ago

AGLC6 days agoPointsBet Canada Officially Begins Registration Process in Alberta