Gaming

Flexion Q4 Report – 31 December 2021

Flexion produces record results: 52% growth in revenue, 63% growth in gross profit and 163% growth in EBITDA

October 2021 to December 2021 performance

- Total revenue increased by 52% to GBP 10.5m (GBP 6.9m)*

- Gross profit increased by 63% to GBP 1.5m (GBP 0.9m)

- Adjusted EBITDA‡ increased by 163% to GBP 0.33m (GBP 0.13m)

- Operating profit increased to GBP 0.63m (GBP 0.06m)

- Earnings per share amounted to GBP 1.28 pence (GBP 0.13 pence)

- Cash amounted to GBP 14.5m (GBP 12.4m)

April 2021 to December 2021 performance

- Total revenue increased by 46% to GBP 26.1m (GBP 17.9m)*

- Gross profit increased by 43% to GBP 3.4m (GBP 2.4m)

- Adjusted EBITDA‡ increased by 68% to GBP 0.43m (GBP 0.25m)

- Operating result increased by 734% to GBP 0.56m (GBP 0.07m)

Important events during the quarter

- Launch of Evony: The King’s Return from Top Games Inc.

- Launch of The Ants: Underground Kingdom from StarUnion

- Launch of Puzzles & Survival from 37Games

- Signing of Mahjong Treasure Quest from Vizor

Important events after the quarter

- Strategic investment in mobile game influencer, Liteup Media UG

- Alignment of the financial year with the calendar year by closing the current financial year after 9 months in December 2021

* Comparable number for the same quarter of the previous financial year in brackets

‡ The Company defines adjusted EBITDA as earnings before interest, tax, depreciation, amortisation, finance costs, impairment losses and other income. Adjusted EBITDA (adjusting operating profit for several non-cash items) is used by the Company for internal performance analysis to assess the execution of our strategies. Management believe that this adjusted measure is a more appropriate metric to understand the underlying performance of the Company

Notes from the CEO

What a great quarter we had – our best so far! We entered the 4th quarter with three new top titles leading up to the important Christmas period and I am really pleased that we managed to launch all of them and benefit from store promotions during the festive season.

Evony: The King’s Return, The Ants: Underground Kingdom and Puzzles and Survival are some of the biggest titles in the market and generated more than USD 40m in Google Play during December. These are now part of our portfolio and contributed to our strong performance in Q4. We experienced 52% growth in quarterly revenue compared with the same period last year and an increase of 46% for the whole year, which was in line with our guidance. The strong performance can also be seen in gross profit and EBITDA, up 63% and 163% respectively.

In 2021, we reached critical mass on the platform, and that’s why we now see a positive effect on our EBITDA for each new game we launch. I am also very happy that we generated GBP 0.6m in net profit for the period partly thanks to the recovery of GBP 0.4m from the impairment write-down we made in March 2020. These titles performed better than expected and are now generating positive contribution.

We added one more leading developer during the quarter, Vizor Games, and we are preparing to launch their title Mahjong Treasure Quest. On the back of our current strong performance and growing portfolio, we are actively phasing out low performing titles. This will help us improve the overall portfolio’s performance and increase the average revenue per game. Our top-tier monthly average has improved from USD 560K in Q3 to USD 730K. This can be seen in our KPI section on page 12.

We have now started to invest in new strategic initiatives within paid user-acquisition, with focus on influencer marketing and performance marketing to support our core business and to expand our footprint into the game services market as previously announced. The plan involves acquisition of talent through investments and acquisitions, but we are also strengthening our development and product teams to support these new initiatives. Our first step into influencer marketing was the investment made in January 2022 in Liteup Media. Liteup Media is a promising German start-up that has set out to disrupt influencer marketing and make it more mainstream and accessible to mobile game advertisers. This investment is attractive to us as we get a foot in the door in influencer marketing, while we have the option to acquire the company.

Looking at the wider market, we can see some clear market trends in favour of new services such as influencer marketing. This is partly due to privacy changes such as deprecation of IDFA by Apple, which makes it more difficult to target and track users. Google have also announced that it will make similar changes adding to the problems for traditional performance marketing. In parallel, we are seeing new demand for influencer marketing from blockchain-based games and NFTs. New marketplaces outside the traditional app stores are evolving for these games, adding to more market fragmentation. This in turn will drive new trends in user acquisition which we want to capitalise on. Other interesting recent moves that will expand our market is Microsoft’s support for Android on Windows 11, through their Amazon Appstore partnership. This project is now publicly launched by Microsoft, and Flexion is already supporting it. In addition, Netflix has entered the overall games market principally to support their core business and recently announced it stepped up its push into gaming by acquiring Next Games, a NASDAQ First North listed game developer.

We are now entering a new financial year and the traditionally weaker Q1 period. Our performance has so far been in line with expectations, we are focusing on growing revenue and audiences for our new top titles. On the back of our strong momentum coming into the new year, we expect our annual revenue to grow with 40-60% and our staff cost by 8-12% during 2022. This growth is driven by our core strategy, while new initiatives are ramping up during 2022. Overall, it should set us up for another strong and exciting year.

I would also like to comment on Flexion’s exposure to the terrible events happening in Ukraine and our thoughts are with all those affected. As a company with business in global markets, we have to date not seen any political events where mobile games have been sanctioned and we do not foresee that happening here either. We are very fortunate that our staff have not been exposed to the region, none of our developer contracts are with Russian companies and our settlement structure is relatively well protected against payment freezes or delays. The risks we see lie within the highly volatile Russian Ruble and the ability of our channel partners to transfer funds out of Russia. So far, the effects on Flexion have been limited and in February less than 10% of our global revenue was generated in the Russian market. The situation is very fluid, and we are monitoring it closely.

Finally, I would like to thank all Flexion staff for a fantastic year and welcome our new colleagues at Liteup Media to the Flexion Group.

Jens Lauritzson – CEO

Powered by WPeMatico

Gaming

Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity

Soft2Bet has revealed the debut of MEGA11, a football management game aimed at enhancing sportsbook interaction and improving player loyalty. Acknowledging that football manager and fantasy games rank among the most favored genres with the longest typical gameplay durations, MEGA11 provides a progression-oriented and captivating football manager experience focusing on fantasy league team construction, allowing players to tactically oversee their own teams and make important choices while competing in leagues and matches.

Users of sportsbooks are inherently used to waiting before making their next wager. That inactivity naturally leads to a decrease in daily engagement, even among bettors who are very focused on football. MEGA11 addresses this issue by providing users with a football management game seamlessly connected to the sportsbook experience. Rather than waiting for the upcoming kickoff, players can remain engaged by forming their team, modifying lineups, and battling in their personal matchups or leagues. This establishes a distinctive two-way interaction cycle, effortlessly integrating real-money wagering with social, engaging gameplay, transforming these calmer times into organized activity with defined objectives, advancement, and a motivation to come back.

MEGA11 is developed as an independent game featuring its own soft-currency system, without any direct links to sportsbook deposits or casino operations. The main experience is free-to-play, enabling players to advance at their own speed. For players seeking to advance quickly or enhance their team, MEGA11 provides optional purchases, such as more powerful player cards and boosters that speed up progress and offer a strategic advantage.

The engagement of the sportsbook is fueled by a straightforward, quantifiable mechanism. Each wager allows players to accumulate points that enhance their advancement in the football manager game. This advancement, consequently, activates sportsbook bonuses, actively encouraging ongoing involvement and strengthening consistent engagement. Advancement is organized via a five-level loyalty and gamification framework that reflects a football career trajectory: Beginner, Amateur, Professional, World Class, and Legend. The tiering aims to maintain motivation over time, providing a consistent feeling of progress that fosters longer-term retention instead of brief spurts of engagement.

The new engine enhances Soft2Bet’s larger MEGA portfolio, which currently features mechanics like MEGA Chance, MEGA Round, and MEGA Clawee. It further enhances Soft2Bet’s sportsbook offering with instant payouts, 24/7 support, and over 200 pre-match football markets, by introducing a perpetual football format designed to maintain fan engagement beyond the live match calendar.

The design of the product continues to prioritize player protection and compliance. MEGA11’s soft-currency, non-deposit model promotes secure and compliant interactions, emphasizing entertainment and advancement while adhering to responsible gaming standards in regulated regions.

Yoel Zuckerberg, CPO at Soft2Bet, stated: “MEGA11 is built to keep football fans engaged between matchdays, pairing a manager-style progression loop with a soft-currency model that supports compliant, long-term sportsbook loyalty. Football manager games are renowned for having the highest player immersion and longest session times in the industry. By bringing this experience to our partners, we are combining real betting with social gameplay to deliver authentic player experiences that resonate with fans and drive sustainable engagement.”

The introduction of MEGA11 enhances Soft2Bet’s emphasis on product-driven engagement, merging game design, loyalty strategies, and a robust regulatory framework to assist operators in achieving more reliable retention during the football season. The technology has received significant industry awards and is eliciting a strong positive reaction from players, confirming its influence on engagement and long-term value generation.

The post Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

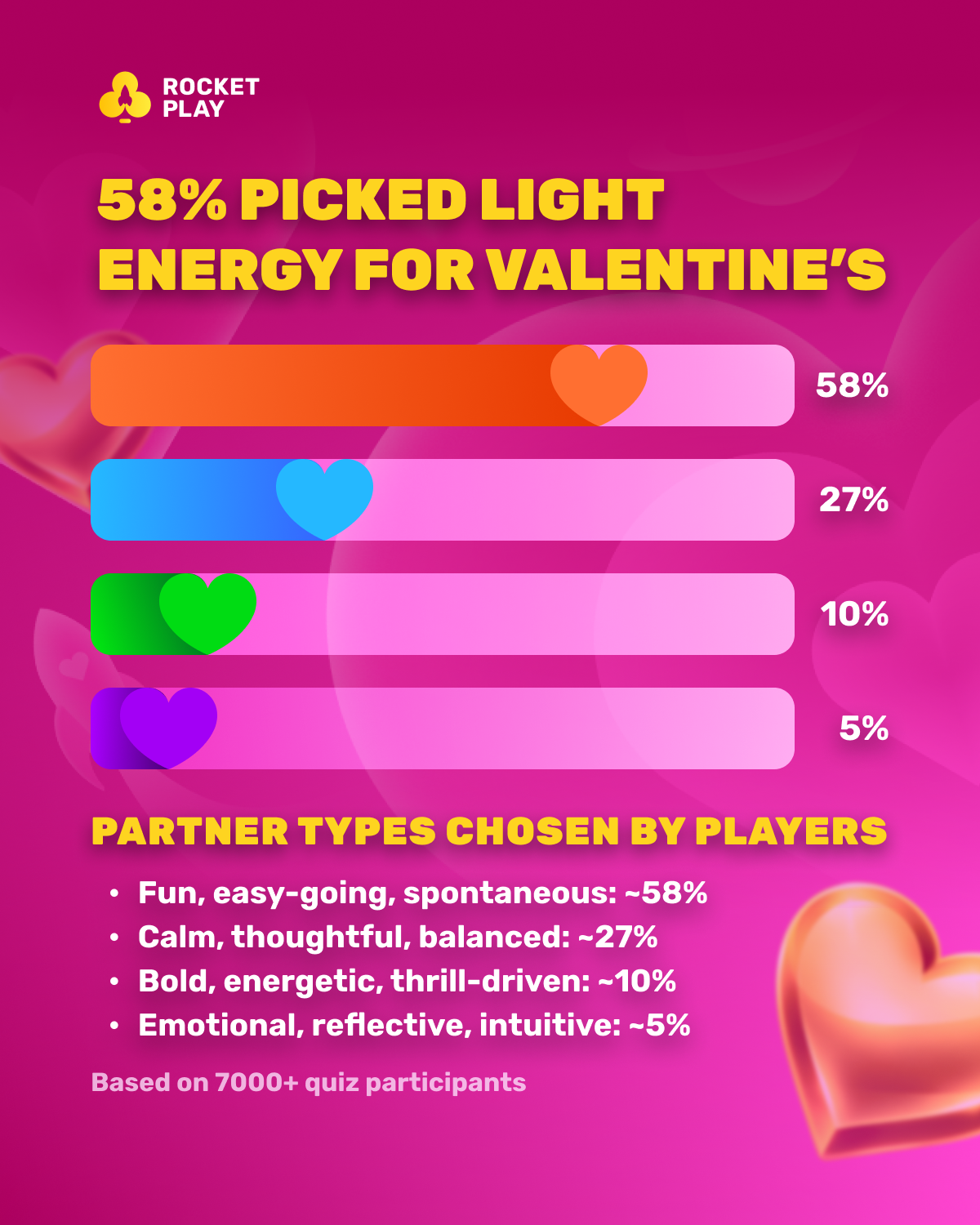

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

-

Latest News6 days ago

Latest News6 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Canada6 days ago

Canada6 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Acquisitions/Merger6 days ago

Acquisitions/Merger6 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™6 days ago

Firecracker Frenzy™ Money Toad™6 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™

-

Compliance Updates5 days ago

Compliance Updates5 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Blueprint Gaming4 days ago

Blueprint Gaming4 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Big Daddy Gaming5 days ago

Big Daddy Gaming5 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Africa6 days ago

Africa6 days agoEveryMatrix gains South Africa licence with customer launch pipeline on the rise