Latest News

Aspire Global: Interim Report Third Quarter 2021

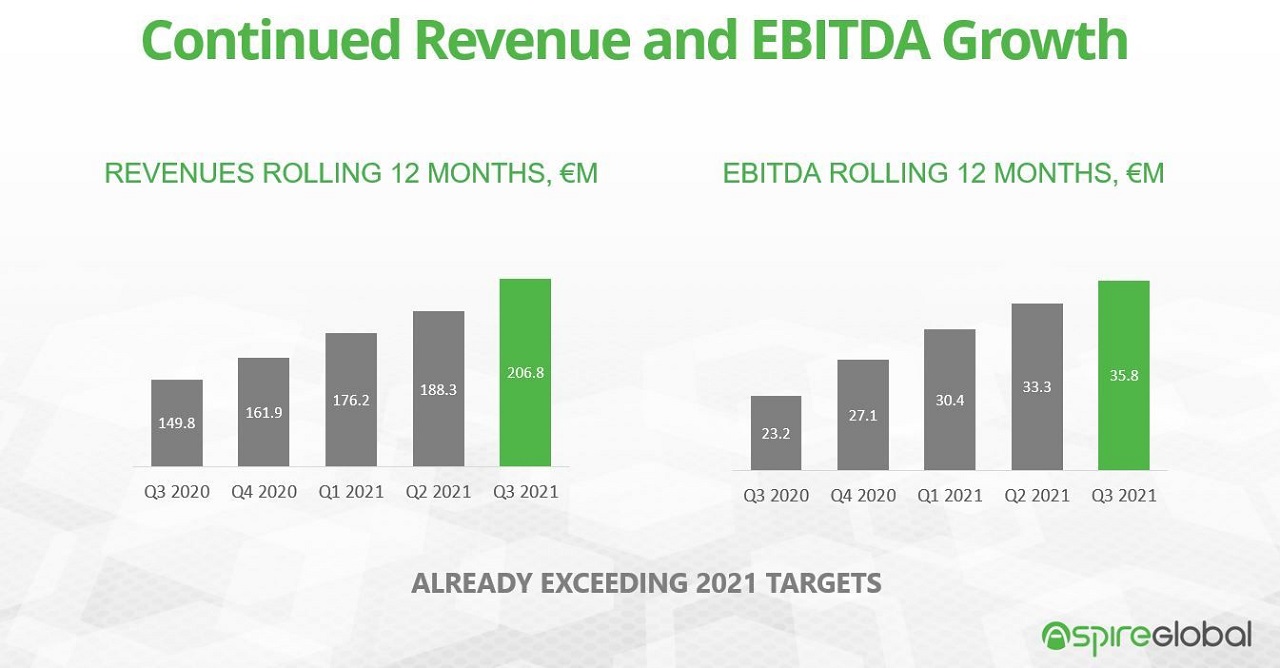

REVENUE INCREASED 46% AND EBITDA 38% IN Q3 2021

THIRD QUARTER

- Revenues increased by 46.0% to €58.6 million (40.1).

- EBITDA increased by 38.0 % to €9.1 million (6.6).

- The EBITDA margin amounted to 15.5% (16.4%).

- EBIT increased by 38.7% to €6.8 million (4.9).

- Earnings after tax increased 68.1% to €6.4 million (3.8).

- Earnings per share increased 62.5% to €0.13 (0.08).

NINE MONTHS

- Revenues increased by 38.2% to €162.4 million (117.5).

- EBITDA increased by 46.0% to €27.5 million (18.8).

- The EBITDA margin increased to 16.9% (16.0%).

- EBIT increased by 45.7% to €21.1 million (14.5).

- Earnings after tax increased 79.0% to €19.4 million (10.8).

- Earnings per share increased 77.2% to €0.39 (0.22).

SIGNIFICANT EVENTS IN THE QUARTER AND AFTER THE END OF THE QUARTER

- Revenues increased 46.0% from Q3 2020 driven by strong development in all segments.

- Organic growth of 39.0% from Q3 2020.

- B2B revenues grew 40.5% from Q3 2020 with organic growth of 31.2%.

- Strong performance in sub-segments Aggregation and Games – Pariplay and Sports – BtoBet.

- Agreement to sell the B2C segment to Esports Technologies announced 1 October – closing expected by 30 November 2021 upon completion

of certain contingent terms. The total value of the transaction sums up to about €65 million. The transaction also includes a four-year platform and managed services agreement with an estimated gross value of €70 million. - Aspire Global signed a platform deal with Esports Technologies in September for its leading brand Gogawi.

- Pariplay further strengthened its position in the Americas – first contract in Brazil signed and granted full supplier license in West Virginia.

- Pariplay signed a deal to provide its proprietary games to Holland Casino in the newly regulated Dutch market.

- First brand live with BtoBet’s sportsbook on Aspire Global’s platform. To date six brands are already live.

- Two deals covering Aspire Global’s complete offering signed.

CEO COMMENTS

“WE CLEARLY EXECUTE OUR GROWTH STRATEGY TO BECOME A WORLD LEADING IGAMING SUPPLIER”

With the sale of the B2C segment, Aspire Global will become a clearly focused B2B company and even stronger and more profitable. The sale will also give us additional resources to further develop and enhance our B2B offering as well as the opportunity to explore new M&A activities. In Q3 2021, we have made key progress towards our objective of establishing strong positions in the US and Brazil. Our success in these markets will be important steps in reaching our goal to become a world leading B2B iGaming supplier.

The sale of the B2C segment – expected to take place at the end of November 2021 – will have a significant positive impact on Aspire Global’s position as a focused B2B company and profitability. Excluding the B2C segment, revenues increased by 36.1% to €118.9 million and EBITDA increased by 54.1% to €22.7 million in the first nine months 2021 with an EBITDA margin of 19.1%. B2B organic growth in the nine-month period amounted to 27.1%.

We initiated the review of our B2C segment in March this year, and on October 1 we announced the agreement with US-based Esports Technologies to acquire the B2C segment. The consideration sums up to about €65 million, consisting of €50 million in cash, €10 million in a promissory note and €5 million in common stock in the listed entity of Esports Technologies. The transaction also includes a four-year platform and managed services agreement with an estimated gross value of €70 million, based on present volumes. The transaction is expected to close by November 30, 2021, pending Esports Technologies receipt of financing, and other closing requirements.

A TRANSFORMATIVE, STRATEGIC MOVE

The divestment of the B2C segment is a transformative, strategic move for Aspire Global. First of all, the change in business mix will affect the revenue so that it will consist only of B2B revenues and, at the same time, the share of managed services will increase. The divestment will also provide Aspire Global with additional resources to further develop the technology platform as well as its offering in casino, sports and managed services. The managed services part of our business is essential to us, not only because it is recurring, but also because it will secure our continued deep knowledge about player behaviour. Furthermore, we expect that Aspire Global will have other peers as a focused B2B company and that investors will find it easier to value the company.

Following the divestment, we will also look into M&A possibilities with the aim to control even more of the value chain. Our successful acquisitions of Pariplay in 2019 and BtoBet in 2020 are proof of our ability to identify and integrate companies that complement our offering in the value chain. In the first nine months of 2021, Pariplay has grown by 79.4% to €21.7 million with an EBITDA margin of 27.9%. BtoBet has also demonstrated strong growth of 68.7% to €7.8 million in the nine-month period with an EBITDA margin of 23.1%.

KEY PROGRESS IN THE US AND BRAZIL

The B2C divestment also provides us with increasing opportunities to continue to invest in establishing a considerable position in above all the big and quickly growing Brazilian and US markets. In Q3 2021, we have made key progress in the US and Brazil. Pariplay signed a deal with FansUnite Entertainment, entailing that Aspire Global enters the Brazilian market for the first time. FansUnite is a Canadian sports and entertainment company, and Pariplay will supply its wide portfolio of proprietary and third-party content, via its Fusion

Pariplay also further strengthened its position in Latin America by a deal with the world-famous land-based and online games provider Ainsworth Game Technology. The deal will see Ainsworth partnering exclusively with Pariplay for all new online releases in Latin America, with making its titles available to players through Pariplay’s Fusion

Pariplay reached another milestone in its US expansion strategy during Q3 2021 after being granted a full iGaming Supplier License in West Virginia. Pariplay made its debut in the fast-growing US market when its content went live in New Jersey in February 2021 and Pariplay has applied for licenses in several states.

DEEPER ESPORTS RELATIONSHIPS

We are also proud and happy with the relationship we have established with Esports Technologies. Esports Technologies is a leading global operator and provider of products and marketing solutions in the quickly growing esports market. Beside the B2C deal, we also signed a strategic license agreement with Esports Technologies in Q3 2021. As part of the deal, Esports Technologies will launch its esports/sportsbook Gogawi.com in certain key markets on our platform and intends to launch an additional brand on the platform in the future. In addition, we will make the Esports Technologies proprietary esports feed available to our partners around the world.

Esports Technologies are at a rapid growth phase and aim to become the world’s number one esports company. As part of the B2C agreement, Karamba and our other B2C brands will join our B2B network, and will become one of our biggest B2B partners. I’m sure that the experience and excellence of our B2C team, together with the ambition and investment of Esports Technologies, will take the brands to new heights.

PROFITABLE GROWTH IN REGULATED MARKETS

In the quarter, Germany introduced a new regulation with higher gaming duties. Despite this regulatory change, the EBITDA margin in the B2B segment increased to 18.7% from 18.0% in Q3 2020. This clearly demonstrates Aspire Global’s ability to manage a profitable operation in regulated markets.

In October, the Netherlands opened for online gaming and Pariplay just a few days ago announced a deal to supply its proprietary games to Holland Casino. Holland Casino has a leading presence within the new regulated digital ecosystem in the Netherlands.

OUTLOOK

Aspire Global has consistently demonstrated its ability to execute its growth strategy, reaching its financial targets and create value. We see great growth opportunities by expanding with existing partners, gaining new partners and entering new markets. With the divestment of the B2C segment we will further enhance investments in our technology and product offering as well as geographic presence with focus on Brazil and the US. We will also put even more energy on increasing the M&A pipeline. We clearly execute our growth strategy to become a world leading iGaming supplier.

Tsachi Maimon, CEO.

Powered by WPeMatico

Gambling in the USA

Digicode at NEXT.io Summit NYC 2026: Driving the Future of iGaming Technology

Digicode, a leading provider of next-generation iGaming solutions, announced its participation in NEXT.io Summit NYC 2026: Innovation in iGaming, one of North America’s most influential iGaming and sports betting events taking place March 10–11, 2026, at Convene, 225 Liberty Street, Downtown New York.

NEXT.io Summit NYC 2026 brings together more than 1,200 senior executives, investors, technology leaders, operators, and innovators from across the global iGaming and sports betting ecosystem to explore breakthrough technologies, partnerships, and growth opportunities shaping the future of online gaming.

“At a time when the industry is rapidly evolving, NEXT.io Summit NYC serves as the premier stage for strategic conversation, innovation, and partnership,” said Elkhan Shabanov, CEO of Digicode Americas. “We’re excited to showcase our cutting-edge solutions that empower operators and suppliers to build faster, scale smarter, and take ownership of their technology stack.”

During NEXT.io Summit NYC 2026, Digicode will demonstrate how the Diger Suite empowers iGaming businesses to modernize their technology stack, offering a modular ecosystem of advanced solutions engineered to replace legacy systems with flexible, scalable, and performance-driven infrastructure:

- DigerRGS – Next-generation iGaming platform with full IP control and capacity for high throughput performance

- DigerPAM – Cross-market ready player account management system

- DigerPay – PSP-agnostic payment gateway supporting 200+ methods with real-time fraud protection

- DigerClick – Fully owned affiliate management platform with customizable tools and analytics

- DigerCompanion – AI-driven assistant for multilingual support, responsible gaming automation, and compliance management

During the event, Digicode experts will share real-world use cases and actionable frameworks to help industry leaders transition from legacy constraints to competitive advantage. Key topics include scaling rent-to-own iGaming platforms, automating support and compliance with AI, building resilient payment stacks, owning affiliate systems, and operating in regulated markets with adaptive technology.

The post Digicode at NEXT.io Summit NYC 2026: Driving the Future of iGaming Technology appeared first on Americas iGaming & Sports Betting News.

Latest News

NFL LEGEND ROB GRONKOWSKI TAKES ON HIGH-STAKES POKER PROS ON POKERSTARS BIG GAME ON TOUR IN LAS VEGAS

Gronk makes high-stakes debut taking on poker legends Phil Hellmuth and Antonio Esfandiari

Four-time Super Bowl champion and FanDuel Ambassador Rob Gronkowski is competing in a new arena as the former NFL tight end makes his high-stakes poker debut in Las Vegas on PokerStar’s The Big Game on Tour. Gronk goes head-to-head with some of the game’s best-known pros.

Known for his dominance on the football field and his larger-than-life personality, Gronk tests his competitive instincts at the poker table, where he is reading opponents, attempting a poker-face, cracking jokes and cracking aces when trying to take down pots worth thousands.

Gronk joins a table that includes:

- Phil Hellmuth, 17-time World Series of Poker champion

- Antonio Esfandiari, one of poker’s most recognisable high-stake pros

- Rania Nasreddine, a rising star known for fearless play

- Nick Wright, sports broadcaster and analyst

- Luke Waekelin, the loose cannon who earned his seat playing online on PokerStars

Season 2 of The Big Game on Tour features high stakes cash game action filmed in Las Vegas during the PokerStars North American Poker Tour and blends established poker players with celebrity competitors and ambitious qualifiers. The result is an unpredictable mix of elite gameplay, competitive ego and real money drama. Gronk’s appearance highlights the crossover appeal between professional sports and poker where competitors use skills in psychology, risk-taking and performance under pressure.

New episodes air weekly beginning Sunday, March 8 with the season culminating on April 5. Episodes are available via PokerStars’ YouTube channels.

Season 2 Release Schedule:

- Sunday, March 8 – BGOT Season 2 Episode 11

- Sunday, March 15 – BGOT Season 2 Episode 12

- Sunday, March 22 – BGOT Season 2 Episode 13

- Sunday, March 29 – BGOT Season 2 Episode 14

- Sunday, April 5 – BGOT Season 2 Episode 15

The latest season arrives just in time to celebrate the launch of FanDuel and PokerStars in the US, marking the coming together of the two brands.

To find out more, head to the PokerStars Blog.

For more details, please contact [email protected].

More information on responsible gaming can be found at: pokerstars.com/about/responsible-gaming/

The post NFL LEGEND ROB GRONKOWSKI TAKES ON HIGH-STAKES POKER PROS ON POKERSTARS BIG GAME ON TOUR IN LAS VEGAS appeared first on Americas iGaming & Sports Betting News.

Aleksandra Rudis CEO at Heaven of 7

Nurturing Female Leaders in iGaming

VeliTech is considered one of the best companies for welcoming and developing female leaders. We speak to three members of its team to find out more.

Olha Yatsyna — CMO at VeliTech & Chief Communications Officer at Veli Group

The VeliTech group of companies have earned a reputation for nurturing female leaders in iGaming. Talk us through your approach to this.

We want to attract the absolute best talent to VeliTech, and don’t believe that a person’s gender should have any impact on their suitability for a particular role. We are a committed equal opportunity employer and provide support and career development opportunities for all our employees. That said, the industry has a bit of a reputation for being male-dominated, so we have made it our mission from day one to make it clear that we want to welcome female leaders to the business, and that we will provide them with the support and development opportunities they need to achieve their full potential. This approach has seen us build out a balanced team, with some truly exceptional females in senior positions across the organisation.

Have you faced challenges in creating a culture where you can welcome and then nurture female leaders? If so, how were these challenges overcome?

The challenge has been mostly around getting the message out to female leaders that VeliTech offers the career opportunities they are seeking. The skills, qualities and qualifications required for most of the roles across the organisation can also be applied to other industries, so we have done a lot of work around engaging and communicating with female leaders to make them aware of the opportunities the global iGaming industry presents, and why VeliTech is the right company for them to join. One of the most effective ways of doing this has been to celebrate the success of the female leaders we have across the organisation, and use their stories to inspire others to apply for the open roles we have or just to connect with us and find out more about the business.

How do you attract top talent, and how do you make it known that a core aspect of your culture is supporting female leaders?

Attracting top talent, whether female or male, comes down to several factors. It starts with offering an engaging and interesting role that will allow them to develop their skills and competencies, challenge them in the right way, and provide a clear path of progression. It’s then about making them aware of the company culture and how the organisation will support them in achieving their own goals and aspirations. I think it’s important for potential candidates to get a feel for the types of people the organisation employs so they can determine if they would fit in well with the team. As for female leaders specifically, we do a lot to promote what our female leaders are doing and achieving, and to celebrate their successes. This helps others to see that we are true to our word when it comes to supporting female leaders, nurturing their talents and providing them with the opportunities to develop and secure senior roles within the organisation.

What are the upsides to having a diversified team where employees are provided with an environment to achieve their full potential?

We have the absolute best people working in any given role. A diversified and balanced workforce also brings new perspectives, different approaches to problem-solving and even unlocks unexpected opportunities for the business. By embracing female leaders and giving them the environment to succeed, VeliTech has grown at scale and pace, driven by the brightest minds and creative talents, regardless of their gender. I think we have also created a blueprint for other companies to follow when it comes to empowering female leaders, creating a culture based on equality, hiring individuals based on merit and ensuring they fit within the wider organisation.

What would you say to female leaders considering a career in the global iGaming industry?

Go for it. This is a fascinating industry that evolves at a fast pace. Things are always changing, and this is what makes it so interesting. It’s an industry that takes in everything from technology and law to consumer behaviour, data, marketing, engineering, creativity, finance and compliance, with a wide range of roles for individuals to explore and consider. It’s great for career development, and there are some truly fantastic organisations that you can work for, and in desirable locations across the world. For me, VeliTech has been the pinnacle of my career and has ultimately become my work home – a home that I would love to share with more like-minded female leaders.

VeliTech is a pioneering company in many respects, but especially when it comes to its approach to diversity and inclusion, and nurturing female leaders.

To find out more about the company culture that’s driving this, we spoke to two female leaders, Aleksandra Rudis, CEO at Heaven of 7 and Yevheniia Bocharova, CEO at VeliPlay.

We speak to both about their experience at VeliTech and how the company has supported their career aspirations.

How has the VeliTech culture allowed you to achieve your career goals and reach your full potential?

AR: What I value most about the VeliTech culture is that it recognises individuality. It’s a place where ideas can come from anyone, not just from titles. This has given me the freedom to lead Heaven of 7 in a way that feels authentic, combining business logic with creativity and empathy. I’ve always worked across different industries, from finance to tech and AAA gaming, and this variety shaped how I lead today. Veli’s environment supports that diversity of thought and lets you apply it without limits.

YB: When I joined VeliTech, I started as a Product Manager. From the very beginning, I experienced a culture that values initiative, innovative ideas and the courage to take risks, regardless of your position. Leadership didn’t just support me, they believed in me and my vision, giving me the freedom to take ownership and deliver results. Thanks to this culture of trust and openness, I was able to grow, take on new challenges, and expand my impact. Today, as CEO of VeliPlay, I see that the VeliTech focus on respect, transparency and equal opportunities has allowed me to fully realise my potential and inspire others to do the same. This environment nurtures leaders at all levels and encourages the entire team to contribute, innovate and excel.

What challenges have you faced as a female in the iGaming industry, and how has VeliTech helped you overcome these challenges?

AR: In the early years, I often felt that women in gaming had to over-explain their competence before being trusted with responsibility. Within the Veli ecosystem, that narrative changes. I’ve never had to prove my worth because of gender, only through the work itself. That’s a powerful shift. I’m surrounded by colleagues who value skill, commitment and results above everything else, and that creates a culture where you can truly grow.

YB: Early in my career, the industry often questioned women in leadership roles. At VeliPlay, the focus is always on competence, contribution and accountability, not gender. The company fosters a culture where anyone can express ideas freely and have their performance evaluated based on results. This support has allowed me to focus on growth and impact rather than overcoming stereotypes, and it encourages all employees to thrive.

Why is it so important for organisations to embrace diversity and equality, and to give female talent the same opportunities as their male counterparts?

AR: Because innovation doesn’t happen in echo chambers. The best ideas often come from the friction of different experiences, and gender balance is part of that equation. Women bring different instincts, such as emotional intelligence, holistic thinking and resilience, all of which are vital in industries built on understanding people. I’ve seen that firsthand, both in gaming and in tech startups, where diverse teams consistently outperform homogeneous ones.

YB: Diversity strengthens teams and drives innovation. Leaders of any gender bring unique perspectives and skills, but women often contribute flexible thinking, critical analysis and the ability to evaluate multiple possible outcomes, which enhances decision-making and strategic planning. Additionally, women frequently bring empathy and strong awareness of team dynamics, helping prevent conflicts and fostering a positive, collaborative environment. Providing equal opportunities ensures that all talent, regardless of gender, can contribute fully, making teams stronger, more resilient and more innovative.

Can you give an example of how having females in senior positions has benefited your company?

AR: At Heaven of 7, women hold key leadership roles across product, design and operations, and I’ve seen how that directly shapes both our culture and the games we create. In the iGaming industry, there’s often pressure to focus on short-term results. Having strong female leaders at the table naturally brings more balance and more attention to player psychology, emotional pacing and long-term retention alongside commercial performance. For me, the biggest benefit is perspective. We stay competitive and ambitious, but we also build with sustainability and responsibility in mind. That balance influences how we design our products and how we collaborate as a team.

YB: Female leaders have strengthened the VeliPlay culture of collaboration, communication and support. Their empathy and attention to team dynamics improve understanding across departments and help anticipate challenges before they escalate. This approach creates a harmonious, productive workplace, reduces employee turnover and encourages team members to stay longer than average, contributing to greater stability and continuity. As a result, teams work more cohesively, engagement increases and business outcomes improve.

How do you approach supporting other female colleagues in reaching their full potential, both within the VeliTech group of companies and the wider industry?

AR: I believe support starts with visibility and real responsibility. In the iGaming industry, women are still less represented in product and executive roles, so it’s important that we actively create those opportunities. When Forbes Cyprus recognised me as one of the Women in Tech Award winners, it reinforced how meaningful representation can be. It shows that leadership in our industry is possible and accessible. Within VeliTech, I encourage women to take ownership by leading projects, managing budgets and joining strategic discussions. Confidence grows with responsibility. Beyond the organisation, I’m always open to mentoring and honest conversations about both the opportunities and the challenges of leadership.

YB: I aim to lead by example, showing that leadership is defined by competence, confidence and accountability, not gender. I actively support colleagues by sharing experience, offering guidance and encouraging them to embrace challenges and take initiative. Our team is evenly balanced by gender, with a strong representation of women in core leadership, and I actively advocate for hiring talented women into managerial roles to ensure they have opportunities to grow and lead. Supporting each other and recognising achievements is essential, and this collective encouragement strengthens the entire team.

Any final thoughts or anything else you’d like to add?

AR: The global iGaming industry is evolving rapidly, and that evolution requires thoughtful and diverse leadership. Women bring perspective, resilience and strong people awareness – qualities that matter in a fast-moving, regulated environment. At Heaven of 7, I’m proud that we are building products that balance performance with player respect, while contributing to an industry where female leadership feels natural and visible.

YB: iGaming is a fast-paced, rapidly evolving industry where success depends on adaptability, openness and continuous learning. I am proud to work in a company that nurtures these qualities and creates equal opportunities for all employees, allowing talent to flourish regardless of background or gender. Diverse leadership, combined with collaboration and shared vision, makes VeliPlay and VeliTech stronger, more innovative and ready to achieve ambitious goals.

The post Nurturing Female Leaders in iGaming appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Canada7 days ago

Canada7 days agoPointsBet Canada to Contest Proposed 5-Day Suspension by AGCO

-

Africa7 days ago

Africa7 days agoEGT showcases African growth strategy at SiGMA Africa 2026

-

Ben Bradtke Co-Founder of ThrillTech7 days ago

Ben Bradtke Co-Founder of ThrillTech7 days agoThrillTech enters Brazilian market with EstrelaBet

-

Denmark7 days ago

Denmark7 days agoELA Games Strengthens Danish Market Presence via Stake.dk Tie-Up

-

BIG Cyber6 days ago

BIG Cyber6 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

AdmiralBet Serbia6 days ago

AdmiralBet Serbia6 days agoDigitain Enters into Multi-Vector Collaboration with AdmiralBet Serbia

-

bets7 days ago

bets7 days agoRegulatory crossroads: Anti-match-fixing bill and betting tax rejection

-

Brasil7 days ago

Brasil7 days agoBrasil ante una encrucijada: match-fixing e impuesto rechazado