Latest News

LeoVegas AB Q2: Quarterly report 1 April – 30 June 2020

“The strong EBITDA growth clearly illustrates the scalability of our business model”

– Gustaf Hagman, Group CEO

second quarter 2020: 1 april–30 june

- Revenue increased by 17% to EUR 110.7 m (94.4). Organic growth in local currencies was 19%.

- EBITDA was EUR 23.0 million (15.1), corresponding to an EBITDA margin of 20.8% (16.0%) and a growth of 53 %.

- The number of depositing customers was 434,453 (350,298), an increase of 24%.

- Earnings per share were EUR 0.14 (0.08) before and after dilution, while adjusted earnings per share were EUR 0.19 (0.11).

Events during the quarter

- LeoVegas completed the migration of 12 brands in the UK to the Group’s proprietary technical platform.

- The LiveCasino.com brand was launched in a number of English-speaking countries.

- At LeoVegas’ Annual General Meeting on 8 May, Anna Frick and Fredrik Rüdén were re-elected as board members. Hélène Westholm, Mathias Hallberg, Carl Larsson, Per Norman and Torsten Söderberg were elected as new board members. Per Norman was elected as Chairman of the Board.

- The effects related to COVID-19 are judged overall to have had a positive impact on NGR during April and May, however, the effect on revenues in Sweden was negative during the quarter.

Events after the end of the quarter

- Preliminary revenue in July amounted to EUR 30.7 m (29.3), representing growth of 5%. The temporary restrictions introduced in Sweden starting on 2 July have had a negative impact on revenue.

- The number of depositing customers increased by 34% in July compared with the same period a year ago, to a new record level for a single month.

- GoGoCasino was launched in Finland. An international rollout of the brand is now continuing.

- LeoVegas has increased its ownership in the e-sports betting operator Pixel.bet to 85%, from 51% previously.

COMMENT FROM GUSTAF HAGMAN – GROUP CEO

SECOND QUARTER 2020

LeoVegas has delivered continued solid growth and profitability during a period of exceptional circumstances in the world around us. Supported by the record-large customer base that we entered the quarter with, together with our ability to quickly adapt to new conditions, the positive trend from the first quarter is continuing.

Revenue during the second quarter amounted to EUR 110.7 m (94.4), representing organic growth of 19%. Net Gaming Revenue (NGR) for casino grew 24% during the period, while for sports betting it decreased by 53% compared with the same period a year ago.

EBITDA amounted to EUR 23.0 m (15.1), corresponding to a margin of 20.8% (16.0%). We thus grew EBITDA by 53%, which shows the scalability in our business model from higher revenue. The sharply improved operating profit has been achieved despite a continued high pace of expansion and increased investments in technology and products.

covid-19

I am very satisfied with how we at LeoVegas are handling the COVID-19 situation so that we can conduct our business without noticeable disruptions, despite challenges such as not being able to meet in our daily work. Our industry, like many other sectors, is experiencing a structural shift from offline to online. Owing to LeoVegas’ online position, appreciated brands and proprietary technical platform, we stand strong in an increasingly digital world.

Markets

We had favourable development in most of our markets during the second quarter. Growth has been driven primarily by a record-large depositing customer base, which grew 24% compared with a year ago. The Rest of Europe region experienced exceptionally high growth, with Italy posting record-strong performance. The effects related to COVID-19 are judged overall to have had a positive impact on NGR during April and May, mainly in the markets that were entirely shut down during the period. In these markets, LeoVegas has taken market shares from the land-based gambling industry. However, the effect on revenue related to COVID-19 is judged to have been negative in Sweden during the quarter.

responsible gaming

During the quarter, several countries implemented measures to reduce the risk for problem gaming in connection with COVID-19. Spain, for example, introduced a temporary ban on gambling advertising. On top of these restrictions, LeoVegas has chosen to implement its own proactive measures to strengthen player protection. Most of the temporary restrictions throughout Europe ended in June, and Spain and the UK, among other countries, have reverted to normal regulations once their respective societies opened up again.

It is therefore remarkable that Sweden, despite massive criticism from most areas, has moved in the opposite direction and introduced new, temporary restrictions, effective 2 July, focused particularly on online casino. There is a large risk that these restrictions, implemented entirely without supporting factual data, are undermining the Swedish regulation system and driving players to companies without Swedish licences, where player protection is non-existent. These restrictions therefore risk being counter-productive and instead contribute to an increase in problem gaming in Sweden.

The independent research consultancy Copenhagen Economics has noted that one consequence of the new restrictions is that the unregulated market for online casino may increase to as much as 50%, which is far from the authorities’ stated goal to limit the unregulated market to 10% at most.

We advocate for balanced and clear regulations for achieving long-term sustainable licensing systems. LeoVegas wants to contribute to this through a broader dialogue and collaboration with the authorities in the countries we are active in.

MULTIBRAND STRATEGY

During the quarter we launched the new LiveCasino.com brand in a number of English-speaking countries. We see great potential for the brand. The start has been promising, and additional markets are to be expected.

Following the successful launch of GoGoCasino in Sweden last year, an international rollout of the brand is now under way. Finland was the second market to launch, at the start of July.

The successful launches of new brands are in line with the company’s multibrand strategy and show our ability to create new revenue streams while at the same time drawing benefit from the Group’s economies of scale.

comments on third quarter

Revenue for the month of July amounted to EUR 30.7 m (29.3), representing a growth rate of 5%.

Our assessment is that the gaming market has returned to a more normal environment in July, with a natural player shift from casino back to sports betting now that the major sports leagues have restarted. At the same time, the temporary restrictions introduced in Sweden starting on 2 July are having a negative impact on revenue.

The positive trend in our customer base is continuing into the third quarter, and the number of depositing customers increased by 34% in July compared with the same period a year ago, to a new record level for a single month. We will maintain a continued high rate of investment during the third quarter, partly linked to the launch of new brands and market establishments. Our current assessment is therefore that marketing costs will be in line with – or slightly higher than – the level during the second quarter.

We continue to focus on delivering sustainable and profitable growth for our shareholders and on offering an entertaining and safe gaming experience for our customers around the world. LeoVegas’ long-term vision is to be “King of Casino”.

Presentation of the report – today at 09:00 CET

- To participate in the conference call, and thereby be able to ask questions, please call one of the following numbers: SE: +46 (0) 8 50 69 21 80, UK: +44 (0) 20 71 92 80 00, US: +1 63 15 10 74 95, Confirmation code: 222 77 69 or join at the web https://edge.media-server.com/mmc/p/5fggroyh

Powered by WPeMatico

DAZN Bet

Vibrez! A New, Mysterious Sports Betting Operator Gains ANJ Approval in France

The French online sports betting market, often described as one of the most tightly regulated yet least dynamic in Europe, is preparing to welcome a surprising new entrant: Vibrez!. The operator secured regulatory approval and is now gearing up for launch, marking one of the few truly new brand arrivals in recent years.

Regulatory Approval and Market Entry

In 2025, Vibrez obtained an operating license from the Autorité Nationale des Jeux (ANJ), under the authorization number 0063-PS-2025-05-15-AGR-00. The five-year renewable license covers only sports betting, with no authorization for poker or horse racing verticals.

At this stage, Vibrez’s website (www.vibrez.fr) is little more than a placeholder page. But the license approval signals the company’s commitment to entering France in 2026, timed closely with another newcomer, Bet365, which is in the process of getting its license just weeks later.

Who is Behind Vibrez?

The operator remains shrouded in mystery. Unlike market entrants backed by household names such as FDJ, Kindred, or Entain, Vibrez appears to be an independent French-facing brand.

The licensing application was submitted via BCFR, the same entity linked to brands like DAZN Bet, Circus Bet, and Vbet in France. This strongly suggests that BetConstruct, a B2B software and platform provider with experience powering multiple operators, is the technology backbone behind Vibrez.

While the corporate structure offers some clarity, Vibrez’s strategic positioning and long-term ambitions remain uncertain.

Branding and Market Positioning: Hints of Community?

Even the usually well-informed French website lebonparisportif.com, which monitor the iGaming market in France, cannot say much about what this new bookmaker will offer, but they wrote a few guesses about in an article in French (“Qui se cache derrière Vibrez?”) that we translate some key suggestions here:

According to them, the brand name “Vibrez” (French for “feel the thrill” or “vibrate”) and the teaser slogan “prépare-toi à vibrer” hint at a potentially community-driven or experience-focused positioning. This suggests Vibrez may experiment with new betting formats, perhaps inspired by simplified or binary-style markets such as “Yes/No” propositions, aiming to differentiate from more traditional sportsbook offerings.

The French market, while sizable, leaves little room for pure replication strategies. To gain traction against entrenched competitors like Winamax, Betclic, and ParionsSport (FDJ), Vibrez will need to bring innovation, either through product design, gamification, or marketing strategies that resonate with younger demographics.

The French Market: A Rare Case of New Entrants

The arrival of Vibrez is significant precisely because new operators are rare in France. DAZN Bet, is the most recent betting site launched in France.

With two brand launches expected before the end of 2026, observers anticipate a modest shake-up in an otherwise mature and concentrated market. Whether Vibrez will bring genuine disruption or simply serve as a niche challenger remains to be seen.

What Comes Next

Vibrez has yet to announce an official launch date, though industry insiders expect the platform to go live in 2026, probably before the World Cup this summer, which should be a highlight in the sports betting world this year. Welcome bonuses are likely to follow the French market standard, capped at €100 in free bets due to ANJ’s strict promotional guidelines.

Until then, Vibrez represents one of the most intriguing mysteries in French iGaming: a brand with no legacy, no major international parent, but potentially bold ambitions to “make the market vibrate.”

The post Vibrez! A New, Mysterious Sports Betting Operator Gains ANJ Approval in France appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

blask

Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained

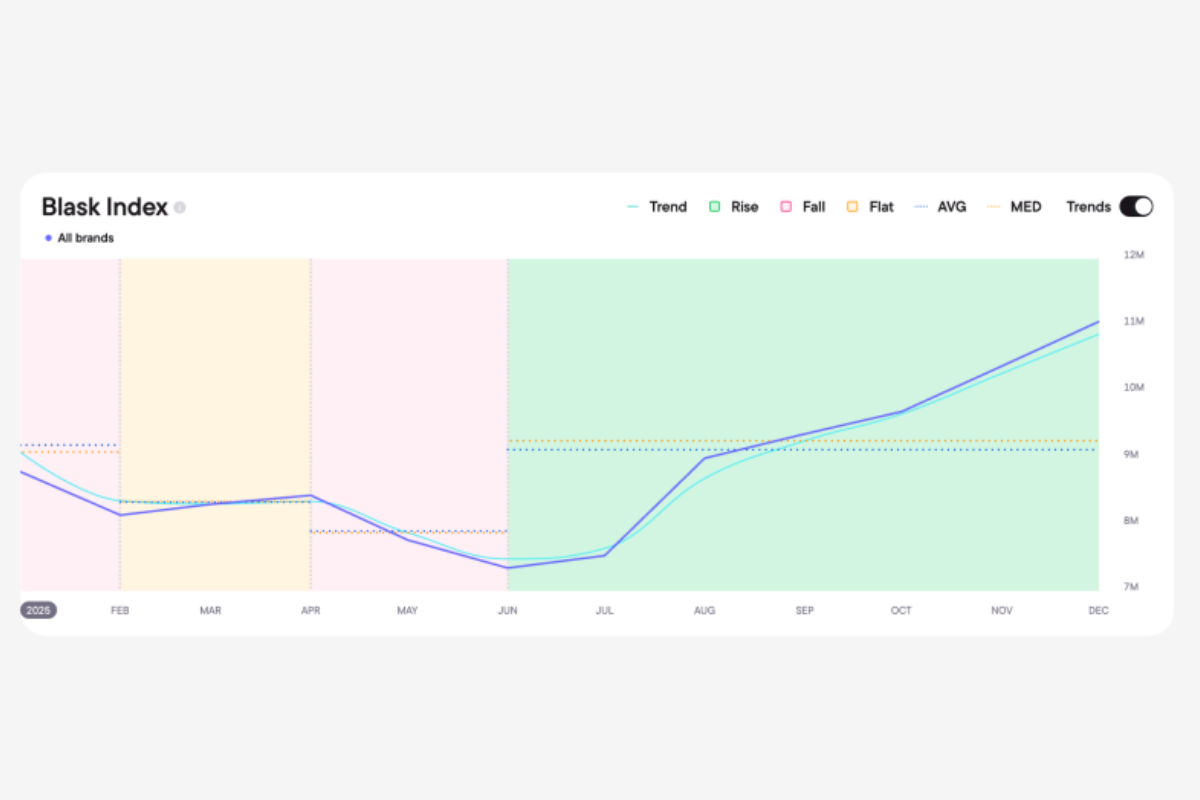

In the second half of 2025, Greece emerged as Europe’s fastest-growing iGaming market. While several major jurisdictions slowed or declined, Greek market demand rose by more than 50% between June and December, standing out as one of the year’s clearest growth stories.

According to data from Blask, the surge was not the result of a single tournament or seasonal spike. Instead, it reflected a structural shift driven by a combination of sports momentum, regulatory reform and casino market dynamics — factors that can now be traced in detail through Blask’s newly released Market Explanation feature.

Continuous sports momentum without demand gaps

Greece’s growth was underpinned by a tightly stacked sports calendar that sustained engagement across multiple months. EuroBasket 2025 in late August, the kickoff of the Stoiximan Super League, UEFA Champions League matchdays under the new league-phase format, and the EuroLeague season featuring Greek clubs created a continuous rhythm of high-interest betting cycles throughout autumn.

Rather than short-lived peaks followed by sharp declines, demand remained elevated well beyond individual events. This is a pattern clearly visible on the Blask Index trend line.

Casino reform reshaped demand behavior

One of the most significant contributors came from the casino segment. Greece’s decision to raise RNG stake limits from €2 to €20 altered the mechanics of the market, allowing online casinos to absorb demand during sports off-peak periods.

As sports-led acquisition increasingly converted into casino play, operators reported double-digit iGaming growth. Market Explanation analysis shows that this effect persisted over time, confirming the shift as structural rather than seasonal.

Enforcement redirected demand to licensed operators

Regulatory action further reinforced the upward trend. In December, Greek authorities blocked approximately 11,000 illegal gambling domains. Instead of suppressing demand, the move redirected player interest toward licensed platforms, strengthening regulated market performance.

The impact was amplified by the adoption of IRIS instant payments, which reduced deposit friction and improved conversion from interest to activity.

From tracking trends to understanding causes

To surface these drivers, Blask has introduced Market Explanation — an AI-powered layer within the Blask Index that allows users to click on any country’s trend line and instantly see a sourced breakdown of the forces behind the movement. Sports calendars, regulatory changes, casino dynamics and macro factors are analyzed together, turning raw demand signals into actionable market context.

Greece’s 2025 performance illustrates how this approach changes market analysis. Rather than simply observing that demand is rising, operators, suppliers and investors can now see why it is happening — and which levers are shaping the trajectory of a market in real time.

The post Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Crypto Turnkey

GR8 Tech Delivers 1.6× Higher Deposit Conversion and 3× Reduction in Transaction Costs for Crypto Turnkey Clients

Unlock Your Crypto Advantage at ICE Barcelona 2026

The post GR8 Tech Delivers 1.6× Higher Deposit Conversion and 3× Reduction in Transaction Costs for Crypto Turnkey Clients appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Booming Games6 days ago

Booming Games6 days agoBooming Games and Live Play Mobile Launch “LivePlay™ Slots” with Exclusive Modo Debut

-

Arizona7 days ago

Arizona7 days agoArizona Department of Gaming Reports $44.9 Million in Tribal Gaming Contributions for the Second Quarter of Fiscal Year 2026

-

Affiliate Events6 days ago

Affiliate Events6 days agoTaking Off with N1 Partners at iGB Affiliate 2026 in Barcelona: Grand Final and a Helicopter for the N1 Puzzle Promo Winner

-

Affiliate Management6 days ago

Affiliate Management6 days agoN1 Faces: Daria Maichuk — “Communication as the Key to Strong, Effective Partnerships in Affiliate Marketing”

-

Affiliate Management6 days ago

Affiliate Management6 days agoN1 Faces: Daria Maichuk — “Communication as the Key to Strong, Effective Partnerships in Affiliate Marketing”

-

Affiliate Events6 days ago

Affiliate Events6 days agoTaking Off with N1 Partners at iGB Affiliate 2026 in Barcelona: Grand Final and a Helicopter for the N1 Puzzle Promo Winner

-

Global Expansion6 days ago

Global Expansion6 days agoProgressPlay Unveils Dual-Engine Strategy for 2026: Empowering Partners via Standalone and Sweepstakes Solutions

-

AI in iGaming7 days ago

AI in iGaming7 days agoSCCG Announces Partnership Extension with Golden Whale – Driving AI-Led Optimization Across iGaming Operators and Platforms