Latest News

Sportradar Reports Strong First Quarter 2023 Results

Sportradar Group AG, a leading global technology company focused on enabling next generation engagement in sports through providing business-to-business solutions to the global sports betting industry, today announced financial results for its first quarter ended March 31, 2023.

First Quarter 2023 Highlights

Revenue in the first quarter of 2023 increased 24% to €207.6 million ($226.2 million)1 compared with the first quarter of 2022.

The RoW Betting segment, accounting for 52% of total revenue, grew 25% to €108.5 million ($118.3 million)1, primarily driven by strong performance from Managed Betting Services (MBS) and Live Odds.

The U.S. segment revenue grew 55% to €39.7 million ($43.3 million)1 compared with the first quarter of 2022, driven by higher sales of betting products as well as the Company’s digital advertising (ad:s) product. The U.S. segment generated positive Adjusted EBITDA2 for the third consecutive quarter with an Adjusted EBITDA2 margin of 17%.

Total Profit for the first quarter of 2023 was €6.8 million compared with €8.2 million for the same quarter last year. The Company’s Adjusted EBITDA2 in the first quarter of 2023 increased 37% to €36.7 million ($40.0 million)1 compared with the first quarter of 2022, demonstrating operational leverage from higher revenue despite increased investment into Artificial Intelligence (AI) for liquidity trading, and Computer Vision technology.

Adjusted EBITDA margin2 was 18% in the first quarter of 2023, an increase of 176 bps compared with the prior year period.

Adjusted Free Cash Flow2 in the first quarter of 2023 was €12.4 million, compared with €12.9 million for the prior year period, as a result of improved working capital management offset by an unfavorable impact from foreign currency exchange rates. The resulting Cash Flow Conversion2 was 34% in the quarter.

The Company’s customer Net Retention Ratio (NRR) was 120% in the first quarter of 2023, an improvement over the NRR from the fourth quarter of 2022 of 119%.

Carsten Koerl, Chief Executive Officer of Sportradar said: “We started fiscal 2023 on solid footing, as we continued to deliver strong top line growth, predominately by growing our value add products such as MBS and Live Odds in the Rest of World business, and strong, profitable growth in our U.S. segment. We are also demonstrating operational leverage as we continue to focus on cost discipline across the organization and invest prudently to grow our top line. We are confident that our ongoing product innovation in AI and computer vision will enable us to remain a market leader and increase shareholder value for our investors.”

Key Financial Measures

In millions, in Euros € Q1 Q1 Change

2023 2022 %

Revenue 207.6 167.9 24 %

Adjusted EBITDA2 36.7 26.7 37 %

Adjusted EBITDA margin2 18 % 16 % –

Adjusted Free Cash Flow2 12.4 12.9 (4 %)

Cash Flow Conversion2 34 % 48 % –

Segment Information

RoW Betting

Segment revenue in the first quarter of 2023 increased by 25% to €108.5 million compared with the first quarter of 2022. This growth was driven primarily by increased sales of the Company’s higher value-add offerings including MBS, which increased 40% to €37.1 million as well as Live Odds services which increased 29% year over year.

Segment Adjusted EBITDA2 in the first quarter of 2023 increased by 6% to €47.4 million compared with the first quarter of 2022. Segment Adjusted EBITDA margin2 decreased to 44% from 51% in the first quarter of 2022 due to increased investment in AI technology for MTS and Computer Vision technology. These investments will enable the Company to further grow revenue and improve its Adjusted EBITDA margin over time.

RoW Audiovisual (AV)

Segment revenue in the first quarter of 2023 decreased 3% to €44.6 million compared with the first quarter of 2022. Revenue was impacted by the expected completion of the Tennis Australia contract partially offset by growth in sales to new and existing customers.

Segment Adjusted EBITDA2 in the first quarter of 2023 increased 27% to €11.3 million compared with the first quarter of 2022. Segment Adjusted EBITDA margin2 improved to 25% in the first quarter of 2023 compared with 19% in the first quarter of 2022 due to savings associated with the completion of the Tennis Australia contract.

United States

Segment revenue in the first quarter of 2023 increased by 55% to €39.7 million ($43.3 million)1 compared with the first quarter of 2022. Results were driven by growth in core betting data products and the ad:s product.

Segment Adjusted EBITDA2 in the first quarter of 2023 was €6.8 million ($7.4 million)1 compared with a loss of (€6.4) million in the first quarter of 2022. This is the third consecutive quarter with positive Adjusted EBITDA2 indicating the strong operational leverage in the U.S. business model despite continuous investments. Segment Adjusted EBITDA margin23improved to 17% from (25%) compared with the first quarter of 2022.

Costs and Expenses

Purchased services and licenses in the first quarter of 2023 increased by €11.6 million to €48.4 million compared with the first quarter of 2022, reflecting continuous investments in content creation, greater event coverage and higher scouting costs. Of the total purchased services and licenses, approximately €14.0 million were expensed sports rights.

Personnel expenses in the first quarter of 2023 increased by €25.2 million to €77.5 million compared with the first quarter of 2022. The increase was primarily as a result of increased investment for growth which was driven by higher headcount associated with investments in AI and Computer Vision, increased share based compensation, and inflationary adjustments for labor costs.

Other operating expenses in the first quarter of 2023 increased by €1.7 million to €21.2 million, compared with the first quarter of 2022, primarily as a result of higher software license costs, higher audit fees and implementation costs for a new financial management system.

Total sports rights costs in the first quarter of 2023 decreased by €2.8 million to €51.2 million compared with the first quarter of 2022, primarily due to savings from the expected completion of the Tennis Australia contract.

Recent Company Highlights

SportradarSportradar renewed its partnership with the Big Ten Network extends partnership with the Big 10 Conference to broaden its footprint in the U.S. college space by powering its OTT platform B1G+ through the 2024-2025 college athletics season. Sportradar is providing its technology and data-driven OTT solutions to manage B1G+’s OTT web, mobile and connected TV apps, UX/UI design and third party integration.

Sportradar announced the integration of its ad:s technology into Snapchat, creating a new channel for betting operators to engage and acquire customers using the Company’s paid social media advertising service. Using Snapchat’s advanced age and location targeting capabilities to ensure only legally qualified audiences are reached, betting operators have a potential to reach Snapchat’s 350 million daily active users and over 750 million monthly active users.

Sportradar was selected as the successful bidder for the global Association of Tennis Professionals (ATP) data and streaming rights starting in 2024 as a result of the Company’s commitment to product innovation. Sportradar offers the broadest reach to tennis fans globally and has been a supplier of official ATP Tour and Challenger Tour secondary data feeds since 2022.

Sportradar published its first Sustainability Report highlighting its commitment to sustaining its business, communities and environment. The report is based on Sportradar’s five key sustainability priorities, sustainability, people, oversight, respect and technology-led (SPORT), which are aligned with the standards and framework of the Sustainability Accounting Standards Board (SASB).

Sportradar Integrity Services released its second Annual Report on Betting Corruption and Match-Fixing in 2022, revealing the Company had identified 1,212 suspicious matches across 12 sports in 92 countries, an increase of 34% year over year. The overall data confirmed that 99.5% of sporting events are free from match-fixing, with no single sport having a suspicious match ratio of greater than 1%.

Sportradar named technology executive Gerard Griffin as Chief Financial Officer effective May 9, 2023. Mr Griffin previously served as CFO of Zynga Inc., a global leader in interactive entertainment, and will be responsible for Sportradar’s accounting, finance and investor relations functions. Mr. Griffin brings more than 25 years of leadership experience in financial and operational management within the gaming, media and technology sectors.

Annual Financial Outlook

Sportradar reaffirmed its annual outlook provided on March 15, 2023, for revenue and Adjusted EBITDA2 for fiscal 2023 as follows:

Sportradar expects its revenue for fiscal 2023 to be in the range of €902.0 million to €920.0 million ($983.2 million to $1002.8 million)1, representing growth of 24% to 26% over fiscal 2022.

Adjusted EBITDA2 is expected to be in a range of €157.0 million to €167.0 million ($171.1 million to $182.0 million)1, representing 25% to 33% growth versus last year.

Adjusted EBITDA margin2 is expected to be in the range of 17% to 18%.4

Powered by WPeMatico

affiliate marketing

N1 Partners Takes Flight in Barcelona: Helicopter Awarded at iGB Affiliate 2026 Finale

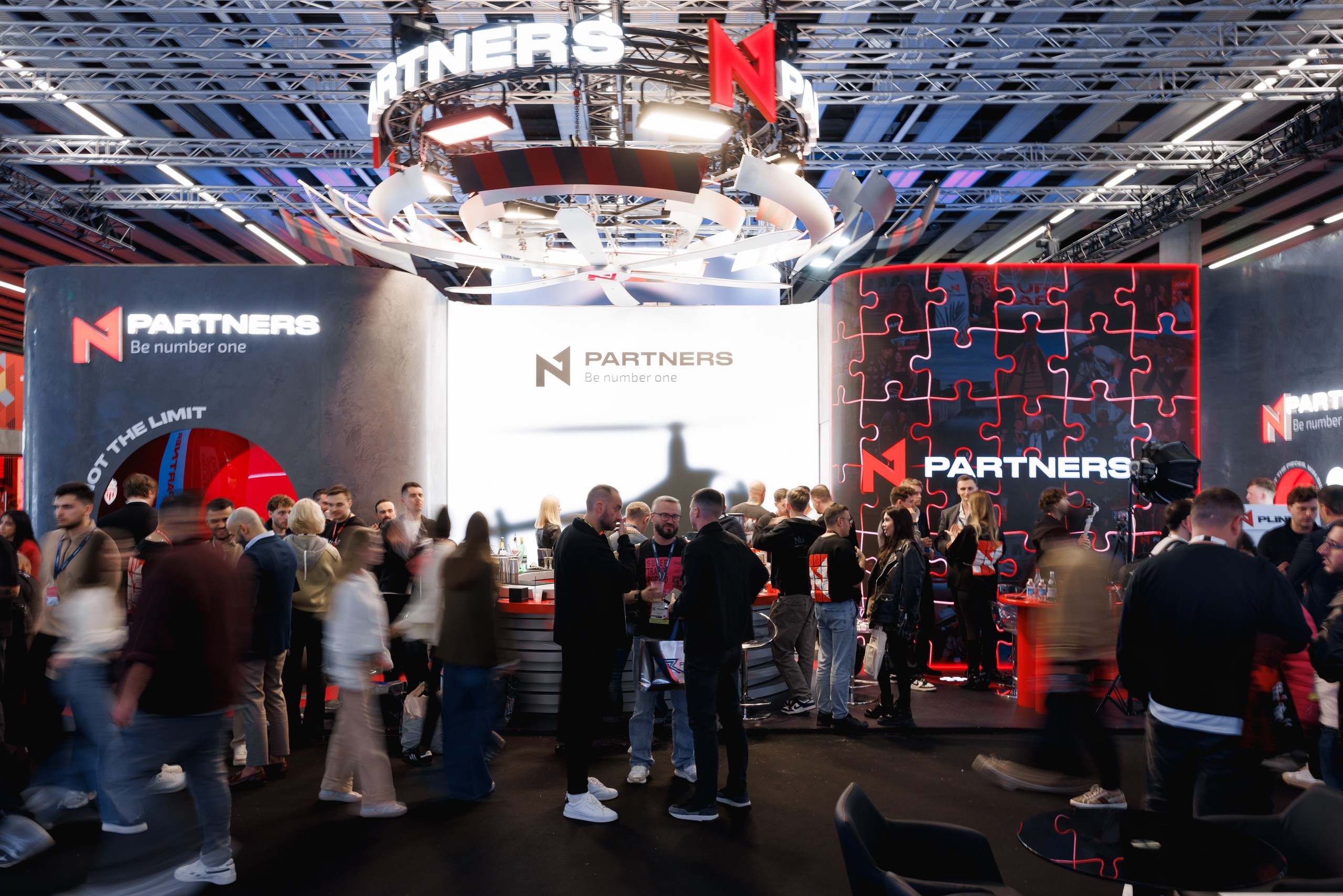

The curtains have closed on iGB Affiliate 2026, but the echoes of N1 Partners’ massive presence are still vibrating through the halls of the Fira de Barcelona. After two days of high-stakes networking and over 500 business meetings, the company concluded the event by awarding a Robinson R22 Beta II helicopter to the grand winner of the N1 Puzzle Promo.

A Hub of Industry Activity

From January 20 to 21, the N1 Partners stand (80-C80) served as a primary nervous system for the expo floor. The team maintained a relentless pace, facilitating hundreds of discussions regarding traffic strategies and custom deals.

Beyond the boardroom-style meetings, the stand offered a more interactive “Plinko” activity and distributed over 300 branded merchandise packs, ensuring the N1 brand remained visible across the entire conference.

Media Spotlight and Thought Leadership

The company’s influence extended beyond the booth, with leadership participating in more than 10 interviews and podcasts. These sessions focused on sustainable growth within the iGaming sector and evolving affiliate expectations, further solidifying N1 Partners’ reputation as a transparent and performance-driven program.

The Grand Finale: A Night to Remember

The highlight of the week was undoubtedly the N1 Puzzle Promo Party, an exclusive, closed-format celebration that saw over 2,000 registrations. While only 600 guests could be accommodated, the venue was packed with the industry’s top decision-makers and affiliates.

The atmosphere reached a fever pitch as the winners of the N1 Puzzle Promo leaderboard were announced:

| Rank | Partner Name |

| 1st Place (Helicopter Winner) | Cash Splash |

| 2nd Place | Advertise |

| 3rd Place | Traffic Squad |

| 4th Place | Seven Group |

| 5th Place | Alfaleads Network |

The evening concluded with a live performance from a surprise headline guest and high-energy DJ sets, marking the successful end of a campaign that was recently named Best Advertising and Marketing Campaign at the European iGaming Awards.

The post N1 Partners Takes Flight in Barcelona: Helicopter Awarded at iGB Affiliate 2026 Finale appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

affiliate marketing

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

iGB Affiliate 2026 in Barcelona has officially come to an end, marking two powerful days for the affiliate industry and an unforgettable grand finale for N1 Puzzle Promo. N1 Partners wrapped up the conference days with high-intensity networking, strong media attention and a large-scale final event that brought the community together.

From January 20 to 21, N1 Partners welcomed partners, media and industry leaders at stand 80-C80, which quickly became one of the most dynamic meeting points on the expo floor.

A Key Meeting Point During iGB Affiliate 2026

Throughout both conference days, the N1 Partners stand maintained a steady flow of visitors and ongoing media attention. The scale of partner engagement and the volume of conversations naturally positioned the stand as a focal point for meetings, interviews and informal discussions across the venue.

Over the course of the conference, the team held more than 500 meetings, covering traffic strategies, custom deals and long-term collaboration opportunities. In parallel, 300+ branded merch packs were distributed to stand visitors, reinforcing brand visibility and partner engagement throughout the event.

The stand experience combined business and interaction in a relaxed format. Guests enjoyed signature cocktails while discussing top-performing deals, took part in the Plinko activity to win exclusive N1 Partners merchandise, and used the space to build new connections, strengthen existing partnerships and move forward with concrete business agreements.

Strong Media Engagement and Industry Dialogue

iGB Affiliate 2026 also served as an important media platform for N1 Partners. During the conference, the team took part in over 10 interviews and podcasts, sharing perspectives on affiliate marketing trends, partner expectations and sustainable growth within the iGaming sector.

This level of media interest reflected the market’s attention to N1 Partners’ approach and reinforced the company’s position as a visible and trusted affiliate program.

The Grand Finale. N1 Puzzle Promo Party

The highlight of the week took place after the first day of the iGB Affiliate conference, when N1 Partners hosted the grand final event of N1 Puzzle Promo in Barcelona. The evening was designed as a closed-format celebration, welcoming a carefully selected audience of partners, industry leaders and key players from the iGaming community.

The event generated significant interest well ahead of time, with over 2,000 registrations, while attendance exceeded 600 guests, filling the venue with decision-makers, top affiliates and long-term partners. The closed nature of the event and limited access created a high level of anticipation and made the finale one of the most talked-about gatherings of the conference week.

During the night, N1 Partners revealed the winner of the main N1 Puzzle Promo prize, awarding a Robinson R22 Beta II helicopter, alongside exclusive giveaways for guests.

As part of the finale, N1 Partners proudly presented the finalists of N1 Puzzle Promo, recognising the partners who consistently maintained a strong pace throughout the campaign and secured the top positions on the leaderboard.

- 1st place: Cash Splash

- 2nd place: Advertise

- 3rd place: Traffic Squad

- 4th place: Seven Group

- 5th place: Alfaleads Network

The program was complemented by DJ sets and a live performance from the event’s headline guest, turning the evening into a landmark moment that combined celebration, entertainment and strong brand presence.

Recognising N1 Puzzle Promo’s Impact

In addition to its industry presence at iGB Affiliate 2026, N1 Puzzle Promo was recently recognised at the European iGaming Awards, where it was named Best Advertising and Marketing Campaign. This accolade highlights the campaign’s global reach and impact, acknowledging it as one of the most innovative and performance-driven marketing initiatives in the iGaming industry.

Closing the Barcelona Chapter

N1 Partners expressed appreciation to everyone who visited the stand, took part in meetings and contributed to the energy of iGB Affiliate 2026.

Special thanks were also extended to all guests who joined the N1 Puzzle Promo grand final party and helped turn the evening into one of the most memorable moments of the conference week.

The Barcelona chapter has closed, but the momentum continues.

Be number one with N1 Partners!

The post N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona appeared first on Americas iGaming & Sports Betting News.

Latest News

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

iGB Affiliate 2026 in Barcelona has officially come to an end, marking two powerful days for the affiliate industry and an unforgettable grand finale for N1 Puzzle Promo. N1 Partners wrapped up the conference days with high-intensity networking, strong media attention and a large-scale final event that brought the community together.

From January 20 to 21, N1 Partners welcomed partners, media and industry leaders at stand 80-C80, which quickly became one of the most dynamic meeting points on the expo floor.

A Key Meeting Point During iGB Affiliate 2026

Throughout both conference days, the N1 Partners stand maintained a steady flow of visitors and ongoing media attention. The scale of partner engagement and the volume of conversations naturally positioned the stand as a focal point for meetings, interviews and informal discussions across the venue.

Over the course of the conference, the team held more than 500 meetings, covering traffic strategies, custom deals and long-term collaboration opportunities. In parallel, 300+ branded merch packs were distributed to stand visitors, reinforcing brand visibility and partner engagement throughout the event.

The stand experience combined business and interaction in a relaxed format. Guests enjoyed signature cocktails while discussing top-performing deals, took part in the Plinko activity to win exclusive N1 Partners merchandise, and used the space to build new connections, strengthen existing partnerships and move forward with concrete business agreements.

Strong Media Engagement and Industry Dialogue

iGB Affiliate 2026 also served as an important media platform for N1 Partners. During the conference, the team took part in over 10 interviews and podcasts, sharing perspectives on affiliate marketing trends, partner expectations and sustainable growth within the iGaming sector.

This level of media interest reflected the market’s attention to N1 Partners’ approach and reinforced the company’s position as a visible and trusted affiliate program.

The Grand Finale. N1 Puzzle Promo Party

The highlight of the week took place after the first day of the iGB Affiliate conference, when N1 Partners hosted the grand final event of N1 Puzzle Promo in Barcelona. The evening was designed as a closed-format celebration, welcoming a carefully selected audience of partners, industry leaders and key players from the iGaming community.

The event generated significant interest well ahead of time, with over 2,000 registrations, while attendance exceeded 600 guests, filling the venue with decision-makers, top affiliates and long-term partners. The closed nature of the event and limited access created a high level of anticipation and made the finale one of the most talked-about gatherings of the conference week.

During the night, N1 Partners revealed the winner of the main N1 Puzzle Promo prize, awarding a Robinson R22 Beta II helicopter, alongside exclusive giveaways for guests.

As part of the finale, N1 Partners proudly presented the finalists of N1 Puzzle Promo, recognising the partners who consistently maintained a strong pace throughout the campaign and secured the top positions on the leaderboard.

- 1st place: Cash Splash

- 2nd place: Advertise

- 3rd place: Traffic Squad

- 4th place: Seven Group

- 5th place: Alfaleads Network

The program was complemented by DJ sets and a live performance from the event’s headline guest, turning the evening into a landmark moment that combined celebration, entertainment and strong brand presence.

Recognising N1 Puzzle Promo’s Impact

In addition to its industry presence at iGB Affiliate 2026, N1 Puzzle Promo was recently recognised at the European iGaming Awards, where it was named Best Advertising and Marketing Campaign. This accolade highlights the campaign’s global reach and impact, acknowledging it as one of the most innovative and performance-driven marketing initiatives in the iGaming industry.

Closing the Barcelona Chapter

N1 Partners expressed appreciation to everyone who visited the stand, took part in meetings and contributed to the energy of iGB Affiliate 2026.

Special thanks were also extended to all guests who joined the N1 Puzzle Promo grand final party and helped turn the evening into one of the most memorable moments of the conference week.

The Barcelona chapter has closed, but the momentum continues.

Be number one with N1 Partners!

-

Cash Collect Mechanic7 days ago

Cash Collect Mechanic7 days agoRed Papaya Launches Nova Blast Ultra: A Cosmic Slot Adventure via Microgaming

-

AI4 days ago

AI4 days agoPrimero Games Uses XGENIA for Their First AI-Generated Slot Game

-

Africa7 days ago

Africa7 days agoLogifuture’s Simulate Forecasts Morocco AFCON Glory After 1,000 Final Simulations

-

Balkans4 days ago

Balkans4 days agoKiril Kirilov takes on new leadership role at CT Interactive

-

Baltic Tech Week4 days ago

Baltic Tech Week4 days agoHIPTHER Baltics Announces Riga Event and Strategic Partnership with LexLegas

-

ALGS 2026 Championship4 days ago

ALGS 2026 Championship4 days agoS8UL Esports secures historic top five finish at ALGS 2026 Championship; bags INR 1 crore in prize money

-

Compliance Updates4 days ago

Compliance Updates4 days agoSEON Launches Identity Verification Built on Real-Time Fraud Intelligence

-

College Sport Prediction Markets4 days ago

College Sport Prediction Markets4 days agoNCAA Urges CFTC to Suspend College Sport Prediction Markets