Latest News

Smartico Develops a Rockstar AI Predictive Tool for CRMs

Knowing me, knowing you … There’s nothing we can do …

Goes the famous ABBA song of the 1970s.

Ironically, this is exactly the conundrum that customer relationship management (CRM) executives face when they design and implement a marketing strategy. Especially those in the gaming and betting industry. They know who their customers are. They know their customers could punt big.

But they don’t know the most ideal time to send a simple email to their customers. Or they don’t know the best time to push a social media post.

Shortcomings of One-size-fits-all Strategy

Oftentimes, CRM executives resort to a one-size-fits-all strategy. Take the email campaign as an example. They push their mails over the night so that the job is done by the next day. That is one neat tick on the box of weekly tasks.

But does it get the job done? The job of making the customers read the mail and follow the call for action?

Well, a no has to be the answer here. Different customers have different reading habits and different routines. The mail, for example, may not reach them at the exact time when a user engages most on the internet.

How would a CRM executive know this? That’s why we are back again to the ABBA song of the seventies: Knowing me, knowing you … There’s nothing we can do.

But not quite so now. This is 2021. And there has to be a way.

Enter Smartico’s AI Model

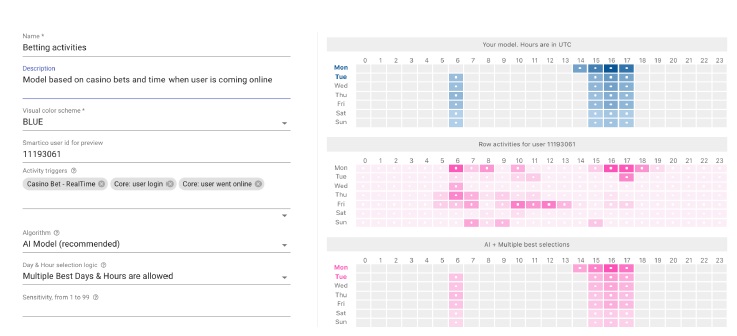

Smartico’s new AI tool automatically customizes the communication schedule of each and every customer, based on the real-time data on the online habits of the customer.

If X is most active during the mornings for the last six months or so, and is most likely to make a bet on that time on Sunday, it is a no brainer that the CRM executive must push the mail and social media posts on Sunday mornings.

The new module of Smartico CRM does exactly this. The AI tool analyzes the real-time data on customer behavior and predicts the optimum timings for communication.

Let’s look briefly into how it is done.

How It Works

The Smartico AI model relies on machine learning. It can make accurate predictions from large data sets. It will be of great use in customer retention. The model predicts the best time of the day to send email communication to the customers.

The model uses the user data on the existing CRM. It predicts the best time for sending communications to the user. Communications can be

- Emails

- Push messages

- Short messages

- Social media posts

The next step is to define the best time. Is it mornings, evenings or later nights? Smartico’s model uses a 24-hour time frame.

The model analyzes the past activities of a customer in the CRM database to predict the best times. Customer activities can be any of the following:

- Just being online – opening mails or seeing social media posts

- Engaging with the message – reading mails, clicking links on messages or interacting with social media posts

- Doing business – making deposit, posting a bet, or signing up

This is not a plug-and-play AI model. It needs active involvement of a CRM operator for best setup. Smartico offers a smooth interface that allows the operator to set up the tool. While it could take some hours to set up the campaign initially, the tool will provide results within much more quickly once perfected.

During the setup, the operator can perform any of the following tasks:

- Finding optimum timings for communication – The tool will offer multiple optimum timings during the 24-hour period. Human intervention is required to identify the best timing among them.

- For short term campaign – The model will predict the nearest best timing for sending a communication.

- For long term campaign – The tool will offer a range of best timings over a week for scheduling a campaign.

Simplifying AI

Smartico’s team spent long hours to create a working AI model that could improve the CRM platform’s customer retention and conversion rate. The team tried and discarded several models, and tried again, found and improved the present prediction model. It has the proven capability to improve the conversion rates.

AI is going to change the way a CRM system works, especially for highly competitive segments like betting and gaming. It is here to stay. It’s like a sweeping wave. The smart way is to harness its power to improve your CRM and enhance customer retention.

The AI systems do not come often with a low entry point. It’s high-end engineering. Smartico’s AI model is perhaps the one with the lowest entry level. It simplifies the human tasks so much so that the user does not need to worry about the architecture or data processing. Just follow the interface and see the results.

Knowing all these things, this is the best you can do – for your CRM that is.

Powered by WPeMatico

AI

Despite AI’s Rise, Fraud Teams Keep Growing — SEON 2026 Report

SEON, the command centre for immediate Fraud Prevention and AML Compliance, has unveiled AI Reality Check: 2026 Fraud & AML Leaders Report, the second iteration of its sector research, derived from a worldwide survey of 1,010 leaders in fraud, risk, and compliance spanning payments, fintech, financial services, retail, eCommerce, and gaming.

The figures reveal an unforeseen narrative: AI is ubiquitous, yet operations are not becoming easier to manage. Currently, 98% of organizations utilize AI in fraud and AML processes, with 95% expressing confidence in its effectiveness; meanwhile, headcount plans rose from 88% to 94% year-over-year, and 83% anticipate budget increases in 2026.

Complexity Is Surpassing Automation

AI has not lessened the workload — it has revealed the extent of work that has always existed. Fraud losses are increasingly approaching revenue growth, threats are advancing more rapidly, and disjointed systems restrict the true potential of AI at scale. Key year-over-year shift:

Leadership’s confidence in their teams’ performance is lagging. The number of leaders who disagreed with the statement, “fraud losses are growing faster than revenue,” dropped by almost 40% from the previous year

Inside the Numbers:

AI is baseline, not experimental

- 98% already integrate AI into daily workflows (only 2% still planning)

- 95% are confident AI can detect and prevent fraud (52% very confident)

- Top use case: AI/ML for transaction monitoring (30%)

Fraud and AML investment keeps climbing

- 83% expect fraud/AML budgets to increase in 2026

- 94% plan to add at least one full-time hire (up from 88% in 2025)

- 85% plan to add a vendor, 49% plan to replace one

Fragmentation is the bottleneck

- 95% claim “some integration” between fraud and AML systems

- Only 47% run fully integrated workflows; the rest rely on partial connections

- 80% say getting a unified view of data is challenging

For many, time-to-value remains slow

Only 10% go live in under two weeks

38% take 1–3 months, 24% take 4+ months

When implementations run long, top impacts include increased costs (52%) and prolonged fraud exposure (47%)

Teams are growing, not shrinking

94% plan to increase headcount despite automation gains

85% see AI agents as support/augmentation, not replacement (only 12% see eventual replacement)

Top fraud threats reported:

- Account takeovers: 26%

- Promo/discount abuse: 18%

- Return fraud: 18%

“Fraud and financial crime were supposed to become more manageable as AI matured,” said Tamas Kadar, CEO and co-founder, SEON. “Instead, 2026 is the year leaders are confronting a more complicated reality. AI adoption is real, confidence is high, but the scale and pace of fraud — compounded by fragmented systems — continue to drive increased investment rather than reduced overhead. The bottleneck is no longer whether AI works. It’s everything around it: disconnected data, siloed teams, slow implementations. The organisations that pull ahead will be the ones that unify fraud and AML intelligence, shorten the distance between threats and controls, and treat integration as strategy, not plumbing.”

Fast-Growing Companies Invest in Integration Early

Organisations growing 51%+ are nearly twice as likely as slower peers to report that achieving unified visibility is “not very challenging.” They treat integration as infrastructure, not an IT project.

What’s Next: From “Does AI Work?” to “Can We Trust It?”

With adoption near-universal, the conversation is shifting to governance, explainability and accountability:

- 78% say decentralised digital identity will become central to fraud/AML

- 33% cite data privacy regulations (GDPR, CCPA) as the biggest external force shaping AML

- 25% point to criminals’ advancing use of AI and obfuscation techniques

The post Despite AI’s Rise, Fraud Teams Keep Growing — SEON 2026 Report appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

N1 Faces: Shirin Mammadov — Building Trust That Drives Performance

Growth in affiliate marketing is easy to promise, but sustaining it over the long term is another story. Real results are built on consistency, clear communication, and relationships that can withstand market shifts, changing traffic sources, and rising competition.

In the latest episode of N1 Faces, the N1 Partners team introduces Shirin Mammadov, Senior Affiliate Manager — a specialist dedicated to creating structured, trust-based collaborations with affiliates. Shirin shares his journey into the industry, the principles guiding his work today, and what it takes to maintain performance and clarity in high-pressure environments.

How did you get into affiliate marketing, and when did you know this was your path?

“It started unexpectedly. At the time, I was running my own startup and wasn’t actively looking to move into affiliate marketing. The industry felt fast-paced, competitive, and performance-driven — exactly where I thrive. I’ve always enjoyed communication, negotiation, and building relationships, and affiliate marketing combines all of that. Over time, I realized it wasn’t just a temporary step — it was a field where I could grow and challenge myself long-term.”

What brought you to N1 Partners, and what was the deciding factor?

“Before joining N1 Partners, I was on the affiliate side, and N1 was one of my partners. From the beginning, the team was transparent, professional, and performance-minded, while also maintaining a genuinely friendly atmosphere. Trust was the key factor — I knew their standards and approach to growth. It wasn’t a risky move; it was strategic.”

Advice to your first-month self as an affiliate manager

“Focus less on proving yourself immediately and more on deeply understanding the product, numbers, and traffic quality. Strong partnerships take time, and trust matters more than quick deals. Ask questions, challenge assumptions, and the faster you understand the bigger picture, the faster you grow.”

How do you spot long-term partners versus one-off deals?

“You can often tell from the very first conversations. If a partner is transparent about traffic sources, open to feedback, and focused on optimization rather than only the highest CPA, that’s a good sign. Long-term partners think strategically, test continuously, and plan for growth. When trust and goals align, the partnership naturally becomes sustainable.”

Separating normal volatility from a real problem

“I look at trends over time instead of reacting to a single day’s numbers. Minor fluctuations are normal, but consistent drops or unusual patterns are red flags. External factors like seasonality or campaign changes are considered before jumping to conclusions. If a pattern is concerning, I dig into the data and communicate with the partner to find the root cause.”

A time communication “saved” a partnership

“Yes, a partner was frustrated with underperformance. Rather than focusing on numbers alone, I scheduled a conversation to understand their concerns. Aligning on goals, explaining strategy, and suggesting practical adjustments rebuilt trust and improved results. Proactive, transparent communication can turn challenges into stronger, strategic partnerships.”

Personal motto

“Work smart, communicate clearly, and always aim for long-term results.”

Staying balanced under pressure

“I stay active — at the gym or through consistent movement — and take short breaks from work to reset. Planning my day carefully and focusing on one task at a time helps manage stress. Physical activity and structured focus keep me calm and effective.”

If you weren’t in iGaming

“I’d probably be a seaman. I’m drawn to the sea — the adventure, challenge, and discipline appeal to me. Both paths require focus, navigating uncertainty, and taking responsibility for outcomes.”

Top-3 Blitz: Biggest Red Flags in Leads

-

Unclear traffic sources — ask detailed questions and require transparency.

-

Inconsistent performance — monitor closely and set clear KPIs.

-

Lack of communication — address directly, set expectations, and decide if the partnership is viable.

What affiliates value most in a program

-

Timely and transparent payments

-

Clear communication and support

-

Growth opportunities with competitive offers, incentives, and scalable tools

Essential tools for affiliate managers

-

CRM / affiliate tracking platforms

-

Spreadsheet & analytics tools

-

Communication platforms (email, chat, video calls)

Join N1 Partners

Partners interested in launching, exploring tailored terms, or testing an offer can reach out directly to Shirin.

N1 Partners provides everything affiliates need to stay ahead: high-converting products, ongoing analytics with optimization guidance, and hands-on support from managers focused on long-term performance.

More than just an affiliate program, N1 Partners is a multi-brand platform and direct advertiser, uniting 14+ casino and betting brands, operating across Tier-1 GEOs, delivering Reg2Dep rates up to 70%, and offering competitive deals for top partners — CPA up to €700 and RevShare up to 45%. Trusted by over 14,000 partners, N1 Partners is recognized for transparency, flexibility, and a partner-first approach — where people and communication quality are the foundation of long-term success.

The post N1 Faces: Shirin Mammadov — Building Trust That Drives Performance appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

N1 Faces: Shirin Mammadov — Building Trust That Drives Performance

Growth in affiliate marketing is easy to promise — much harder to sustain. Real long-term results are built on consistency, clear communication, and relationships that can withstand market shifts, changing traffic sources, and rising competition.

In the new episode of N1 Faces, the N1 Partners team introduces Shirin Mammadov, Senior Affiliate Manager — a specialist focused on building structured, trust-based collaboration with partners. In this interview, Shirin shares how he entered the industry, what principles guide his work today, and what it takes to maintain performance and clarity in a high-pressure environment.

Shirin Mammadov

Senior Affiliate Manager, N1 Partners

How did you get into affiliate marketing, and when did you realize this was the field you wanted to grow in?

It started unexpectedly. At the time, I was running our own startup and wasn’t actively looking to move into affiliate marketing. The industry felt fast-paced, competitive, and performance-driven — exactly where I thrive. I’ve always enjoyed communication, negotiations, and building relationships, and affiliate marketing combines all of that. After some time in the role, I realized this wasn’t just a temporary step — it was a field where I could grow and challenge myself long term.

What brought you to N1 Partners, and what was the deciding factor?

Before joining N1 Partners, I was on the affiliate side, and N1 was one of my partners. From the start, the relationship with the team was transparent and professional. I saw their structured processes and strong performance mindset, but also a genuinely friendly atmosphere.

When I decided to move forward in my career, the key factor was trust. I already knew their standards and approach to growth. It wasn’t a risky move — it was a strategic one. I wanted to join a company I respected and where my affiliate-side experience could add real value.

What advice would you give your first-month self as an affiliate manager?

I would tell my first-month self to focus less on trying to prove myself immediately and more on deeply understanding the product, numbers, and traffic quality. Building strong partnerships takes time, and trust is more important than quick deals. I would also remind myself to ask more questions and not be afraid to challenge assumptions. The faster you understand the bigger picture, the faster you grow.

When do you know a partner will become a long-term relationship rather than a one-off deal?

You can usually see it from the very first conversations. If a partner is transparent about their traffic sources, open to feedback, and interested in continuous optimization rather than just the highest CPA, that’s a strong sign. Long-term partners think about strategy, testing, and growth — not just short-term profit. When there is mutual trust and aligned goals, it naturally turns into a sustainable relationship rather than a one-off deal.

How do you separate “normal volatility” from a real problem when you look at performance reports?

I separate normal volatility from a real problem by looking at trends over time rather than reacting to a single day’s numbers. Small fluctuations are normal, but consistent drops, unusual patterns, or deviations from historical performance are red flags. I also consider external factors, like seasonality or campaign changes, before jumping to conclusions. Once a pattern looks concerning, I dig into the data and communicate with the partner to identify the root cause.

Was there a time when the right communication truly “saved” a partnership? What did you do differently?

Yes, there was a situation where a partner was underperforming and frustrated with their results. Instead of focusing on numbers alone, I scheduled a direct conversation to understand their concerns and listen carefully. By aligning on goals, explaining the strategy, and suggesting practical adjustments, we rebuilt trust and improved performance together. It showed me that proactive, transparent communication can turn a challenging situation into a stronger, strategic partnership.

Do you have a personal motto? Sum yourself up in one sentence.

Work smart, communicate clearly, and always aim for long-term results

What helps you stay balanced and clear-headed during high-pressure periods?

I stay balanced by keeping active and making sure I move my body, whether it’s at the gym or just staying consistent with workouts. I also make a point to disconnect from work for short periods, which helps me reset and approach challenges with a clear mind. Planning my day carefully and focusing on one task at a time keeps stress manageable. This combination of physical activity and structured focus helps me stay calm and effective under pressure.

If you weren’t in iGaming …

If I weren’t in iGaming, I think I’d be a seaman. I’ve always been drawn to the sea – the challenge, the adventure, and the discipline it requires really appeal to me. In a way, both paths share the same mindset: staying focused, navigating uncertainty, and taking responsibility for outcomes.

Top-3 Blitz

What are the biggest red flags in leads — and what do you do when you see them?

- Unclear traffic sources — I ask detailed questions and request transparency before moving forward.

2. Inconsistent performance — I monitor closely and set clear KPIs to track improvements.

3. Lack of communication or responsiveness — I address it directly, set expectations, and decide if the partnership is worth continuing.

From an affiliate’s perspective, what matters most in an affiliate program?

1.Timely and transparent payments — affiliates need confidence in accurate, on-time payments.

2.Clear communication and support — being able to get answers, guidance, and updates quickly is essential.

3.Opportunities for growth — competitive offers, performance incentives, and tools that help them scale traffic effectively.

Name the tools you can’t imagine an affiliate manager working without.

- CRM / Affiliate tracking platforms — to monitor performance, track partners, and analyze data accurately.

2. Spreadsheet & analytics tools — for performance analysis, trend spotting, and making data-driven decisions.

3. Communication tools — email, chat, and video calls to maintain strong partner relationships.

Join N1 Partners

Partners who want to discuss a launch, explore tailored terms, or test an offer can reach out to Shirin directly.

N1 Partners provides everything affiliates need to stay ahead: high-converting products, ongoing analytics with optimization recommendations, and hands-on support from managers focused on long-term performance.

N1 Partners is more than an affiliate program. As a multi-brand affiliate platform and direct advertiser, the company unites 14+ casino and betting brands, operates across Tier-1 GEOs, delivers Reg2Dep rates of up to 70%, and offers competitive deals for top partners — CPA up to €700 and RevShare up to 45%. Trusted by 14,000+ partners, N1 Partners is recognized for its transparency, flexibility, and partner-first approach — where people and communication quality remain the foundation of long-term success.

The post N1 Faces: Shirin Mammadov — Building Trust That Drives Performance appeared first on Americas iGaming & Sports Betting News.

-

iGaming6 days ago

iGaming6 days agoPRAGMATIC PLAY UNEARTHS PROGRESSIVE MULTIPLIERS IN ROLLING IN TREASURES

-

Comatel5 days ago

Comatel5 days agoCOMATEL CELEBRARÁ UNA FIESTA PARA CIENTOS DE OPERADORES TRAS FINALIZAR EL PRIMER DÍA DE LA FERIA ESPAÑOLA, INTERAZAR

-

Booming Games6 days ago

Booming Games6 days agoBooming Games Introduces Instastrike, the Latest Diamond Hits Trio

-

ELA Games6 days ago

ELA Games6 days agoELA Games Powers the Reels with Retro-Electric Slot “Rapid Wild”

-

Africa6 days ago

Africa6 days agoGaming Realms Makes South African Debut in Partnership with Hollywoodbets

-

Alex Green Vice President Games at ZEAL6 days ago

Alex Green Vice President Games at ZEAL6 days agoWunderino Adds ZEAL’s Premium Slots as Partnership Kicks Off

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoNew collect modifiers and dual bonus offering star in Blueprint Gaming’s King Kong™ Splash

-

Brasil6 days ago

Brasil6 days agoBrasil evita choque fiscal y apuestas entran en fase reputacional en LATAM