Detroit casinos

Detroit Casinos Report $109.44M in April Revenue

The three Detroit casinos reported $109.44 million in monthly aggregate revenue (AGR) for the month of April 2024, of which $107.87 million was generated from table games and slots, and $1.57 million from retail sports betting.

The April market shares were:

- MGM, 46%

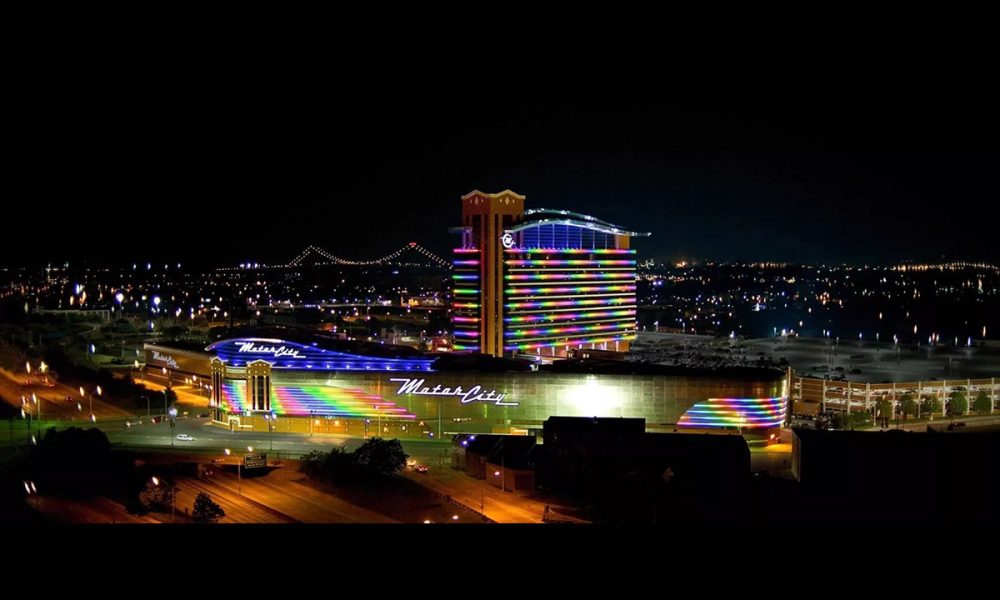

- MotorCity, 30%

- Hollywood Casino at Greektown, 24%

Monthly Table Games, Slot Revenue, and Taxes

The casinos’ revenue for table games and slots for the month of April 2024 decreased 1.6% when compared to the same month last year. April’s monthly revenue was 11.8% lower when compared to the previous month, March 2024. From Jan. 1 through April 30, the Detroit casinos’ table games and slots revenue decreased by 1.6% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to April of last year:

- MGM, down 0.7% to $49.86 million

- MotorCity, down 4.5% to $32.68 million

- Hollywood Casino at Greektown, up 0.6% to $25.33 million

In April 2024, the three Detroit casinos paid $8.74 million in gaming taxes to the State of Michigan. They paid $8.88 million for the same month last year. The casinos also reported submitting $12.8 million in wagering taxes and development agreement payments to the City of Detroit in April.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $15.28 million in total retail sports betting handle, and total gross receipts were $1.57 million for the month of April. Retail sports betting qualified adjusted gross receipts (QAGR) were up by $1.5 million in April when compared to the same month last year. Compared to March 2024, April QAGR was down by 1.7%.

April QAGR by casino was:

- MGM: $475,492

- MotorCity: $516,812

- Hollywood Casino at Greektown: $578,131

During April, the casinos paid $59,362 in gaming taxes to the state and reported submitting $72,554 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Fantasy Contests

For March 2024, fantasy contest operators reported total adjusted revenues of $494,162 and paid taxes of $41,510.

Detroit casinos

Detroit Casinos Report $103.9M in January Revenue

Detroit’s three commercial casinos reported $103.9 million in aggregate revenue (AGR) for January 2026. Table games and slots generated $103.1 million, while retail sports betting produced $770,319 in qualified adjusted gross receipts (QAGR).

January market shares were:

• MGM, 49%

• MotorCity, 30%

• Hollywood Casino at Greektown, 21%

Table Games and Slot Revenue

January 2026 table games and slot revenue increased 0.8% compared with January 2025 and declined 0.3% from December 2025. For the period Jan. 1-31, revenue was also up 0.8% year-over-year.

Casino-level results compared with January 2025 were:

• MGM: up 0.5% to $50.2 million

• MotorCity: up 1.2% to $31.0 million

• Hollywood Casino at Greektown: up 0.7% to $21.9 million

The casinos paid $8.4 million in state gaming taxes in January, compared with $8.3 million in January 2025. They also reported submitting $12.3 million in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue

Detroit casinos reported $11.3 million in total retail sports betting handle for January. Total gross receipts were $789,669. QAGR declined 69.5% from January 2025 and 55.2% from December 2025.

January QAGR by casino:

• MGM: $227,918

• MotorCity: $255,937

• Hollywood Casino at Greektown: $286,464

The casinos paid $29,118 in state taxes and submitted $35,589 in wagering taxes to the City of Detroit based on January retail sports betting activity.

Fantasy Contests

For December 2025, fantasy contest operators reported $993,921 in adjusted revenues and paid $83,489 in taxes.

From Jan. 1 through Dec. 31, 2025, operators reported $9.9 million in aggregate fantasy contest adjusted revenues and paid $827,511 in taxes.

The post Detroit Casinos Report $103.9M in January Revenue appeared first on Americas iGaming & Sports Betting News.

Detroit casinos

Michigan iGaming, Sports Betting Operators Report $399.8M in December Revenue, $3.8B Total for 2025

Michigan commercial and tribal operators reported a combined $399.8 million total internet gaming (iGaming) gross receipts and gross sports betting receipts in December. Gross receipts increased 19.1% compared to November.

Monthly Gross Receipts

December iGaming gross receipts totaled $315.8 million, the highest to date. The previous high was $278.5 million recorded in October 2025. December gross sports betting receipts totaled $84.0 million, which is a decrease from the $87.3 million recorded in November.

Monthly Adjusted Gross Receipts

Combined total iGaming and internet sports betting adjusted gross receipts (AGR) for December were $357.87 million, including $296.74 million from iGaming and $61.13 million from internet sports betting — representing an iGaming increase of 27.2% and a sports betting decrease of 5.6% when compared to November 2025. Compared to December 2024 reported revenues, iGaming AGR was up by 35.1% and sports betting was up by $60.9 million.

Monthly Handle

Total internet sports betting handle at $512.9 million was down by 18.7% from the $631.1 million handle recorded in November 2025.

Monthly State Taxes/Payments

The operators reported submitting $66.3 million in taxes and payments to the State of Michigan during December, of which:

• iGaming taxes and fees = $62.1 million

• Internet sports betting taxes and fees = $4.2 million

Monthly City of Detroit Taxes/Payments

The three Detroit casinos reported paying the City of Detroit $15.2 million in wagering taxes and municipal services fees during December, of which:

• iGaming taxes and fees = $13.8 million

• Internet sports betting taxes and fees = $1.4 million

Monthly Tribal Operators’ Payments

Tribal operators reported making $8.5 million in payments to governing bodies in December.

Annual Gross Receipts

In 2025, Michigan commercial and tribal operators reported a combined $3.8 billion total iGaming gross receipts and gross sports betting receipts — $3.1 billion from iGaming and $671.3 million from internet sports betting — a 29.5% increase over 2024.

Annual Adjusted Gross Receipts

In 2025, Michigan commercial and tribal operators reported a combined $3.3 billion total iGaming adjusted gross receipts and adjusted gross sports betting receipts — $2.9 billion from iGaming and $435.9 million from internet sports betting — a 39.5% increase over 2024.

Annual Handle

Total handle for 2025 was $5.4 billion.

Annual State Taxes/Payments

The operators paid $624.6 million in taxes and payments to the State of Michigan in 2025, of which:

• iGaming taxes and fees = $597.5 million

• Internet sports betting taxes and fees = $27.1 million

Annual City of Detroit Taxes/Payments

The three Detroit casinos reported paying the City of Detroit $161.4 million in wagering taxes and municipal services fees in 2025, of which:

• iGaming taxes and fees = $152.6 million

• Internet sports betting taxes and fees = $8.8 million

Annual Tribal Operators’ Payments

Tribal operators reported making $71.9 million in payments to governing bodies in 2025.

The post Michigan iGaming, Sports Betting Operators Report $399.8M in December Revenue, $3.8B Total for 2025 appeared first on Americas iGaming & Sports Betting News.

Detroit casinos

Detroit Casinos Report $105.1M in December Revenue, $1.2B for Year

The three Detroit casinos reported $105.1 million in monthly aggregate revenue (AGR) for the month of December 2025. Table games and slots generated $103.4 million and retail sports betting generated $1.7 million.

The December market shares were:

• MGM, 49%

• MotorCity, 29%

• Hollywood Casino at Greektown, 22%

Monthly Table Games, Slot Revenue, and Taxes

The casinos’ revenue for table games and slots for the month of December 2025 decreased 5.4% when compared to the same month last year. December’s monthly revenue was 2.9% lower when compared to the previous month, November 2025. From Jan. 1 through Dec. 31, the Detroit casinos’ table games and slots revenue decreased by 1.3% compared to the same period last year.

The casinos’ monthly gaming revenue results decreased compared to December 2024:

• MGM, down 1.0% to $50.7 million

• MotorCity, down 9.2% to $30.0 million

• Hollywood Casino at Greektown, down 9.5% to $22.7 million

In December 2025, the three Detroit casinos paid $8.4 million in gaming taxes to the State of Michigan. They paid $8.9 million for the same month last year. The casinos also reported submitting $12.8 million in wagering taxes and development agreement payments to the City of Detroit in December.

Quarterly Table Games, Slot Revenue, and Taxes

For the fourth quarter of 2025 that ended Dec. 31, aggregate revenue was down for all three Detroit casinos by 1.1% compared to the same period last year. Quarterly gaming revenue numbers for the casinos were:

• MGM: $154.1 million

• MotorCity: $91.9 million

• Hollywood Casino at Greektown: $69.8 million

Compared to the fourth quarter of 2024, MGM was up by 2.8%, and MotorCity and Hollywood Casino were down by 6.0% and 2.7%, respectively. The three casinos paid $25.6 million in gaming taxes to the state in the fourth quarter of 2025, compared to $25.9 million in the same quarter last year.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $12.23 million in total retail sports betting handle, and total gross receipts of $1.8 million for the month of December. Retail sports betting qualified adjusted gross receipts (QAGR) were up by $1.4 million in December when compared to December 2024, and up by 0.7% when compared to November 2025.

December QAGR by casino was:

MGM: $372,771

MotorCity: $747,568

Hollywood Casino at Greektown: $599,224

During December, the casinos paid $64,999 in gaming taxes to the state and reported submitting $79,444 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Annual Revenue for Table Games, Slots, and Retail Sports Betting

The total yearly aggregate revenue of $1.28 billion by the three Detroit casinos for slots, table games, and retail sports betting was generated by:

• Slots: $1.02 billion (79.5%)

• Table games: $247.8 million (19.4%)

• Retail sports betting: $14.2 million (1.1%)

The casinos’ market shares for the year were:

• MGM, 48%

• MotorCity, 30%

• Hollywood Casino at Greektown, 22%

Compared to 2024, slots and table games yearly gaming revenue for the three casinos were as follows:

• MGM, up by 0.3% to $605.3 million

• MotorCity, down by 2.5% to $376.1 million

• Hollywood Casino at Greektown, down by 3.1% to $283.9 million

Aggregate retail sports betting qualified adjusted gross receipts (QAGR) for 2025 was up by 45.9% to $14.2 million compared to last year, with MGM totaling $3.0 million, MotorCity totaling $6.8 million, and Hollywood Casino at Greektown totaling $4.4 million.

In 2025, the three Detroit casinos paid the state $102.5 million in wagering taxes for slots and table games, and $535,323 in wagering taxes for retail sports betting. In 2024, they had paid $103.9 million and $372,729 for each, respectively.

Fantasy Contests

For November, fantasy contest operators reported total adjusted revenues of $1.16 million and paid taxes of $97,032.

From Jan. 1 through Nov. 30, fantasy contest operators reported $8.9 million in aggregate fantasy contest adjusted revenues and paid $744,022 in taxes.

The post Detroit Casinos Report $105.1M in December Revenue, $1.2B for Year appeared first on Americas iGaming & Sports Betting News.

-

Canada4 days ago

Canada4 days agoPointsBet Canada to Contest Proposed 5-Day Suspension by AGCO

-

Africa4 days ago

Africa4 days agoEGT showcases African growth strategy at SiGMA Africa 2026

-

Ben Bradtke Co-Founder of ThrillTech4 days ago

Ben Bradtke Co-Founder of ThrillTech4 days agoThrillTech enters Brazilian market with EstrelaBet

-

Denmark4 days ago

Denmark4 days agoELA Games Strengthens Danish Market Presence via Stake.dk Tie-Up

-

BIG Cyber4 days ago

BIG Cyber4 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

ANJ4 days ago

ANJ4 days agoWhat’s up and what’s next on the French gambling market ?

-

Colombian market4 days ago

Colombian market4 days agoGoldenRace reinforces leadership in the Colombian market alongside Olympia Apuestas Virtuales

-

Crypto7 days ago

Crypto7 days agoUK To Explore Crypto Gambling Framework