Gaming

Kaspersky and FACEIT join forces to empower gamers

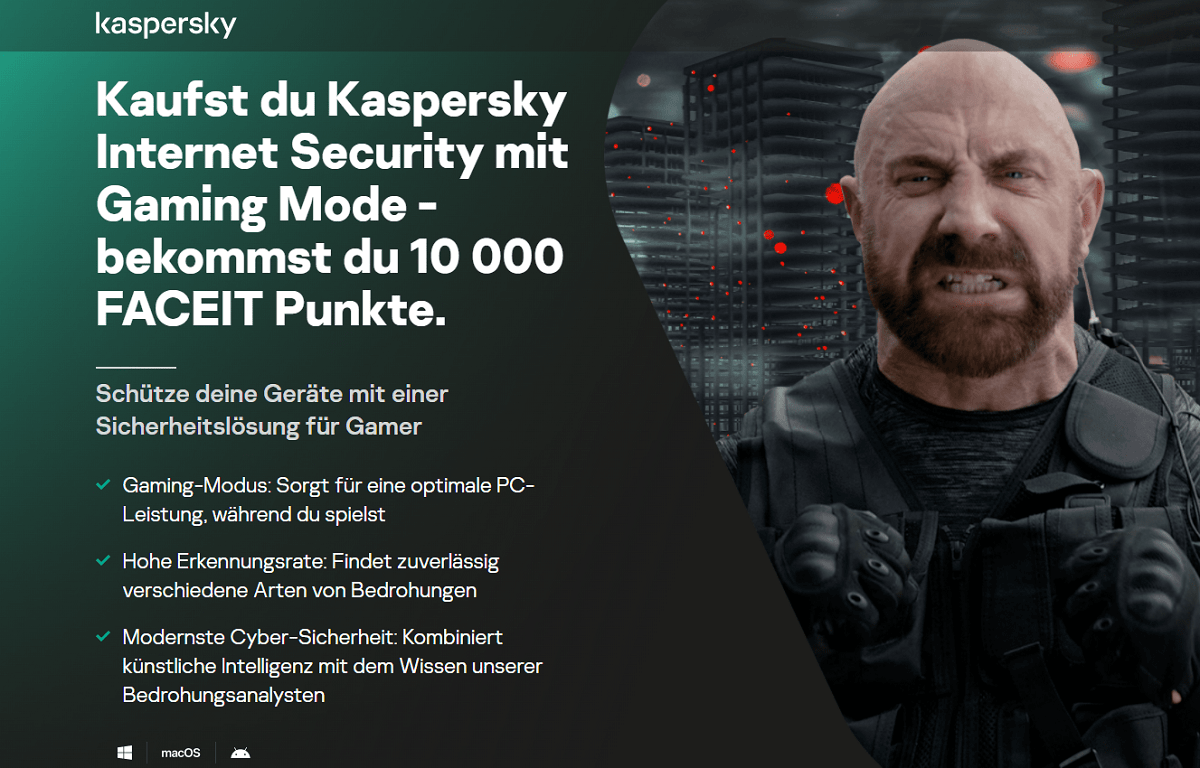

When purchasing Kaspersky Internet Security with Gaming Mode, gamers in Russia will automatically receive a three-month FACEIT Premium Subscription or a three-month NAVI community subscription on FACEIT and gamers in Germany will automatically receive 10,000 FACEIT Points or a two-month BIG community subscription on FACEIT

Gamers on the leading competitive platform for online multiplayer games, FACEIT, now benefit from a new partnership with global cyber security expert Kaspersky. By purchasing an annual subscription to Kaspersky Internet Security with Gamer Mode, FACEIT registered users in Russia will automatically receive a three-month FACEIT Premium Subscription or a three-month NAVI community subscription on FACEIT and in Germany will automatically receive 10,000 FACEIT points or a two-month subscription to the German BIG Community on the platform. This offer is available until March 14, 2022.

Gamers and their accounts are a high value target for cyber criminals. From January 2020 to July 2021, over 300,000 users encountered various gaming-related malware that targeted personal information, money, cryptocurrencies as well as account access data. To protect themselves, gamers need a dedicated security solution. However, many fear that this might affect their gaming experience. Kaspersky Internet Security incorporates Gamer Mode, which offers comprehensive protection with a high detection rate and which does not hamper the gaming experience. Specifically, it has low impact on Frames per Second (FPS) and optimises the device resources to maximise performance.

Kaspersky–FACEIT Bundles: Combining premium gaming experiences and protection for fearless gaming

The Kaspersky – FACEIT bundle combines security, performance and access to gaming experiences including:

For Russia:

three-month FACEIT Premium Subscription or

a three-month subscription to the NAVI community on FACEIT

For Germany:

10.000 FACEIT Points or

a two-month subscription to the BIG community on FACEIT

Furthermore, gamers can take part in the Kaspersky Fearless Gaming Community Nights. During this six-week-long ladder competition, gamers can win 50.000 FACEIT Points and annual Kaspersky subscriptions, while improving their ranking on the competitive gaming platform.

Interested FACEIT Organizers can also become part of Kaspersky’s Global Influencer Program. This offers players who recommend Kaspersky, a commission of up to 50 percent of the purchases generated, and exclusive 100-day trial licenses for their followers.

“We are very pleased to be able to continue driving the topic of security in gaming together with FACEIT”, said Ivan Imhoff, Vice President Digital Business at Kaspersky. “The protection of data, financial resources as well as accounts and the associated digital assets such as skins or equipment are very important to us. Through our offer and this partnership, we want to create an incentive for gamers to install protection solutions so that they can concentrate fully on their game while staying secure.”

“Kaspersky is one of the global leaders in cybersecurity and it has developed an excellent product specifically designed for gamers, which offers players peace of mind without compromising performance or gameplay. Creating fantastic gaming experiences is the bedrock of FACEIT and we’re looking forward to working on this project together”, said Michele Attisani, Co-founder & CBO at FACEIT.

Powered by WPeMatico

Aviamasters™ 2

New Aviamasters™ 2 from BGaming Drives Larger Payouts

Rapidly expanding content provider fuels up for another high-flying hit in this groundbreaking sequel

Popular iGaming content provider BGaming is taking to the skies once again for the sequel to its award-winning Aviamasters casual game, Aviamasters

casual game, Aviamasters 2.

2.

The organic growth of Aviamasters , which made it BGaming’s biggest #Casual viral hit, inspired the decision to make the sequel. The game sees Aviamasters

, which made it BGaming’s biggest #Casual viral hit, inspired the decision to make the sequel. The game sees Aviamasters soar to new heights, with improved graphics, exciting new features, and an increased maximum multiplier, which has quadrupled from x250 to x1,000.

soar to new heights, with improved graphics, exciting new features, and an increased maximum multiplier, which has quadrupled from x250 to x1,000.

Aviamasters became famous across streaming platforms worldwide, with streamers and players shouting “LAND!” as they watched their planes stack up wins mid-flight. These core landing mechanics remain the same in the sequel. Players watch as their plane flies through the sky, gathering wins and collecting multipliers, all while trying to avoid dangerous obstacles and land safely.

became famous across streaming platforms worldwide, with streamers and players shouting “LAND!” as they watched their planes stack up wins mid-flight. These core landing mechanics remain the same in the sequel. Players watch as their plane flies through the sky, gathering wins and collecting multipliers, all while trying to avoid dangerous obstacles and land safely.

Four booster symbols can be picked up during any flight, while the Buy Bonus mode, known as the Safe Landing feature, can guarantee a landing for x50 the player’s stake. Players should be aware that Safe Landing increases their stake on each spin and can be deactivated at any time.

Aviamasters found success with the streaming community, and BGaming has tapped into this relationship during the creative process for Aviamasters

found success with the streaming community, and BGaming has tapped into this relationship during the creative process for Aviamasters 2. Selected streamers have provided feedback on the gameplay, ensuring it exceeds the high standards set by the original.

2. Selected streamers have provided feedback on the gameplay, ensuring it exceeds the high standards set by the original.

Aviamasters 2 also tweaks the sound and visuals to appeal to a wider audience. These changes make the game more casual-looking, inviting players to enjoy its fast rounds and unpredictable features. Like the original, it will be added to BGaming’s #Casual portfolio.

2 also tweaks the sound and visuals to appeal to a wider audience. These changes make the game more casual-looking, inviting players to enjoy its fast rounds and unpredictable features. Like the original, it will be added to BGaming’s #Casual portfolio.

It is not just players and streamers who will benefit from Aviamasters 2. The game can also be customised to reflect operator branding, providing the title with a wide reach and high marketing potential. The original game delivered viral moments that converted into traffic and big hits for operators, and the sequel promises more of the same.

2. The game can also be customised to reflect operator branding, providing the title with a wide reach and high marketing potential. The original game delivered viral moments that converted into traffic and big hits for operators, and the sequel promises more of the same.

Vasili Pauliuchenko, Game Producer at BGaming, said, “The first Aviamasters was a massive hit for us, with players loving its signature “LAND!” mechanics. With Aviamasters

was a massive hit for us, with players loving its signature “LAND!” mechanics. With Aviamasters 2, we have kept everything that players loved about the original title and improved upon it.

2, we have kept everything that players loved about the original title and improved upon it.

The game is bigger and better than its predecessor, building on its success with greater winning potential and even more gameplay features. We can’t wait to hear even more shouts of “LAND!” coming from players when the sequel hits casino lobbies.”

The post New Aviamasters™ 2 from BGaming Drives Larger Payouts appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Codere Online

RubyPlay and Codere Online join forces to elevate gaming offering in Mexico

RubyPlay, the studio-based content ecosystem, has strengthened its footprint in Mexico through a new partnership with Codere Online (Nasdaq: CDRO), one of the country’s leading digital sports betting and casino operators.

The collaboration sees Codere Online integrate a broad selection of RubyPlay’s most popular titles, including player favourites such as J Mania® Loco Habanero, Grand Express Diamond Class, and Zeus Rush Fever® Deluxe SE. The deal also incorporates content from Koala Games, one of the fastest-growing studios within RubyPlay’s ecosystem, featuring hits like Voltage Blitz® Rapid and Voltage Blitz® Vortex. Codere Online will gain ongoing access to additional content from RubyPlay’s wider studio network as new titles are released.

This partnership reinforces RubyPlay’s expansion across the LATAM region, where its content has been performing strongly with multiple leading brands. At the heart of this growth is RubyPlay’s multi-layered content ecosystem, designed to deliver a diverse and tailored portfolio while benefiting operators of all sizes. The model enables faster delivery cycles, greater portfolio variety, and improved responsiveness to both operator needs and evolving player preferences.

Dima Reiderman, CCO at RubyPlay, commented:

“Partnering with Codere Online represents a significant milestone in our expansion across Mexico and the wider LATAM region. The operator’s strong brand recognition and vast customer base make them an ideal partner to reach even more players. Through our studio-based ecosystem, including Koala Games and Mad Hat Games, we can deliver market-focused content to support Codere Online’s evolving strategy in Mexico and LATAM.”

Sarit Adania, Head of Casino Product at Codere Online, added:

“RubyPlay’s consistently high-performing titles will be a significant addition to our online casino offering in Mexico. By integrating content from both RubyPlay and Koala Games, we are diversifying our portfolio and continuing to deliver the engaging, premium experiences our players expect.”

The post RubyPlay and Codere Online join forces to elevate gaming offering in Mexico appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

François LaFlamme

Motorola Becomes the Official Smartphone Partner of FIFA Heroes Game

Motorola, a Lenovo company, has become the official smartphone partner of the recently announced FIFA Heroes game, published by Solace. FIFA Heroes is an arcade-style, 5-a-side football title that, for the first time, features real players, mascots and fictional IP characters on the same pitch. This partnership brings together Motorola’s cutting-edge mobile technology and the game’s immersive gaming experience, creating a seamless experience for fans to enjoy the world’s most popular sport in a fun and interactive way.

As the official smartphone partner for the FIFA World Cup 2026, Motorola is committed to bringing the excitement of the tournament directly into consumers’ hands. FIFA Heroes delivers on that promise, offering fans innovative, mobile-first experiences that keep them connected to this unique moment in time.

With this partnership, Motorola’s presence will extend across multiple touchpoints. Motorola will appear directly within the FIFA Heroes game, and many upcoming Motorola smartphones will include instant access to the newest FIFA-licensed mobile game. Fans can also download the game from the Google Play Store, making it simple to play from anywhere.

All Motorola users will gain access to exclusive in-game content designed just for them, including power up tokens and gems, game emotes, a retro razr goal celebration, playable characters, and more. This content is part of a broader collaboration that will unfold through a series of global activations, leading up to and throughout the FIFA World Cup 26, giving fans around the globe new ways to connect with the action, on and off the pitch.

Beyond the content itself, the partnership introduces a gaming experience designed specifically for the brand new razr fold, redefining what a foldable form factor can bring to the gaming space. This exclusive experience optimizes the device’s large 8.1″ unfolded display so that players get an expanded view of the pitch that keeps the action fully in focus. Plus, the extra screen space makes it so that controls can sit comfortably below gameplay for an unobstructed display, and also gives players the flexibility to customise their layout for optimal ergonomics.

“This collaboration goes beyond gaming—it’s about delivering an experience that feels faster, smoother, and more connected for every fan. By working closely with Solace and FIFA, we’ve optimized FIFA Heroes for Motorola devices so players get the best possible performance right out of the box. It’s a powerful way to show how our technology enhances the way people play, connect, and experience entertainment, and we’re excited to share even more in the months ahead,” said François LaFlamme, Chief Marketing Officer at Motorola.

The post Motorola Becomes the Official Smartphone Partner of FIFA Heroes Game appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Canada6 days ago

Canada6 days agoPointsBet Canada to Contest Proposed 5-Day Suspension by AGCO

-

Africa6 days ago

Africa6 days agoEGT showcases African growth strategy at SiGMA Africa 2026

-

Ben Bradtke Co-Founder of ThrillTech6 days ago

Ben Bradtke Co-Founder of ThrillTech6 days agoThrillTech enters Brazilian market with EstrelaBet

-

Denmark5 days ago

Denmark5 days agoELA Games Strengthens Danish Market Presence via Stake.dk Tie-Up

-

BIG Cyber5 days ago

BIG Cyber5 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

ANJ6 days ago

ANJ6 days agoWhat’s up and what’s next on the French gambling market ?

-

Brasil5 days ago

Brasil5 days agoBrasil ante una encrucijada: match-fixing e impuesto rechazado

-

AdmiralBet Serbia5 days ago

AdmiralBet Serbia5 days agoDigitain Enters into Multi-Vector Collaboration with AdmiralBet Serbia