Gaming

Azerion successfully completes its business combination with EFIC1

Azerion Holding B.V., a high-growth, profitable, digital entertainment and media company, and European FinTech IPO Company 1 B.V. (“EFIC1”), a special purpose acquisition company (SPAC) listed on Euronext Amsterdam, have successfully completed their business combination on 1 February 2022.

As part of the completion of the business combination, the legal form of the combined company has been converted into a limited company (naamloze vennootschap) and it has been renamed Azerion Group N.V. (“Azerion Group”). The first day of trading on Euronext Amsterdam under the new name of Azerion Group’s shares and warrants will be on 2 February 2022 (today) under the new ticker symbols AZRN and AZRNW, respectively.

The business combination received the support of EFIC1’s shareholders, with more than 95% of the votes cast at EFIC1’s extraordinary general meeting held on 31 January 2022 (the “EGM”) approving the business combination.

The completion of the business combination supports Azerion Group in its ambitions to become a global digital entertainment and media powerhouse. The business combination furthermore provides for a strong complementary partnership accelerating future value creation for all stakeholders through continued investments in Azerion Group’s growth, both organically and through M&A. Azerion Group expects this listing to create a new long-term supportive shareholder base, permit Azerion Group to incentivise the existing and future management team and senior staff and continue to attract high calibre individuals.

The business combination resulted in approximately €93 million of gross total primary cash proceeds, including approximately €70 million of funds from the EFIC1 escrow account (net of negative interest and after effectuation of the share repurchase arrangement) complemented by a sponsor and co investor commitment of €23.15 million. With the completion of the business combination, Azerion Group received approximately €56 million of net primary cash proceeds (net of transaction costs and expenses), which will be used to continue to pursue value-accretive acquisitions (with Azerion having a strong acquisition track record and a broad pipeline of potential targets), and to further invest in organic growth initiatives (such as new games and features, platform investments, etc.) as well as general corporate purposes.

Immediately after completion of the business combination and the related restructuring steps (including the cancellation of 31,228,299 ordinary shares that were repurchased by EFIC1 from its shareholders), the issued share capital of Azerion Group is as follows:

1

Public

Type of security #¹

Ordinary Shares (excl. treasury) 111,483,296

Ordinary Shares in treasury² 70,078,452

Total Ordinary Shares 181,561,748

Capital Shares 22

Conditional Special Shares 1,152,886

Warrants³ 12,736,605

Please see section 6.4. “Description of Securities” in the EFIC1 Shareholders Circular dated 13 December 2021 for a description of the classes of securities of Azerion Group.

1. Excluding any conditional and unconditional option rights and Founder Warrants existing at the date of this press release, which in aggregate entitle the holders to receive up to a maximum of 24,160,245 Ordinary Shares. 2. The Ordinary Shares in treasury can be used for acquisitions, exercise of warrants and option rights and other general funding purposes.

3. The outstanding Warrants listed on Euronext Amsterdam at the date of this press release entitle the holders to receive up to 12,736,605 Ordinary Shares.

Immediately after completion of the business combination, the ownership percentages of Ordinary Shares are as follows:

Shareholder % Ordinary Shares⁴

Principion Holding B.V.⁵ 74.3%⁶

Azerion former depositary receipt holders 7.5%

Azerion former stock appreciation rights holders 4.0%⁷

Former EFIC1 converted special shares holders 5.9%

Other Shareholders 8.3%

Total 100.0%

Based on Azerion Group’s information. Actual share ownership percentages and regulatory filings and notifications of ownership percentages may differ.

4. Excluding treasury shares as well as any conditional and unconditional option rights and Founder Warrants existing at the date of this press release, which in aggregate entitle the holders to receive up to a maximum of 24,160,245 Ordinary Shares.

5. An entity controlled by Azerion’s co-founders and co-CEOs.

6. Including shares held for settlement of future acquisition-related earn out and other obligations. 7. Excluding shares held for settlement of future acquisition-related earn out and other obligations.

Atilla Aytekin, co-founder and co-CEO of Azerion says: “Today marks an important step for Azerion, and we are excited to finally enter the public markets and continue to grow and advance our platform whilst raising our profile amongst our customer and partner groups and talented workforce globally. We are proud to achieve this important milestone, and we look forward to our next growth phase and future

2

Public

as a public company. I am grateful to the entire Azerion team for all their hard work, which has brought us to this pivotal moment, and for the dedicated support of our partner EFIC1.”

Martin Blessing, former Chief Executive Officer of EFIC1, adds: “The journey of our SPAC EFIC1 comes to a successful end while the exciting journey of Azerion as a listed company starts now. The whole EFIC1 team thanks its shareholders for their support. We look forward to continuing our partnership with Azerion over the long term and wish the company, its founders, employees and shareholders success as they continue their impressive growth story.”

To celebrate the completion of the business combination, the management team of Azerion Group will ring the opening bell at Euronext Amsterdam at 09.00 CET on 2 February 2022. A live stream of the event and replay can be accessed via this link.

Advisers

Credit Suisse Bank (Europe), S.A. acted as capital markets adviser, Hogan Lovells International LLP acted as legal adviser and ABN AMRO Bank N.V acted as financial adviser to EFIC1.

N.M. Rothschild & Sons Limited acted as financial adviser, Stibbe N.V. acted as legal adviser, and Citigroup Global Markets Europe AG and Jefferies GmbH as capital markets advisers to Azerion.

ABN AMRO (acting in cooperation with ODDO BHF SCA), ING Bank N.V. and Pareto Securities AB acted as co-capital markets advisers to EFIC1, and Clifford Chance LLP acted as legal adviser to the capital markets advisers.

Liquidity Provider

As from 2 February 2022, Azerion Group will enter into a liquidity provider agreement pursuant to which ABN AMRO Bank N.V. will act as liquidity provider for the trade in listed shares of Azerion Group.

Powered by WPeMatico

Gaming

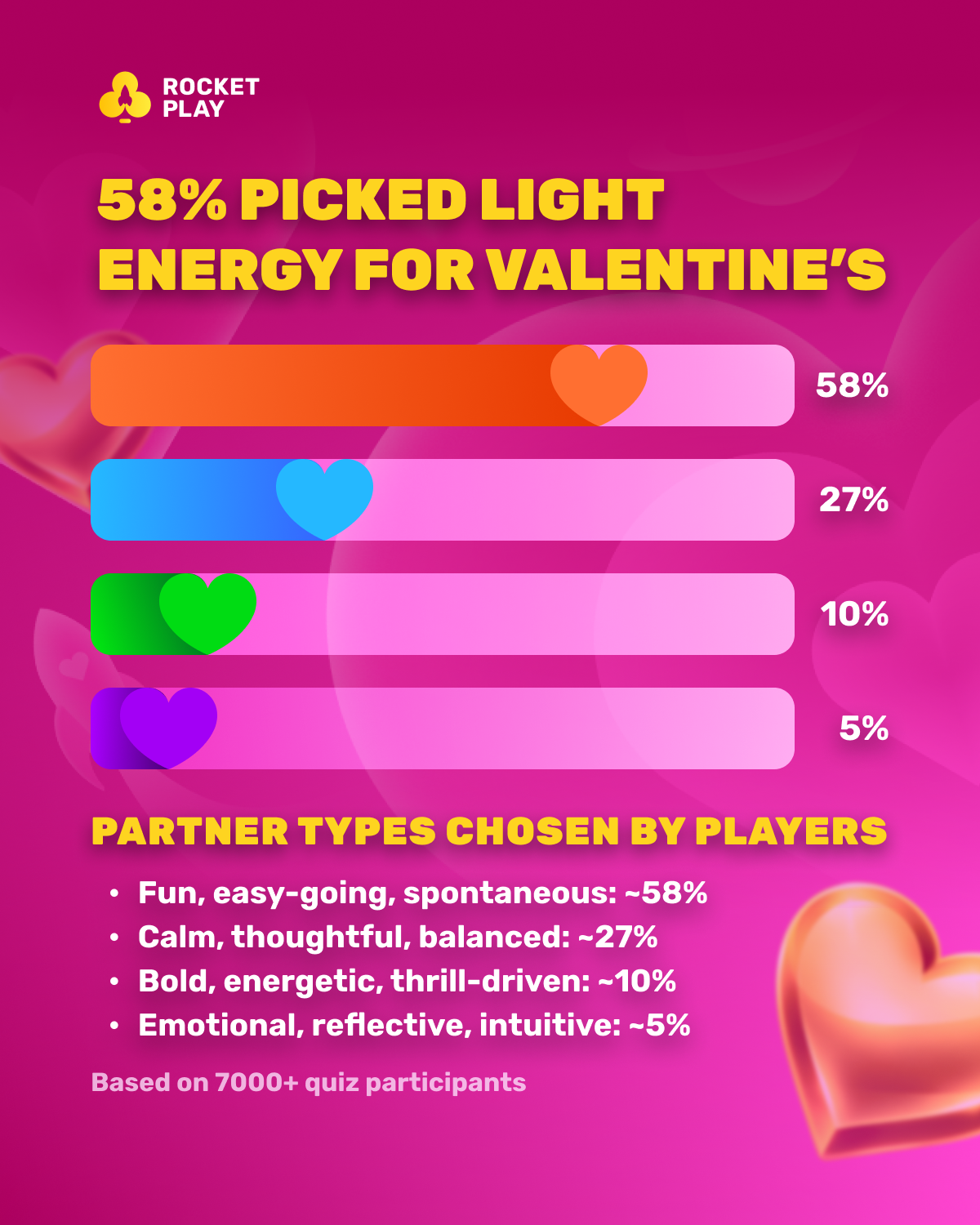

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

CEO of GGBET UA Serhii Mishchenko

GGBET UA kicks off the “Keep it GG” promotional campaign

A leading gaming brand in Ukraine has launched a collection of ads featuring the tagline “Keep it GG” as part of an extensive communications initiative. The videos are currently being broadcast on Ukrainian TV, online platforms, and the brand’s social media accounts.

“GG” (Good Game) started in video game culture, yet its significance has far surpassed the literal meaning of “well played.” Currently, it symbolizes a worldwide sign of honor and gratitude for the feelings exchanged following a match, no matter the outcome. This concept served as the basis for GGBET UA’s latest marketing campaign. The video series embodies a unique GG atmosphere: rather than using a conventional voiceover, it incorporates complete audio tracks; the narrative features both literal and metaphorical allusions to sports and esports terms, alongside in-game and casino aspects; and prominent Ukrainian footballers are among the main characters.

“Every game, every match, every tournament is a moment that brings people together. For us, it’s important that every interaction with GGBET gives users that good game feeling — an experience that outlives the result and leaves vivid emotions behind, just like after watching a match,” comments CEO of GGBET UA, Serhii Mishchenko.

Going beyond the traditional view of GG also signifies a more profound implication — the brand’s strategic focus. The international brand, which has concentrated on esports for several years and attained significant success in esports betting and collaborations, is now adopting best practices to enhance traditional sports in regional markets. GGBET UA showcases a wider strategy for Good Game via collaborations (FC Dynamo Kyiv, FC Polissya, and the Ukrainian Basketball Federation), by organizing its own events and special projects, including initiatives that blend sports with esports, like the Match of LeGGends: Derby showmatch on the server featuring esports athletes and football players.

The brand’s creative team collaborated with a Ukrainian advertising agency and a Ukrainian production company to develop the commercials. GGBET UA made this choice to assist the local creative sector amid the war.

The post GGBET UA kicks off the “Keep it GG” promotional campaign appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Bet Rite7 days ago

Bet Rite7 days agoSpintec Expands into Canada with Bet Rite

-

Alex Malchenko6 days ago

Alex Malchenko6 days agoEvoplay Strengthens Canadian Presence with BetMGM Partnership

-

3 Oaks Gaming6 days ago

3 Oaks Gaming6 days ago3 Oaks Gaming Enters Spanish Market

-

blask7 days ago

blask7 days agoWhen LATAM gambles: Blask reveals seasonality patterns across six countries

-

Latest News6 days ago

Latest News6 days agoRed Papaya Presents: Lucky Rainbow Rush Adventure