Latest News

Sportradar Reports Strong First Quarter 2023 Results

Sportradar Group AG, a leading global technology company focused on enabling next generation engagement in sports through providing business-to-business solutions to the global sports betting industry, today announced financial results for its first quarter ended March 31, 2023.

First Quarter 2023 Highlights

Revenue in the first quarter of 2023 increased 24% to €207.6 million ($226.2 million)1 compared with the first quarter of 2022.

The RoW Betting segment, accounting for 52% of total revenue, grew 25% to €108.5 million ($118.3 million)1, primarily driven by strong performance from Managed Betting Services (MBS) and Live Odds.

The U.S. segment revenue grew 55% to €39.7 million ($43.3 million)1 compared with the first quarter of 2022, driven by higher sales of betting products as well as the Company’s digital advertising (ad:s) product. The U.S. segment generated positive Adjusted EBITDA2 for the third consecutive quarter with an Adjusted EBITDA2 margin of 17%.

Total Profit for the first quarter of 2023 was €6.8 million compared with €8.2 million for the same quarter last year. The Company’s Adjusted EBITDA2 in the first quarter of 2023 increased 37% to €36.7 million ($40.0 million)1 compared with the first quarter of 2022, demonstrating operational leverage from higher revenue despite increased investment into Artificial Intelligence (AI) for liquidity trading, and Computer Vision technology.

Adjusted EBITDA margin2 was 18% in the first quarter of 2023, an increase of 176 bps compared with the prior year period.

Adjusted Free Cash Flow2 in the first quarter of 2023 was €12.4 million, compared with €12.9 million for the prior year period, as a result of improved working capital management offset by an unfavorable impact from foreign currency exchange rates. The resulting Cash Flow Conversion2 was 34% in the quarter.

The Company’s customer Net Retention Ratio (NRR) was 120% in the first quarter of 2023, an improvement over the NRR from the fourth quarter of 2022 of 119%.

Carsten Koerl, Chief Executive Officer of Sportradar said: “We started fiscal 2023 on solid footing, as we continued to deliver strong top line growth, predominately by growing our value add products such as MBS and Live Odds in the Rest of World business, and strong, profitable growth in our U.S. segment. We are also demonstrating operational leverage as we continue to focus on cost discipline across the organization and invest prudently to grow our top line. We are confident that our ongoing product innovation in AI and computer vision will enable us to remain a market leader and increase shareholder value for our investors.”

Key Financial Measures

In millions, in Euros € Q1 Q1 Change

2023 2022 %

Revenue 207.6 167.9 24 %

Adjusted EBITDA2 36.7 26.7 37 %

Adjusted EBITDA margin2 18 % 16 % –

Adjusted Free Cash Flow2 12.4 12.9 (4 %)

Cash Flow Conversion2 34 % 48 % –

Segment Information

RoW Betting

Segment revenue in the first quarter of 2023 increased by 25% to €108.5 million compared with the first quarter of 2022. This growth was driven primarily by increased sales of the Company’s higher value-add offerings including MBS, which increased 40% to €37.1 million as well as Live Odds services which increased 29% year over year.

Segment Adjusted EBITDA2 in the first quarter of 2023 increased by 6% to €47.4 million compared with the first quarter of 2022. Segment Adjusted EBITDA margin2 decreased to 44% from 51% in the first quarter of 2022 due to increased investment in AI technology for MTS and Computer Vision technology. These investments will enable the Company to further grow revenue and improve its Adjusted EBITDA margin over time.

RoW Audiovisual (AV)

Segment revenue in the first quarter of 2023 decreased 3% to €44.6 million compared with the first quarter of 2022. Revenue was impacted by the expected completion of the Tennis Australia contract partially offset by growth in sales to new and existing customers.

Segment Adjusted EBITDA2 in the first quarter of 2023 increased 27% to €11.3 million compared with the first quarter of 2022. Segment Adjusted EBITDA margin2 improved to 25% in the first quarter of 2023 compared with 19% in the first quarter of 2022 due to savings associated with the completion of the Tennis Australia contract.

United States

Segment revenue in the first quarter of 2023 increased by 55% to €39.7 million ($43.3 million)1 compared with the first quarter of 2022. Results were driven by growth in core betting data products and the ad:s product.

Segment Adjusted EBITDA2 in the first quarter of 2023 was €6.8 million ($7.4 million)1 compared with a loss of (€6.4) million in the first quarter of 2022. This is the third consecutive quarter with positive Adjusted EBITDA2 indicating the strong operational leverage in the U.S. business model despite continuous investments. Segment Adjusted EBITDA margin23improved to 17% from (25%) compared with the first quarter of 2022.

Costs and Expenses

Purchased services and licenses in the first quarter of 2023 increased by €11.6 million to €48.4 million compared with the first quarter of 2022, reflecting continuous investments in content creation, greater event coverage and higher scouting costs. Of the total purchased services and licenses, approximately €14.0 million were expensed sports rights.

Personnel expenses in the first quarter of 2023 increased by €25.2 million to €77.5 million compared with the first quarter of 2022. The increase was primarily as a result of increased investment for growth which was driven by higher headcount associated with investments in AI and Computer Vision, increased share based compensation, and inflationary adjustments for labor costs.

Other operating expenses in the first quarter of 2023 increased by €1.7 million to €21.2 million, compared with the first quarter of 2022, primarily as a result of higher software license costs, higher audit fees and implementation costs for a new financial management system.

Total sports rights costs in the first quarter of 2023 decreased by €2.8 million to €51.2 million compared with the first quarter of 2022, primarily due to savings from the expected completion of the Tennis Australia contract.

Recent Company Highlights

SportradarSportradar renewed its partnership with the Big Ten Network extends partnership with the Big 10 Conference to broaden its footprint in the U.S. college space by powering its OTT platform B1G+ through the 2024-2025 college athletics season. Sportradar is providing its technology and data-driven OTT solutions to manage B1G+’s OTT web, mobile and connected TV apps, UX/UI design and third party integration.

Sportradar announced the integration of its ad:s technology into Snapchat, creating a new channel for betting operators to engage and acquire customers using the Company’s paid social media advertising service. Using Snapchat’s advanced age and location targeting capabilities to ensure only legally qualified audiences are reached, betting operators have a potential to reach Snapchat’s 350 million daily active users and over 750 million monthly active users.

Sportradar was selected as the successful bidder for the global Association of Tennis Professionals (ATP) data and streaming rights starting in 2024 as a result of the Company’s commitment to product innovation. Sportradar offers the broadest reach to tennis fans globally and has been a supplier of official ATP Tour and Challenger Tour secondary data feeds since 2022.

Sportradar published its first Sustainability Report highlighting its commitment to sustaining its business, communities and environment. The report is based on Sportradar’s five key sustainability priorities, sustainability, people, oversight, respect and technology-led (SPORT), which are aligned with the standards and framework of the Sustainability Accounting Standards Board (SASB).

Sportradar Integrity Services released its second Annual Report on Betting Corruption and Match-Fixing in 2022, revealing the Company had identified 1,212 suspicious matches across 12 sports in 92 countries, an increase of 34% year over year. The overall data confirmed that 99.5% of sporting events are free from match-fixing, with no single sport having a suspicious match ratio of greater than 1%.

Sportradar named technology executive Gerard Griffin as Chief Financial Officer effective May 9, 2023. Mr Griffin previously served as CFO of Zynga Inc., a global leader in interactive entertainment, and will be responsible for Sportradar’s accounting, finance and investor relations functions. Mr. Griffin brings more than 25 years of leadership experience in financial and operational management within the gaming, media and technology sectors.

Annual Financial Outlook

Sportradar reaffirmed its annual outlook provided on March 15, 2023, for revenue and Adjusted EBITDA2 for fiscal 2023 as follows:

Sportradar expects its revenue for fiscal 2023 to be in the range of €902.0 million to €920.0 million ($983.2 million to $1002.8 million)1, representing growth of 24% to 26% over fiscal 2022.

Adjusted EBITDA2 is expected to be in a range of €157.0 million to €167.0 million ($171.1 million to $182.0 million)1, representing 25% to 33% growth versus last year.

Adjusted EBITDA margin2 is expected to be in the range of 17% to 18%.4

Powered by WPeMatico

Latest News

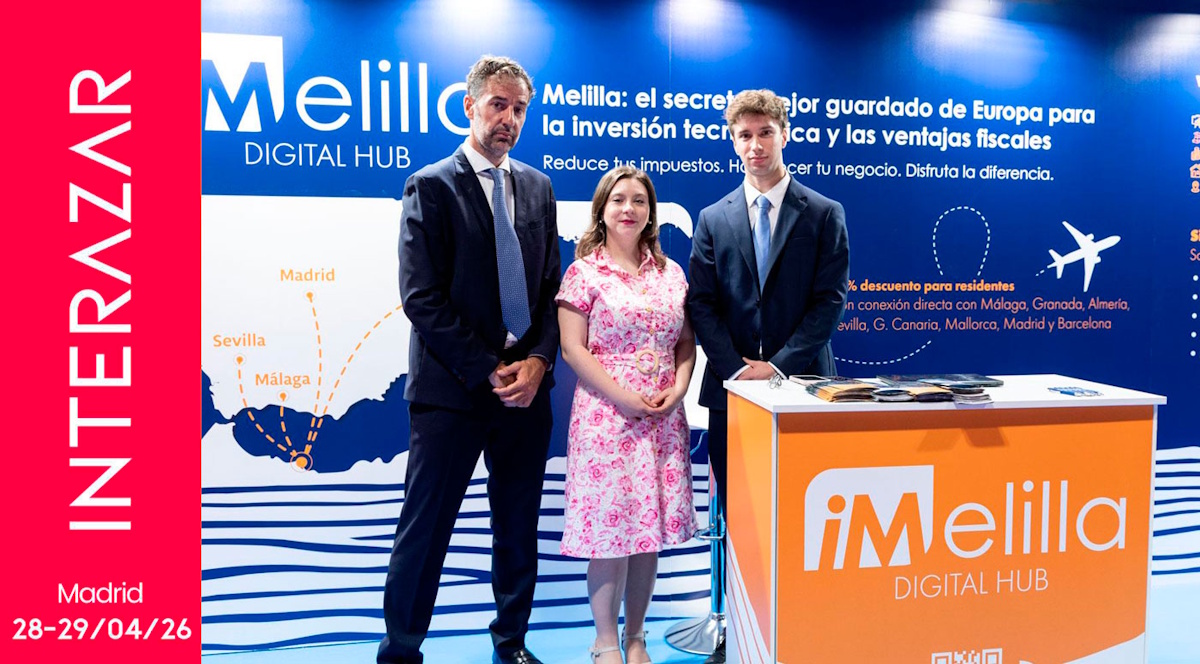

NdP INTERAZAR 2026 – Participación de Melilla en Interazar

Interazar reunirá de nuevo a Operadores, empresas y administraciones en Madrid los próximos días 28 y 29 de abril

Interazar volverá a ser el gran escaparate donde se mide el pulso real de la industria nacional, y en esta nueva edición contará nuevamente con la participación activa de la Ciudad Autónoma de Melilla, que refuerza así su compromiso con un Sector clave para su estrategia de crecimiento económico y tecnológico.

En este contexto, Melilla llega a la Feria Española del Juego los próximos días 28 y 29 de abril con la intención de seguir ganando visibilidad como destino atractivo para el Juego online y para las empresas tecnológicas que orbitan en torno al Sector. La ciudad ha ido construyendo un entorno competitivo basado en un marco fiscal favorable, acompañamiento institucional y una apuesta clara por la innovación aplicada al Juego.

Interazar se presenta, así, como un escenario natural para seguir avanzando en esta estrategia. La participación de Melilla refleja una estrategia continuada, con resultados visibles, que busca afianzar su posición como uno de los polos emergentes del Juego online y la innovación en España.

The post NdP INTERAZAR 2026 – Participación de Melilla en Interazar appeared first on Americas iGaming & Sports Betting News.

Conferences

SportsGrid to return to NEXT NYC 2026

Tuesday 3rd March 2026 – SportsGrid has confirmed its renewed media partnership with NEXT.io and will attend NEXT Summit: New York to cover key discussions and insights from North America’s premier iGaming and sports betting event. The content will be syndicated across SportsGrid’s streaming and digital platforms.

NEXT Summit: New York, in partnership with Morgan Stanley, will take place from 10–11 March at Convene 225 Liberty Street, bringing together 1,400 senior-level delegates for two days of high-impact content and networking.

This year, Emerging Verticals will accompany NEXT Summit: New York, providing a dedicated focus on the fast-growing sectors reshaping the industry — including sweepstakes, micro-markets, crypto, esports, new betting formats, and the evolving intersection of technology and capital.

Now in its fifth edition, the Summit continues to deliver insider knowledge, high-level networking, and direct access to the latest innovations shaping the future of the industry.

Across the two days, leaders from the most influential operators, investment firms, regulators, and technology providers will take to the stage.

Confirmed speakers include:

- Adam Greenblatt, CEO of BetMGM;

- Adam Rosenberg, Senior Advisor, Gaming & Leisure at Blackstone;

- Benjie Cherniak, Principal at Avenue H Capital;

- Lloyd Danzig, Managing Partner at Sharp Alpha Advisors;

- Roger Ehrenberg, Managing Partner at Eberg Capital;

- Ramy Ibrahim, Managing Director at Moelis & Company;

- Joey Levy, Founder and CEO of Betr;

- and Gavin Isaacs, Former CEO of Entain.

The programme will also feature voices from across the regulatory, legal and association landscape including:

- Tres York, VP of Government Relations at the American Gaming Association;

- Paul Burns, President & CEO of the Canadian Gaming Association;

- Kelci S. Binau, Gaming Law Attorney at McDonald Carano;

- and Katie Lever, General Counsel, Chief Privacy Officer & Corporate Secretary at Great Canadian Gaming Corporation.

From the casino floor to emerging tech and capital markets, sessions will also include:

- Brooke Hilton, Head of Casino at PointsBet Canada;

- Chris Garrow, Director of Gaming at Prairie Band Casino & Resort;

- Davis Catlin, Managing Partner at Discerning Capital;

- Jeffrey Haas, Venture Partner at DreamCraft VC;

- Jamison Selby, CEO of Rubystone;

- Desiree Dickerson, Founder of THNDR;

- Kevin Scott, Chief Technology Officer at PGA of America;

- and Darren Woodson, Former NFL Player.

“NEXT Summit: New York continues to set the standard as North America’s premier meeting point for senior leaders in online sports betting and iGaming. With Emerging Verticals joining the Summit this year, the conversations are expanding into some of the most disruptive and fast-moving areas of the industry. We’re excited to once again partner with NEXT.io and bring on-the-ground coverage of the event’s most important discussions to a wider audience across SportsGrid’s streaming and digital platforms,” commented Jeremy Stein, CEO, SportsGrid, Inc.

“NEXT Summit: New York is where the industry’s biggest names come together to define the future of online gaming and sports betting,” said Pierre Lindh, Co-Founder & Managing Director at NEXT.io. “With Emerging Verticals accompanying the Summit this year, and more than 1,400 senior decision-makers attending, having SportsGrid on-site strengthens our mission to share critical insights and discussions with the broader iGaming community.”

SportsGrid will be on the ground at NEXT Summit: New York, covering conference sessions, interviews, and key discussions. Content from the event will be syndicated across its streaming video network and relevant media channels, extending the reach of discussions to a broader audience.

This initiative marks the continuation of a long-term collaboration between SportsGrid and NEXT.io, with plans to provide rich, curated content exploring the latest trends, innovations, and developments shaping the global gaming industry.

For more information on NEXT Summit: New York and to register for the event, visit: next.io/summits/newyork/

The post SportsGrid to return to NEXT NYC 2026 appeared first on Americas iGaming & Sports Betting News.

Latest News

GR8 Tech at SAGSE Latam: Where Platform for Champions Meets the Region

GR8 Tech will exhibit at Booth 103 at SAGSE Latam on March 18–19 in Buenos Aires, Argentina.

With Latin America a major growth market for the company, GR8 Tech brings regional expertise and the full platform ecosystem to the floor to showcase capabilities that turn ambitious operators into the next iGaming Champions.

Five flagship solutions make up the lineup, each built for operators competing in dynamic, high-growth markets:

- ULTIM8 Sportsbook—Flexible, high-performance sportsbook perfect for fast-moving Latam markets

- Hyper Turnkey—End-to-end iGaming business infrastructure for fast, reliable market entry and operations

- Crypto Turnkey—A platform built to attract and retain VIP and crypto-first players

- Aff.Tech—Affiliate management that tracks performance and optimizes acquisition across channels

- Infinite Casino Aggregation—A wide game catalog accessible through a single integration

Each solution is part of GR8 Tech’s Platform for Champions—a proposition that goes beyond technology into expertise, genuine partnership, and a community built around pushing each other to the top.

“When people talk about Latam iGaming, Brazil often gets most of the attention, but the opportunity across the rest of the region is substantial and largely underserved by platforms built for larger markets,” said Yevhen Krazhan, CSO at GR8 Tech. “SAGSE Latam is the right room to bring the conversation to the potential of markets like Argentina, Chile, Colombia, Paraguay, Peru, Uruguay, and we’re looking forward to connecting with new partners.”

Book a meeting with the GR8 Tech team at SAGSE Latam and start your move to dominate the region.

The post GR8 Tech at SAGSE Latam: Where Platform for Champions Meets the Region appeared first on Americas iGaming & Sports Betting News.

-

Adjusted EBITDA7 days ago

Adjusted EBITDA7 days agoBragg Gaming Announces Select Preliminary Unaudited Fourth Quarter and Full Year 2025 Financial Results, and Issues Full Year 2026 Guidance

-

Bagley-Keene Act7 days ago

Bagley-Keene Act7 days agoCalifornia Gambling Control Commission Issues Critical Guidance on Stakeholder Communications and Ex Parte Rules

-

iGaming6 days ago

iGaming6 days agoPRAGMATIC PLAY UNEARTHS PROGRESSIVE MULTIPLIERS IN ROLLING IN TREASURES

-

Comatel5 days ago

Comatel5 days agoCOMATEL CELEBRARÁ UNA FIESTA PARA CIENTOS DE OPERADORES TRAS FINALIZAR EL PRIMER DÍA DE LA FERIA ESPAÑOLA, INTERAZAR

-

Betty Casino7 days ago

Betty Casino7 days agoBetty Casino Announces Partnerships with Toronto FC and Toronto Argonauts

-

Africa7 days ago

Africa7 days agoGroove Targets Africa’s iGaming Boom at SiGMA Cape Town 2026

-

Australia7 days ago

Australia7 days agoTabcorp Pays $158,400 Penalty for Taking Illegal In-Play Sports Bets

-

Booming Games6 days ago

Booming Games6 days agoBooming Games Introduces Instastrike, the Latest Diamond Hits Trio