Conferences in Europe

Viktoria Soltesz: the Online Payments Pro Teaching Us How Money Moves

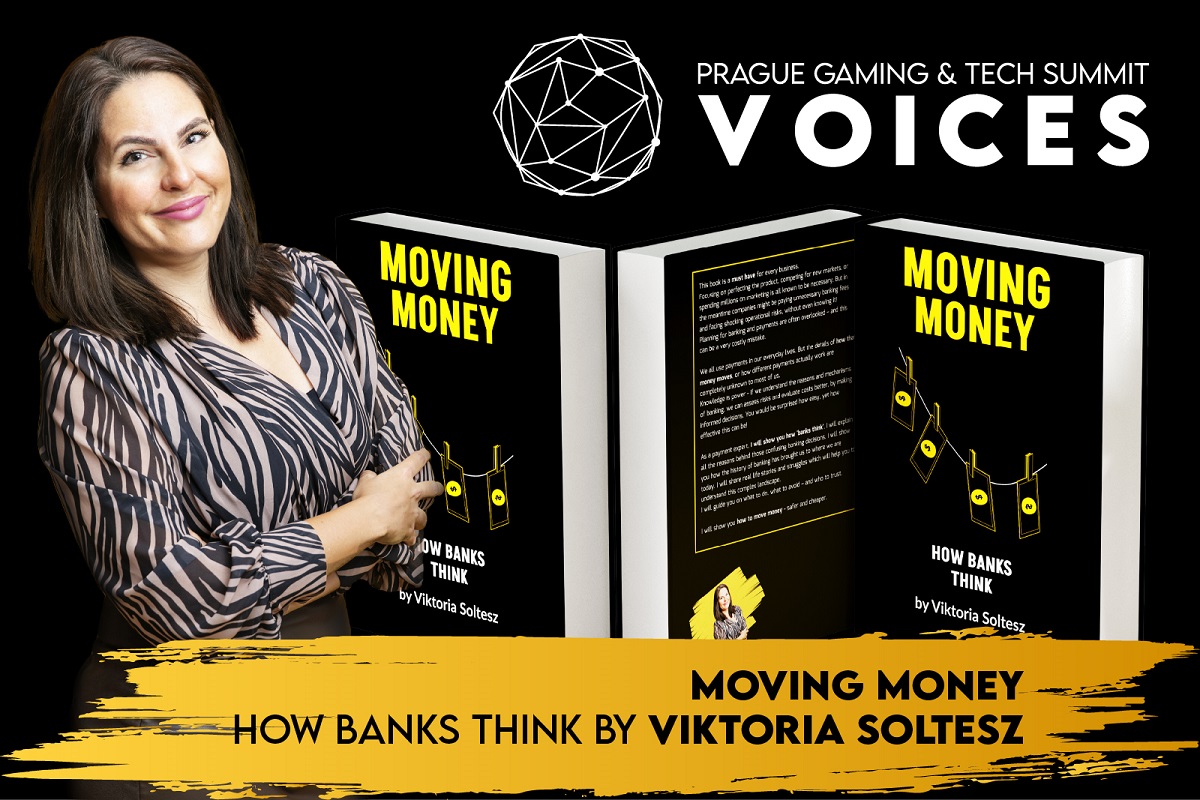

Viktoria Soltesz is a Payment Consultant, BusinessWoman of the Year 2023, and now an Author, with her book “Moving Money – How Banks Think”, being published on all Amazon stores since early January 2024.

Viktoria is the founder and CEO of PSP Angels Group – an independent payment consulting firm with a vast understanding of the payment market, and an extended network of banks and financial providers, offering personalized payment consulting services, helping clients operate their business globally.

In her book, “Moving Money – How Banks Think”, she walks the reader through the history of transactions and financial systems, offers a detailed explanation of basic banking principles, and delves deep into payment solutions, requirements, risk policies, and compliance limitations associated with online payments.

Viktoria, congratulations on the publication of your book, and thank you for joining us to share more information about it with our readers! In the Foreword of the book, you introduce yourself, detailing your professional background and your fascinating journey into the world of online payments. Can you please give us a short introduction here as well?

My adventure began in England, where I worked for a well-known accounting software company, witnessing firsthand the globalization of financial practices. My move to Cyprus coincided with the adoption of the Euro, offering me unique insights into the island’s financial dynamics. In Cyprus, I started working in accounting and finance, offering tax planning and managing complex global transactions. When I faced various payment and banking compliance challenges, I determined to understand the payment industry and founded PSP Angels, an independent payment consultancy. My goal with the book is to simplify the payment and banking industry, educate businesses about the importance of compliance, and foster understanding between clients and payment service providers.

Blending personal anecdotes, real time stories and my professional experiences, I describe the challenges businesses face in navigating the evolving landscape of online payments. The book aspires to contribute to making online payments more efficient, secure, and understandable, while encouraging open discussions within the industry.

In the book, you speak of “Financial Literacy” and “Payments Literacy”, and how this fundamental knowledge is not taught in schools. Can you give us a brief summary of the key points that businesses should be aware of and take into consideration when setting up their financial operations? What are the basics of “Financial Literacy” and “Payments Literacy”?

Finance is the language of business and understanding the basics of accounting, taxes, and financial expressions is a must for every business. Financial Literacy is the knowledge to manage money effectively, and plan for future financial goals. Knowing the financial terms and concepts helps businesses to make informed decisions regarding savings, investments, and debt. On the other hand, Payments Literacy is often neglected and misunderstood. The concept of “how money moves” globally is not taught in schools, however today all businesses need to understand how to navigate various payment methods, systems, and processes. Payments Literacy encompasses a range of topics related to financial transactions, including online payments, electronic transfers, and traditional banking methods. It is essential for businesses to understand cybersecurity, the various compliance and regulatory environments, plan banking and payments ahead and source and select the relevant providers for these transactions. All international companies need to be aware of diverse payment methods to align with local customer preferences. Payments Literacy is complementing Financial Literacy and they are both vital for effective business operations.

As you describe your journey into payments and how the problems you encountered lead to understanding, you share instances of complicated structures, early financial compliance attempts and rigid bank processes around the mid ‘00s to 2010s. How has the landscape evolved by now? Would you say that compliance has found its footing, have the banking and payments processes become more clear and friendly to businesses and consumers alike?

I believe that challenges in payment and banking have become more complex and will continue to evolve. With the increasing shift of businesses to online platforms and their expansion into international markets, complexities in payment and banking processes are on the rise for everyone involved. Maintaining transparency, ensuring compliance, and managing the risks associated with uncertain territories and service providers has become a challenging task. The emergence of new technologies, such as crypto payments, and the variety of currency and asset management options add an extra layer of complexity to these challenges. Not to mention the various cybersecurity and data protection requirements, too. Businesses today not only need to be experts in the traditional financial structures but also have to adapt to the dynamic landscape of digital payments, banking, and payment methods. Successfully addressing these multifaceted challenges requires heightened awareness, strategic planning, and a commitment to staying informed about evolving technologies and about the ever-changing regulatory landscapes.

How has Fintech played a pivotal role in shaping the evolution of the payment market, and what key contributions or innovations has it introduced over the course of its history?

Fintech became a powerful force reshaping the traditional banking and payment market. Innovations in such a conventional industry was much needed and have significantly improve the efficiency and accessibility of financial transactions. One noteworthy contribution is the introduction of mobile payments, enabling individuals and businesses to seamlessly conduct transactions through their smartphones. This shift to mobile-centric solutions not only simplifies the payment process but also promotes financial inclusivity, reaching individuals who may not have had access to traditional banking services. This has opened up new markets for global trade.

Fintech also brought us the digital wallets and peer-to-peer payment platforms, facilitating fast and secure fund transfers. These innovations have transformed consumer expectations, placing emphasis on speed, convenience, and heightened security in financial transactions. Fintech has driven progress in data analytics, enabling more sophisticated risk assessment and fraud prevention measures. The integration of Application Programming Interfaces (APIs) has played a pivotal role in fostering collaboration between financial institutions and Fintech entities. This interconnected ecosystem has resulted in the creation of diverse financial solutions, ranging from automated budgeting tools to advanced investment platforms.

Speaking of Fintech, in practical terms, how are Blockchain and Cryptocurrencies currently being utilized in everyday applications within the payments system, and what impact are they having on traditional payment methods?

Blockchain and cryptocurrencies, although holding significant promise, currently face challenges in practical application within everyday payment systems. Unfortunately, these technologies have become vulnerable to misuse and scams due to the absence of regulation, undermining their positive potential. Despite their increasing adoption, the tarnished reputation blocks widespread acceptance. In every country, authorities worry that unmonitored transactions may facilitate tax evasion or criminal activities. Although efforts are underway to implement regulations and bring order to the landscape, the current situation remains complex, still providing opportunities for creative individuals to exploit gray areas. The potential benefits of blockchain and cryptocurrencies, such as enhanced security and transparency, are unfortunately still overshadowed by instances of misuse. Achieving widespread adoption necessitates not only technological advancements but also a coordinated effort to address regulatory ambiguities. It is crucial to educate users about the legitimate and responsible use of these innovations. Until a balanced and well-regulated approach is established, the transformative potential of blockchain and cryptocurrencies may be hindered by their association with illicit activities. This underscores the critical need for a comprehensive and carefully regulated integration into mainstream payment systems.

Readers will have the opportunity to meet you and get their book copies signed at the Prague Gaming & TECH Summit, on 26-27 March 2024; you will be participating as an expert speaker in two panels: “Navigating the Future: Integrating iGaming, AI, Fintech, and Advertising with Compliance and Data Privacy”, and “Capital Navigation: Expert Strategies for Securing Investment”. Can you give us a sneak-peek of the key points you will be discussing?

In the upcoming discussion, I’ll be sharing practical tips to help the audience navigate common challenges with banking and payment pproviders and their products, digital assets, and other payment methods, mainly present for the iGaming sector. My focus is on providing valuable insights into more cost-effective and secure banking and payment providers. Unfortunately, the iGaming sector is still facing serious payment and banking challenges, and complexities of global fund transfers. I’ll offer advice on executing these transactions in a safer and more economical manner. The aim is to deliver substantial content value to the audience by offering real-life tips and conducting workshops that empower individuals to navigate the intricacies of financial transactions with confidence.

In ‘Moving Money – How Banks Think, you mention that your goal is to introduce a new approach in both payment planning and execution. What are the key insights that businesspeople and everyday individuals can gain from your book, and in what areas can they seek your professional consultation?

In the book, I’ve distilled years of experience into a practical method outlined in the Strategy section, serving as a step-by-step guide to minimize risk and optimize costs for any online business. My consultancy work aims to bridge knowledge gaps by providing a detailed explanation of basic banking principles and fundamental economic concepts. I assist businesses by offering insights on staying updated about emerging payment and banking trends. My work helps clarifying various aspects and benefits of online payment solutions, positioning for innovation, seizing growth opportunities, exploring global payment methods and their impact on customer satisfaction, acquisition, and retention. I also provide guidance on understanding various regulations and compliance for navigating legal landscapes, ensuring data security and protecting consumer rights. My 20+ years payment and financial experience helps businesses creating effective payment plans for their complex online payment and banking flows. This comprehensive approach is designed to empower businesses with the necessary knowledge and strategic insights to successfully navigate the intricate world of payments.

Thank you for your time and this riveting interview, Viktoria! We look forward to seeing you at the Prague Gaming & TECH Summit this March, learn more about the exciting updates in the ever-evolving world of payments, and get our books signed!

Conferences in Europe

HIPTHER’s European Gaming Congress 2025 Marks Record Attendance and Announces Marek Plota as Ambassador of the HIPTHER Warsaw Summit

Reading Time: 3 minutes

The 2025 edition of the European Gaming Congress (EGC) closed its doors in Warsaw with record-breaking attendance, a strengthened industry footprint, and an announcement that marks a new chapter for HIPTHER’s European expansion: in 2026, EGC officially evolves into the HIPTHER Warsaw Summit with renowned legal expert Marek Plota appointed as its first Ambassador.

Held across two content-rich stages – the Compliance & Operations Lad and the TechXperience Stage – alongside the hands-on HIPTHER Academy Workshops, EGC 2025 delivered its most ambitious program to date. Attendance has now tripled compared to its reintroduction in 2023, establishing Warsaw as one of the most dynamic conversation hubs for gaming, compliance, and tech in Europe.

A European Outlook With Global Relevance

The Compliance & Operations Lab brought together regulators, lawyers, and industry specialists for a panoramic review of the evolving European ecosystem. Discussions spanned the Polish market’s legal framework, cross-border compliance from Paris to Berlin, key CEE territories, the Czech Republic and Romania, and an outlook on emerging priorities in the Baltics. Experts also explored global trends with a timely update on several LATAM jurisdictions.

A highlight of the Agenda was the IMGL Masterclass – “Regulators, Legislators, and the Power of One Voice: A Legal Strategy for Industry Unity” – which explored the future of collaborative governance and harmonization.

Fintech, taxation, licensing, and responsible gaming standards added essential layers to a program designed to help operators and suppliers navigate an increasingly interconnected regulatory landscape.

Tech, Innovation, and the Human Factor

On the TechXperience Stage, conversations shifted to the future:

– AI for competitive advantage

– The evolution of esports and startup innovation

– AEO & SEO trends redefining discoverability

– Personalization and the new player journey

– Cyber resilience in iGaming

– Strategic Event Preparation in B2B PR, Marketing & BizDev

These sessions brought together marketing leaders, technologists, founders, and innovators across iGaming, fintech, digital entertainment, and cybersecurity, underlining Warsaw’s emerging status as a cross-industry meeting point in Europe.

A Key Voice: Marek Plota’s Impactful Participation

Throughout the Congress, Marek Plota – Founding Attorney at RM Legal & Gaming in Poland – played a leading role as both moderator and speaker. His contributions spanned Poland’s gambling framework, European lessons for CEE markets, and strategic taxation and licensing standards. He also brought legal depth to the IMGL Masterclass, adding critical clarity to one of the most pressing topics for operators in the region.

Marek’s widely respected presence across national and international gaming markets, combined with his years-long collaboration with HIPTHER as panelist, moderator, sponsor, and advisor, made this year’s Congress a natural moment to formalize the partnership.

Introducing the Ambassador of the HIPTHER Warsaw Summit

HIPTHER is proud to announce Marek Plota as the Ambassador of the HIPTHER Warsaw Summit, beginning with the 2026 edition.

In his own words: “It’s a real honor to serve as an ambassador for the Hipther Warsaw Summit and the European Gaming Congress. My collaboration with Zoltan Tundik and the Hipther team goes back many years as a panelist, moderator, sponsor, and above all, as a friend. These events are truly unique in the global gaming and gambling conference calendar — intimate, insightful, and refreshingly personal. Unlike the vast expos, Hipther events give people a genuine chance to meet, talk, and exchange ideas without walking 50,000 steps from one meeting to another. We are already looking forward to the next editions and to working together to make these conferences a true must-have for everyone in the industry.”

Marek is a founder and a head of the legal team at RM Legal Law Firm and Gaming In Poland, jointly providing multidisciplinary and multijurisdictional support for leading international gambling operators in the Polish, European Union, and African markets. His gambling practice includes regulatory support at the pre and post-licensing stage, IT, and taxation services, as well as the unique service of performing a function of a gambling representative. RM Legal is the only law firm in Poland representing offshore companies operating legally in the Polish gambling market. Apart from gambling Marek specializes in corporate commercial law and international investment projects.

A New Era for Warsaw, Europe, and the Global Market

The transition from EGC to the HIPTHER Warsaw Summit marks a strategic evolution with HIPTHER enhancing the region’s growing importance: Poland now stands as a crossroads of regulatory influence, iGaming innovation, and international market expansion – connecting Western Europe, CEE, and fast-emerging global markets, from Africa to LATAM.

In 2026, the HIPTHER Warsaw Summit will continue shaping the conversations and connections that define the future of gaming and tech.

HIPTHER looks forward to welcoming the industry back to Warsaw next year for an even bigger, more influential, and more globally connected event – assisted by the expertise and vision of its new Ambassador.

The post HIPTHER’s European Gaming Congress 2025 Marks Record Attendance and Announces Marek Plota as Ambassador of the HIPTHER Warsaw Summit appeared first on European Gaming Industry News.

ADMIRAL Pay

NOVOMATIC Italia Showcases Innovation and Responsible Growth at SiGMA 2025

Reading Time: 3 minutes

NOVOMATIC Italia played a key role at SiGMA Central Europe 2025, one of the leading international events for the gaming and digital technology industry, which was held in Rome from November 4 to 6. The Group showcased ADMIRAL Pay, the payment institution authorised by the Bank of Italy, and Quigioco, its online gaming brand, presenting an integrated and sustainable vision for the future of payments and digital entertainment.

The synergy between the Quigioco gaming platform and ADMIRAL Pay was at the heart of NOVOMATIC Italia’s presence at SiGMA Central Europe 2025 was. This integrated solution offers legal gaming operators a concrete response to the ongoing transformation of the market, particularly in terms of regulatory compliance.

The combined structure of Quigioco and ADMIRAL Pay ensures fully compliant financial flow management by providing operators with technologically advanced tools that are aligned with the latest Italian legislative requirements. This infrastructure represents an integrated payment system and a complete digital ecosystem that is designed to support operators in an increasingly regulated and competitive market. The model is complemented by B2C solutions, including APay E-Wallet and APay Card, which interface seamlessly with the B2B architecture to expand additional growth opportunities.

Driving the market with technology and security

The collaboration between ADMIRAL Pay and Quigioco marks a key milestone for the Italian market: by adopting integrated digital payment systems, online gaming platforms can now deliver increasingly personalized and secure experiences to their users.

ADMIRAL Pay technology enables rapid conversion between cash and digital currency, ensuring instant and secure transactions that meet the highest international standards. For PVRs (Punti Vendita Ricarica: venues authorised to sell recharges for online gaming) and operators, this means access to an advanced payment tool that simplifies operations and guarantees efficiency, even during peak periods.

Meeting new regulatory and market demands

The digital payments and gaming sector in Italy is now subject to increasingly stringent regulatory standards that are designed to ensure maximum security, traceability and transparency. The integration of Quigioco and ADMIRAL Pay fully meets these requirements, offering a unique solution that strengthens compliance while enhancing the customer experience. By managing financial flows in a compliant manner, operators can reduce risks and provide players with immediate and secure access to their funds. This model translates into trust and long-term loyalty, creating value across the entire supply chain.

Responsibility and leadership: the pillars of the future

SiGMA Central Europe 2025 was also an opportunity to highlight NOVOMATIC’s commitment to promoting responsible gaming and continuous product innovation. The target is to maintain industry leadership by investing in technologies that not only enhance the user experience but also ensure maximum player protection and operator transparency.

“Our goal is to extend the success and expertise that have always defined NOVOMATIC Italia in the land-based sector into the digital world. We want to offer operators and players an integrated ecosystem that combines technology, security, and innovation, reaffirming our Group’s leadership in online gaming,” said Markus Buechele, CEO of NOVOMATIC Italia.

This strategic vision was recognized when NOVOMATIC Italia received the “B2B Industry Leader Italy 2025” award at the SiGMA B2B Awards, in honour of the company’s excellence and ongoing commitment to an innovative, responsible and sustainable approach to development. The Group is not only addressing evolving market and regulatory challenges but also paving the way for a future in which innovation and sustainability move forward together.

Through ADMIRAL Pay, Quigioco and the major innovations showcased at SiGMA, NOVOMATIC Italia demonstrates how the convergence of digital payments and online gaming can drive growth, security, and long-term sustainability across the industry. By being built on innovation, responsibility and strategic vision, this model is positioning the company at the forefront of a tech-driven and sustainable future.

The post NOVOMATIC Italia Showcases Innovation and Responsible Growth at SiGMA 2025 appeared first on European Gaming Industry News.

2026 iGaming Trends Report

Presenting Industry Trends and Celebrating 100 Brands: SOFTSWISS Shines at SiGMA Central Europe

Reading Time: 2 minutes

SOFTSWISS, a global tech leader in iGaming solutions, has wrapped up a remarkable showcase at SiGMA Central Europe 2025. From the launch of the 2026 iGaming Trends Report to the live-built Alfa Romeo 4C handover, the company once again demonstrated why it stands as the industry’s leading technology provider and creative pioneer.

One of the main highlights of the event was the official release of the 2026 iGaming Trends Report. The fourth edition offers a data-driven overview of the macro- and microtrends shaping the future of iGaming – from the industrialisation of AI to regulatory shifts, cybersecurity evolution, and the rise of brand trust.

To mark the launch, SOFTSWISS hosted the 2026 iGaming Trends Marathon, a four-hour live event featuring global thought leaders. In the opening panel discussion, Ivan Montik, Founder of SOFTSWISS, Heathcliff Farrugia, COO of SiGMA, and Pierre Lindh, CEO of NEXT.io, arranged the ‘Ultimate Forecast Duel,’ exploring which trends will define the industry’s next chapter.

Another key moment was the Alfa Romeo 4C gifting, organised to celebrate the launch of the 100th brand powered by SOFTSWISS software in 2025. The sports car, assembled live during the expo at the SOFTSWISS stand, became a symbol of the company’s engineering precision and team spirit.

During a special ceremony, Ivan Montik handed over the keys to one of SOFTSWISS’ valued partners, Lottu, represented by Hugo Baungartner, Chief Business Officer, marking another milestone in a long-standing partnership based on trust and shared success.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Casino Platform, the Game Aggregator with over 36,700 casino games, Affilka Affiliate Platform, the Sportsbook Software and the Jackpot Aggregator. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

The post Presenting Industry Trends and Celebrating 100 Brands: SOFTSWISS Shines at SiGMA Central Europe appeared first on European Gaming Industry News.

-

Hold and4 days ago

Hold and4 days agoPragmatic Play Rings in 2026 with Joker’s Jewels Hold & Spin™

-

iGaming News 20264 days ago

iGaming News 20264 days agoSpinomenal Rings in 2026 with Japanese-Inspired “Kami Reign Ultra Mode”

-

Five Elements Slot4 days ago

Five Elements Slot4 days agoPG Soft Concludes 2025 with High-Volatility Launch: Mythical Guardians

-

Aztec Slot3 days ago

Aztec Slot3 days agoEvoplay Unveils Sunstone Riches: An Aztec Adventure Powered by the Sun

-

Latest News4 days ago

Latest News4 days agoFrom ‘Mummyverse’ to Crash Games: Belatra Reviews a Landmark 2025

-

Bespoke Gaming Studio4 days ago

Bespoke Gaming Studio4 days agoCreedRoomz and Casumo Forge Strategic Partnership to Elevate Live Casino Experience

-

Akshat Rathee3 days ago

Akshat Rathee3 days agoIndian Esports 2026: Strategic Growth and the Asian Games Milestone

-

Brazil Betting Law3 days ago

Brazil Betting Law3 days ago2026 iGaming Regulatory Roadmap: Key Compliance Deadlines