Greece

BetGames readies Greece rollout with major Kaizen Gaming deal

BetGames, the leading live dealer and betting games supplier, has taken the next step in its enviable recent expansion by bringing its award-winning products and services into Greece with Kaizen Gaming.

Following a record-breaking 18 months, the latest tier-one move highlights the evolution of BetGames’ commercial growth as the industry’s unique live dealer and betting games supplier.

Kaizen Gaming is one of the fastest- growing gaming tech companies in Europe, currently operating in six countries, under the Stoiximan brand in Greece and Cyprus and as the Betano brand in Germany, Portugal and Romania.

The development comes after the studio’s recent major relaunch of its Lotto products and bolsters the success it has already seen with its market-leading popular content across Europe.

Thanks to the deal, Kaizen players are now able to enjoy an array of hit BetGames titles such as its revolutionised Lotto games, as well as the equally refreshed next-generation Wheel of Fortune.

Perennial BetGames chart-toppers such as Bet on Poker, War of Bets, and its innovative twist on Texas hold’em poker, 6+ Poker, will also be available to players. Each has proven to be industry-leading revenue drivers, and hugely popular with global audiences.

Reflecting on the studio’s latest milestone, BetGames’ COO Aiste Garneviciene said: “Maintaining our recent growth momentum is vital for us and our move into Greece is helping us capitalise on that.

“It’s been a long time coming and we couldn’t be happier that Greek players will be able to start enjoying our wonderful products! With a whole host of re-vamped games, we’re ready to take the country by storm with some of the best live dealer and betting games available globally.

“It’s been a big year of us so far, and after all the hard work and investment we’ve put into our company, we’re now in the ideal position to make the absolute the most of our latest expansion. Our partnership with Kaizen Gaming will no doubt prove to be the first of many big-name announcements in the region.”

Christos Mavridis, Live Casino Manager at Kaizen Gaming, added: “We have a thriving domestic market in Greece and as one of its leading operators, we need to have the best products on our platforms.

“We, at Kaizen Gaming, continually improve our products and services to offer the best experience to those who trust us for their entertainment and BetGames’ range of hugely popular titles will suit the Greek market perfectly. We’re delighted to have them on board.”

The latest in a key series of deals signed in recent months, BetGames is expected to go live shortly with a further number of major tier-one operators, with more news expected over the coming weeks.

The move follows BetGames launch of its first Malta-based Hub, opened earlier this year – with a business development focus on LatAm, African and European markets.

Established as the industry’s ‘go-to’ regulated live dealer supplier, BetGames holds licences issued by multiple jurisdictions including the UK, as well as being compliant with the local regulatory requirements of Malta, Italy, Lithuania, Estonia, Bulgaria and various relevant South African gambling authorities.

Powered by WPeMatico

blask

Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained

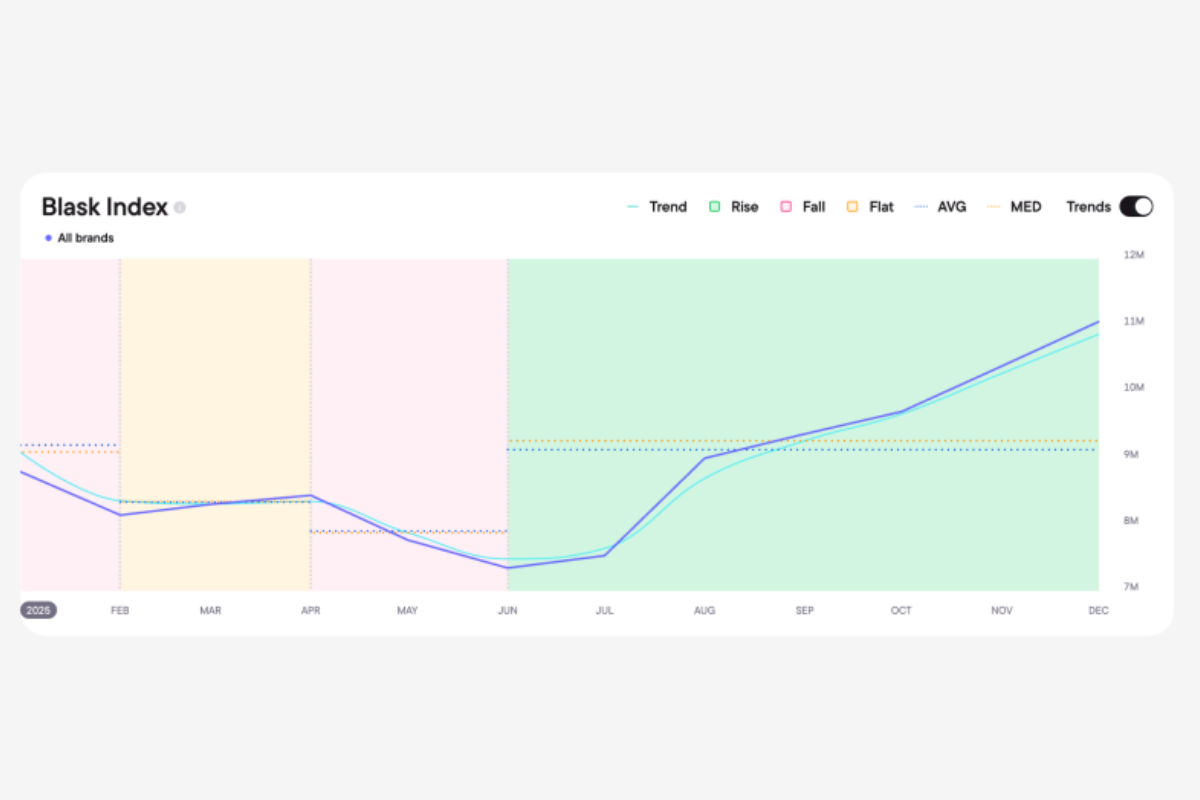

In the second half of 2025, Greece emerged as Europe’s fastest-growing iGaming market. While several major jurisdictions slowed or declined, Greek market demand rose by more than 50% between June and December, standing out as one of the year’s clearest growth stories.

According to data from Blask, the surge was not the result of a single tournament or seasonal spike. Instead, it reflected a structural shift driven by a combination of sports momentum, regulatory reform and casino market dynamics — factors that can now be traced in detail through Blask’s newly released Market Explanation feature.

Continuous sports momentum without demand gaps

Greece’s growth was underpinned by a tightly stacked sports calendar that sustained engagement across multiple months. EuroBasket 2025 in late August, the kickoff of the Stoiximan Super League, UEFA Champions League matchdays under the new league-phase format, and the EuroLeague season featuring Greek clubs created a continuous rhythm of high-interest betting cycles throughout autumn.

Rather than short-lived peaks followed by sharp declines, demand remained elevated well beyond individual events. This is a pattern clearly visible on the Blask Index trend line.

Casino reform reshaped demand behavior

One of the most significant contributors came from the casino segment. Greece’s decision to raise RNG stake limits from €2 to €20 altered the mechanics of the market, allowing online casinos to absorb demand during sports off-peak periods.

As sports-led acquisition increasingly converted into casino play, operators reported double-digit iGaming growth. Market Explanation analysis shows that this effect persisted over time, confirming the shift as structural rather than seasonal.

Enforcement redirected demand to licensed operators

Regulatory action further reinforced the upward trend. In December, Greek authorities blocked approximately 11,000 illegal gambling domains. Instead of suppressing demand, the move redirected player interest toward licensed platforms, strengthening regulated market performance.

The impact was amplified by the adoption of IRIS instant payments, which reduced deposit friction and improved conversion from interest to activity.

From tracking trends to understanding causes

To surface these drivers, Blask has introduced Market Explanation — an AI-powered layer within the Blask Index that allows users to click on any country’s trend line and instantly see a sourced breakdown of the forces behind the movement. Sports calendars, regulatory changes, casino dynamics and macro factors are analyzed together, turning raw demand signals into actionable market context.

Greece’s 2025 performance illustrates how this approach changes market analysis. Rather than simply observing that demand is rising, operators, suppliers and investors can now see why it is happening — and which levers are shaping the trajectory of a market in real time.

The post Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Fotini Matthaiou Executive Director of Casino at Novibet

Novibet Expands Greek Casino Offering with Octoplay Live

“The current Greek launch with Novibet demonstrates the momentum of our European expansion,” says Ralitsa Georgieva, Director of Business Development at Octoplay. “Adding Greece to our portfolio of regulated markets reinforces our strategy of rapid growth across Europe, bringing our premium content to new player audiences throughout the continent.”

Fotini Matthaiou, Executive Director of Casino at Novibet, comments:“Our partnership with Octoplay marks another important step in Novibet’s ongoing commitment to delivering next-generation gaming experiences. By integrating Octoplay’s innovative portfolio into our platform, we continue to expand the range of premium content available to our players, combining cutting-edge technology with entertainment value. At Novibet, we constantly seek strategic collaborations that enhance the quality and diversity of our offering, ensuring that every player enjoys a personalized, world-class gaming experience.”

The post Novibet Expands Greek Casino Offering with Octoplay Live appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Andreas Nikolopoulos

Betsson Becomes Naming Partner and Major Sponsor of Peristeri Betsson BC

Reading Time: 2 minutes

Betsson has entered a new two-year partnership with Peristeri BC, a well-established Athens club with more than 50 years of history, competing in the top tier of Greek basketball and in European competitions. As part of the agreement, the team will now compete under its official name, Peristeri Betsson BC.

This collaboration reflects Betsson’s continued investment in Greek sport. With more than six decades of heritage and operations across 24 countries, Betsson’s strategy in Greece is centred around supporting historic clubs, strengthening local communities and contributing to the broader development of sport in the country. Following Mykonos Betsson and Aris Betsson, Peristeri Betsson BC represents the next step in building a network of sponsorships that carry meaningful cultural and community impact.

For Peristeri, the partnership provides strong strategic backing for the club’s competitive ambitions and its long-term mission to remain a reference point within Greek basketball. Both organisations share a commitment to professionalism, consistency and delivering high-quality experiences to fans. The collaboration will also include a suite of social impact initiatives focused on youth, education, equality and access to sport in Peristeri.

Andreas Nikolopoulos, Commercial Director at Betsson, said: “It is a great pleasure for all of us at Betsson to stand alongside a club with such a strong history and identity as Peristeri, a club that has been a reference point in Greek basketball for decades and continues to grow thanks to the steady and methodical work of its management. We do not view this merely as a sponsorship but as a strategic alliance. We share the same values with Peristeri, professionalism, consistency and a constant commitment to offering high-quality experiences to fans. We are committed to supporting them throughout this journey and we wish the team a season full of health, energy and success.”

Manos Kotsis, General Manager of Peristeri Betsson BC, said: “We are now officially Peristeri Betsson and will be for the next two years. Our approach is based on two pillars: reconnecting with our local community and bringing people back to the arena, and restoring Peristeri’s identity as a club that develops talent, whether local or international. We believe we have made meaningful progress over the past two years, but both goals require strong organisation, planning and method. We are delighted that Betsson is by our side supporting this effort and enabling us to move forward with greater confidence.”

The post Betsson Becomes Naming Partner and Major Sponsor of Peristeri Betsson BC appeared first on European Gaming Industry News.

-

Compliance Updates5 days ago

Compliance Updates5 days agoIllinois Gaming Board and Attorney General’s Office Issue more than 60 Cease-and-Desist Letters to Illegal Online Casino and Sweepstakes Operators

-

Canada5 days ago

Canada5 days agoINCENTIVE GAMES PARTNERS WITH LOTO-QUÉBEC TO LAUNCH REAL-MONEY GAMES IN THE PROVINCE OF QUÉBEC, CANADA

-

Latest News5 days ago

Latest News5 days agoLaunch Of A Fresh Online Casino Guide 2026

-

Australia5 days ago

Australia5 days agoRegulating the Game 2026 Sydney — One Month Countdown as Sector Leaders Anticipate Inaugural RTG Global Awards

-

Always Up! x100005 days ago

Always Up! x100005 days agoRing in the Chinese New Year with BGaming’s Seasonal Promotion

-

Latest News5 days ago

Latest News5 days agoVolcano Power — Hold & Hit 3×3 from Spinomenal

-

Affigates5 days ago

Affigates5 days agoSoftConstruct AI and Affigates Bring Cutting‑Edge Solutions to AIBC Eurasia 2026 in Dubai

-

Accra5 days ago

Accra5 days agoKaizen Gaming Launches Betano in Ghana — 20th Regulated Market & Responsible GameTech Expansion