Latest News

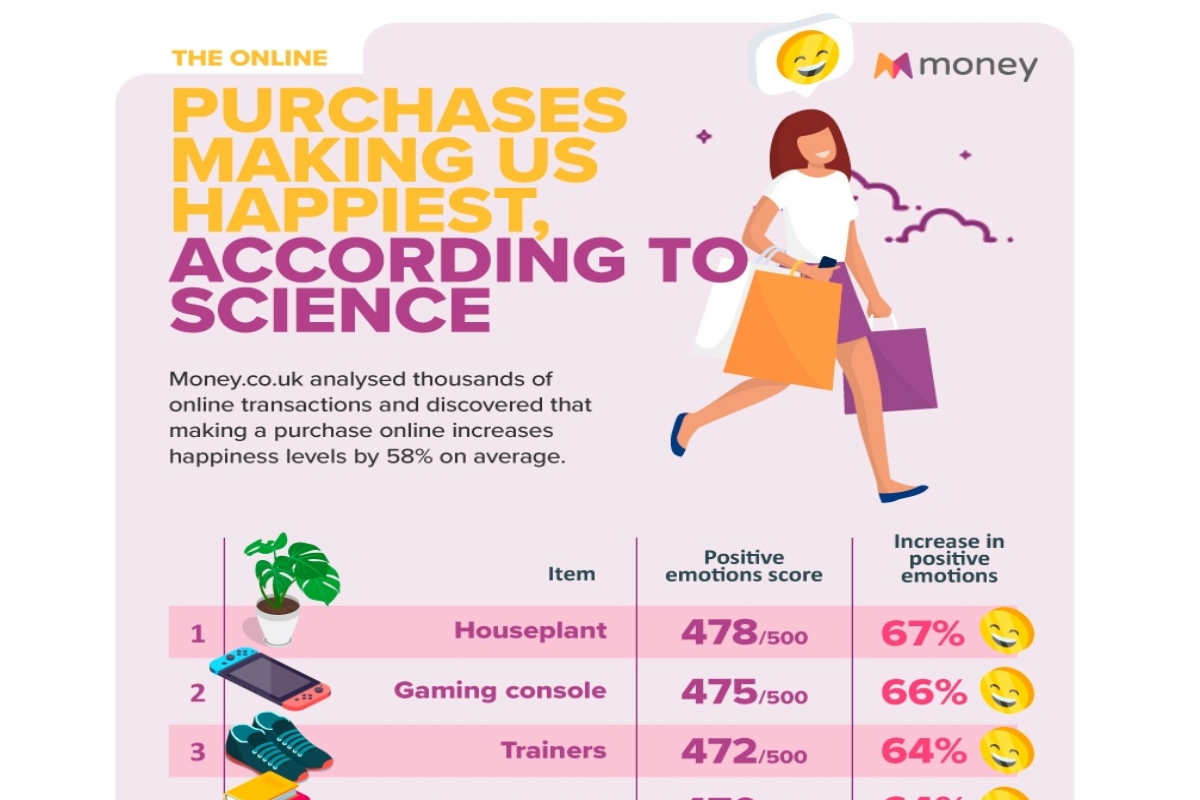

Emotions test reveals: The online purchases making us 67% happier!

- On average, online purchases are found to raise our positive feelings by 56%

- Participants reported the biggest increase in happiness when purchasing houseplants – positive emotions soared by 67%

- Gaming console purchases saw the second highest increase in positive feelings (+66%)

- Trainers and fiction books are also among the purchases raising positive emotions most

- Holidays abroad came in last; participants noted high levels of excitement but also reported an increase in concern due to its uncertainty

Thanks to ‘doom shopping’, it was revealed that the UK spends three times more when online shopping compared to the global average, costing the average person a whooping £1,382 per year! Clearly these purchases keep us coming back for more, but how do we enjoy splashing our cash the most?

Interested in online shopping, money.co.uk conducted an emotions test among 2,560 participants to discover which online purchases bring us the most joy!

Participants were asked to complete a variation* of the BMIS test (Brief Mood Intensity Scale) and record the intensity of 10 different emotions after making an online purchase. The intensity of each emotion was allocated a score based on its positivity, with a maximum score of 500 points per item – the higher the score, the better. Participants were also asked to complete the same test before making any purchases to uncover the percentage increase in positive emotions when shopping.

Which online purchases make us happiest?

Money.co.uk can reveal that a houseplant purchase increases our intensity of positive emotions more than any other transaction!

Collecting 478 points out of a potential 500, moods improved by 67% after making a plant purchase. Plants are proven to invoke feelings of vitality by improving the state of mind and lifting spirits – no wonder it scores highly!

With the PS5 still proving hard to get, purchasing a gaming console is the second online transaction that makes us happiest.

As many gamers are left on the edge of their seats waiting to snatch the latest console, it accumulated 475 points out of 500, and purchasing a console was found to raise positive feelings by 66% on average.

In third position are trainer purchases. With the demand for sneakers like Jordan 1s only increasing, those who purchased new trainers reported a 64% increase in happiness, and purchases racked up 472 points.

With bookworms reported to be happier than those who don’t read, the transaction that makes us fourth happiest is a fiction book, improving positive emotions by 64% and collecting 470 points.

Due to the huge surge in personal fitness and wellbeing during lockdown, home gym equipment purchases are found to make us fifth happiest! This transaction led to a 63% increase in positive emotions and scored a healthy 468 points.

To complete the top 10 purchases that increase our intensity of positive emotions:

6. Video game: 466 points, +62%

7. Eyeshadow palette: 465 points, +62%

8. Scented candle: 463 points, +61%

9. Exercise clothing: 461 points, +61%

10. Fashion jewellery: 459, +60%

Coming in last is a holiday abroad with 393 points out of 500 (+37%). Those who plan on jet-setting this year reported high levels of excitement and happiness but were pushed down the table as feelings of worry and nerves due to its current uncertainty.

Interested in the reasons behind our vast improvement in positive feelings, money.co.uk spoke exclusively to Lee Chambers, psychologist and wellbeing consultant, to uncover why shopping makes us happy.

“Online shopping has the ability to make us happy through several different mechanisms. Firstly, even in a world of plenty, we are still evolutionarily designed to consider scarcity. Because of this, acquiring new items, especially when discounted or limited, tends to make us happy, the feeling we have satisfied a need and potentially averted a future threat.

Shopping is also an exercise in control. We select from millions of items precisely what we want, and especially in the uncertain times we live in, we know we will get exactly what we have purchased, and it will be delivered straight to us. This control of selection and guarantee of receipt is powerful, as it becomes a defined event. We also build a level of expectation and anticipation from the moment we press the purchase button, as we believe we now have ownership over the item but have a delay until it is with us physically.

From a cultural perspective, we have been conditioned to see shopping as a reward, either an investment in ourselves or for the satisfaction of others. Shopping is likely to activate the nucleus accumbens in our brain, releasing dopamine and motivating us to repeat the behaviour. Buying printed media taps into our desire to better ourselves, gain knowledge, understand the world around us and provide stories and entertainment that can take us on a journey. And let’s not forget how lovely they look on your bookshelf on a video call, as books have become a decorative symbol over the past year.

And why do we keep buying? Our brain is adaptive, and shopping can relieve stress, provide entertainment when bored and give us a hit of dopamine. The rewarding feeling will keep us finding new things to purchase, especially since our excitement and anticipation fade once we’ve received the item.”

Catherine Hilley, mobiles expert at money.co.uk, said: “Our research reveals how small purchases can increase customers’ emotions in a positive way, something we all need after the past 12 months. With an average 63% increase in positive emotions noted across all top 10 purchases, it seems that shopping online for items such as houseplants, trainers and candles are sparking a lot more joy at the moment, than booking a holiday, which comes with a lot of added uncertainty.”

For more information, please see the blog post for the full rankings and a breakdown by sex, and age: https://www.money.co.uk/mobiles/online-shopping-joy

Powered by WPeMatico

accumulators

Record-breaking volumes at the World Sports Betting Cape Town Met, powered by OpenBet technology

OpenBet, a global leader in betting and gaming technology, powered record-breaking volumes for World Sports Betting (WSB) during the 2026 World Sports Betting Cape Town Met, processing more than three times WSB’s typical daily activity with zero downtime.

The Cape Town Met is one of South Africa’s premier horseracing events, drawing intense traffic that tests platform performance. Less than a year after migrating to OpenBet’s unified technology stack, WSB demonstrated the resilience and scalability of its platform under extreme demand.

OpenBet’s Player Account Management (PAM) technology and sportsbook solution — phased in with PAM going live in February 2025 and the sportsbook in October 2025 — now underpin WSB’s enterprise-grade wagering infrastructure across both digital and retail channels. The integrated system delivers streamlined KYC, a unified wallet, accurate reporting and a robust compliance framework designed for South Africa’s regulatory environment.

Enhanced features available to WSB customers include 50-leg accumulators, partially redeemable free bets, advanced Telebet telephone betting and integrated pools betting for sports and racing through OpenBet’s advanced trading system.

“With the World Sports Betting Cape Town Met, we processed more than three times the usual volume with zero downtime, showcasing the strength and scalability of our technology,” said Runa Walia Desai, Chief Customer Experience Officer at OpenBet. “This milestone also extends our footprint into Africa, reinforcing our position across six continents.”

Warren Tannous, CEO of World Sports Betting, added that OpenBet’s modular solution gives the operator the confidence to expand its sportsbook offering and support increased user engagement while maintaining performance and compliance.

The post Record-breaking volumes at the World Sports Betting Cape Town Met, powered by OpenBet technology appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

10000x multiplier

Choice Gaming Launches Evra Crash in Exclusive Collaboration with Patrice Evra

Choice Gaming has officially launched Evra Crash, a new multiplayer crash game developed in exclusive collaboration with football legend Patrice Evra.

The title blends high-energy crash mechanics with football culture, delivering a synchronized, shared-table experience designed to boost player engagement and social interaction.

A Football Icon Powers the Gameplay

At the center of Evra Crash is Patrice Evra, one of football’s most recognizable personalities. His presence adds authenticity and competitive intensity to the gameplay, reinforcing the game’s energetic, community-driven concept. The partnership between Choice Gaming and Evra aims to merge competitive spirit with immersive entertainment in the fast-growing crash gaming segment.

Multiplayer Crash Experience

Unlike traditional single-session crash games, Evra Crash is built around real-time shared rounds:

- All players join the same round simultaneously

- Fully networked multiplayer participation

- Visible, synchronized gameplay across users

This structure creates a social crash environment where anticipation builds collectively, increasing engagement and enhancing the thrill of each round.

Game Features & Performance Metrics

Evra Crash offers a balanced gameplay structure designed for broad player appeal:

- RTP: 95%

- Maximum Multiplier: 10,000x

- Volatility: Low

The low-volatility model provides consistent entertainment while maintaining the potential for high multipliers, positioning Evra Crash as an accessible yet exciting crash title in the iGaming market.

Cross-Platform Optimization

Built for seamless performance across environments, Evra Crash is:

- Fully mobile-optimized

- Compatible with land-based gaming solutions

- Designed for consistent cross-platform gameplay

Whether accessed online or in physical gaming venues, players experience uninterrupted performance and smooth gameplay integration.

The post Choice Gaming Launches Evra Crash in Exclusive Collaboration with Patrice Evra appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

EARN YOUR PLACE AMONG THE BEST AS POKERSTARS REVEALS SCHEDULE FOR PRESTIGIOUS SPRING CHAMPIONSHIP OF ONLINE POKER

More than $45 million guaranteed across 400 tournament opportunities for all players to earn their greatness

The full schedule for poker’s first major online series of the year, PokerStars prestigious Spring Championship of Online Poker (SCOOP), has been unveiled featuring 136 events and more than $45 million guaranteed.

From March 1 to 25, players have the chance to earn their greatness once more and battle for an acclaimed SCOOP title across three weeks of elite online poker action. The 136-event schedule (with a total of 400 tournaments) offers low, medium, and high buy-in levels from $5.50 to $15,000, and a wide range of formats including No-Limit Hold’em, PLO, 8-Game, Mystery Bounties, Turbo, and Deep Stack events, making SCOOP accessible for everyone.

KEY SCHEDULE HIGHLIGHTS

The flagship Main Events will be a schedule highlight and will award a total of $5.5 million across the NLHE Main Events on March 22, and $550,000 across the PLO Main Events on March 23.

- $109 SCOOP NLHE Main Event Low – $1.5 million guaranteed

- $1,050 SCOOP NLHE Main Event Med – $2 million guaranteed

- $5,200 SCOOP NLHE Main Event High – $2 million guaranteed

- 109 SCOOP PLO Main Event Low – $100,000 guaranteed

- $1,050 SCOOP PLO Main Event Med – $200,000 guaranteed

- $5,200 SCOOP PLO Main Event High – $250,000 guaranteed

Other highlights of the 18th edition of SCOOP include:

- March 1 – $215 Sunday Million PKO – $1 million guaranteed

- March 8 – $22 Mystery Sunday Special, $300,000 guaranteed – All-in Shoot Out for United Kingdom & Ireland players to award an Emerald Pass to the Irish Open on March 10 at 7am GMT

- March 8 – $109 Sunday Million PKO – $1 million guaranteed

- March 15 – $55 Mini Sunday Million PKO – $500,000 guaranteed – All-in Shoot Out for United Kingdom & Ireland players to award an Emerald Pass to the Irish Open on March 17 at 7am GMT

- March 15 – $530 Sunday Million – $1 million guaranteed

As well as the huge prizes and trophies on offer, players can also compete in the SCOOP Leaderboards where an additional $100,000 in cash prizes will be awarded across the Low, Medium and High Player of the Series Leaderboards.

As ever, there are a number of qualification routes giving players the chance to qualify into SCOOP events for a fraction of the buy-in. Routes include satellites from just $0.55, the SCOOP Lucky Dip where $500,000 in SCOOP tickets are up for grabs and the $55 Power Path Express SCOOP Edition, on March 1st,where more than $200,000 in SCOOP Power Passes and Main Event tickets will be awarded to boost players’ grind to greatness. Finally, all players are still in time to crack open a SCOOP Prize Vault and earn a SCOOP ticket worth up to $1,050 upon opt-in.

“SCOOP is where greatness isn’t given, it’s earned. Every title represents weeks of preparation, relentless competition and beating the toughest fields in online poker. That’s what makes a SCOOP win so special,” said Steve Clarricoats, Associate Director of Poker Operations at PokerStars. “With a huge schedule and accessible buy-ins and formats, SCOOP remains the title every online player wants on their record.”

For 17 years, SCOOP has been appointment poker of the highest order and winning a SCOOP title has been a bucket list dream for poker players all over the world. More than $1.4 billion in prize pools have been awarded to players since SCOOP started in 2009, with some of the world’s best players earning coveted SCOOP trophies.

Sweden’s Simon “C. Darwin” Mattsson is the greatest player in SCOOP history having earned 14 titles, followed by fellow Swede Niklas “Lena900” Astedt and the UK’s Benny “RunGodlike” Glaser who both have 11 titles, with Benny being the most decorated player in COOP history also having a record-leading 16 WCOOP titles.

For more information about SCOOP head to the PokerStars website or PokerStars Blog.

The post EARN YOUR PLACE AMONG THE BEST AS POKERSTARS REVEALS SCHEDULE FOR PRESTIGIOUS SPRING CHAMPIONSHIP OF ONLINE POKER appeared first on Americas iGaming & Sports Betting News.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Denmark7 days ago

Denmark7 days agoRoyalCasino Partners with ScatterKings for Company’s Danish Launch

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Baltics7 days ago

Baltics7 days agoEstonia to Reinstate 5.5% Online Gambling Tax From March 1

-

Booming Games7 days ago

Booming Games7 days agoTreasure Hunt Revival — Booming Games Launches Gold Gold Gold Hold and Win

-

ELA Games7 days ago

ELA Games7 days agoELA Games Unveils Tea Party of Fortune — A Magical Multiplier Experience

-

Bet Rite7 days ago

Bet Rite7 days agoSpintec Expands into Canada with Bet Rite