Gaming

EGDF: UNITY’S INSTALL FEES ARE A SIGN OF LOOMING GAME ENGINE MARKET FAILURE

Step by step, video game engines are becoming key gatekeepers of European cultural and creative sectors. Currently, Unity dominates game engine markets, Unreal being its primary challenger. These two engines are not just clear market leaders in the game industry but increasingly vital market actors in film, architecture, and industrial design and simulations. In 2022, Unity reported that globally, 230,000 game developers made and operated over 750,000 games using the Unity Engine and the Unity Gaming Services portfolio of products.

Unity’s new fee structure is going to have a drastic impact on the game industry.

Over the years, the Unity game engine has reached close to unofficial industry-standard status in some game markets. Its well-designed tools and services have lowered the market access barriers in the game industry. Furthermore, it has played a crucial role in removing technological barriers to cross-platform game development. Now, Unity has informed the game dev community that it will move from subscription-based fees to subscription and install-based fees, which will significantly increase the game development costs for most game developers relying on their services. EGDF finds it unfortunate that Unity has significantly damaged its reputation as a reliable and predictable business partner with these sudden and drastic changes in its pricing principles.

Bigger game developer studios have the luxury of being able to develop their own game engines. Consequently, market uncertainty and significantly increased service provider risks caused by Unity’s new fee structure will hit, in particular, SME game developers. It will be much harder for them to build reliable business plans, make informed decisions on game engines, and run a profitable business. Many of these studios struggled to access risk funding before Unity’s announcement, and it has only worsened their situation.

Unity’s decision will have a broader impact on the whole game industry ecosystem. Many professional game education institutions have built their curriculum on the Unity game engine. If Unity’s new pricing model starts a mass exodus from Unity’s engine, it will lead to rapid changes in professional game education itself and place many young industry professionals who have built their career plans on mastering Unity’s tools in a very difficult position.

Although Unity’s decision will cause significant challenges for the industry, EGDF kindly reminds that instead of focusing on blaming individual Unity employees for the changes, it is far more productive to focus on taking measures that increase competition in game engine markets.

Unity’s anti-competitive market behaviour must be carefully monitored, and, if required, the European competition authorities must step in.

Unity is an increasingly dominant market player in the game markets. According to Unity’s own estimate, in general, 63% of all game developers use its game engine. The share can be even higher in some submarkets. Unity estimates that 70% of top mobile games are powered by its engine. Unsurprisingly, Unity’s game engine is now a de facto standard in mobile game markets to the extent that whole formal professional game education degree programmes have been built on training its use. However, Unity’s market dominance is not just based on the quality of its game engine. It is also an outcome of aggressive competition practices and systematic and methodological work of making game developers dependent on Unity services.

How Unity bundes different services together potentially distorts competition in game middleware markets. Over the years, Unity has, step by step, bundled its game engine more and more together with other game development tools under the Unity Gaming Services portfolio. Unity is not just a game engine; it is also a player sign-in and authentication service, a game version control tool, a player engagement service, a game analytics service, a game chat service, a crash reporting tool, a game ad network, game ad mediation tool, an user acquisition service and in-game store building tool. This creates a significant vendor lock risk for game developers using Unity services. It also makes it difficult for many game middleware developers to compete against Unity and, all in all, significantly strengthened Unity’s game engine’s market position compared to its rivals.

Now, Unity is strategically using install fees to deepen the lock-in effect by creating a solid financial incentive to bundle other Unity services even closer to its game engine: “ Qualifying customers may be eligible for credits toward the Unity Runtime Fee based on the adoption of Unity services beyond the Editor, such as Unity Gaming Services or Unity LevelPlay mediation for mobile ad-supported games. This program enables deeper partnership with Unity to succeed across the entire game lifecycle.” This will, of course, drastically impact Unity’s direct competitors.

Unity’s install fees are an excellent example of Unity’s potentially anti-competitive market behaviour. It is clear that if Unity’s pricing model had, in the past, been similar to the now-introduced model, it would likely never have achieved the level of dominance it enjoys today, as more developers would have chosen another alternative in the beginning.

The fact that Unity’s new install fees are only targeted at video games and do not apply to other industries logically leads to a question: Is Unity setting prices below cost level at different market segments, or is Unity charging excessive prices in game markets? Furthermore, does the fact that Unity is now introducing an install fee on top of the licensing fee mean that licensing fees have before been below cost level? Or does the introduction of install fees on top of the licensing fees of their game engine allow them to provide other, lock-in generating, services below cost level?

In the end, Unity has built its dominant position in game markets for years and systematically made game developers more dependent on it. It is a good question if Unity has now crossed the line of abusing its market dominance on weaker trading parties that deeply depend on its services. Game productions can take years, and game developers cannot change their game engine at the last minute, so they are forced to accept all changes in contract terms, no matter how exploitative they are. Unity must know that if they had given more notice, many more developers might have had a realistic chance of abandoning Unity altogether by the time the new pricing came into play.

The new install fees will limit game developers’ freedom to conduct business as it pushes them to implement Unity ad-based business models even in games that otherwise would not have ad-based monetisation. Furthermore, this will create a competitive disadvantage for those game distribution platforms that do not use ad-based monetisation at all (e.g. subscription services and pay-per-download games), as Unity is de facto forcing them to increase their consumer fees compared to channels that allow the use of Unity’s ad-based monetisation tools.

The new install fees will likely lead to less choice for consumers. Install fees will allow Unity to extract value from games that generate a lot of installs through, e.g. virality, but do not necessarily generate money. Install fees will lead to markets where game developers want to limit the downloads and try to avoid installs from the wrong players. This can potentially kill part of the game market. For example, indie developers that have an unfortunate mix of being a success on the number of installs but that are struggling to generate revenue, or hyper-casual game studios based on combining a huge install base with minuscule revenue generated per game.

In the long run, the EU needs to update its regulatory framework to answer the challenges caused by dominant game engines.

Unity’s install fees demonstrate why the EU needs a new regulatory framework for unfair, non-negotiable B2B contract terms. Contract terms Unity has with game developers are non-negotiable. With the new non-negotiable install fee, European game developers have to either withdraw their games from markets, increase consumer prices or renegotiate their contracts with third parties. For example, if a game memory institution makes games available for download on their website, a game developer studio must now ask for a fee for it or ban making European digital cultural heritage available to European citizens. The three-month time frame Unity is providing for all this is not enough.

The Commissions should introduce a specific regulation for non-negotiable B2B contract terms. The regulation should provide sufficient time (e.g. in a minimum, six months) for markets to react to significant changes in non-negotiable terms and conditions that a service provider has communicated to their business users in a plain, clear and understandable manner (e.g. now it is unclear how Unity counts the installs). Furthermore, the Commission should bring much-needed market certainty by banning retroactive pricing and contract changes.

The Commission should include game engines in DMA. While reviewing the recently adopted Digital Markets Act (DMA), the Commission should consider lowering the B2B user thresholds and adding gatekeeper game engines under its scope. This would, for example, ensure that Unity cannot use data it collects through its game engine to gain an unfair competitive advantage for its other services like advertisement services.

The Commission should increase its R&D support for the European game industry. The fact that there is no major competitor for Unity Engine that does not require constant back-end server connection is a market failure in itself. The Unity Game engine is not fully scalable because Unity has built its engine in a way that it calls home every time it is installed to report instals for Unity. Consequently, the Commission should strengthen its efforts to support the emergence of new European game technology and business service providers. In particular, the Commission should increase its support for privacy-friendly open-source alternatives for game engines, like for example Godot or Defold or similar, that do not require constant back-end server connection and thus have no need for scalable revenue-based fees or install fees.

Gaming

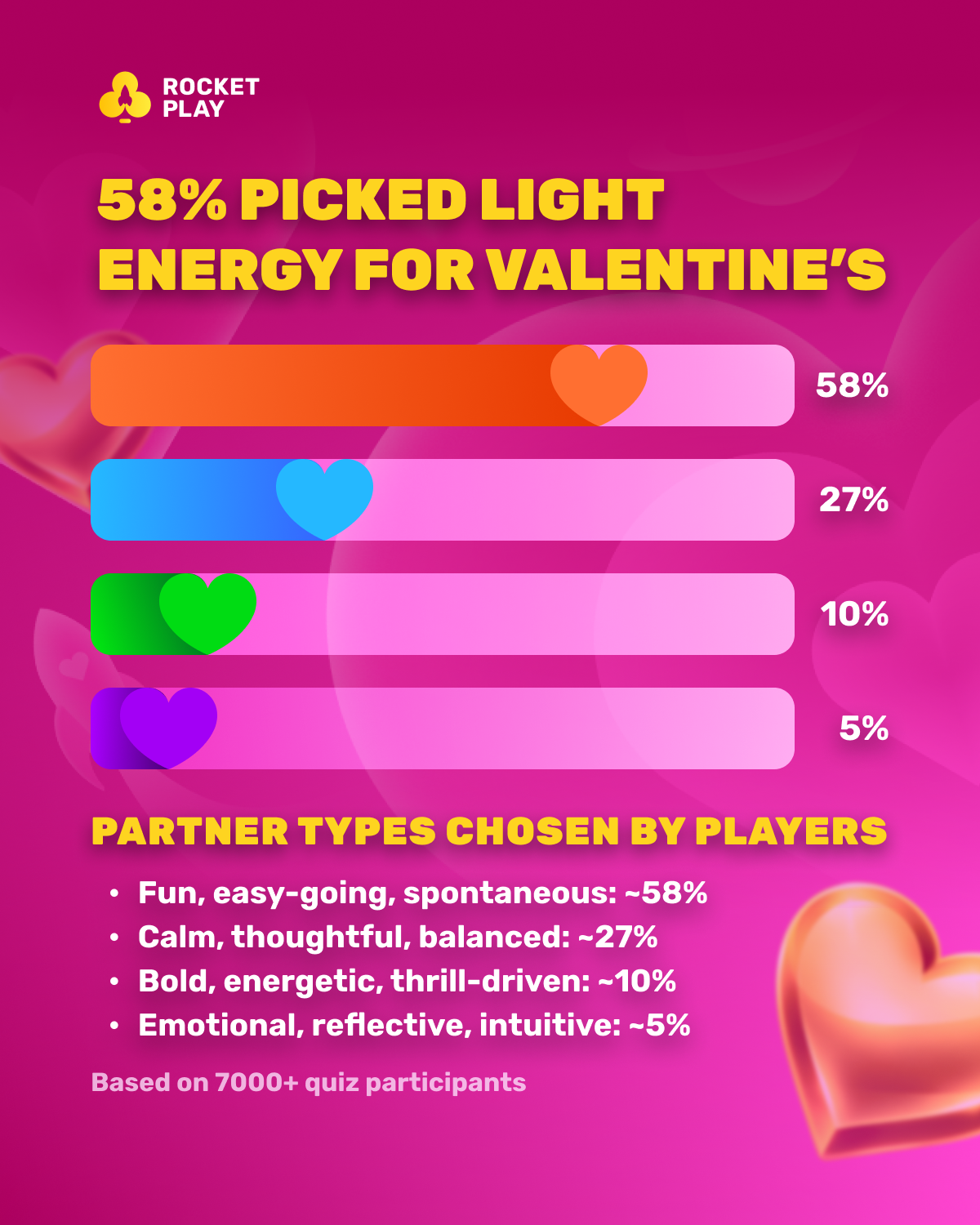

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

CEO of GGBET UA Serhii Mishchenko

GGBET UA kicks off the “Keep it GG” promotional campaign

A leading gaming brand in Ukraine has launched a collection of ads featuring the tagline “Keep it GG” as part of an extensive communications initiative. The videos are currently being broadcast on Ukrainian TV, online platforms, and the brand’s social media accounts.

“GG” (Good Game) started in video game culture, yet its significance has far surpassed the literal meaning of “well played.” Currently, it symbolizes a worldwide sign of honor and gratitude for the feelings exchanged following a match, no matter the outcome. This concept served as the basis for GGBET UA’s latest marketing campaign. The video series embodies a unique GG atmosphere: rather than using a conventional voiceover, it incorporates complete audio tracks; the narrative features both literal and metaphorical allusions to sports and esports terms, alongside in-game and casino aspects; and prominent Ukrainian footballers are among the main characters.

“Every game, every match, every tournament is a moment that brings people together. For us, it’s important that every interaction with GGBET gives users that good game feeling — an experience that outlives the result and leaves vivid emotions behind, just like after watching a match,” comments CEO of GGBET UA, Serhii Mishchenko.

Going beyond the traditional view of GG also signifies a more profound implication — the brand’s strategic focus. The international brand, which has concentrated on esports for several years and attained significant success in esports betting and collaborations, is now adopting best practices to enhance traditional sports in regional markets. GGBET UA showcases a wider strategy for Good Game via collaborations (FC Dynamo Kyiv, FC Polissya, and the Ukrainian Basketball Federation), by organizing its own events and special projects, including initiatives that blend sports with esports, like the Match of LeGGends: Derby showmatch on the server featuring esports athletes and football players.

The brand’s creative team collaborated with a Ukrainian advertising agency and a Ukrainian production company to develop the commercials. GGBET UA made this choice to assist the local creative sector amid the war.

The post GGBET UA kicks off the “Keep it GG” promotional campaign appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet5 days ago

Amusnet5 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss5 days ago

Aphrodite’s Kiss5 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Latest News7 days ago

Latest News7 days agoWinSpirit’s UnValentine’s Day: A New Take on February Engagement

-

Denmark6 days ago

Denmark6 days agoRoyalCasino Partners with ScatterKings for Company’s Danish Launch

-

Booming Games6 days ago

Booming Games6 days agoTreasure Hunt Revival — Booming Games Launches Gold Gold Gold Hold and Win

-

Baltics6 days ago

Baltics6 days agoEstonia to Reinstate 5.5% Online Gambling Tax From March 1

-

Brino Games5 days ago

Brino Games5 days agoQTech Games integrates more creative content from Brino Games

-

ELA Games6 days ago

ELA Games6 days agoELA Games Unveils Tea Party of Fortune — A Magical Multiplier Experience