Press Releases

Announcement from LeoVegas 2020 Annual General Meeting

The 2020 Annual General Meeting of LeoVegas AB was held on 8 May 2020, at which the shareholders approved the following resolutions.

Adoption of the income statement and balance sheet

The AGM resolved to adopt LeoVegas’ income statement and balance sheet as well as the consolidated income statement and consolidated balance sheet

Distribution of profit and dividend

The AGM resolved, in accordance with the Board of Directors’ proposal, that of the amount available for distribution to the shareholders, totaling EUR 36,317,631, SEK 142,314,158 shall be distributed to the shareholders, corresponding to an amount of SEK 1.40 per share, and that the remainder, EUR 22,758,736 shall be carried forward. In addition, it was resolved, in accordance with the Board of Directors’ proposal, that dividends will be paid out half-yearly in the amount of SEK 0.70 per share, and that the first record date for entitlement to the dividend shall be 12 May 2020, whereby dividends will be paid out via Euroclear Sweden AB on 15 May 2020, and that the second half-yearly dividend record date shall be 12 November 2020, whereby dividends will be paid out via Euroclear Sweden AB on 17 November 2020.

DISCHARGE FROM LIABILITY

The board members and CEO were discharged from liability for the 2019 financial year.

ELECTION OF THE BOARD OF DIRECTORS AND AUDITOR, AND DIRECTORS’ AND AUDITORS’ FEES

The AGM resolved that the Board of Directors shall consist of seven directors and no deputy directors. It was resolved that the Company shall have a chartered auditing firm as auditor.

In addition, it was resolved in accordance with the Nomination Committee’s proposal that directors’ fees shall amount to a total of SEK 2,800,000 including fees for committee work (preceding year: SEK 1,900,000) and shall be paid out to the directors and committee members in the following amounts:

SEK 300,000 for each non-executive director and SEK 600,000 for the Chairman of the Board, provided that he is not an employee of the Company;

SEK 50,000 for each non-executive director serving as a member of the Remuneration Committee, and SEK 100,000 for the Remuneration Committee chair, provided that he or she is not an employee of the Company; and

SEK 50,000 for each member of the Audit Committee and SEK 100,000 for the Audit Committee chair.

In addition, it was resolved that the auditor’s fees shall be paid in accordance with approved invoices.

Anna Frick and Fredrik Rüdén were re-elected as directors on the Board. Hélène Westholm, Mathias Hallberg, Carl Larsson, Per Norman och Torsten Söderberg were elected as a new directors. Per Norman was elected as Chairman of the Board. Robin Ramm-Ericson, Mårten Forste and Tuva Palm declined re-election.

PricewaterhouseCoopers AB was re-elected as the Company’s auditor. PricewaterhouseCoopers AB has announced that Authorised Public Accountant Aleksander Lyckow will continue as auditor-in-charge.

PRINCIPLES FOR APPOINTMENT OF THE NOMINATION COMMITTEE

The AGM resolved to adopt principles for appointment of the Nomination Committee in accordance with the Nomination Committee’s proposal (unchanged principles from the preceding year in all essential respects).

GUIDELINES FOR REMUNERATION OF SENIOR EXECUTIVES

The AGM resolved in accordance with the Board’s proposal to adopt guidelines for remuneration of senior executives.

WARRANT BASED INCENTIVE PROGRAM FOR EXECUTIVE MANAGEMENT AND KEY INDIVIDUALS

The AGM resolved, in accordance with the board of directors’ proposal, to issue a maximum of 1,000,000 warrants, with deviation from the shareholders preferential rights, which may result in a maximum increase in the Company’s share capital of approximately EUR 12,000. The warrants shall entitle to subscription of new shares in the Company.

The warrants shall be subscribed for by the subsidiary Gears of Leo AB, with the right and obligation to, at one or several occasions, transfer the warrants to a maximum of 50 selected members of the management team, senior executives and key employees, at a price that is not less than the fair market value of the warrant according to the Black & Scholes valuation model and otherwise on the same terms as in the issuance.

The subscription price per share shall be determined to 130 percent of the volume weighted average price for the Company’s share on Nasdaq Stockholm during the period of five trading days starting with the day following 12 May 2020.

The warrants may be exercised for subscription of shares during the period from 1 June 2023 up to and including 30 June 2023.

The maximum dilution effect of the incentive program amounts to a maximum of approximately 1.00 percent of the total number of shares and votes in the Company, assuming full subscription, acquisition and exercise of all offered warrants.

AUTHORIZATION FOR THE BOARD OF DIRECTORS TO DECIDE ON REPURCHASE AND TRANSFER OF OWN SHARES

The AGM resolved, in accordance with the Board’s proposal, to authorize the Board of Directors to decide on purchases of the company’s own shares. Share repurchases may be made only on Nasdaq Stockholm or any other regulated market. The authorization may be exercised on one or more occasions before the 2021 Annual General Meeting. The maximum number of own shares that may be repurchased so that the Company’s holding of shares at any given time does not exceed 10 percent of the total number of shares in the Company. Repurchases of the Company’s own shares on Nasdaq Stockholm may only be made at a price within the range of the highest purchase price and lowest selling price at any given time. Payment for the shares shall be made in cash.

The AGM also resolved, in accordance with the Board’s proposal, to authorize the Board of Directors to to decide on transfers of own shares, with or without deviation from the shareholders’ preferential rights. Transfers may be made on (i) Nasdaq Stockholm or (ii) outside of Nasdaq Stockholm in connection with acquisitions of companies, operations or assets. The authorization may be exercised on one or more occasions before the 2021 Annual General Meeting. The maximum number of shares that may be transferred corresponds to the number of shares held by the Company at the point in time of the Board of Directors’ decision on the transfer. Transfers of shares on Nasdaq Stockholm may only be made at a price within the range of the highest purchase price and lowest selling price at any given time. For transfers outside of Nasdaq Stockholm, the price shall be set so that the transfer is made at market terms. Payment for transferred shares may be made in cash, through in-kind payment, or through set-off against claims with the Company.

The purpose of the authorizations is to give the Board of Directors greater scope to act and the opportunity to adapt and improve the Company’s capital structure and thereby create further shareholder value and take advantage of any attractive acquisition opportunities.

AUTHORIZATION FOR THE BOARD OF DIRECTORS TO DECIDE ON NEW ISSUE OF SHARES

The AGM resolved, in accordance with the Board’s proposal, to authorize the Board of Directors, on one or more occasions, during the time up until the next Annual General Meeting, to decide to increase the Company’s share capital through a new issue of shares to such extent that it corresponds to a dilution of a maximum of 10% of the number of shares outstanding at the time of the Annual General Meeting calculated after full exercise of the issue authorization now proposed. A new issue of shares may be carried out with or without deviation from the shareholders’ preferential rights. Shares issued with deviation from the shareholders’ preferential rights shall be issued at market terms. The Board of Directors shall have the right to decide on other terms for the issue. Payment may be made against cash payment, in-kind payment for through set-off against claims with the Company.

The purpose of the authorization is to give the Board of Directors greater scope to act and the opportunity to adapt and improve the Company’s capital structure and thereby create further shareholder value and take advantage of any attractive acquisition opportunities.

For detailed terms regarding the above-described resolutions at the AGM, please refer to the complete proposals, which are available on the Company’s website: www.leovegasgroup.com.

Powered by WPeMatico

Fanatics Casino

RLX Gaming expands US reach through Fanatics Casino launch

RLX Gaming, the iGaming aggregator and supplier of unique content, has successfully launched its comprehensive content portfolio with Fanatics Casino in the United States.

RLX Gaming’s extensive library of in-house and third-party titles is now available to Fanatics Casino players in New Jersey and Pennsylvania, following a soft launch in the Keystone State.

Top-performing RLX Gaming slots including Temple Tumble, Bonsai Dragon Blitz, and The Great Pigsby have been rolled out, alongside a wide selection of other releases from some of the industry’s most creative studios.

Fanatics Casino is available in Michigan, New Jersey, Pennsylvania and West Virginia on iOS and Android and offers players a chance to explore a wide array of classic and modern casino games, including slots, blackjack, roulette, progressive jackpots and video poker. Each game is crafted to deliver authentic casino action, ensuring endless entertainment.

The latest pivotal partnership reaffirms RLX Gaming’s dedication to providing dynamic, global-ready content that drives innovation in the online casino sector.

Matthew Hockenjos, Commercial Account Manager for North America at RLX Gaming, said: “Our collaboration with Fanatics Casino represents a major milestone for RLX Gaming as we strategically broaden our footprint across North America.

“Fanatics Casino’s focus on delivering outstanding entertainment is perfectly aligned with our core mission, and we are excited to bring our engaging slot experiences to its players in New Jersey and Pennsylvania.”

Kieron Shaw at Fanatics Casino, added: “We are delighted to integrate RLX Gaming’s extensive and captivating portfolio into our platform. This collaboration strengthens our commitment to offering a premier online casino experience, guaranteeing our players access to top-tier titles with a proven resonance for players across New Jersey and Pennsylvania.”

The post RLX Gaming expands US reach through Fanatics Casino launch appeared first on Americas iGaming & Sports Betting News.

Belatra

Belatra celebrates 33rd anniversary at SiGMA South America

Belatra Games, the specialist online slots developer, is marking its 33rd anniversary at this year’s SiGMA South America, taking place in São Paulo, Brazil, where the company will welcome partners, clients, and industry friends to celebrate the milestone at Booth M70.

The event provides the perfect backdrop for Belatra to reflect on more than three decades of innovation in the global iGaming industry. Since its founding, the company has earned a reputation for creating engaging and immersive gaming experiences, powered in part by long-standing partnerships across international markets.

Visitors to the Belatra stand will have the chance to meet the LatAm team based in Buenos Aires, led by Head of Accounts LatAm Lucila M. Barletta, and discover more about the company’s latest titles and the opportunities emerging across LatAm. Members of Belatra’s European team will also be present in São Paulo to celebrate the milestone together with partners and guests.

To mark the occasion, Belatra will also host a special stand celebration, inviting guests to raise a glass with the team while taking part in an exclusive booth giveaway featuring a selection of prizes.

Celebrations will take place during the exhibition at Booth M70 at the Transamérica Expo Center, where Belatra is excited to welcome industry partners and celebrate 33 years of innovation together.

Sergey Chernyavski, Belatra Games’ CCO, said: “Celebrating 33 years of Belatra at SiGMA South America is a special moment for our team. A huge part of our success has been inspired by relationships within the iGaming community and events like this give us a chance to say thanks to our partners and friends. LatAm and Brazil are big markets for us and we look forward to showcasing our latest titles and plans for the region.”

The post Belatra celebrates 33rd anniversary at SiGMA South America appeared first on Americas iGaming & Sports Betting News.

Bonus Cards

CasinoCanada.com introduces redesigned Bonus Cards

CasinoCanada.com has updated its bonus presentation, unveiling a redesigned Bonus Card system that simplifies understanding, comparison, and claiming of offers.

The newly released Bonus Cards bring a streamlined and structured approach to bonus discovery.

This update resolves persistent issues with cluttered and inconsistent bonus information. Previously, varied naming conventions, lengthy descriptions, and hidden exclusive offers made it difficult for users to identify relevant deals.

Clean, consistent cards

Each bonus now uses a clear unified format with concise names and key details presented upfront. The simple, scannable layout eliminates complexity and allows users to quickly understand each offer.

Exclusive bonuses front and center

CasinoCanada.com now highlights its proprietary offers – bonuses available exclusively through the platform. A new Exclusive toggle allows users to instantly surface these deals without navigating to a separate page or taking additional steps. With a single tap, exclusive offers move to the top of the list.

Expandable details for deeper insights

Each card now includes an expandable section with key terms, pros and cons, and qualification requirements. This helps visitors quickly find the type of promotion they are looking for, reducing search time and improving overall navigation.

The redesigned system makes bonuses easier to read, compare, and claim. By reducing friction and highlighting exclusive offers, this update enhances CasinoCanada.com’s value to its audience.

CasinoCanada.com will continue expanding and refining the product, with upcoming visual enhancements and additional functionality already in development.

The post CasinoCanada.com introduces redesigned Bonus Cards appeared first on Americas iGaming & Sports Betting News.

-

Booming Games7 days ago

Booming Games7 days agoBooming Games’ Trollfufu Bonanza Bursts Onto the Scene

-

Latest News6 days ago

Latest News6 days agoNFL LEGEND ROB GRONKOWSKI TAKES ON HIGH-STAKES POKER PROS ON POKERSTARS BIG GAME ON TOUR IN LAS VEGAS

-

Animal Wellness Action4 days ago

Animal Wellness Action4 days agoGREY2K USA Worldwide and Animal Wellness Action Celebrate House Agriculture Committee Passage of a Ban on Greyhound Racing in America

-

Compliance Updates7 days ago

Compliance Updates7 days agoDutch Regulator Publishes Match-fixing Trend Analysis 2025

-

Gambling in the USA6 days ago

Gambling in the USA6 days agoDigicode at NEXT.io Summit NYC 2026: Driving the Future of iGaming Technology

-

AI4 days ago

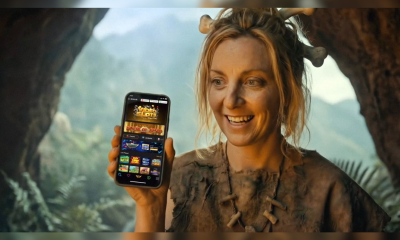

AI4 days agoNew Videoslots app stars in AI-assisted “Stone Age” ad

-

Inferno Mayhem3 days ago

Inferno Mayhem3 days agoPG Soft cranks up the volume with electrifying Inferno Mayhem slot

-

Caesars Entertainment Windsor Limited4 days ago

Caesars Entertainment Windsor Limited4 days agoOLG and Caesars Sign Long-term Operating Agreement for Windsor Casino