Nasdaq:CPHC

Canterbury Park Holding Corporation Reports 2021 Second Quarter Results

SHAKOPEE, Minn., Aug. 09, 2021 (GLOBE NEWSWIRE) — Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (NASDAQ: CPHC), today reported financial results for the second quarter and six months ended June 30, 2021.

($ in thousands, except per share data and percentages)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||

| 2021 | 2020 | Increase(3) | 2021 | 2020 | Increase(3) | ||||||

| Net revenues(1) | $15,872 | $2,768 | 473.4% | $25,097 | $13,717 | 83.0% | |||||

| Net income (loss) (1) | $1,869 | ($1,181) | NM | $2,421 | ($926) | NM | |||||

| Adjusted EBITDA(1) (2) | 3,514 | (1,775) | 298.0% | 4,936 | (916) | 638.8% | |||||

| Basic EPS | $0.39 | ($0.25) | NM | $0.51 | ($0.20) | NM | |||||

| Diluted EPS | $0.39 | ($0.25) | NM | $0.51 | ($0.20) | NM | |||||

(1) Net revenues and net income for the six month period ended June 30, 2021 include $515,000 in grant funds received as a result of the Minnesota COVID-19 relief package that was passed and signed into law in December 2020.

(2) Adjusted EBITDA, a non-GAAP measure, excludes certain items from net income, a GAAP measure. Non-GAAP financial measures are not intended to be considered in isolation from, a substitute for, or superior to GAAP results. Definitions, disclosures, and reconciliations of non-GAAP financial information are included later in the release.

(3) Amounts referred to as “NM” are defined as not meaningful.

Financial results for the three and six months ended June 30, 2020 reflect the impact of the onset of the COVID-19 pandemic and closure of the Card Casino, simulcast, and special events operations at Canterbury Park from March 16, 2020 to June 9, 2020, after which the Company reopened in a limited capacity. Results for the six months ended June 30, 2021 include the impact of the state-mandated closure of Canterbury Park which ended January 10, 2021 and capacity restrictions from January 11, 2021 to May 28, 2021. Canterbury Park re-opened on January 11, 2021 with a capacity limitation of 150 guests per designated area; this was subsequently increased on February 13, 2021 to 250 guests per designated area. All capacity restrictions were removed on May 28, 2021, and we began operating under pre-pandemic guidelines.

Management Commentary

“Canterbury Park’s strong operating momentum continued in the second quarter of 2021, as income from operations (excluding one-time gains) increased 157% over the comparable 2019 non-COVID impacted period and, despite lower revenue, we generated record quarterly adjusted EBITDA of $3.5 million,” said Randy Sampson, President and Chief Executive Officer of Canterbury. “This strong performance reflects improved guest visitation as capacity restrictions were lifted which helped drive consistent monthly increases in our higher-margin Card Casino revenues throughout the quarter. The second quarter also benefited from healthy contributions from our racing operations, including the continuation of the strong out-of-state handle increases we achieved in 2020 with our shift to featuring more mid-week racing.

“Importantly, the many operating changes we have effected since the beginning of the pandemic are delivering higher margins and cash flow as reflected by the quarterly record for adjusted EBITDA as a percentage of revenue of 22% in the 2021 second quarter. Our ability to operate in a significantly more efficient manner is also evidenced by the improvement in this metric as compared to 10% achieved in the non-COVID impacted 2019 second quarter period. We are achieving improved operating expense management and efficiencies across our operations including labor management, purchasing, pricing, and marketing, and we are highly focused on maintaining this operating discipline to drive increased profitability as our revenues return to pre-COVID levels.

“Canterbury is leveraging our margin enhancement initiatives with operating strategies focused on profitable revenue growth. These strategies include a focus on higher value Card Casino players, new targeted social media advertising, and ongoing refinements to our marketing programs aimed at deepening the market penetration of our Card Casino. We’re also maintaining the increased spacing for our guests in the Card Casino, which players appreciate and which we believe is contributing to higher theoretical win per player. In addition, we are aggressively courting racing fans in our market by highlighting Canterbury as a horseplayer-friendly racetrack that features high quality racing and entertaining promotions. We are also bringing back special event days that our fans love and drive large family day crowds. Finally, we believe our capable food and beverage and events team, as well as our focus on expanding catering opportunities for events of all sizes and our commitment to launch new event experiences, offers significant growth opportunities for our hospitality operations. However, like most hospitality businesses, we face the challenge of hiring and maintaining adequate staffing at both manager and front-line levels of the Company. We continue to be creative in finding ways to fill our staffing shortages to maintain our customer service standards and allow us to execute on our growth initiatives.

“Progress on the development of Canterbury Commons™ continued throughout the 2021 second quarter and to-date in the third quarter. The number of people living and/or working full time at Canterbury Commons is growing every day. Following our initial focus on residential and office development, we are now seeing an uptick in business development discussions for new retail and hospitality development, particularly for restaurant and hotel venues. We are pleased with both the pace of development for existing projects and with our ongoing discussions around new potential developments and remain highly confident in our ability to achieve our vision of establishing a population, business, and entertainment center at Canterbury. We believe this development will benefit our Card Casino, racing operations, and event facilities and create new value for our shareholders.

“The operating and cost control initiatives we’ve implemented since March 2020 that have resulted in significant operating efficiencies combined with organic growth opportunities in our Card Casino and racetrack operations positions Canterbury to benefit from enhanced margins and cash flow as our operations continue to return to normalized levels. In addition, we have the financial flexibility to pursue strategic growth and diversification transactions where we can leverage our operating expertise. Finally, we are continuing with our efforts to unlock Canterbury Commons’ value for the benefit of our shareholders. Our ability to manage through the challenges of the pandemic and emerge as a stronger company with an extremely bright future is due to our talented and dedicated team members who continue to demonstrate to our guests daily our unwavering commitment to provide exceptional entertainment and customer service. I could not be more excited about our future or prouder of the entire Canterbury team.”

Canterbury Commons Development Update

Canterbury Commons development work continued during the 2021 second quarter. Leasing continues for the Phase 1 development of the upscale Triple Crown Residences at Canterbury Park, and Canterbury Park and Doran Properties Group expect early stages of the construction of the project’s second phase of roughly 300 additional apartments will begin in the fall of 2021 with the main construction project starting in the spring of 2022.

Development of a new 28,000 square foot office building by Greystone Construction (“Greystone”) was completed in July and approximately 85% of the building is leased, including the portion of the building now occupied by Greystone as its new corporate headquarters. Canterbury Park and Greystone, via their joint venture, continue to make progress on securing additional partners for the balance of the 13-acre site for potential uses such as hospitality, dining, residential, commercial, and service-oriented retail. At present, 50% of the site is either under contract or completed with recent contracts for two commercial sites. A purchase agreement has been signed on 1.67 acres for commercial use with a developer and entitlements are underway on a 156-unit, age-restricted multifamily project.

As previously reported, in April 2021, the Company closed on the sale of approximately eight acres of land to Pulte Homes of Minnesota for the development of 63 new row homes and townhome residences, and on two acres of land to Lifestyle Communities for the development of a new cooperative community featuring a 56-unit, four-story building with over 5,000 square feet of amenity spaces. The sale of the remaining approximately three acres to Pulte Homes is expected to close in 2022, subject to the satisfaction of certain conditions. Total consideration received by the Company for these land sale agreements was approximately $2,500,000.

Developer and partner selection for the remaining approximately 90 acres of Canterbury Commons continues. The primary focus for future projects will be on entertainment, office, retail, hotel, and restaurant uses. Canterbury expects to make additional new partner announcements in the future.

Summary of 2021 Second Quarter Operating Results

The operating results for the three-month period ended June 30, 2020 presented below reflect the impact of the suspension of operations at Canterbury through June 9, 2020. Live racing, simulcast wagering, and limited food and beverage operations reopened on June 10, 2020 with capacity constraints, followed by the resumption with capacity restraints of table games operations on June 15, 2020. There were no temporary shutdowns during the 2021 second quarter, but capacity was restricted in the 2021 second quarter until May 28, 2021.

Net revenues for the three months ended June 30, 2021 increased 473.4% to $15.9 million, compared to $2.8 million for the same period in 2020. This year-over-year increase in net revenues reflects an increase in all of the Company’s areas of operating revenue in second quarter of 2021 as compared to second quarter 2020, primarily as a result of a return to normalized operations and full capacity in the second quarter 2021 as compared to the prior year temporary suspension of operations through June 9, 2020, which was followed by the resumption of operations over the balance of the second quarter 2020 on a very limited basis.

Operating expenses for the three months ended June 30, 2021 were $13.0 million, an increase of $8.0 million, or 156.4%, compared to operating expenses of $5.1 million for the same period in 2020. This year-over-year increase in operating expenses reflects an increase in all of the Company’s operating expenses in the second quarter 2021 as compared to the second quarter 2020, primarily as a result of a return to normalized operations in the second quarter 2021 as compared to the prior year temporary suspension of operations through June 9, 2020.

During the 2021 second quarter, the Company recorded a $264,000 gain related to the sale of approximately 9.7 acres of land adjacent to the racetrack to Pulte Homes of Minnesota and Lifestyle Communities for $2,500,000.

The Company recorded a loss from equity investment of $641,000 for the three months ended June 30, 2021, primarily related to its share of depreciation, amortization, and interest expense from the Doran Canterbury joint ventures that are developing the Triple Crown Residences, which opened its initial phase in June 2020. The Company recorded a loss from equity investment of $150,000 for the three months ended June 30, 2020, also primarily related to its share of depreciation, amortization, and interest expense from the Doran Canterbury joint ventures.

The Company recorded income tax expense of $758,000 for the three months ended June 30, 2021. The Company recorded an income tax benefit of $1.1 million for the three months ended June 30, 2020.

The Company recorded net income of $1.9 million, or diluted earnings per share of $0.39, for the three months ended June 30, 2021. The Company recorded a net loss and diluted loss per share for the three months ended June 30, 2020 of $(1.2) million and $(0.25), respectively.

Adjusted EBITDA, a non-GAAP measure, was a quarterly record $3.5 million in the 2021 second quarter compared to an adjusted EBITDA loss of $(1.8) million for the same period in 2020.

Summary of 2021 Year-to-Date Operating Results

Net revenues for the six months ended June 30, 2021 increased 83.0% to $25.1 million, compared to $13.7 million for the same period in 2020. This year-over-year increase in net revenues reflects an increase in all the Company’s areas of operating revenue as a result of a return to normalized operations and full capacity in the second quarter 2021 as compared to the temporary suspension of operations from March 16, 2020 through June 9, 2020.

Operating expenses for the six months ended June 30, 2021 were $21.0 million, an increase of $5.1 million, or 32.1%, compared to operating expenses of $15.9 million for the same period in 2020. This year-over-year increase in operating expenses reflects increases in a majority of the Company’s operating areas, primarily as a result of a return to normalized operations and full capacity in the second quarter 2021 as compared to the prior year temporary suspension of operations from March 16, 2020 through June 9, 2020.

The Company recorded a loss from equity investment of $1.3 million for the six months ended June 30, 2021. The Company recorded a loss from equity investment of $150,000 for the six months ended June 30, 2020. These losses from equity investments were primarily related to the Company’s share of depreciation, amortization, and interest expense from the Doran Canterbury joint ventures.

The Company recorded income tax expense of $1.0 million for the six months ended June 30, 2021. The Company recorded an income tax benefit of $1.1 million for the six months ended June 30, 2020.

The Company recorded net income of $2.4 million, or diluted earnings per share of $0.51 for the six months ended June 30, 2021. The Company recorded a net loss and diluted loss per share for the six months ended June 30, 2020 of $926,000 and $0.20, respectively.

Adjusted EBITDA was $4.9 million for the six months ended June 30, 2021 compared to an adjusted EBITDA loss of $916,000 for the same period in 2020.

Additional Financial Information

Further financial information for the second quarter ended June 30, 2021 is presented in the accompanying tables at the end of this press release. Additional information will be provided in the Company’s Quarterly Report on Form 10-Q that will be filed with the Securities and Exchange Commission on or about August 10, 2021.

Use of Non-GAAP Financial Measures

To supplement our financial statements, we also provide investors with information about our EBITDA and Adjusted EBITDA, each of which is a non-GAAP measure, which excludes certain items from net income a GAAP measure. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We define Adjusted EBITDA as earnings before interest income, income tax expense (benefit), depreciation and amortization, as well as excluding gains on sale of land, depreciation and amortization related to equity investments, grant money received from the Minnesota COVID-19 relief package, and interest expense related to equity investments. Neither EBITDA nor adjusted EBITDA is a measure of performance calculated in accordance with generally accepted accounting principles (“GAAP”), and should not be considered an alternative to, or more meaningful than, net income as an indicator of our operating performance. We have presented EBITDA as a supplemental disclosure because it is a widely used measure of performance and basis for valuation of companies in our industry. Other companies that provide EBITDA information may calculate EBITDA differently than we do. We have presented Adjusted EBITDA as a supplemental disclosure because it enables investors to understand our results excluding the effect of these items.

About Canterbury Park

Canterbury Park Holding Corporation (Nasdaq: CPHC) owns and operates Canterbury Park Racetrack and Card Casino in Shakopee, Minnesota, the only thoroughbred and quarter horse racing facility in the State. The Company generally offers live racing from May to September. The Card Casino hosts card games 24 hours a day, seven days a week, dealing both poker and table games. The Company also conducts year-round wagering on simulcast horse racing and hosts a variety of other entertainment and special events at its Shakopee facility. The Company is also pursuing a strategy to enhance shareholder value by the ongoing development of approximately 140 acres of underutilized land surrounding the Racetrack that was originally designated for a project known as Canterbury Commons™. The Company is pursuing several mixed-use development opportunities for the remaining underutilized land, directly and through joint ventures. For more information about the Company, please visit www.canterburypark.com.

Cautionary Statement

From time to time, in reports filed with the Securities and Exchange Commission, in press releases, and in other communications to shareholders or the investing public, we may make forward-looking statements concerning possible or anticipated future financial performance, business activities or plans. These statements are typically preceded by the words “believes,” “expects,” “anticipates,” “intends” or similar expressions. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in federal securities laws. Shareholders and the investing public should understand that these forward-looking statements are subject to risks and uncertainties which could affect our actual results and cause actual results to differ materially from those indicated in the forward-looking statements. We report these risks and uncertainties in our Annual Report on Form 10-K filed with the SEC and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. They include, but are not limited to: the effect that the COVID-19 coronavirus pandemic and resulting precautionary measures may have on us as an entertainment venue or on the economy generally, including the fact that we temporarily suspended all card casino, simulcast, and special events operations during portions of 2020 and may be required to do so again in 2021, that we were required to limit visitors and engage in new cleaning protocols, social distancing measures and other changes to our racetrack and card casino operations to comply with state law and health protocols and reductions in the number of visitors due to their COVID-19 concerns; material fluctuations in attendance at the Racetrack; material changes in the level of wagering by patrons; any decline in interest in the unbanked card games offered in the Card Casino; competition from other venues offering unbanked card games or other forms of wagering; competition from other sports and entertainment options; increases in compensation and employee benefit costs; increases in the percentage of revenues allocated for purse fund payments; higher than expected expense related to new marketing initiatives; the impact of wagering products and technologies introduced by competitors; the general health of the gaming sector; legislative and regulatory decisions and changes; our dependence on the Cooperative Marketing Agreement with the Shakopee Mdewakanton Sioux Community for purse enhancement payments and marketing payments, which may not continue after 2022; our ability to successfully develop our real estate, including the effect of competition on our real estate development operations and our reliance on our current and future development partners; temporary disruptions or changes in access to our facilities caused by ongoing infrastructure improvements; and other factors that are beyond our ability to control or predict.

| Investor Contacts: | ||

| Randy Dehmer | Richard Land, Jim Leahy | |

| Vice President and Chief Financial Officer | JCIR | |

| Canterbury Park Holding Corporation | 212-835-8500 or [email protected] | |

| 952-233-4828 or [email protected] | ||

– Financial tables follow –

CANTERBURY PARK HOLDING CORPORATION’S

SUMMARY OF OPERATING RESULTS

(UNAUDITED)

| Three months ended | Six months ended |

||||||||||||||

| June 30, | June 30, |

||||||||||||||

| 2021 | 2020 |

2021 |

2020 |

||||||||||||

| Net Operating Revenues | $15,871,818 | $2,767,855 | $25,097,360 | $13,716,814 | |||||||||||

| Operating Expenses | (13,042,932 | ) | (5,086,434 | ) | 20,996,363 | (15,893,698 | ) | ||||||||

| Gain on Sale of Land | 263,581 | – | 263,581 | – | |||||||||||

| Income (Loss) from Operations | 3,092,467 | (2,318,579 | ) | 4,364,578 | (2,176,884 | ) | |||||||||

| Other (Loss) Income, net | (465,786 | ) | 19,719 | (934,180 | ) | 183,409 | |||||||||

| Income Tax (Expense) Benefit | (757,597 | ) | 1,117,663 | (1,009,821 | ) | 1,067,499 | |||||||||

| Net Income (Loss) | $1,869,084 | ($1,181,197 | ) | $2,420,577 | ($925,976 | ) | |||||||||

| Basic Net Income (Loss) Per Common Share | $0.39 | ($0.25 | ) | $0.51 | ($0.20 | ) | |||||||||

| Diluted Net Income (Loss) Per Common Share | $0.39 | ($0.25 | ) | $0.51 | ($0.20 | ) | |||||||||

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(UNAUDITED)

| Three months ended | Six months ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| NET INCOME (LOSS) | $ | 1,869,084 | $ | (1,181,197 | ) | $ | 2,420,577 | $ | (925,976 | ) | ||||||

| Interest income, net | (175,090 | ) | (169,358 | ) | (344,400 | ) | (333,048 | ) | ||||||||

| Income tax expense (benefit) | 757,597 | (1,117,663 | ) | 1,009,821 | (1,067,499 | ) | ||||||||||

| Depreciation | 694,168 | 693,640 | 1,383,753 | 1,410,493 | ||||||||||||

| EBITDA | 3,145,759 | (1,774,578 | ) | 4,469,751 | (916,030 | ) | ||||||||||

| Gain on sale of land | (263,581 | ) | — | (263,581 | ) | — | ||||||||||

| Depreciation and amortization related to equity investments | 393,673 | — | 787,347 | — | ||||||||||||

| Interest expense related to equity investments | 237,871 | — | 457,066 | — | ||||||||||||

| Other revenue, COVID-19 relief grants | — | — | (515,000 | ) | — | |||||||||||

| ADJUSTED EBITDA | $ | 3,513,723 | $ | (1,774,578 | ) | $ | 4,935,583 | $ | (916,030 | ) | ||||||

Powered by WPeMatico

Nasdaq:CPHC

Canterbury Park Holding Corporation Reports Third Quarter Results

SHAKOPEE, Minn., Nov. 06, 2025 (GLOBE NEWSWIRE) — Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (Nasdaq: CPHC) today reported financial results for the three and nine months ended September 30, 2025.

| ($ in thousands, except per share data and percentages) | |||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| 2025 | 2024 | Change | 2025 | 2024 | Change | ||||||||||||

| Net revenues | $18,315 | $19,284 | (5.0%) | $47,122 | $49,585 | (5.0%) | |||||||||||

| Net income (loss) (1) | $487 | $2,022 | (75.9%) | ($139) | $3,358 | (104.1%) | |||||||||||

| Adjusted EBITDA (2) | $2,814 | $3,281 | (14.2%) | $6,626 | $8,901 | (25.6%) | |||||||||||

| Basic EPS | $0.10 | $0.40 | (75.0%) | ($0.03) | $0.67 | (104.5%) | |||||||||||

| Diluted EPS | $0.10 | $0.40 | (75.0%) | ($0.03) | $0.67 | (104.5%) | |||||||||||

| (1) | Net income and basic and diluted EPS for the three and nine months ended September 30, 2024 benefited from a $1.7 million gain related to the transfer of land to a new joint venture. |

| (2) | Adjusted EBITDA, a non-GAAP measure, excludes certain items from net income, a GAAP measure. Non-GAAP financial measures are not intended to be considered in isolation from, a substitute for, or superior to GAAP results. Definitions, disclosures, and reconciliations of non-GAAP financial information are included later in the release. Adjusted EBITDA margin is Adjusted EBITDA as a percentage of net revenues. |

Management Commentary

“The quarterly results were consistent with year-to-date trends as we remain focused on increasing casino traffic and our ongoing growth and development strategies. Third quarter revenues of $18.3 million reflect a 5.0% decline versus the third quarter of 2024, largely related to reduced casino revenues partially as a result of low hold early in the quarter. Similar to recent prior quarters, casino visits and player counts remain relatively stable, while per patron wagering levels declined. We saw strong quarterly growth in our food and beverage operations and pari-mutuel revenues were in line with prior year results. Adjusted EBITDA of $2.8 million resulted in an adjusted EBITDA margin of 15.4%, reflecting lower casino revenue partially offset by a slight year-over-year decline in operating expenses. We continue to take measures to improve operating efficiencies, particularly labor which is our largest expense, while pursuing opportunities to continue to grow our entertainment and hospitality businesses and develop our real estate,” said Randy Sampson, President and Chief Executive Officer of Canterbury Park.

“The third quarter marked the first full quarter of operation of the Boardwalk Kitchen & Bar, an upscale restaurant and live entertainment venue which opened to very positive customer response. Canterbury’s real estate joint venture partner, Trackside Holdings, LLC, completed construction in June at which time the lessee, Boardwalk Kitchen & Bar, began operations. The success of this venue, particularly the large outdoor patio located adjacent to the racetrack, is confirming the development opportunity of the unique experience and views of horses and the track’s greenspace. We are currently exploring additional entertainment and hospitality opportunities for the remaining trackside parcels that would add to the nearly 1,000 residential units, five restaurants and breweries, two music and entertainment venues, 57,000 square-feet of office space, and other distinct amenities already open in the trackside and adjacent Winner’s Circle developments. This, coupled with our successful events business, is validating our proof-of-concept of drawing more visitors to our destination for entertainment, gaming, dining and other experiences as we continue to unlock the monetary value of our real estate through our Canterbury Commons development. As such, Canterbury, in partnership with the City of Shakopee, continues to progress on our market analysis study with Hunden Partners to identify the highest and best use for our prime 25 acres of land near the amphitheater that could include office, retail, hospitality, entertainment venues or other opportunities.

“While our growth and efficiency initiatives are focused on maximizing cash flows from our existing gaming, F&B and entertainment operations, we believe that Canterbury’s record of consistent cash flow, return of capital through quarterly cash dividends and strong balance sheet are not reflected in our current valuation. Canterbury has no debt and our cash, tax increment financing (TIF) receivables and real estate joint ventures are valued at over $10 per share. In terms of liquidity, we had nearly $17 million, or approximately $3.28 per share, in cash and short-term investments at the end of the 2025 third quarter. In total, we had over $20 million, or approximately $3.95 per share, in TIF receivables on our balance sheet at quarter’s end, on which we expect to receive payments beginning later this quarter or very early in 2026. In addition, we’ve contributed a total of approximately $16 million, or approximately $3.20 per share, in land and cash to our real estate joint venture development projects for which we share in the economics. This estimated $10.43 per share value does not include the roughly 50 acres of land held for future development, the current value of which is not fully reflected on our balance sheet due to it being recorded on a cost basis. With the proven successes of our development and diversification initiatives and a pipeline of exciting growth opportunities, we remain committed to delighting our guests, serving our residents and delivering long-term value to shareholders.”

Canterbury Commons Development Update

The Company’s barn relocation and redevelopment plan is complete with over 300 new stalls completed and in operation. Swervo Development Corporation continues to make progress on the construction of its state-of-the-art 19,000-seat amphitheater, which will be operated by Live Nation Entertainment and is scheduled to open for a full season in the summer of 2026. Canterbury also completed a new road adjacent to the amphitheater which will unlock the high-value development potential of approximately 25 acres of prime land in that portion of the site.

Residential and commercial construction updates related to joint ventures include:

- Phase II of The Doran Group’s upscale Triple Crown Residences at Canterbury Park leased 93% of its available units.

- In addition, Phase I of the Triple Crown Residences is now 52% leased.

- 98% of the 147 units of senior market rate apartments at The Omry at Canterbury are leased.

- The pizza restaurant, fitness center and BBQ restaurant in the 10,000 square-foot commercial building within the Winners Circle development are in their first year of operation and finished their first summer of business at Canterbury with positive patronage.

- Construction of an additional 28,000 square-foot commercial office building within the Winners Circle development is now complete.

- Danny’s Construction occupies the entire second floor, and Edward Jones is putting the finishing touches on their build out of the first floor.

- The building is 66% leased and marketing is underway for the remainder of the available space with strong initial interest.

- Canterbury’s joint venture partner, Trackside Holdings, LLC, completed construction and transferred the building to the operating entity, Boardwalk Kitchen & Bar.

- The food and beverage and entertainment space of the facility opened in late June and is experiencing a strong and positive reception from the public.

- The restaurant and event space continue to create buzz with a strong social media presence, programming and entertainment.

Residential and commercial construction updates related to prior land sales include:

- Pulte Homes of Minnesota continues development on the 45-unit third phase of its row home and townhome residences, and all the remaining lots are under contract or under construction.

- Building exteriors and landscaping on the last units are expected to be complete on schedule and before winter.

Summary of 2025 Third Quarter Operating Results

Net revenues for the three months ended September 30, 2025 decreased 5.0% to $18.3 million, compared to $19.3 million for the same period in 2024. The year-over-year comparison reflects declines of 9.7%, 2.7%, and 11.1% in Casino, Pari-mutuel and Other revenues, respectively, partially offset by a 13.1% increase in Food and Beverage revenues. With the implementation of a new, point-of-sale system to improve speed of service, Food & Beverage was able to grow revenues on live racing and event days through increased overall transactions and average spend per customer. The year-over-year decreases in Casino revenues reflect increased competition as well as lower than average hold during the quarter, while Pari-mutuel revenues and Other revenues were impacted by one less live race day and decreased admission revenues from concerts.

Operating expenses for the three months ended September 30, 2025, were $17.3 million, a decrease of $106,000, or 0.6%, compared to operating expenses of $17.4 million for the same period in 2024. The year-over-year decrease in operating expenses primarily reflects a decrease in Purse expense, due primarily to the decreased Casino and Pari-mutuel revenues, offset in part by increased Advertising and Marketing expense intended to drive patronage to our property. Depreciation expense also increased due to the completion of large capital improvement projects over the past year. Salaries and Benefits, our largest expense line item, was essentially flat, compared to the same period in 2024.

The Company recorded a gain on transfer of land of $1.7 million in the three months ended September 30, 2024. There were no transfers of land or gains in the three months ended September 30, 2025.

The Company recorded a net loss of $936,000 and $1.4 million from equity investments for the three months ended September 30, 2025 and 2024, respectively. The loss in both periods is primarily related to the Company’s share of depreciation, amortization and interest expense from the Doran Canterbury joint ventures. The decreased loss for the three months ended September 30, 2025 is due to the Doran I joint venture continuing to increase their leasing rate after fully re-opening in 2025.

The Company recorded income tax expense of $156,000 and $772,000 for the three months ended September 30, 2025 and 2024, respectively. The decrease in income tax expense is primarily due to a decrease in income from operations before taxes.

The Company recorded net income of $487,000 and diluted earnings per share of $0.10 for the three months ended September 30, 2025. The Company recorded net income of $2.0 million and earnings per share of $0.40 for the three months ended September 30, 2024 which benefited from the aforementioned $1.7 million gain on the transfer of land.

Adjusted EBITDA, a non-GAAP measure, was $2.8 million in the 2025 third quarter, compared to $3.3 million in the 2024 third quarter.

Summary of 2025 Year-to-Date Operating Results

Net revenues for the nine months ended September 30, 2025, decreased 5.0% to $47.1 million, compared to $49.6 million in the same period last year. The year-over-year comparison reflects declines of 7.3%, 7.4% and 0.6% in Casino, Pari-mutuel, and Other revenues respectively, partially offset by a 3.9% increase in Food and Beverage. The year-over-year decreases primarily reflect the previously noted increased competition impacting Casino revenues along with four less live race days impacting Pari-mutuel and Other revenues, while the increase in Food and Beverage revenues grew with overall attendance and events at our facility.

Operating expenses for the nine months ended September 30, 2025 were $45.0 million, an increase of $203,000, or 0.5%, compared to operating expenses of $44.8 million for the same period in 2024. The year-over-year increase in operating expenses primarily reflects increased Advertising and Marketing, Depreciation and Amortization, and Salaries and Benefits expenses, as mentioned above.

The Company recorded a gain on transfer of land of $1.7 million in the nine months ended September 30, 2024. There were no transfers of land or gains in the nine months ended September 30, 2025.

The Company recorded a net loss of $3.9 million and $3.4 million from equity investments for the nine months ended September 30, 2025 and 2024, respectively. The loss in both periods is primarily related to the Company’s share of depreciation, amortization and interest expense from the Doran Canterbury joint ventures. The increased loss for the nine months ended September 30, 2025 is due to the year-ago period benefiting from the aforementioned $1.7 million gain on the transfer of land and the Doran Canterbury II joint venture opening in 2024, resulting in a full year of depreciation, amortization and interest expense.

The Company recorded an income tax benefit of $176,000 and income tax expense of $1.4 million for the nine months ended September 30, 2025 and 2024, respectively. The income tax benefit for the nine months ended September 30, 2025 compared to the income tax expense for the same period in 2024 is primarily due to a decrease in income before taxes from operations and a federal interest income tax refund received in the first quarter of 2025.

The Company recorded a net loss of $139,000 and a diluted loss per share of $0.03 for the nine months ended September 30, 2025. The Company recorded net income of $3.4 million and diluted earnings per share of $0.67 for the nine months ended September 30, 2024.

Adjusted EBITDA, a non-GAAP measure, was $6.6 million for the nine months ended September 30, 2025, compared to $8.9 million for the same period in 2024.

Additional Financial Information

Further financial information for the third quarter ended September 30, 2025, is presented in the accompanying tables at the end of this press release. Additional information will be provided in the Company’s Quarterly Report on Form 10-Q that will be filed with the Securities and Exchange Commission on or about November 7, 2025.

Use of Non-GAAP Financial Measures

To supplement our financial statements, we also provide investors with information about our EBITDA and Adjusted EBITDA, each of which is a non-GAAP measure, and which exclude certain items from net income, a GAAP measure. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We define Adjusted EBITDA as earnings before interest income (net of interest expense), income tax expense or benefit, depreciation and amortization, as well as excluding stock-based compensation (which includes our 401(k) match expense as this match occurs in Company stock), gain on the transfer of land, depreciation and amortization related to equity investments, and interest expense related to equity investments. We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of net revenues. Neither EBITDA, Adjusted EBITDA, or Adjusted EBITDA margin are measures of performance calculated in accordance with generally accepted accounting principles (“GAAP”), and should not be considered an alternative to, or more meaningful than, net income as an indicator of our operating performance. See the table below, which presents reconciliations of these measures to the GAAP equivalent financial measure, which is net income. We have presented EBITDA as a supplemental disclosure because we believe that, when considered with measures calculated in accordance with GAAP, EBITDA gives investors a more complete understanding of our operating results before the impact of investing and financing transactions and income taxes, and it is a widely used measure of performance and basis for valuation of companies in our industry. Other companies that provide EBITDA information may calculate EBITDA or Adjusted EBITDA differently than we do. We have presented Adjusted EBITDA as a supplemental disclosure because we believe it enables investors to understand and assess our core operating results excluding the effect of these items and is useful to investors in allowing greater transparency related to a significant measure used by management in its financial and operational decision-making. Adjusted EBITDA has economic substance because it is used by management as a performance measure to analyze the performance of our business and provides a perspective on the current effects of operating decisions.

About Canterbury Park

Canterbury Park Holding Corporation (Nasdaq: CPHC) owns and operates Canterbury Park Racetrack and Casino in Shakopee, Minnesota, the only thoroughbred and quarter horse racing facility in the State. The Company generally offers live racing from May to September. The Casino hosts card games 24 hours a day, seven days a week, dealing both poker and table games. The Company also conducts year-round wagering on simulcast horse racing and hosts a variety of other entertainment and special events at its Shakopee facility. The Company is also pursuing a strategy to enhance shareholder value by the ongoing development of approximately 140 acres of underutilized land surrounding the Racetrack that was originally designated for a project known as Canterbury Commons™. The Company is pursuing several mixed-use development opportunities for the remaining underutilized land, directly and through joint ventures. For more information about the Company, please visit www.canterburypark.com.

Cautionary Statement

From time to time, in reports filed with the Securities and Exchange Commission, in press releases, and in other communications to shareholders or the investing public, we may make forward-looking statements concerning possible or anticipated future financial performance, business activities or plans. These statements are typically preceded by the words “believes,” “expects,” “anticipates,” “intends” or similar expressions. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in federal securities laws. Shareholders and the investing public should understand that these forward-looking statements are subject to risks and uncertainties which could affect our actual results and cause actual results to differ materially from those indicated in the forward-looking statements. We report these risks and uncertainties in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. They include, but are not limited to: we may not be successful in implementing our growth strategy; sensitivity to reductions in discretionary spending as a result of downturns in the economy and other factors; we have experienced a decrease in revenue and profitability from live racing; challenges in attracting a sufficient number of horses and trainers; a lack of confidence in core operations resulting in decreasing customer retention and engagement; personal injury litigation due to the inherently dangerous nature of horse racing; material fluctuations in attendance at the Racetrack; material changes in the level of wagering by patrons; any decline in interest in horse racing or the unbanked card games offered in the Casino; competition from other venues offering racing, unbanked card games or other forms of wagering; competition from other sports and entertainment options; increases in compensation and employee benefit costs; the impact of wagering products and technologies introduced by competitors; the general health of the gaming sector; legislative and regulatory decisions and changes; our ability to successfully develop our real estate, including the effect of competition on our real estate development operations and our reliance on our current and future development partners; our obligation to make improvements in the TIF district that will only be reimbursed to the extent of future tax revenue; temporary disruptions or changes in access to our facilities caused by ongoing infrastructure improvements; inclement weather and other conditions affecting the ability to conduct live racing; technology and/or key system failures; cybersecurity incidents; the general effects of inflation; our ability to attract and retain qualified personnel; dividends that may or may not be issued at the discretion of our Board of Directors; and other factors that are beyond our ability to control or predict.

The forward-looking statements in this press release speak only as of the date of this press release. Except as required by law, Canterbury assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

# # #

| Investor Contacts: |

|

| Randy Dehmer Senior Vice President and Chief Financial Officer Canterbury Park Holding Corporation 952-233-4828 or [email protected] |

Joseph Jaffoni, Christin Armacost JCIR 212-835-8500 or [email protected] |

– Financial tables follow –

| CANTERBURY PARK HOLDING CORPORATION’S SUMMARY OF OPERATING RESULTS (UNAUDITED) |

|||||||||||

| Three months ended | Nine months ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||

| OPERATING REVENUES: | |||||||||||

| Casino | $8,925,116 | $9,878,660 | $27,605,997 | $29,780,059 | |||||||

| Pari-mutuel | 3,236,032 | 3,327,332 | 6,577,878 | 7,100,316 | |||||||

| Food and beverage | 3,507,789 | 3,102,706 | 7,199,300 | 6,930,086 | |||||||

| Other | 2,645,764 | 2,975,669 | 5,738,892 | 5,774,290 | |||||||

| Total Net Revenues | $18,314,701 | $19,284,367 | $47,122,067 | $49,584,751 | |||||||

| OPERATING EXPENSES | (17,263,655) | (17,370,092) | (44,989,533) | (44,786,387) | |||||||

| Gain on transfer of land | – | 1,732,353 | – | 1,732,353 | |||||||

| INCOME FROM OPERATIONS | 1,051,046 | 3,646,628 | 2,132,534 | 6,530,717 | |||||||

| Other loss, net | (407,763) | (852,822) | (2,447,867) | (1,808,471) | |||||||

| INCOME TAX (EXPENSE) BENEFIT | (156,000) | (772,000) | 176,000 | (1,364,000) | |||||||

| NET INCOME (LOSS) | $487,283 | 2,021,806 | ($139,333) | 3,358,246 | |||||||

| Basic Earnings (Loss) Per Share | $0.10 | $0.40 | ($0.03) | $0.67 | |||||||

| Diluted Earnings (Loss) Per Share | $0.10 | $0.40 | ($0.03) | $0.67 | |||||||

| RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA (UNAUDITED) |

|||||||||||

| Three months ended | Nine months ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||

| NET INCOME (LOSS) | $487,283 | $2,021,806 | ($139,333) | $3,358,246 | |||||||

| Interest income, net | (528,501) | (521,579) | (1,451,162) | (1,592,676) | |||||||

| Income tax expense (benefit) | 156,000 | 772,000 | (176,000) | 1,364,000 | |||||||

| Depreciation and amortization | 1,026,994 | 936,033 | 2,944,900 | 2,676,092 | |||||||

| EBITDA | 1,141,776 | 3,208,260 | 1,178,405 | 5,805,662 | |||||||

| Stock-based compensation | 392,994 | 359,039 | 1,201,749 | 1,074,397 | |||||||

| Gain on transfer of land | – | (1,732,353) | – | (1,732,353) | |||||||

| Depreciation and amortization related to equity investments |

517,893 | 605,138 | 1,968,919 | 1,667,927 | |||||||

| Interest expense related to equity investments |

760,956 | 840,504 | 2,277,031 | 2,085,327 | |||||||

| ADJUSTED EBITDA | $2,813,619 | $3,280,588 | $6,626,104 | $8,900,960 | |||||||

Nasdaq:CPHC

Canterbury Park Holding Corporation Announces Quarterly Cash Dividend

SHAKOPEE, Minn., Sept. 10, 2025 (GLOBE NEWSWIRE) — Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (NASDAQ: CPHC), today announced that the Company’s Board of Directors, pursuant to its dividend policy, approved a quarterly cash dividend of $0.07 per share that will be paid on October 14, 2025 to stockholders of record on September 30, 2025. At this quarterly rate, the annual dividend is equivalent to $0.28 per common share.

About Canterbury Park

Canterbury Park Holding Corporation (Nasdaq: CPHC) owns and operates Canterbury Park Racetrack and Casino in Shakopee, Minnesota, the only thoroughbred and quarter horse racing facility in the State. The Company generally offers live racing from May to September. The Casino hosts card games 24 hours a day, seven days a week, dealing both poker and table games. The Company also conducts year-round wagering on simulcast horse racing and hosts a variety of other entertainment and special events at its Shakopee facility. The Company is also pursuing a strategy to enhance shareholder value by the ongoing development of approximately 140 acres of underutilized land surrounding the Racetrack that was originally designated for a project known as Canterbury Commons™. The Company is pursuing several mixed-use development opportunities for the remaining underutilized land, directly and through joint ventures. For more information about the Company, please visit www.canterburypark.com.

Cautionary Statement

From time to time, in press releases and in other communications to shareholders or the investing public, Canterbury Park Holding Corporation may make forward-looking statements concerning possible or anticipated future financial performance, business activities or plans based on management’s beliefs and assumptions. These forward looking statements are typically preceded by the words such as “believes,” “expects,” “anticipates,” “intends” or similar expressions. Shareholders and the investing public should understand that these forward-looking statements are subject to risks and uncertainties, including those disclosed in our periodic filings with the Securities and Exchange Commission, which could cause actual performance, activities, future dividends or plans after the date the statements are made to differ significantly from those indicated in the forward-looking statements when made.

Investor Contacts:

Randy Dehmer

Senior Vice President and Chief Financial Officer

Canterbury Park Holding Corporation

952-233-4828 or [email protected]

Richard Land, Jim Leahy

JCIR

212-835-8500 or [email protected]

Nasdaq:CPHC

Canterbury Park Holding Corporation Reports Second Quarter Results

SHAKOPEE, Minn., Aug. 07, 2025 (GLOBE NEWSWIRE) — Canterbury Park Holding Corporation (“Canterbury” or the “Company”) (Nasdaq: CPHC) today reported financial results for the three and six months ended June 30, 2025.

| ($ in thousands, except per share data and percentages) | |||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||

| 2025 | 2024 | Change | 2025 | 2024 | Change | ||||||

| Net revenues | $15,666 | $16,202 | (3.3%) | $28,807 | $30,300 | (4.9%) | |||||

| Net (loss) income | ($327) | $338 | (196.8%) | ($627) | $1,336 | (146.9%) | |||||

| Adjusted EBITDA(1) | $1,873 | $2,407 | (22.2%) | $3,812 | $5,620 | (32.2%) | |||||

| Basic EPS | ($0.06) | $0.07 | (195.3%) | ($0.12) | $0.27 | (146.2%) | |||||

| Diluted EPS | ($0.06) | $0.07 | (195.3%) | ($0.12) | $0.27 | (146.2%) | |||||

| (1) | Adjusted EBITDA, a non-GAAP measure, excludes certain items from net income, a GAAP measure. Non-GAAP financial measures are not intended to be considered in isolation from, a substitute for, or superior to GAAP results. Definitions, disclosures, and reconciliations of non-GAAP financial information are included later in the release. Adjusted EBITDA margin is Adjusted EBITDA as a percentage of net revenues. |

Management Commentary

“Throughout the first half of 2025, we remained focused on our development and growth strategies and mitigating the impact of increased competition. Second quarter revenues of $15.7 million reflect a smaller year-over-year decline versus the first quarter of 2025. Similar to the first quarter, our second quarter results reflect the competitive environment in addition to the impact of fewer live race days versus the prior year period. Notably, casino visits and player counts remain relatively stable though betting levels declined. Adjusted EBITDA of $1.9 million resulted in an adjusted EBITDA margin of 12.0%, slightly lower than the prior year period, partially reflecting the costs to ramp up our casino marketing efforts that are delivering some early signs of success,” said Randy Sampson, President and Chief Executive Officer of Canterbury Park.

“For the casino business, we are re-calibrating and expanding our marketing programs to attract and retain new customers, and increase visitation from high-value guests. For our horse racing operations, we finished the barn relocation and are completing several other renovations which are dramatically improving the racing experience and the environment for our horsemen. In our events business, we have already driven record attendance for several 2025 events and intend to further expand our special event offerings with more large-scale events planned for the balance of the year.

“At the same time, we continue to unlock the monetary value of our real estate through our Canterbury Commons expansion, as our vision to transform Canterbury into a premier regional destination to live, play, work and stay continues to take hold. We are exploring additional trackside development opportunities that would add to the nearly 1,000 residential units, five restaurants and breweries, two music and entertainment venues, 57,000 square-feet of office space, and other distinct amenities already open or under construction.

“While our growth and efficiency initiatives are focused on 2025 and beyond, we continue to believe that our record of consistent annual cash flow generation, return of capital through our quarterly cash dividend and strong balance sheet are not fully recognized in our current valuation. Canterbury has no debt and we believe our cash, tax increment financing (TIF) receivables and real estate joint ventures are valued at over $10 per share. In terms of liquidity, we have nearly $17 million, or approximately $3.33 per share, in cash and short-term investments at the end of the 2025 second quarter. We have nearly $20 million, or approximately $3.90 per share, in TIF receivables on our balance sheet at quarter’s end, on which we expect to receive payments beginning in the fourth quarter of 2025. Lastly, we have contributed a total of just over $16 million, or approximately $3.17 per share, in land and cash to our real estate joint venture development projects for which we share in the economics. This estimated $10.40 per share value does not include the roughly 50 acres of land held for future development, the current value of which is not fully reflected on our balance sheet due to it being recorded on a cost basis. We remain committed to delighting our guests, serving our residents and driving significant long-term value to our shareholders.”

Canterbury Commons Development Update

The Company’s barn relocation and redevelopment plan is substantially complete with over 300 new stalls completed and in operation. Swervo Development Corporation continues to make progress on the construction of its state-of-the-art 19,000-seat amphitheater, which will be operated by Live Nation Entertainment. Canterbury is also nearing completion of a new road adjacent to the amphitheater which will unlock the high-value development potential of approximately 25 acres of prime land in that portion of the site.

Residential and commercial construction updates related to joint ventures include:

- Phase II of The Doran Group’s upscale Triple Crown Residences at Canterbury Park has leased 95% of its available units. In addition, Phase I of the Triple Crown Residences is now at 42% leased.

- 95% of the 147 units of senior market rate apartments at The Omry at Canterbury are leased.

- The pizza restaurant, fitness center and BBQ restaurant in the 10,000 square-foot commercial building within the Winners Circle development are in their first year of operation and experiencing their first summer business at Canterbury with positive patronage.

- Construction of an additional 28,000 square-foot commercial office building within the Winners Circle development is ongoing. The building is 66% leased and marketing is underway for the remainder of the available space. A certificate of occupancy for the new space is expected in the third quarter of 2025.

- Canterbury’s joint venture partner, Trackside Holdings, LLC, completed construction and transferred the building to the operation entity of Boardwalk Kitchen & Bar. The food and beverage and entertainment space of the facility opened in late June and has experienced a strong start and positive reception from the public.

Residential and commercial construction updates related to prior land sales include:

- Pulte Homes of Minnesota continues development on the 45-unit second phase of its row home and townhome residences and all of the remaining lots are under contract and construction.

Developer and partner selection for the remaining 50 acres of Canterbury Commons, including 25 acres that will become available for development following the completion of the new road noted above, continues. Uses for these 50 acres could include office, retail, hotel and restaurants. Canterbury, in partnership with the City of Shakopee, engaged a market study with Hunden Partners to identify the highest and best use for this land. Findings will be articulated into a new masterplan.

Summary of 2025 Second Quarter Operating Results

Net revenues for the three months ended June 30, 2025 decreased 3.3% to $15.7 million, compared to $16.2 million for the same period in 2024. The year-over-year comparison reflects declines of 3.6%, 12.9% and 1.6% in Casino, Pari-mutuel and Food and Beverage revenues, respectively, partially offset by an 11.4% increase in Other revenues. The year-over-year decreases primarily reflect the previously noted increased competition that is impacting Casino revenues, two and a half live race days being cancelled due to inclement weather impacting Pari-mutuel and F&B revenues, while the increase in Other revenues reflects strong admission revenues for live racing and special events in the second quarter.

Operating expenses for the three months ended June 30, 2025 were $15.2 million, an increase of $154,000, or 1.0%, compared to operating expenses of $15.1 million for the same period in 2024. The year-over-year increase in operating expenses primarily reflects increased salaries and wages due to annual wage increases, increased professional and contracted services due to increased costs for state vets and stewards, and increased advertising and marketing costs reflecting the implementation of the Company’s expanded and revamped marketing initiatives in the 2025 second quarter. Depreciation expense also increased due to the completion of large capital improvement projects over the past year.

The Company recorded a net loss of $1.4 million and $1.2 million from equity investments for the three months ended June 30, 2025 and 2024, respectively. The loss in both periods is primarily related to the Company’s share of depreciation, amortization and interest expense from the Doran Canterbury joint ventures. The increased loss for the three months ended June 30, 2025 is due to the Doran Canterbury II joint venture opening in 2024.

The Company recorded an income tax benefit of $151,000 and income tax expense of $142,000 for the three months ended June 30, 2025 and 2024, respectively. The income tax benefit for the three months ended June 30, 2025 compared to the income tax expense for the same period in 2024 is primarily due to a decrease in income from operations before taxes.

The Company recorded a net loss of $327,000 and a diluted loss per share of $0.06 for the three months ended June 30, 2025. The Company recorded net income of $338,000 and diluted earnings per share of $0.07 for the three months ended June 30, 2024.

Adjusted EBITDA, a non-GAAP measure, was $1.9 million in the 2025 second quarter, compared to $2.4 million in the 2024 second quarter.

Summary of 2025 Year-to-Date Operating Results

Net revenues for the six months ended June 30, 2025, decreased 4.9% to $28.8 million, compared to $30.3 million in the same period last year. The year-over-year comparison reflects declines of 6.1%, 11.4% and 3.5% in Casino, Pari-mutuel and Food and Beverage revenues, respectively, partially offset by a 10.5% increase in Other revenues. The year-over-year decreases primarily reflect the previously noted increased competition that is impacting Casino revenues, two and a half live race days being cancelled due to inclement weather impacting Pari-mutuel and F&B revenues, while the increase in Other revenues reflects strong event admission revenues in the first half of 2025.

Operating expenses for the six months ended June 30, 2025 were $27.7 million, an increase of $310,000, or 1.1%, compared to operating expenses of $27.4 million for the same period in 2024. The year-over-year increase in operating expenses primarily reflects increased salaries and wages due to annual wage increases, increased other operating expenses due to increased property taxes, increased professional and contracted services due to increased costs for state vets and stewards, and higher advertising and marketing costs reflecting the implementation of the Company’s expanded and revamped marketing initiatives implemented in 2025. Depreciation expense also increased due to the completion of large capital improvement projects over the past year.

The Company recorded a net loss of $3.0 million and $2.0 from equity investments for the six months ended June 30, 2025 and 2024, respectively. The loss in both periods is primarily related to the Company’s share of depreciation, amortization and interest expense from the Doran Canterbury joint ventures. The increased loss for the six months ended June 30, 2025 is due to the Doran Canterbury II joint venture opening in 2024.

The Company recorded an income tax benefit of $332,000 and income tax expense of $592,000 for the six months ended June 30, 2025 and 2024, respectively. The income tax benefit for the six months ended June 30, 2025 compared to the income tax expense for the same period in 2024 is primarily due to a decrease in income before taxes from operations and a federal interest income tax refund received in the first quarter of 2025.

The Company recorded a net loss of $627,000 and a diluted loss per share of $0.12 for the six months ended June 30, 2025. The Company recorded net income of $1.3 million and diluted earnings per share of $0.27 for the six months ended June 30, 2024.

Adjusted EBITDA, a non-GAAP measure, was $3.8 million for the six months ended June 30, 2025, compared to $5.6 million for the same period in 2024.

Additional Financial Information

Further financial information for the second quarter ended June 30, 2025, is presented in the accompanying tables at the end of this press release. Additional information will be provided in the Company’s Quarterly Report on Form 10-Q that will be filed with the Securities and Exchange Commission on or about August 8, 2025.

Use of Non-GAAP Financial Measures

To supplement our financial statements, we also provide investors with information about our EBITDA and Adjusted EBITDA, each of which is a non-GAAP measure, and which exclude certain items from net income, a GAAP measure. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We define Adjusted EBITDA as earnings before interest income (net of interest expense), income tax expense, depreciation and amortization, as well as excluding stock-based compensation (which includes our 401(k) match expense as this match occurs in Company stock), depreciation and amortization related to equity investments, and interest expense related to equity investments. We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of net revenues. Neither EBITDA, Adjusted EBITDA, or Adjusted EBITDA margin are measures of performance calculated in accordance with generally accepted accounting principles (“GAAP”), and should not be considered an alternative to, or more meaningful than, net income as an indicator of our operating performance. See the table below, which presents reconciliations of these measures to the GAAP equivalent financial measure, which is net income. We have presented EBITDA as a supplemental disclosure because we believe that, when considered with measures calculated in accordance with GAAP, EBITDA gives investors a more complete understanding of our operating results before the impact of investing and financing transactions and income taxes, and it is a widely used measure of performance and basis for valuation of companies in our industry. Other companies that provide EBITDA information may calculate EBITDA or Adjusted EBITDA differently than we do. We have presented Adjusted EBITDA as a supplemental disclosure because we believe it enables investors to understand and assess our core operating results excluding the effect of these items and is useful to investors in allowing greater transparency related to a significant measure used by management in its financial and operational decision-making. Adjusted EBITDA has economic substance because it is used by management as a performance measure to analyze the performance of our business and provides a perspective on the current effects of operating decisions.

About Canterbury Park

Canterbury Park Holding Corporation (Nasdaq: CPHC) owns and operates Canterbury Park Racetrack and Casino in Shakopee, Minnesota, the only thoroughbred and quarter horse racing facility in the State. The Company generally offers live racing from May to September. The Casino hosts card games 24 hours a day, seven days a week, dealing both poker and table games. The Company also conducts year-round wagering on simulcast horse racing and hosts a variety of other entertainment and special events at its Shakopee facility. The Company is also pursuing a strategy to enhance shareholder value by the ongoing development of approximately 140 acres of underutilized land surrounding the Racetrack that was originally designated for a project known as Canterbury Commons™. The Company is pursuing several mixed-use development opportunities for the remaining underutilized land, directly and through joint ventures. For more information about the Company, please visit www.canterburypark.com.

Cautionary Statement

From time to time, in reports filed with the Securities and Exchange Commission, in press releases, and in other communications to shareholders or the investing public, we may make forward-looking statements concerning possible or anticipated future financial performance, business activities or plans. These statements are typically preceded by the words “believes,” “expects,” “anticipates,” “intends” or similar expressions. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in federal securities laws. Shareholders and the investing public should understand that these forward-looking statements are subject to risks and uncertainties which could affect our actual results and cause actual results to differ materially from those indicated in the forward-looking statements. We report these risks and uncertainties in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. They include, but are not limited to: we may not be successful in implementing our growth strategy; sensitivity to reductions in discretionary spending as a result of downturns in the economy and other factors; we have experienced a decrease in revenue and profitability from live racing; challenges in attracting a sufficient number of horses and trainers; a lack of confidence in core operations resulting in decreasing customer retention and engagement; personal injury litigation due to the inherently dangerous nature of horse racing; material fluctuations in attendance at the Racetrack; material changes in the level of wagering by patrons; any decline in interest in horse racing or the unbanked card games offered in the Casino; competition from other venues offering racing, unbanked card games or other forms of wagering; competition from other sports and entertainment options; increases in compensation and employee benefit costs; the impact of wagering products and technologies introduced by competitors; the general health of the gaming sector; legislative and regulatory decisions and changes; our ability to successfully develop our real estate, including the effect of competition on our real estate development operations and our reliance on our current and future development partners; our obligation to make improvements in the TIF district that will only be reimbursed to the extent of future tax revenue; temporary disruptions or changes in access to our facilities caused by ongoing infrastructure improvements; inclement weather and other conditions affecting the ability to conduct live racing; technology and/or key system failures; cybersecurity incidents; the general effects of inflation; our ability to attract and retain qualified personnel; dividends that may or may not be issued at the discretion of our Board of Directors; and other factors that are beyond our ability to control or predict.

The forward-looking statements in this press release speak only as of the date of this press release. Except as required by law, Canterbury assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

| Investor Contacts: | |

| Randy Dehmer | Joseph Jaffoni, Christin Armacost |

| Senior Vice President and Chief Financial Officer | JCIR |

| Canterbury Park Holding Corporation | 212-835-8500 or [email protected] |

| 952-233-4828 or [email protected] | |

– Financial tables follow –

| CANTERBURY PARK HOLDING CORPORATION’S | |||||||

| SUMMARY OF OPERATING RESULTS | |||||||

| (UNAUDITED) | |||||||

| Three months ended | Six months ended | ||||||

| June 30, | June 30, | ||||||

| 2025 | 2024 | 2025 | 2024 | ||||

| Operating Revenues: | |||||||

| Casino | $9,488,723 | $9,845,371 | $18,680,881 | $19,901,399 | |||

| Pari-mutuel | 2,263,361 | 2,598,716 | 3,341,846 | 3,772,984 | |||

| Food and Beverage | 2,066,758 | 2,100,231 | 3,691,511 | 3,827,380 | |||

| Other | 1,846,892 | 1,658,077 | 3,093,128 | 2,798,621 | |||

| Total Net Revenues | $15,665,734 | $16,202,395 | $28,807,366 | $30,300,384 | |||

| Operating Expenses | (15,233,916) | (15,080,180) | (27,725,877) | (27,416,295) | |||

| Income from Operations | 431,818 | 1,122,215 | 1,081,489 | 2,884,089 | |||

| Other Loss, net | (910,224) | (641,929) | (2,040,105) | (955,649) | |||

| Income Tax Benefit (Expense) | 151,000 | (142,000) | 332,000 | (592,000) | |||

| Net (Loss) Income | ($327,406) | $338,286 | ($626,616) | $1,336,440 | |||

| Basic (Loss) Earnings Per Share | ($0.06) | $0.07 | ($0.12) | $0.27 | |||

| Diluted (Loss) Earnings Per Share | ($0.06) | $0.07 | ($0.12) | $0.27 | |||

| RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA | |||||||

| (UNAUDITED) | |||||||

| Three months ended | Six months ended | ||||||

| June 30, | June 30, | ||||||

| 2025 | 2024 | 2025 | 2024 | ||||

| NET (LOSS) INCOME | ($327,406) | $338,286 | ($626,616) | $1,336,440 | |||

| Interest income, net | (479,380) | (532,570) | (922,661) | (1,071,097) | |||

| Income tax (benefit) expense | (151,000) | 142,000 | (332,000) | 592,000 | |||

| Depreciation and amortization | 986,418 | 889,073 | 1,917,906 | 1,740,059 | |||

| EBITDA | 28,632 | 836,789 | 36,629 | 2,597,402 | |||

| Stock-based compensation | 426,298 | 368,893 | 808,755 | 715,358 | |||

| Depreciation and amortization related to equity investments | 678,733 | 535,164 | 1,451,026 | 1,062,789 | |||

| Interest expense related to equity investments | 739,540 | 666,507 | 1,516,075 | 1,244,822 | |||

| ADJUSTED EBITDA | $1,873,203 | $2,407,353 | $3,812,485 | $5,620,371 | |||

-

Latest News6 days ago

Latest News6 days agoBMM TESTLABS GRANTED NEW LICENSE IN BRAZILIAN STATE OF MINAS GERAIS, EXPANDING ITS PRODUCT TESTING AND CERTIFICATION FOOTPRINT IN BRAZIL

-

BMM Innovation Group6 days ago

BMM Innovation Group6 days agoBMM Testlabs Secures Minas Gerais License, Expanding iGaming and Sports Betting Certification in Brazil

-

Colombia7 days ago

Colombia7 days agoZITRO INSTALLS OVER 70 MACHINES ACROSS GRUPO ALADDIN CASINOS IN COLOMBIA

-

Conferences6 days ago

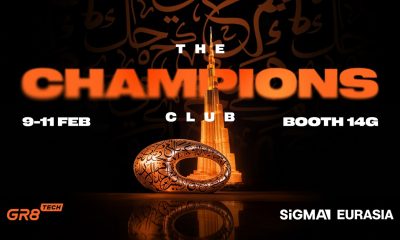

Conferences6 days agoChampions Club Bound for Dubai

-

Latest News5 days ago

Latest News5 days agoMillion Games Unveils Looting Raccoons: A Charming Pirate Slot Packed with Features

-

Brasil on Track4 days ago

Brasil on Track4 days agoODDSGATE LAUNCHES “BRASIL ON TRACK”, A STRATEGIC PLATFORM FOR NAVIGATING BRAZIL’S REGULATED IGAMING MARKET

-

Canada6 days ago

Canada6 days agoKambi Group Becomes the Official Sportsbook Partner of Ontario Lottery and Gaming Corporation

-

Casino-Groups6 days ago

Casino-Groups6 days agoSebastian Jarosch Becomes Head of AI at Casinos Groups