Greece

GoldenRace strengthens its presence in the online Greek market

GoldenRace, the leading Virtual Sports provider, has recently signed a partnership deal with Betsson, becoming the first and only Virtual Games provider of Betsson Group in Greece.

Thanks to this agreement, Betsson’s online players in Greece will be able to enjoy GoldenRace’s Virtual Sports and Games through an aggregator platform.

Thanos Marinos, managing director at Betsson Greece, said: “At Betsson, we are always listening to our customers’ needs and wants and we constantly strive to provide the very best entertainment to our clients. Bringing in new and fresh content is a big part of what we do, and I would like to welcome GoldenRace to our product portfolio, which I am sure our customers will find as a great addition to our existing offering.”

Martin Wachter, GoldenRace CEO and Founder, highlighted: “The Greek gambling market is growing fast and offers exciting opportunities. We knew that when we first started operations in the country, and it is amazing to join forces with Betsson, to keep offering Greek players our leading virtuals.”

This new partnership contributes to GoldenRace’s growth in the Greek online market, where the company has been operating with great success since they obtained their licence in 2021.

Powered by WPeMatico

blask

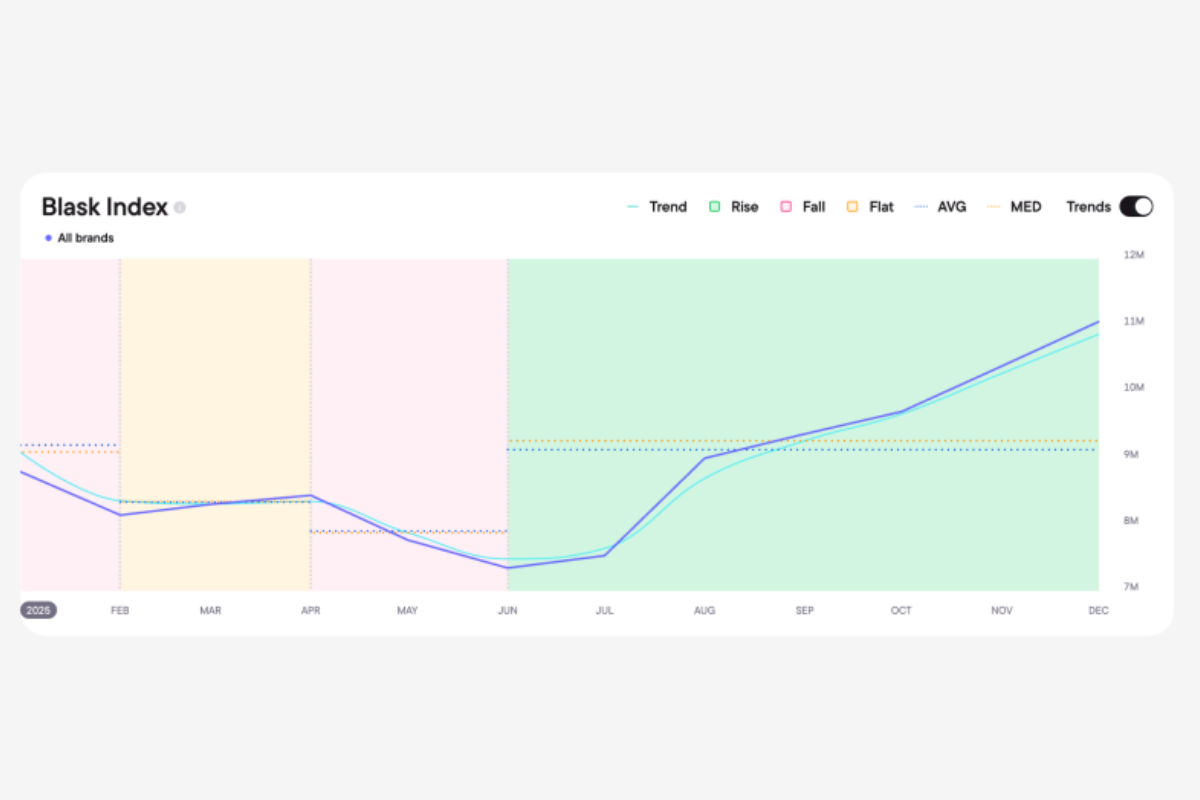

Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained

In the second half of 2025, Greece emerged as Europe’s fastest-growing iGaming market. While several major jurisdictions slowed or declined, Greek market demand rose by more than 50% between June and December, standing out as one of the year’s clearest growth stories.

According to data from Blask, the surge was not the result of a single tournament or seasonal spike. Instead, it reflected a structural shift driven by a combination of sports momentum, regulatory reform and casino market dynamics — factors that can now be traced in detail through Blask’s newly released Market Explanation feature.

Continuous sports momentum without demand gaps

Greece’s growth was underpinned by a tightly stacked sports calendar that sustained engagement across multiple months. EuroBasket 2025 in late August, the kickoff of the Stoiximan Super League, UEFA Champions League matchdays under the new league-phase format, and the EuroLeague season featuring Greek clubs created a continuous rhythm of high-interest betting cycles throughout autumn.

Rather than short-lived peaks followed by sharp declines, demand remained elevated well beyond individual events. This is a pattern clearly visible on the Blask Index trend line.

Casino reform reshaped demand behavior

One of the most significant contributors came from the casino segment. Greece’s decision to raise RNG stake limits from €2 to €20 altered the mechanics of the market, allowing online casinos to absorb demand during sports off-peak periods.

As sports-led acquisition increasingly converted into casino play, operators reported double-digit iGaming growth. Market Explanation analysis shows that this effect persisted over time, confirming the shift as structural rather than seasonal.

Enforcement redirected demand to licensed operators

Regulatory action further reinforced the upward trend. In December, Greek authorities blocked approximately 11,000 illegal gambling domains. Instead of suppressing demand, the move redirected player interest toward licensed platforms, strengthening regulated market performance.

The impact was amplified by the adoption of IRIS instant payments, which reduced deposit friction and improved conversion from interest to activity.

From tracking trends to understanding causes

To surface these drivers, Blask has introduced Market Explanation — an AI-powered layer within the Blask Index that allows users to click on any country’s trend line and instantly see a sourced breakdown of the forces behind the movement. Sports calendars, regulatory changes, casino dynamics and macro factors are analyzed together, turning raw demand signals into actionable market context.

Greece’s 2025 performance illustrates how this approach changes market analysis. Rather than simply observing that demand is rising, operators, suppliers and investors can now see why it is happening — and which levers are shaping the trajectory of a market in real time.

The post Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Fotini Matthaiou Executive Director of Casino at Novibet

Novibet Expands Greek Casino Offering with Octoplay Live

“The current Greek launch with Novibet demonstrates the momentum of our European expansion,” says Ralitsa Georgieva, Director of Business Development at Octoplay. “Adding Greece to our portfolio of regulated markets reinforces our strategy of rapid growth across Europe, bringing our premium content to new player audiences throughout the continent.”

Fotini Matthaiou, Executive Director of Casino at Novibet, comments:“Our partnership with Octoplay marks another important step in Novibet’s ongoing commitment to delivering next-generation gaming experiences. By integrating Octoplay’s innovative portfolio into our platform, we continue to expand the range of premium content available to our players, combining cutting-edge technology with entertainment value. At Novibet, we constantly seek strategic collaborations that enhance the quality and diversity of our offering, ensuring that every player enjoys a personalized, world-class gaming experience.”

The post Novibet Expands Greek Casino Offering with Octoplay Live appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Andreas Nikolopoulos

Betsson Becomes Naming Partner and Major Sponsor of Peristeri Betsson BC

Reading Time: 2 minutes

Betsson has entered a new two-year partnership with Peristeri BC, a well-established Athens club with more than 50 years of history, competing in the top tier of Greek basketball and in European competitions. As part of the agreement, the team will now compete under its official name, Peristeri Betsson BC.

This collaboration reflects Betsson’s continued investment in Greek sport. With more than six decades of heritage and operations across 24 countries, Betsson’s strategy in Greece is centred around supporting historic clubs, strengthening local communities and contributing to the broader development of sport in the country. Following Mykonos Betsson and Aris Betsson, Peristeri Betsson BC represents the next step in building a network of sponsorships that carry meaningful cultural and community impact.

For Peristeri, the partnership provides strong strategic backing for the club’s competitive ambitions and its long-term mission to remain a reference point within Greek basketball. Both organisations share a commitment to professionalism, consistency and delivering high-quality experiences to fans. The collaboration will also include a suite of social impact initiatives focused on youth, education, equality and access to sport in Peristeri.

Andreas Nikolopoulos, Commercial Director at Betsson, said: “It is a great pleasure for all of us at Betsson to stand alongside a club with such a strong history and identity as Peristeri, a club that has been a reference point in Greek basketball for decades and continues to grow thanks to the steady and methodical work of its management. We do not view this merely as a sponsorship but as a strategic alliance. We share the same values with Peristeri, professionalism, consistency and a constant commitment to offering high-quality experiences to fans. We are committed to supporting them throughout this journey and we wish the team a season full of health, energy and success.”

Manos Kotsis, General Manager of Peristeri Betsson BC, said: “We are now officially Peristeri Betsson and will be for the next two years. Our approach is based on two pillars: reconnecting with our local community and bringing people back to the arena, and restoring Peristeri’s identity as a club that develops talent, whether local or international. We believe we have made meaningful progress over the past two years, but both goals require strong organisation, planning and method. We are delighted that Betsson is by our side supporting this effort and enabling us to move forward with greater confidence.”

The post Betsson Becomes Naming Partner and Major Sponsor of Peristeri Betsson BC appeared first on European Gaming Industry News.

-

Latest News7 days ago

Latest News7 days agoBMM TESTLABS GRANTED NEW LICENSE IN BRAZILIAN STATE OF MINAS GERAIS, EXPANDING ITS PRODUCT TESTING AND CERTIFICATION FOOTPRINT IN BRAZIL

-

BMM Innovation Group7 days ago

BMM Innovation Group7 days agoBMM Testlabs Secures Minas Gerais License, Expanding iGaming and Sports Betting Certification in Brazil

-

Brasil on Track5 days ago

Brasil on Track5 days agoODDSGATE LAUNCHES “BRASIL ON TRACK”, A STRATEGIC PLATFORM FOR NAVIGATING BRAZIL’S REGULATED IGAMING MARKET

-

Conferences7 days ago

Conferences7 days agoChampions Club Bound for Dubai

-

Latest News6 days ago

Latest News6 days agoMillion Games Unveils Looting Raccoons: A Charming Pirate Slot Packed with Features

-

Canada7 days ago

Canada7 days agoKambi Group Becomes the Official Sportsbook Partner of Ontario Lottery and Gaming Corporation

-

Central Europe7 days ago

Central Europe7 days agoPoland to Classify Gambling Streaming as Serious Crime

-

3 Oaks Gaming6 days ago

3 Oaks Gaming6 days agoStrategic partnership sees 3 Oaks Gaming expand its LatAm footprint with one of Mexico’s fastest-growing operators