Latest News

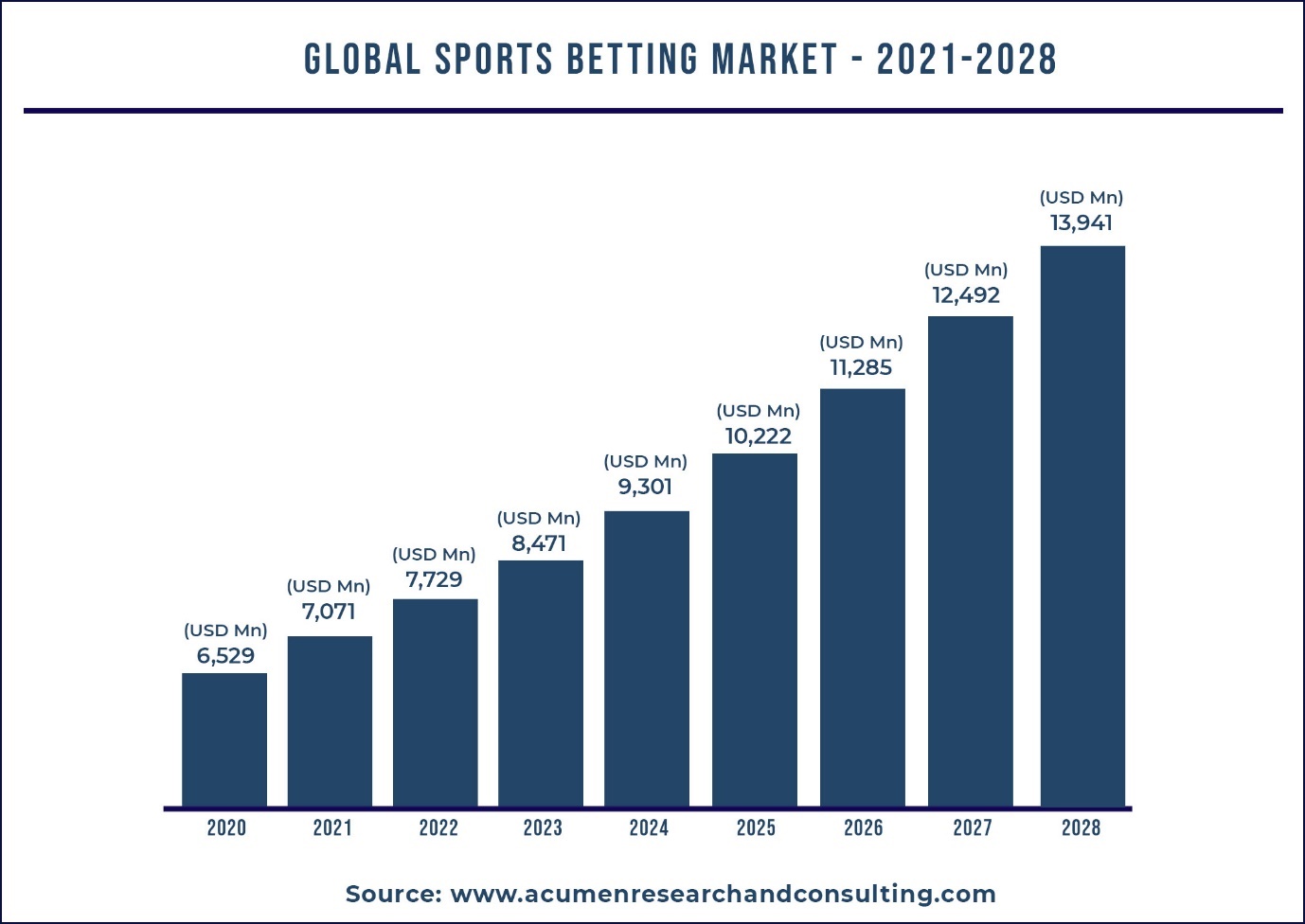

Sports Betting Market Surpass US$ 13,941 Mn by 2028 | CAGR 10.2% Report by Acumen Research and Consulting

The Global Sports Betting Market accounted for US$6,529 Mn in 2020 and is expected to reach US$ 13,941 by 2028 with a considerable CAGR of 10% during the forecast period of 2021 to 2028.

New sports betting trends emerge as a result of people’s rising affinity for betting, ongoing updates, and technical breakthroughs. The sports betting industry is constantly upgrading, which is empowering this sector and making it comparatively more high-tech ultimately leading to success and expansion in the upcoming years. Whether it’s the integration of cutting-edge technologies or increasing the number of consumers, there are a slew of reasons why this business is capturing the attention of the entire world and enticing investors from all over the world.

Global Sports Betting Market Dynamics

The global sports betting market is primarily driven by the growing population betting in this market. This is due to the easy earning of money, the rising number of sports betting apps that provide easy betting guidelines and a rising inclination of youth across the world in the betting industry. After the COVID-19 pandemic (2020), the sports betting industry is coming on track with all the postponed or canceled events restarting in 2021. Thus, a huge rise in the market was witnessed in the year. Besides, large-scale advertising on sport betting apps has also driven a huge amount of crowds to start betting in the industry.

An increase in the number of sports and events across the world coupled with surging digital infrastructure has created a surplus amount of opportunities in the global sports betting market. However, growing concerns over illegal betting and strict regulations for betting are some of the factors that are likely to curb the growth of the market. According to the Illegal Gambling Statistics, illegal gambling activities have been estimated to be around $1.7 trillion each year. Conversely, the advent of 5G technology is expected to create numerous growth opportunities for the market in the coming years. Furthermore, the application of artificial intelligence and blockchain technology has enabled a lot of transparency in the betting process, which eventually supports the substantial growth of the sports betting market.

Growing number of online betting apps surges the demand for online platform

The platform segment is sub-segmented into online and offline. Based on the platform segment, the online segment accumulated for the maximum share in 2020. The rising penetration of smartphones has enabled a majority percentage of crowds to bet at home or anywhere they are which has been a strong growth opportunity for the online platform segment. On the other hand, online sports betting occur mostly during the events such as European Championship, FIFA World Cup, IPL, American Football Leagues, etc.

High percentage of profits earned by fixed odd wagering commands the betting type segment

Live/in-play betting, fixed odds wagering, exchange betting, pari-mutuel, esports betting, and others are the categorization of type segment. Among them, the fixed odd wagering segment dominated the market with a high percentage of shares in 2020. This is credited to the ease of this betting type among people that bet on sports, such as football, hockey, baseball, basketball, and horse racing and internationally.

Huge betting revenue generated from football events propels the segmental growth

Based on sports type, the market is classified into football, basketball, baseball, cricket, hockey, horse racing, and others. Football, among all the sports, conquered the largest market share and is likely to register the fastest growth throughout the forecast period 2021 – 2028. The high popularity of these sport worldwide, chances of winning a large sum of money, and extensive opportunities offered by the European region in football betting are the major aspects driving the growth of the market.

Sports Betting Regional Stance

The global classification of the sports betting market includes Europe, Asia-Pacific, North America, Latin America, and the Middle East & Africa. Among all the regions, Europe subjugated a lion’s share in the regional scenario. Factors such as the high trend on football betting in countries such as Germany, the UK, Italy, Spain, etc, and the popularity of Euro football leagues in the region propels the market dominance of the EU region. Furthermore, the APAC sports betting market is anticipated to witness the fastest growth during the forecast period. This is attributed to the growing inclination of the APAC population towards sports betting, yearly events in India such as IPL, and growing urbanization in the emerging markets.

Major Players

The sports betting market is consolidated with a large number of players. The prominent players presented in the report include 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc, Flutter Entertainment Plc, IGT, Kindred Group Plc, Sportech Plc, William Hill Plc, and others.

For instance, on September 08, 2021 – 888 Holdings plc has partnered with Genius Sports Limited to provide SI Sportsbook with market-leading official data and trading features. Genius Sports is expected to supply pre-game and in-game content across top tier U.S. sports properties such as the NBA, NASCAR, NFL, and NCAA as a result of the relationship.

Moreover, on October 18, 2021- Bet365 launched cross-vertical shared wallet functionality. Customers may now access their funds in a single balance rather than having to set up separate wallets for each vertical.

Powered by WPeMatico

Codere Online

Codere Online Launches iOS Poker App in Mexico, Advancing Its Multi‑Product Expansion Strategy

Codere Online Luxembourg, S.A. a leading online gaming operator in Spain and Latin America, today announced the launch of its new iOS Poker application in Mexico, reinforcing the Company’s strategic objective to provide customers with access to a complete suite of online gaming products. As part of this multi‑product roadmap, both Bingo and the Android Poker app will form the next steps in expanding the Company’s offering in the country.

Developed in partnership with Playtech, one of the world’s most established gaming technology providers, the new iOS Poker app integrates directly with Playtech’s player‑vs‑player (P2P) Poker network. This allows Mexican users to compete in real time with players across multiple operators, ensuring deeper liquidity, a more dynamic environment and a superior competitive experience.

Codere Online continues to observe strong demand for Poker in Mexico, with more than 1,300 unique active users per month already engaging with the vertical across existing channels, a clear indicator of the product’s relevance and potential as mobile availability expands.

“Launching the Poker app for iOS in Mexico is a key step in delivering on our commitment to offer customers all major online gaming categories,” said Alberto Telias, Chief Marketing Officer at Codere Online. “Poker has quickly emerged as a highly attractive vertical for our users, and through our partnership with Playtech, we are bringing them a premium, high‑liquidity platform that elevates their experience.”

The new app offers a stable and intuitive interface with access to cash tables, multi‑table tournaments, Sit & Go formats, and fast‑paced modes. It also incorporates Codere Online’s robust responsible gaming tools to ensure that customers can enjoy Poker in a safe and controlled environment.

“This release reflects our strategy to broaden our product offering and enhance the user experience across all key gaming verticals,” said Ran Licht, Head of Product at Codere Online. “Playtech’s P2P network enables us to deliver a feature‑rich Poker environment connected to a broader operator ecosystem, and we look forward to expanding our product suite with additional verticals currently in development.”

“We are proud to partner with Codere Online and bring our P2P Poker network to their players in Mexico through their new iOS app,” commented Marat Koss, Playtech Chief Interactive Gaming Officer. “Codere Online players will now boast access to one of the most liquid and competitive poker networks in the entire industry.

The post Codere Online Launches iOS Poker App in Mexico, Advancing Its Multi‑Product Expansion Strategy appeared first on Americas iGaming & Sports Betting News.

Akhil Sarin

Akhil Sarin Joins Bet It Drives: Stake’s Growth and What iGaming Gets Wrong About Marketing

Season 4 of Bet It Drives is back, and Episode 2 features Akhil Sarin, CMO at Easygo and the marketing and partnerships mastermind behind Stake.

Sarin dives into the realities of iGaming marketing, sharing how some of the most cost-effective campaigns can deliver massive impact—including a low-budget idea that went viral with over 16 billion impressions.

Key insights from the episode include:

-

Stake’s most valuable partnerships and why they worked

-

What sets their sponsorship strategy apart

-

Common mistakes iGaming marketing teams make

-

The one thing Sarin wishes teams focused more on

-

Biggest red flags and warning signs in partnerships

-

Leadership lessons and internal trust challenges

The episode also features a fun “Confess or Call” segment, highlighting a late-night call to a senior exec about a high-stakes, unconventional idea—a true test of trust and creativity.

“This season is about open conversations, and Akhil was straight with us,” said Yevhen Krazhan, CSO at GR8 Tech and host of Bet It Drives. “iGaming marketers will rethink spend, partnerships, and what truly drives growth after this episode.”

Season 4 also includes a CEO debate with Cedomir Tomic (Founder, Alea) and Oleksandr Feshchenko (CEO, GR8 Tech), along with upcoming insights on crypto payments in iGaming and esports betting strategies.

Watch or listen to Season 4, Episode 2 on:

The post Akhil Sarin Joins Bet It Drives: Stake’s Growth and What iGaming Gets Wrong About Marketing appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

ELA Games

SiGMA Eurasia: ELA Games MD Marharyta Yerina Talks Progression Milestones in Dubai

At SiGMA Eurasia on February 11, Marharyta Yerina, Managing Director of ELA Games, joined the panel “Progress Paths: Making Milestones Matter” to discuss innovative approaches to player retention and engagement. The session, moderated by Tim French (Commercial Manager, Greco Fast Track), explored how studios can design progression systems that go beyond conventional loyalty schemes.

Marharyta emphasized that maintaining player interest often comes from subtle design choices rather than overt progress bars. She highlighted how optimizing volatility and feature frequency creates natural anticipation, keeping players engaged through gameplay rhythm. She also advocated for micro-goals—short, intra-session milestones—and stressed the importance of audio-visual feedback to make moments feel rewarding in real time, rather than relying on long-term VIP systems alone.

The panel featured diverse perspectives from the industry, including Alena Tsuranova (CCO, Megafair) and Bulat Fakhrutdinov (Head of Partnerships, Betronic Software), who discussed how commercial strategies and partnerships shape the player journey.

Marharyta’s participation underscores ELA Games’ commitment to player-centric design and demonstrates how the studio’s “For Players, By Players” ethos translates into creating games that keep audiences coming back, while fostering long-term value in partnerships.

The post SiGMA Eurasia: ELA Games MD Marharyta Yerina Talks Progression Milestones in Dubai appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Alex Malchenko6 days ago

Alex Malchenko6 days agoEvoplay Strengthens Canadian Presence with BetMGM Partnership

-

3 Oaks Gaming6 days ago

3 Oaks Gaming6 days ago3 Oaks Gaming Enters Spanish Market

-

blask7 days ago

blask7 days agoWhen LATAM gambles: Blask reveals seasonality patterns across six countries

-

Latest News6 days ago

Latest News6 days agoRed Papaya Presents: Lucky Rainbow Rush Adventure

-

AMLA6 days ago

AMLA6 days agoAMLA Launches Public Consultation on Three Draft Regulatory Acts