Cryptocurrency

“Operators demand access to new markets and new player bases”: Exclusive crypto gambling interview with Glen Bullen from DAOGroup.

While this year may have been a turbulent time for some, we caught up with Glen Bullen, CCO of DAOGroup to talk through the launch of DAOWallet, its cryptocurrency-fiat payments partner, as well as the opportunity to use crypto payments as a key way to engage new players.

What is it that DAOWallet can offer partners and end users that other payment service providers cannot?

DAOWallet may be new to market, but our team has incorporated many crypto payment learnings into the product to make it a slick, client-driven solution for operators looking to engage new demographics and markets.

In essence, DAOWallet offers a simple, clean solution for partners wanting to integrate crypto payments into their casino brands. We do all the heavy lifting and compliance work at our end, so operators can work hands-off on the payments side and focus on driving acquisition to a new audience of crypto users.

Perhaps DAOWallet’s biggest innovation is its ability to track fund provenance, both to mitigate AML risks, but also to improve VIP management. Any player who deposits crypto via DAOWallet will have their pseudo-anonymous source of funds tracked, ensuring both VIP and AML managers alike will know if this is a player prime for big stakes play, or alternatively whether they’ve been associated with red flag transactions in the past.

How can those with little crypto knowledge use DAOWallet to join the crypto gambling revolution?

The key purpose of DAOWallet is to allow deposits and withdrawals to and from a players crypto account to be as simple and seamless as possible. With that, we feel we offer a solution that requires only a minimum of crypto knowledge.

However, the wallet’s role is not necessarily to entice new players to crypto – though it can – but instead to deliver a functionable, painless means to support the millions out there who already hold and use crypto; and, most importantly, want to gamble with it at the best casinos around.

Do you see DAOWallet appealing to a certain demographic or region?

Without pigeon-holing an ever-expanding crypto base, industry research shows the main European demographic as being between 25 and 45 years of age and with above-average disposable income. This audience sees digital assets as more than a speculative asset, and want to find functional day-to-day uses for them, with gaming arguably the most tangible use case for them at this moment.

Saying that, DAOWallet easily supports varied requirements across any global market, such as Latin America, where concerns regarding banking infrastructure warrant the use of alternatives to fiat; or Africa, where barriers to credit card uptake mean many are keen to explore alternative online payment methods.

No matter the geography or demographic, our igaming clients can be confident DAOWallet will be covering all KYC and AML procedures in the backend on sign-up, ensuring a clean transition to the casino, which receives only whitelisted players. This is a major benefit of our solution over others on the market.

How do you see the current state of the payments sector in the gambling industry?

We hear so often that gambling as an industry is an early adopter for new technology. All the while however, there’s untold examples of cautious decision-making and sluggish, suspicious adoption of tech that could have major benefits to the whole ecosystem.

There is no doubt that the payments sector is impacted by this paradox, and the utilisation of crypto is a key example. Operators demand access to new markets and new player bases, and there is a crypto market hiding in plain sight, waiting to be serviced. They must take advantage of this opportunity, or they will fall back against their more forward-thinking competitors.

Do you see wider crypto adoption as attainable right now, or do other industry movements need to happen to facilitate wider crypto payments?

Yes, it is attainable, but various ways of thinking need to be reset for crypto adoption to reach its potential. It’s likely not a gambling industry-specific mentality, but too many look back at setbacks in the space and cling onto them as proof that crypto doesn’t have its place in today’s world.

This is naïve when you consider the various success stories that crypto has in engaging those who cannot access credit cards, those who may not trust the status quo and those who just want to be a little more progressive. I would like those doubters to take a deep breath and revisit what crypto adoption can do for the gambling industry.

As a deposit method, using the likes of bitcoin and Ether is a no-brainer for supporting bigger audiences in more markets. Those operators who don’t embrace it soon will likely find they have lost this lucrative audience and will struggle to win them back.

We have seen DAOWallet recently sign a major partnership with MoneyMatrix. Do you have any other partnerships on the horizon that you could hint at?

MoneyMatrix was a major deal for us and shows the strength of partner that we are looking at. In terms of what is coming next, we’re optimistic about various, progressed conversations with further platforms and a number of tier one operators in a variety of regions. Without naming names, there is a desire amongst potential partners to complement their existing payment partners to attract a new kind of customer, and that’s what we’re here for.

We’re well set to make some big announcements in Q4 in terms of new clients and operators, so keep an eye out for that.

What product improvements can we expect from DAOWallet in the coming months?

Our most recent launch was stablecoin integration, and this will go live with partners to great effect very soon. Not only are we opening more crypto avenues (Tether/TrueUSD) for those looking outside of the bitcoin and Ether hegemony, but it also makes our platform more adaptable to local banking regulation.

Significantly, this was driven by client feedback and demand, and we delivered it back to those same partners quickly and successfully, further proving our credentials as a customer-first partner. We know the size of the crypto gambling space and we want to help fiat-based operators leverage it for their own growth, and it’s through these collaborative projects that we can best do this.

Powered by WPeMatico

$SCOR

BetOnline.ag Integrates $SCOR, the Premier Crypto Token of the Pro Sports Industry, Ahead of Super Bowl

BetOnline.ag, a preeminent global online sportsbook, casino and poker platform, announced a strategic partnership with Sweet to integrate $SCOR as a newly supported cryptocurrency.

$SCOR, the native token powering verified fan identity and rewards across major professional sports, is now available for deposits and withdrawals within the BetOnline cashier, just in time for Super Bowl Sunday on February 8.

This integration establishes a direct utility lane for the $SCOR, allowing fans to use tokens — earned through engagement in officially licensed sports games or purchased on exchanges — for real-world gameplay on a leading gaming platform.

For BetOnline, the partnership represents a strategic entry point into the burgeoning world of on-chain sports fandom, connecting the platform with high-value, verified fan liquidity.

“We are constantly evolving to meet our players where they are, and that now includes the intersection of sports fandom, gaming and blockchain. $SCOR isn’t just another cryptocurrency…it’s the premier token of the sports industry. This partnership allows us to directly engage with a new generation of sports fans who value real-world gameplay, verifiable achievements and interoperable rewards,” said Eddie Robbins III, CEO of BetOnline.ag.

$SCOR functions as the on-chain layer for fan identity, verifiable engagement and portable rewards across Sweet’s network of major professional sports IP partners that boast officially licensed sports-themed web3 PvP and mini games.

By accepting $SCOR, BetOnline gains a direct connection to verified fan activity from SCOR’s ecosystem of major professional sports IP partners, introducing a high-value audience of competitive sports fans and crypto-savvy players.

To celebrate the launch, BetOnline will offer exclusive deposit perks for $SCOR users, including free-play credits and casino spins for qualifying deposits. Future community activations are planned, featuring token-gated private poker and casino tournaments for verified $SCOR holders, with prizes awarded in both $SCOR and cash.

“We built $SCOR to bridge the passion of sports fandom with tangible utility and value. BetOnline’s integration is a landmark moment, turning fan-earned $SCOR into a key for premium gaming experiences. This partnership validates our vision of a reward-first portable fan identity,” Sweet EVP of Global Partnerships Betsy Proctor said.

The post BetOnline.ag Integrates $SCOR, the Premier Crypto Token of the Pro Sports Industry, Ahead of Super Bowl appeared first on Americas iGaming & Sports Betting News.

Crypto Turnkey

GR8 Tech Delivers 1.6× Higher Deposit Conversion and 3× Reduction in Transaction Costs for Crypto Turnkey Clients

Unlock Your Crypto Advantage at ICE Barcelona 2026

The post GR8 Tech Delivers 1.6× Higher Deposit Conversion and 3× Reduction in Transaction Costs for Crypto Turnkey Clients appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Acebet

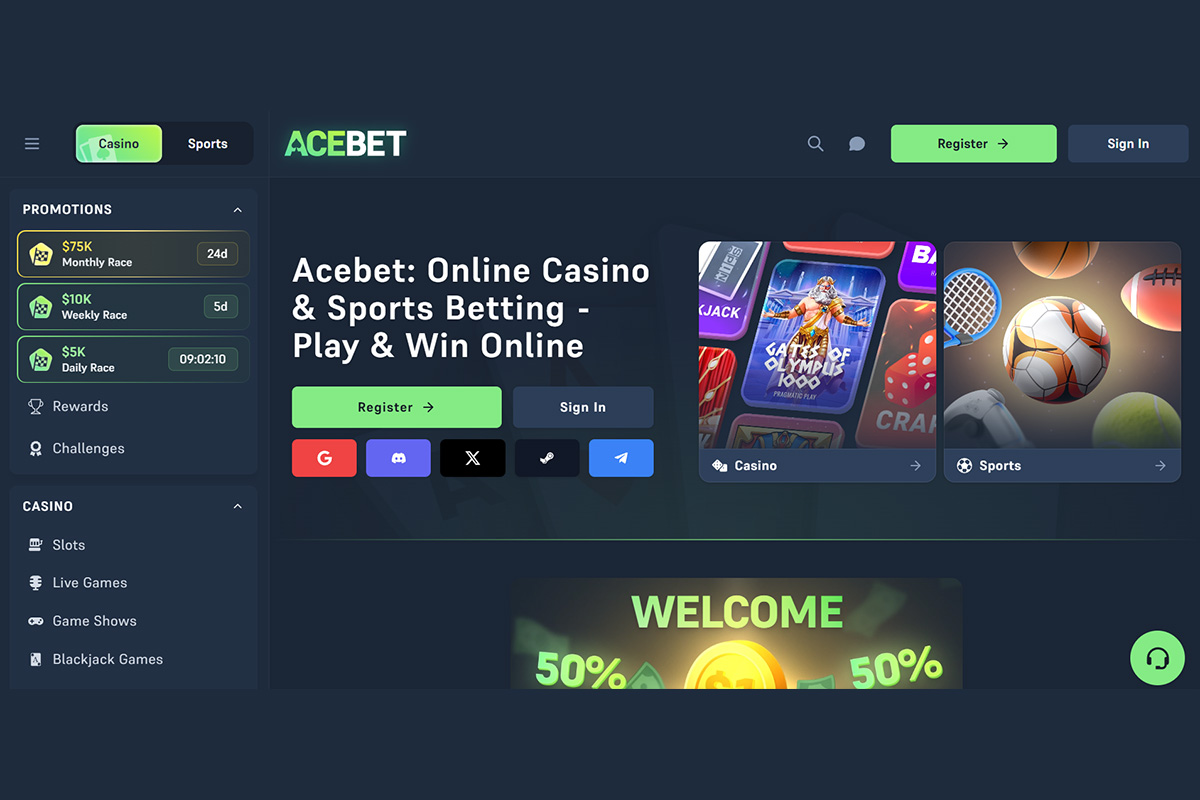

Golden Frog Launches Acebet, a Next-Gen Crypto Gaming Platform

Golden Frog has launched Acebet, an online crypto gaming platform built on advanced blockchain infrastructure. Acebet delivers a seamless blend of casino action, sports betting, and innovative digital features in one unified ecosystem.

With intuitive navigation, fast onboarding, and seamless gameplay, Acebet prioritises ease of use above everything. Fast deposits, quick loading, and responsive support ensure a smooth user experience. Acebet also introduces Chat Rain, a social feature that randomly drops crypto rewards to active users in the chat, fostering a lively, community-driven gaming atmosphere.

Golden Frog says that Acebet reflects the evolving expectations of online players. The company explains that Acebet was developed to reflect the evolving expectations of digital users who value speed, security, global accessibility, and transparency. According to Golden Frog, Acebet demonstrates the company’s vision of merging high-level technology with a user-centred gaming experience.

Acebet launches with more than 2000 casino titles, including slots, table games, card games, and exclusive in-house content. The platform includes modern video slots, classic reel games, table games, card variations, and exclusive in-house content crafted to meet the expectations of both casual users and experienced players.

This broad portfolio ensures that new users immediately find familiar favorites while long-term players can continue discovering fresh experiences. The platform also features Acebet Originals, offering unique games that many competitors don’t provide.

Acebet integrates provably fair technology, allowing players to verify game outcomes using cryptographic hash seeds independently. This creates a fully transparent environment where fairness is not only promised but demonstrable and auditable.

Through its live casino features, Acebet brings professional dealers, real-time interaction, and high-definition streaming together in a refined digital environment. The live casino brings professional dealers, real-time interaction, and high-definition streams in a digital environment inspired by physical casino play.

The post Golden Frog Launches Acebet, a Next-Gen Crypto Gaming Platform appeared first on Americas iGaming & Sports Betting News.

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Latest News5 days ago

Latest News5 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Dan Brown6 days ago

Dan Brown6 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Bragg Gaming Group6 days ago

Bragg Gaming Group6 days agoBragg Gaming Group Partners with StarGames

-

3 Oaks Gaming6 days ago

3 Oaks Gaming6 days ago3 Oaks Gaming unleashes the power of the wild with 4 Wolf Drums: Hold and Win

-

Asia5 days ago

Asia5 days agoBooks on Wheels: DigiPlus Foundation Brings Mobile Library to Boost Literacy Among Aurora’s Young Learners