Latest News

Light & Wonder, Inc. Reports Second Quarter 2024 Results

Light & Wonder, Inc. reported results for the second quarter ended June 30, 2024.

We maintained strong momentum in the second quarter, delivering an 8th consecutive quarter of double-digit consolidated revenue growth year-over-year, and continued execution on our diverse content roadmap and cross-platform strategy. Consolidated revenue grew 12%, driven by continued strong performance across all our businesses, resulting in robust earnings growth:

- Gaming revenue increased to $539 million, up 14% compared to the prior year period, primarily driven by global Gaming machine sales growth, which increased 32%, coupled with record Gaming operations unit expansion in the North American installed base and growth across Gaming systems, resulting in AEBITDA growth and margin expansion of 17% and 100 basis points, respectively.

- SciPlay revenue grew to $205 million, an 8% increase from the prior year period, driven by the social casino business, which continues to outpace the market and gain share on strong payer metrics, while growing our direct-to-consumer platform and expanding AEBITDA margin by 300 basis points.

- iGaming revenue grew to $74 million, a 6% increase from the prior year period, primarily reflecting continued momentum in North America, while the prior year benefited from $2 million in license termination fees.

First half 2024 consolidated revenue increased 13% to $1.6 billion as we continued advancement towards our long-term financial targets and returned $175 million to our shareholders through share repurchases.

Matt Wilson, President and Chief Executive Officer of Light & Wonder, said, “Light & Wonder continues to capitalize on opportunities underpinned by our scale and diversified product offerings as demonstrated through the growth momentum across the business. We saw strong progress in the Gaming business as the expansion of units in the North American installed base reached an inflection point. Our global presence enables further product refinement and market penetration with our suite of games and casino solutions. We continue to develop our catalog of proven, evergreen franchises to bring the most engaging experiences to our players, leveraging the power of our portfolio across land-based, social and iGaming platforms. The uplift that we have continued to see across the business is a testament to the quality of the talent and culture in our organization. I am pleased with the continued momentum that we are seeing and know that the best is yet to come.”

Oliver Chow, Chief Financial Officer of Light & Wonder, added, “Our 13th consecutive quarter of consolidated revenue growth once again reflects the strength of our combined business and solid financial profile. We continue to see improved earnings quality with consistent growth and healthy margins, all while investing back into the business to scale for the future. The new $1.0 billion share repurchase program is a testament to the value we see in the business and confidence in our ability to execute to plan over the long-term. We believe we will continue to create significant value for our shareholders through enhanced cash flow generation initiatives while delivering on our financial targets.”

LEVERAGE AND CAPITAL RETURN UPDATE

- Principal face value of debt outstanding(1) was $3.9 billion, translating to a net debt leverage ratio(2) of 3.0x as of June 30, 2024. Our net debt leverage ratio(2) decreased by 0.1x from December 31, 2023, and remained within our targeted net debt leverage ratio(2) range of 2.5x to 3.5x.

- Returned $175 million of capital to shareholders through the repurchase of approximately 1.8 million shares of L&W common stock during the first half of 2024 and completed the full $750 million share repurchase authorization. Under the initial share repurchase program, we purchased 11.2 million common shares, or 11.6% of shares outstanding at the inception of the program on March 1, 2022. The average purchase price of $66.72 per share represents a 34% discount to yesterday’s closing price of $100.71. In June 2024, the Board of Directors approved a new three-year share repurchase program(3) of up to $1.0 billion of the Company’s outstanding common stock through June 12, 2027.

- Repriced our Term Loan B again in July 2024, reducing our interest rate by 50 basis points resulting in a decrease in annualized interest costs of approximately $11 million, or $19 million in annualized interest costs reduction including our January repricing.

(1) Principal face value of debt outstanding represents outstanding principal value of debt balances that conform to the presentation found in Note 10 to the Condensed Consolidated Financial Statements in our March 31, 2024 Form 10-Q.

(2) Additional information on non-GAAP financial measures presented herein is available at the end of this release.

(3) The program may be conducted via open market repurchases, privately negotiated transactions, including block trades, accelerated share repurchases, issuer tender

offers or other derivative contracts or instruments, “10b5-1” plans, or other financial arrangements, and may be suspended or discontinued at any time.

iGaming

N1 Insights: The iGaming Trends Everyone Will Be Talking About This March

In January, N1 Partners launched a monthly insights series covering real market data and campaign performance across traffic sources, GEOs, content, technology, and regulation. March’s update shows the industry moving beyond winter testing into a phase defined by precision optimization, scalable funnels, and data-driven decision-making.

Below is a practical breakdown of what is changing now — and what to expect next.

Traffic and Performance

Facebook remains the most stable traffic driver, while TikTok and ASO continue to deliver bursts of strong performance but with higher volatility. In SEO, optimization aligned with E-E-A-T standards is now essential. Some sites generate clicks but fail to convert because they lack authority or real user value.

Key SEO developments include:

-

Growing adoption of cross-brand projects that adapt faster to algorithm shifts

-

Increased sports traffic driven by a busy Q1 events calendar

-

Ongoing cleanup of PBN networks from search results

-

Shift from link volume toward content quality and UX

Brands are also tightening traffic quality requirements. Evaluation windows are shrinking to the current month, with early engagement and real player activity becoming decisive factors for scaling.

Primary performance metrics now include:

-

ROAS and Average Deposit Count for SEO

-

Deposit-to-redeposit ratio, LTV, and week 2–4 profitability for paid traffic

Scaling strategies remain channel-specific. PPC prioritizes volume, Facebook focuses on stable ROI, and SEO growth is increasingly driven by parasite SEO, niche review sites, localized keywords, and video-based funnels.

GEO Priorities

Austria and Germany continue to deliver strong monetization across paid channels. SEO growth opportunities are emerging in Canada, Norway, Denmark, New Zealand, Ireland, and Slovenia, where niche content and cross-brand strategies are expanding.

More challenging markets include Germany, Australia, and Canada due to regulatory pressure and competition. Stricter compliance requirements and deposit limits across Tier-1 regions are reshaping acquisition strategies and pushing affiliates toward hybrid traffic models combining organic, social, and paid sources.

SEO Content and Algorithms

Traditional link-building is losing effectiveness as search engines prioritize internal quality signals such as usability, speed, structure, and genuine value.

Declining strategies include:

-

PBN networks and bulk backlink purchases

-

Broad keyword targeting without specialization

-

Volume-driven long-form content

-

Generic, non-specialized pages

Niche expertise and user-focused content are becoming the new baseline.

Economics, Costs, and ROI

Traffic costs have eased slightly after the holiday period, making March a favorable operational window. However, global events can quickly influence auctions and volumes.

The strongest driver of ROI is now player engagement depth, prompting operators to optimize onboarding, deposits, and retention rather than focusing solely on acquisition.

High-quality traffic remains scarce, giving affiliates greater negotiating power. Brands offering flexible terms, fast feedback, and collaborative optimization are becoming preferred partners.

Overall, the market is stabilizing around efficiency rather than scale. Traffic volume remains available, but profitability, transparency, and sustainable player value now define success.

Conclusion

2026 is shaping up to be a year of optimization and selectivity. Market leaders will be those who adapt quickly, prioritize product experience, and build strategies around long-term player value.

N1 Partners supports affiliates with flexible cooperation models, fast response to market shifts, and access to 14+ casino and sportsbook brands across 10+ Tier-1 GEOs — offering CPA up to €700, RevShare up to 45% + NNCO, and hybrid deals for top partners.

Be number one with N1.

The post N1 Insights: The iGaming Trends Everyone Will Be Talking About This March appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

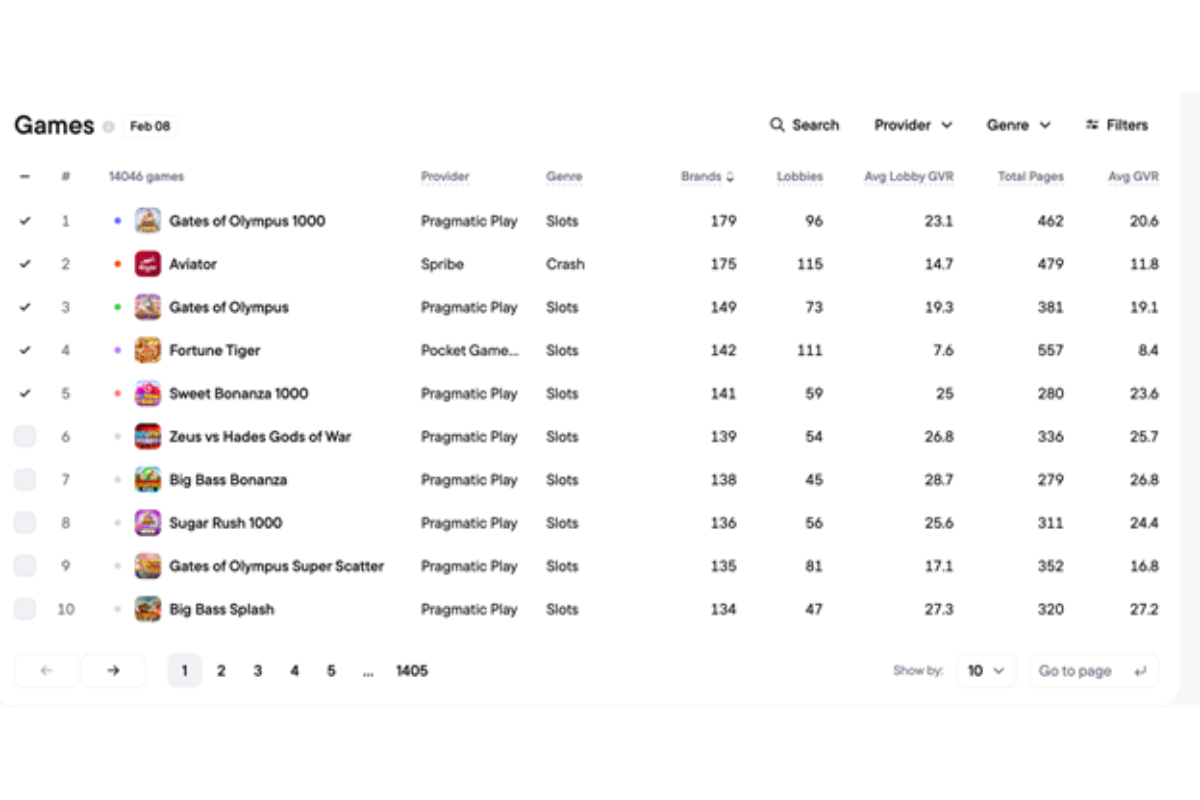

Slots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals

Slots account for 85% of online casino titles in Brazil, with more than 11,700 games competing for visibility across 500+ platforms, according to a new report from Blask. While slots dominate lobby space, player attention is far more concentrated.

Measured by Share of Interest, which tracks organic search demand, a small number of games capture the majority of attention. Fortune Tiger alone generates nearly 30% of total player interest across all categories.

Crash games remain limited in supply, with just 225 titles in the ecosystem, yet they consistently rank among the most searched and prominently placed games. Demand within the category is uneven, however. JetX leads crash-game search interest despite appearing less frequently in prime lobby positions, suggesting player familiarity and peer influence outweigh operator promotion.

Live casino games maintain steady but modest demand, led by Blackjack and Crazy Time, while instant win titles show minimal traction, with only three games registering measurable interest.

Across the market, the top 10 games capture nearly two-thirds of total player attention, leaving hundreds of titles to compete for the remainder. The findings highlight a defining trend in Brazil’s iGaming sector: understanding player attention is becoming more important than expanding game inventories.

The analysis is based on Blask Games technology, which tracks lobby placement through computer vision and maps player search behaviour across regulated and offshore operators. A full report is available here.

The post Slots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

iGaming

N1 Insights: The iGaming Trends Everyone Will Be Talking About This March

In January, N1 Partners launched a new series featuring monthly iGaming market insights – and in March, the team continues to share practical analytics. Each month, N1 Partners’ iGaming affiliate marketing experts break down key changes across traffic sources, GEOs, content, technologies, regulation, and other areas, drawing on real data, campaign statistics, and the experience of the industry’s strongest players.

March shows that the market is окончательно moving out of its winter testing mode and shifting toward precise optimization and scaling. The focus is now on the efficiency of funnels, resilience to platform updates, and process technological maturity. Competition is intensifying, and decisions are becoming increasingly data-driven and strategic.

What is already changing – and what to prepare for in the coming month – we break down step by step.

Part 1: Traffic and Performance

1.1 Top trending traffic sources in March and upcoming tendencies

In terms of dynamics, Facebook remains the main driver, continuing to demonstrate the highest level of stability among traffic sources. TikTok and ASO periodically show strong results as well; however, these channels are characterized by high volatility and do not always provide a predictable traffic volume.

Speaking about SEO traffic, the following trends can be highlighted:

1. Ongoing content optimization in line with E-E-A-T principles. We are seeing cases where websites generate clicks but fail to convert traffic because Google does not perceive them as sufficiently useful or authoritative for users.

- A growing interest in the cross-brand approach. Such projects tend to adapt more easily to market and algorithm changes. We are also observing an increase in sports-related traffic driven by a packed events calendar in Q1 2026.

- In addition, there is a continued gradual cleanup of PBN websites from search results, along with a shift in focus from traditional link-building toward the development of high-quality content.

1.2 Brand requirements for traffic quality

More and more brands are revising their performance evaluation approach, shifting from a 3-4 month horizon to analyzing results within the current month. This significantly increases traffic quality requirements from the very start of cooperation.

No one expects 100% ROI in the first month; however, traffic must demonstrate positive dynamics and, most importantly, bring in active and “real” players. Early engagement metrics and audience quality indicators are becoming the key factors in decisions regarding scaling and further collaboration.

1.3 KPIs and traffic evaluation metrics

In the SEO traffic segment, the key metrics that determine further activity and potential caps are ROAS and Average Deposit Count. These indicators make it possible to assess not only the initial conversion but also the real value of the acquired player.

As for Facebook, PPC, ASO, and other traffic sources, the market is increasingly shifting its focus from volume to quality. Primary attention is given to the deposit-to-redeposit ratio, player LTV, and stream profitability in weeks two, three, and four. Monetization depth and behavioral metrics are becoming the decisive factors when it comes to scaling decisions and budget allocation.

1.4 Scaling approaches that will deliver the best results in March

Much still depends on the GEO and traffic source – there is no universal scenario. For PPC, maintaining volume remains the priority, while for Facebook, stable ROI becomes the key factor. The approach to performance evaluation is becoming increasingly differentiated depending on the acquisition channel.

From an SEO perspective, several consistent trends can be highlighted:

- Parasite SEO.

Across most of our key GEOs, we are seeing a sharp increase in new content published on high-authority platforms such as Trustpilot, Reddit, Yahoo, and other major domains. - SEO funnels with YouTube channels.

Despite some skepticism, this format delivers both volume and stream profitability. Video content strengthens trust and improves organic traffic conversion rates. - Niche review websites.

Large portals are entering narrow segments less frequently, while smaller players are successfully capturing rankings for highly specific keyword queries. These are often simple, strictly keyword-optimized one-page websites that nonetheless demonstrate strong performance. - Local keyword queries.

These perform especially well in smaller but high-income GEOs such as Denmark, Norway, Austria, and Switzerland. In these markets, a localized approach results in significantly higher conversion rates due to the audience’s strong purchasing power. - Cross-brand strategies.

However, they are effective only with strong coordination: a responsive affiliate manager on the webmaster’s side and a strong product manager on the brand’s side who can quickly assess traffic quality and provide prompt feedback on the funnel. Without fast communication, this model loses efficiency.

Part 2: GEO Priorities

2.1 Tier-1 GEOs with the highest growth potential in March

Across Facebook, PPC, and other paid traffic sources, several GEOs stand out with relatively small but high-quality audiences. Players demonstrate consistent activity and strong monetization, particularly in Austria and Germany. This remains a fairly traditional trend.

In terms of SEO, strong potential is currently emerging in Canada, Norway, Denmark, New Zealand, Ireland, and Slovenia. In these countries, parasite SEO is actively developing, cross-brand strategies are performing effectively, and new niche review websites are entering the market with well-structured content and carefully designed UX. Competition is gradually intensifying; however, due to the overall improvement in project quality, the potential for organic scaling remains high.

2.2 More challenging GEOs to enter in March

When it comes to SEO traffic, the situation across key Tier-1 markets remains stable: Germany, Australia, and Canada continue to be characterized by high competition and increased regulatory risks. In Europe, strict GDPR compliance requirements remain in force, where data handling mistakes can lead to significant fines.

Australia also enforces stringent requirements from local regulators. Under such conditions, SEO in these GEOs requires a cautious strategy, strong legal expertise, and heightened attention to compliance.

The situation with Facebook and PPC traffic looks different. The market has accumulated substantial expertise in Tier-1 regions, so Facebook traffic is likely to remain stable and continue performing effectively with proper ROI management.

At the same time, PPC in Tier-1 is becoming increasingly challenging: growing competition, stricter platform policies, and rising auction costs may make this year particularly demanding for partners who primarily rely on PPC traffic.

2.3 March regulatory changes impacting SEO strategies in Tier-1 GEOs

The trend toward stricter regulatory measures in Tier-1 markets will continue to gain momentum. Increased tax pressure and tighter deposit limits per player are already shaping a steady trend: part of the audience in Europe is gradually shifting toward “grey” operators. In turn, this is attracting new webmasters to these markets.

At the same time, tightening restrictions are significantly narrowing traditional funnels and limiting promotional opportunities in the conventional SEO sense. As a result, the market is increasingly moving toward hybrid models, where organic traffic is combined with Facebook, Telegram, social sources, and parasite SEO funnels.

Such diversification is no longer just a competitive advantage – it is becoming a necessity to maintain both traffic volume and quality amid growing regulatory pressure.

Part 3: SEO Content and Algorithms

3.1 How will the effectiveness of classic link building change?

There are already clear precedents showing a decline in the effectiveness of traditional link building. Previously, it was possible to purchase 100 backlinks, with 50 getting indexed and 10 actually ranking and delivering tangible results. Today, there is a high probability that all 100 links may bring little to no measurable impact.

Search engines are increasingly shifting their focus from external factors to the internal quality of a website. Priority is given to navigation usability, page load speed, well-structured content architecture, clear information formatting, and genuine user value. Under these conditions, a mechanical backlink growth strategy is losing effectiveness and requires a shift toward a more comprehensive approach focused on product quality and user experience.

3.2 Which SEO approaches will stop working as effectively as before?

- PBNs and mass purchasing of cheap backlinks are gradually losing relevance.

- A broad keyword set no longer guarantees high traffic volume.

- Long-form content created solely for volume is becoming ineffective.

- Generic, one-size-fits-all content is giving way to highly niche, specialized content.

Part 4: Economics, Costs, and ROI Forecasts

4.1 How will traffic costs change in March compared to the beginning of the year?

After the holiday period, the auction traditionally cools down slightly, making traffic costs more manageable. March is likely to become a favorable period for operations, with traffic available at more optimal prices.

At the same time, it is crucial to closely monitor global events, as auctions tend to react very sensitively to external factors. This can significantly impact both traffic costs and volumes.

4.2 Which factors will have the strongest impact on ROI in March?

For advertisers, the key factor remains player engagement with the product itself. The depth of interaction with the platform directly affects overall economics, retention, and long-term user value.

As a result, many advertisers are actively testing tailored approaches that focus less on acquisition volume and more on the quality of the product experience and the logic of the user flow. Optimizing onboarding, simplifying deposit processes, and strengthening retention strategies are becoming top development priorities.

4.3 How open will brands be in March to flexible deals for high-quality traffic?

This factor influences the market more strongly than it may seem. While overall traffic volume remains sufficient, truly high-quality traffic is becoming increasingly scarce. Under these conditions, partners are becoming more selective when choosing brands to work with.

Priority is given to products that demonstrate flexibility – those willing to negotiate individual terms, respond quickly to traffic quality feedback, and avoid imposing strict caps without objective reasons. Flexibility and openness to dialogue are becoming key competitive advantages in attracting and retaining strong webmasters.

4.4 How will the balance between traffic volume and margins change in March?

No significant changes are expected in March, as the market is likely to move toward stabilization. After active periods, market players tend to balance their performance metrics and establish more predictable unit economics.

There is still enough traffic volume in the market; however, the priority is shifting from quantity to quality. No one is willing to pay simply for traffic anymore – the key factors are efficiency, audience engagement, and actual profitability.

In conclusion, 2026 is likely to become a year of optimization and selection. Those who can quickly adapt to change, work closely with partners on the product side, and build strategies around real player value will be the ones who succeed. In a market saturated with volume, quality, transparency, and sustainable ROI are becoming the main competitive advantages.

The N1 Partners team of professionals understands the specifics of different traffic sources, GEOs, and cooperation models. That’s why we are ready to build flexible terms, respond quickly to market changes, and help our partners maintain stability even amid increasing pressure from regulators and platforms.

- 14+ casino and sportsbook brands with Reg2Dep up to 70%

- 10+ Tier-1 GEOs

- CPA up to €700 and RevShare up to 45% + NNCO for top partners + hybrid models

Be number one with N1!

The post N1 Insights: The iGaming Trends Everyone Will Be Talking About This March appeared first on Americas iGaming & Sports Betting News.

-

ACMA4 days ago

ACMA4 days agoACMA Blocks More Illegal Online Gambling Websites

-

Aurimas Šilys4 days ago

Aurimas Šilys4 days agoREEVO Partners with Betsson Lithuania

-

CEO of GGBET UA Serhii Mishchenko4 days ago

CEO of GGBET UA Serhii Mishchenko4 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Canada3 days ago

Canada3 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News3 days ago

Latest News3 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe4 days ago

Central Europe4 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

AI4 days ago

AI4 days ago2026 Rewards AI Capability, Not AI Talk – HIPTHER Prague Summit Unveils the Next-Era HIPTHER Academy

-

Firecracker Frenzy™ Money Toad™3 days ago

Firecracker Frenzy™ Money Toad™3 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™