Central Europe

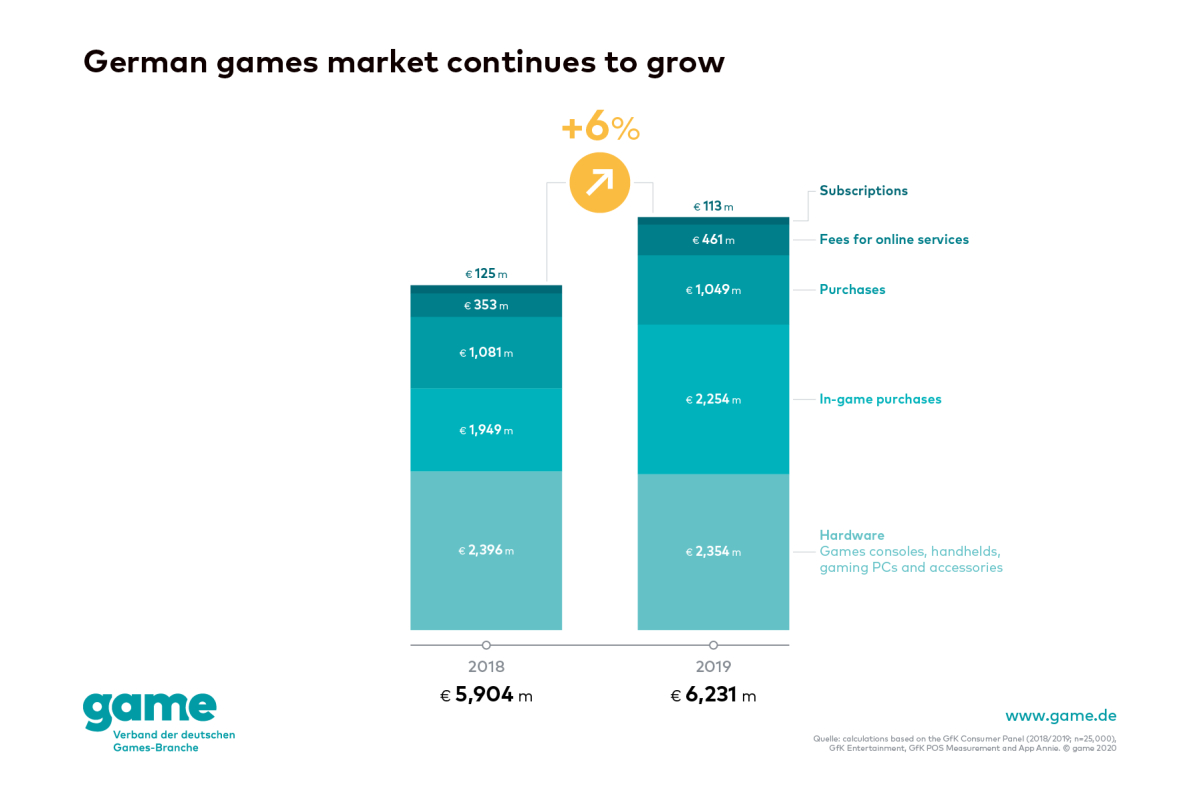

German Games Market Registers 6% Growth in 2019

- German games industry tops the 6-billion-euro mark

- In-game purchases and fees for online services are growth engines

- ‘The dynamic growth shows once again that games are one of the most important drivers of the digital world.’

The German games market registered continued significant growth in 2019: sales of games hardware and software rose by 6 per cent overall, to around 6.2 billion euros. These are the figures released today by game – the German Games Industry Association, based on data collected by GfK and App Annie. Sales of games hardware, including consoles, gaming PCs and accessories, dropped by 2 per cent from the previous year, to 2.4 billion euros. In contrast, the market for games software showed a gain of 11 per cent: in 2019, a total of about 3.9 billion euros was spent on computer and video games and the fees for the respective online services.

‘The German games market developed amazingly well in 2019,’ says Felix Falk, Managing Director of game. ‘Up to now, the years at the end of a console generation have been comparatively weaker economically. But we aren’t seeing any st oe now. Revenue models like in-game purchases and fees for online services have become important columns st oe games market. This means that, alongside the classic purchase of computer and video games, the long-term use of game titles is playing an ever greater role. The dynamic growth shows once again that games are one st o most important drivers st o digital world.’

In-game purchases and fees for online services are decisive growth engines

Sales through fees for online services showed the strongest percentage growth in 2019, rising by 31 per cent, to 461 million euros. These include, among other things, costs st oe online services of games consoles such as Nintendo Switch Online, PlayStation Plus and Xbox Live Gold. Also in this category are subscription services like Origin Access Premiere (EA) and Uplay+ (Ubisoft), which charge a fixed monthly rate for access to a large library of games, as well as sales for cloud gaming offerings like Google Stadia and PlayStation Now. Sales through in-game purchases also grew sharply in 2019: compared to 2018, this submarket increased by 16 per cent, to around 2.3 billion euros. In-game purchases include both small charges – to better equip one’s game character, for example – and more expensive content like whole additional campaigns and season passes. Declines were posted in other market segments, however, such as the one-time purchase of computer and video games (-3 per cent, to around 1 billion euros) and subscription to individual game titles (-10 per cent, to around 113 million euros).

About the market data

When further dedicated games hardware like gaming PCs and the corresponding accessories are taken into account, the market size for 2018 is larger than was communicated last year.

The market data is based on statistics compiled by the GfK Consumer Panel and App Annie. The methods used by GfK to collect data on Germany’s digital games market are unique in terms of both their quality and their global use. They include an ongoing survey of 25,000 consumers who are representative st o German population as a whole regarding their digital game purchasing and usage habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games.

Game – the German Games Industry Association

We are the association st o German games industry. Our members include developers, publishers and many other games industry actors such as esports companies, educational establishments and service providers. As a joint organiser of gamescom, we are responsible st oe world’s biggest event for computer and video games. We are an expert partner for media and for political and social institutions, and answer questions relating to market development, games culture and media literacy. Our mission st o make Germany the best games location.

Powered by WPeMatico

BETANO

CT Interactive Partners with Betano.cz for Live Rollout

CT Interactive has unveiled its newest partnership with Betano in the Czech Republic, representing a significant advancement in the firm’s continuous global growth plan.

As a result of this collaboration, a selection of 30 exciting titles is now offered on the Betano.cz platform, enhancing the online gaming experience for players in the area. The collection includes several of CT Interactive’s most favored games, such as Win Storm, Wild Clover, 40 Treasures, Purple Fruits, and The Big Chile.

Through this launch, CT Interactive maintains its emphasis on offering content suited to local player tastes, reinforcing its dedication to delivering high-quality entertainment. The inclusion of these titles is anticipated to improve Betano Czech Republic’s collection, providing players with a varied and engaging gaming atmosphere.

“We are thrilled to extend our reach into the Czech market, which holds significant growth potential,” said Martin Ivanov, Chief Operating Officer at CT Interactive. “Our forward-thinking approach and understanding of local player preferences will be key as we work to redefine the online gaming experience in this region. We believe this partnership will create exciting opportunities for players and set a new benchmark for the industry in the Czech Republic.”

Monika Zlateva, Chief Commercial Officer at CT Interactive, added: “Building on our long-standing and strong relationship with Kaizen Gaiming across multiple markets, this collaboration enables us to deliver a fresh content tailored to player preferences. We are confident that CT Interactive’s titles will resonate with the audience and contribute to the overall gaming experience on Betano.cz.”

The post CT Interactive Partners with Betano.cz for Live Rollout appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Bragg Gaming Group

Bragg Gaming Group Partners with StarGames

Bragg Gaming Group has strengthened its presence in the German iGaming market by partnering with StarGames to offer its popular, high-performing slots. Through this partnership, Gamomat games and other titles powered by Bragg are available on the StarGames website.

“At Bragg, we are proud that many of our most popular games have become part of the offering on StarGames – one of the best-known and licensed online arcades in Germany. This collaboration stands for trust, quality, and a shared passion: gaming experiences driven by responsibility and dedication, the Company said.

“Our Powered by Bragg program delivers Gamomat to StarGames, a leading German development studio based in Berlin, which has been creating games since 2008 that are played and appreciated around the world. More than 150 Gamomat titles are now available online, Powered by Bragg – across 35 countries and in 27 languages. From the very beginning, Gamomat has followed one guiding principle: ‘Passion for games and people.’ Gamomat games combine timeless design, strong themes, and modern game mechanics – and this combination finds its perfect home on StarGames.

“StarGames is among the leading brands in the regulated German online gaming market. Together, we offer players a legal, safe, and entertaining experience – featuring many of Gamomat’s most popular titles, including:

Ramses Book – an Egyptian classic with cult status.

Crystal Ball – magic, free spins, and excitement in multiple versions.

Sticky Diamonds – dazzling gems, free spins, and high winning potential.

La Dolce Vita – the sweet life on the reels, complete with Mediterranean flair.

“These and many other slots from Gamomat and other studios distributed by Bragg are firmly established in the StarGames portfolio and enjoy great popularity among German players. Our cooperation with StarGames is built on shared values: fairness, transparency, and responsibility. We share the vision of creating sustainable, high-quality online entertainment for German players. Through this partnership, we can make our portfolio accessible to a wide audience – in an environment that stands for quality and integrity.”

The post Bragg Gaming Group Partners with StarGames appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Central Europe

NOVOMATIC Once Again Recognised as an “Austrian Leading Company”

NOVOMATIC AG has been recognised as an “Austrian Leading Company” for 2026/2027 by the independent excellence platform Leitbetriebe Austria.

NOVOMATIC has been a certified leading company since 2013 and this prestigious status has now been confirmed once again following a comprehensive screening. The evaluation process, which takes place every two years, ensures that certified companies meet the highest quality standards. Decisive criteria include sustainable corporate goals such as innovation, growth and targeted employee development. As one of Lower Austria’s largest employers and a substantial taxpayer, the international gaming technology group makes a sustainable contribution to Austrian value creation. At the same time, NOVOMATIC is pursuing a long-term ESG strategy that combines economic performance with ecological responsibility and social sustainability.

“Long-term corporate success is based on stability, innovative strength, and a clear sense of responsibility towards employees, society, and the environment. This renewed recertification as a leading company confirms our strategic orientation and our commitment to combining economic strength with sustainable corporate management,” emphasised NOVOMATIC Executive Board Member Stefan Krenn as he received the certificate at the Group’s Lower Austrian headquarters alongside fellow Executive Board Members Ryszard Presch and Johannes Gratzl.

Monica Rintersbacher, Managing Director of Leitbetriebe Austria, also emphasised the significance of the award: “For many years, NOVOMATIC has been exemplary in the areas that define a leading company: international technological innovation on the one hand and a clear commitment to its location, employees, and society on the other. With this renewed award, the company is underscoring its role as a stable driving force for the economy and employment in Austria.”

This recertification confirms NOVOMATIC’s position as an economically reliable and responsible company both nationally and internationally.

The post NOVOMATIC Once Again Recognised as an “Austrian Leading Company” appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

ACMA6 days ago

ACMA6 days agoACMA Blocks More Illegal Online Gambling Websites

-

CEO of GGBET UA Serhii Mishchenko6 days ago

CEO of GGBET UA Serhii Mishchenko6 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Aurimas Šilys6 days ago

Aurimas Šilys6 days agoREEVO Partners with Betsson Lithuania

-

Canada5 days ago

Canada5 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News5 days ago

Latest News5 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe6 days ago

Central Europe6 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Acquisitions/Merger5 days ago

Acquisitions/Merger5 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™5 days ago

Firecracker Frenzy™ Money Toad™5 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™