Conferences in Europe

Prague Gaming & TECH Summit 2023: Charting the growth of Esports in CEE

Ahead of our sold-out Prague Gaming & TECH Summit 2023 next week, we sat down with some of the brightest minds in Europe to talk all things Esports and its potential for the CEE region.

In one of our most insightful interviews this year, we brought together Peter Rippel Szabo (PRS), Associate at Bird & Bird, Amir Mirazee (AM), Managing Director and COO at Bayes Esports, as well as Dimitris Panageas (DP), Group General Counsel at Kaizen Gaming to get the latest on Esports’ growth.

Covering everything from Ukraine, localised regulation, market demographics, state licensing and taking on traditional sportsbook spend, this one’s not to be missed!

To kick things off, let’s talk about the demand for Esports in CEE – how much does the region stand out in terms of growth potential vs the likes of Scandinavia and Western Europe?

AM: It’s a unique environment and of course being Bayes, we can gauge that from a good standpoint with over 100 betting clients globally and 200 in our extended network. On the CEE side, our major partners are GG.bet, DATA.BET and BETER, and we’re seeing considerable volume. This is particularly the case for Counter Strike – and players love new titles.

The one issue we have right now is the changing political dynamics. While Ukraine and Russia used to offer great Esports teams, as well as serving an anchor for satellite nations around them (Poland, Baltics etc), this equilibrium has of course been shifted, and it now needs to settle at a new one. This is especially the case for Ukraine, which really was the epicentre in the CEE region for Esports. Added to that is Russia of course now being shut out of the market, with operations now needing to be re-established to find a new hub to anchor the vertical’s development. In my view – the Czech Republic will likely be a key component.

PRS: From my base in Hungary, I can certainly say that across CEE organised tournaments are very strong – with growth proving very organic, and indeed, spontaneous. There’s not yet big money in most of the tournaments’ prize pools, but they are certainly crammed with amateur players who are very ‘plugged-in’ online and have a real passion for Esports. This goes for both the relevant products and enjoyment of that entertainment. Also, it is worth mentioning that in Hungary more established clubs with strong foundations across various sports have engaged with Esports (e.g. through establishing dedicated esports departments and training players professionally). Universities and other non-profit organisations have also started to study thoroughly the various physical, psychological and other aspects of Esports.

From a legal perspective what is needed for growth is a clear regulatory environment (dealing with the status of esports, i.e. whether it is a ‘normal’ sport, whether it has a special status, or something in between, as well as covering issues like requirements for tournament organisation, player safeguarding and integrity). This would also help alleviate some aspects negatively perceived by the general public (like lack of exercise, addiction or abuse). Of course, talking about Scandinavia and Western Europe – the one variable in comparison with CEE is consumer spend and the resulting market size which will likely never reach the same level in the East.

DP: For myself, and indeed given our extensive experience at Kaizen, I would say the demand is there to see. It’s not a new way of betting, but rather a new type of possible future verticals, and a set of betting markets to enjoy. As it’s still in the emerging stage, I would say it’s not yet considered a fully established ‘traditional’ vertical like sportsbook, lottery, live casino and others.

Looking at demographics, they are without a doubt smaller than more established verticals, which we need to distil into sub-segments to better understand on a micro level. Factoring in how fast the CEE market is changing, especially with the likes of Hungary (which was until recently a state monopoly), I would definitely say that we have every potential for Esports to really take off in the next 5-10 years.

On a macro level, the major growth blocker that needs to be overcome is that of regulation. Esports needs to be properly and specifically regulated as both a sport and from a betting perspective – this is essential in order to enable it to become a fully established vertical in its own right. So, in summary, it’s emerging fast and gaining traction, but still a long way to go.

What do you see as the key driver for demand for Esports betting in CEE? From a regulatory perspective, do you see CEE jurisdictions as being more open to Esports betting?

AM: Agreeing with Peter in his first answer, I would certainly say it’s a unique generation in CEE and that’s certainly why Esports has grown so much here. Online gaming, and indeed video gaming, has created the generation we’re seeing now, as well providing them with a connection to the rest of Europe and the wider world. Without a doubt, we can say that the ‘internet generation’ in their 20s and 30s have very much been shaped by that culture, whether that’s Call of Duty, memes, and everything else. On the regulation front, again, I agree also – it needs to be regulated as a sport. Germany, for example, does not even acknowledge Esports as a sport, which as a consequence, means it can’t even be bet on yet. That needs to change.

PRS: It’s a complex question but with plenty of potential in CEE. Gambling, betting and generally games of chance have similar basic legal concepts when it comes to regulation across Europe (national regulatory frameworks may differ of course), therefore, CEE jurisdictions can be as open to Esports betting as other countries. I think the key driver is simply how much Esports will gain in popularity in the future, for the more popular certain Esports titles will be the more will the demand be for Esports betting. Also, I think if Esports would be recognised explicitly as a sport and/or it would be a regulated activity in a CEE jurisdiction, then I believe it would likely facilitate the demand for Esports betting in that jurisdiction.

DP: Indeed. The key factor that you need to drive demand (let’s say from a sample set of the 10 major CEE countries), is that they do not yet specifically regulate Esports. Hungary, as Peter has mentioned, is becoming part of that change, so we’re seeing the opportunity for it to become a conducive environment for development. In my view, the regulatory framework for most of CEE is still vague; and as long as it’s principally viewed as a betting market rather than a sporting discipline in its own right, it will stay as that.

Taking the wider perspective, any law and/or regulation will take a minimum of 6-12 months to be adopted and following that – you’ll then need extensive marketing and commercial communication expenses to then push Esports into the mainstream. Without a doubt, however, looking at CEE demographics, the unique composition of their audiences holds plenty of potential. What makes it special is that while it is niche as a sport/product, it’s not the same as niche traditional sports, such as handball in Germany.

Rather, you have a fast-growing product that can easily enter the mainstream as it transcends borders and can offer penetration principally via social media, where it is already very popular. I am sure that with the proper marketing and investment, Esports will create a snowball effect that will allow it to become a mainstream vertical by itself soon enough.

When it comes to being a complementary product to traditional sportsbook spend, how is Esports fitting into the mix and is it cannibalising from traditional sportsbook?

PRS: I’d say that Esports and traditional sportsbook can, and do, complement each other, especially if popular traditional sports (like football or basketball) are played via video games (FIFA or NBA2K) in organised Esports competitions which traditional sports fans can easily perceive and understand.

So, even if audiences are of course very different, you’ll see crossovers when it comes to interests. Using Hungary as an example, the state-owned betting & lottery operator (Szerencsejáték Zrt.) launched betting on esports competitions in 2020 due to the lack of traditional live sports events resulting from the Covid-19 pandemic. It has quickly become one of its most popular betting offerings.

An interesting point too is the ability to convert players to new verticals, and as a result, increase engagement and incremental spend. For example, you’ll have a millennial customer use football as a platform for introduction, and then while waiting for the match to play out for 90 minutes (or indeed after the final whistle), he / she will then give Efootball or another Esports activity a try – which is a great way of introducing the product.

AM: From my perspective, if we’re talking about FIFA and other Esports, these worked superbly well during COVID as a substitute product for those looking to replicate the missing sporting schedule, with nothing happening aside from (as I recall), the Belarusian Premier League. With the likes of League of Legends and Counter Strike, you have a very different demographic / audience – and you’ll find them in different places rather than traditional sportsbook.

As a result, I believe you need to look at providing something different to attract players. Take a look at Bet365’s Esports offering for example, it works surprisingly well for a UX that has evidently been derived from traditional sports. However, there’s much more room for improvement in the coming years. It’s easy to see the use-case for this, looking at all sports betting viewership right now, everything’s declining aside from Esports, so it’s an opportunity to be capitalised on.

We’re also seeing demographics change rapidly, while Esports was previously only for the 20-25 age group, it’s now becoming much older, so you’re closing that monetisation gap. If you want to capture the interest of this fast-growing demographic, you need to reformat the UX to cater to that. So yes, without a doubt, Esports is now becoming a product that can drive traffic in its own right through new audiences, without cannibalising spend from traditional sportsbook.

DP: For me, it depends on the definition of where cannibalisation starts from. When new products are introduced, they certainly drive interest and add to engagement, but in theory that will also bring a decline in engagement for traditional alternatives as overall sportsbook spend is going to be finite.

The positive that Esports brings however, is that it can complement well, given it has a very different schedule to traditional sportsbook. Tournaments taking place across the globe (for example in Asia) are during the evening , meaning it’s during the day in Europe – enabling Esports to boost sportsbook spend both before and the day after evening football matches such as the Champions League mid-week.

Taking the longer view, there is a greater risk of cannibalisation if we see more European Esports tournaments taking place during the evening (at the same time as major football matches), which will likely happen in the next 5-10 years. This will create a tipping point where it becomes more popular to bet on than evening football matches.

Looking at the delayed Euro 2020 held last year, can operators use the standout success of Efootball during the tournament as a reason to engage more players during the weekend’s sport fixtures?

DP: I believe Esports will always hold plenty of potential as a complementary product during major events such as the Euros, where we see heightened betting activity and greater overall spend. However, the challenge is always going to be taking this into the mainstream and having it considered as a regular fixture week in, week out. In my view, it is very possible that this could translate well into a complementary product that fills the gaps between sporting fixtures, especially for those who like to be pre-match and not in play. Given a football match lasts 90 minutes, you have plenty of space to fill over the 90 minutes after pre-match bets are placed. If you can identify and incentivise that opportunity, then I believe there is huge potential in the long term.

AM: Also, as we’ve covered already – the audience you have for Efootball- is completely different to Counter Strike, League of Legends and the like, so in effect we’re only talking about 50% of the potential Esports audience.

Let’s take Europe as a market to speak on a macro level and place Efootball in isolation. Regulation for a start is going to be key, making sure that product is available and acceptable. That’s something in particular we’d need to see in Germany with the Bundesliga, as Esports is not yet regulated to be a betting market. Looking further west towards the UK, there’s far less of an overlap, due to player preferences and composition of audience. However, if we return to the CEE, then yes, without a doubt I see plenty of potential here for operators to really test this out as it’s something the new generation of players are very receptive to.

PRS: To add to that, I would certainly say in many ways we’re looking at an area of spend (and indeed audience) that are traditionalists when it comes to football. However, if we look at the new generation and their social circles and familiarity with the online environment, they are shaped by a very different world than what older generations had for football growing up as a primary source of entertainment.

So, without a doubt, we’ll see a very different trend towards the Esports landscape over the next decade. Whether that’s for Esports as a complementary product or one in its own right, I believe it will be inevitable that it becomes an area of engagement with traditional sports fixture in the decade to come. This is especially the case if Esports will be regulated clearly, as well as Esports tournaments being organised regularly, enabling online gaming operators to follow that lead and invest in technology and commercial communication dedicated to Esports.

Last but not least, looking at the big picture – what’s your take on how Esports is going to develop in CEE over the next five years, how much more do you see it gaining popularity?

DP: I believe it is going to develop, and it will no doubt gain traction. But in my view, it won’t take off immediately. The next few years will likely see Esports continue as a complementary product that will enable operators to diversify and upgrade their offerings. The new generation coming online will power this, and with an extensive spectrum of events around the globe, and the 24-7 betting that it brings, it can scale fast.

However, for that to happen, we also need to see more investment in the vertical for it to become more established. For a start, we need more advanced trading models that can enable operators to offer a much broader spectrum of Esports betting markets to attract more players. We’re already seeing that happen in real-time, and even in the last three years, there’s been a real surge in terms of managed trading services for Esports and the provision of data. As we’re seeing truly specialised companies for this provision begin to corner the market, growth will inevitably become even more exponential, with a ‘hockey stick’ style adoption curve.

AM: I agree. There’s plenty of potential. We can certainly say that outside of the present conflict taking place between Russia and Ukraine, there’s a stable trend towards growth, aside from the recent Parimatch / Ukraine news this week. I’m confident it’s only going to keep growing for all the reasons we’ve covered above.

All of this is fuelled by the unique audiences of the region, and indeed their demand for entertainment. If we compare the potential of Western vs. Eastern Europe, then without a doubt, I believe that CEE is the most likely to emerge as the continent’s major player. Given our position on the market as one of the world’s leading Esports providers, I believe that Esports is exactly what you make of it – and if you take a proactive view and approach, the market share is there for the taking.

PRS: I concur with Amir and Dimitris, I believe it’s only going to grow – all the foundations are there in CEE to make that happen; demographics, interest, increasing awareness of relevant brand values and an established understanding of the mechanics. In the short-term, I don’t believe we’ll see major displacement of the most popular traditional sports or radical shifts in market trends. Longer term, we’ll to see much greater adoption that will no doubt scale over as exponential growth really begins to emerge.

Powered by WPeMatico

Conferences in Europe

HIPTHER’s European Gaming Congress 2025 Marks Record Attendance and Announces Marek Plota as Ambassador of the HIPTHER Warsaw Summit

Reading Time: 3 minutes

The 2025 edition of the European Gaming Congress (EGC) closed its doors in Warsaw with record-breaking attendance, a strengthened industry footprint, and an announcement that marks a new chapter for HIPTHER’s European expansion: in 2026, EGC officially evolves into the HIPTHER Warsaw Summit with renowned legal expert Marek Plota appointed as its first Ambassador.

Held across two content-rich stages – the Compliance & Operations Lad and the TechXperience Stage – alongside the hands-on HIPTHER Academy Workshops, EGC 2025 delivered its most ambitious program to date. Attendance has now tripled compared to its reintroduction in 2023, establishing Warsaw as one of the most dynamic conversation hubs for gaming, compliance, and tech in Europe.

A European Outlook With Global Relevance

The Compliance & Operations Lab brought together regulators, lawyers, and industry specialists for a panoramic review of the evolving European ecosystem. Discussions spanned the Polish market’s legal framework, cross-border compliance from Paris to Berlin, key CEE territories, the Czech Republic and Romania, and an outlook on emerging priorities in the Baltics. Experts also explored global trends with a timely update on several LATAM jurisdictions.

A highlight of the Agenda was the IMGL Masterclass – “Regulators, Legislators, and the Power of One Voice: A Legal Strategy for Industry Unity” – which explored the future of collaborative governance and harmonization.

Fintech, taxation, licensing, and responsible gaming standards added essential layers to a program designed to help operators and suppliers navigate an increasingly interconnected regulatory landscape.

Tech, Innovation, and the Human Factor

On the TechXperience Stage, conversations shifted to the future:

– AI for competitive advantage

– The evolution of esports and startup innovation

– AEO & SEO trends redefining discoverability

– Personalization and the new player journey

– Cyber resilience in iGaming

– Strategic Event Preparation in B2B PR, Marketing & BizDev

These sessions brought together marketing leaders, technologists, founders, and innovators across iGaming, fintech, digital entertainment, and cybersecurity, underlining Warsaw’s emerging status as a cross-industry meeting point in Europe.

A Key Voice: Marek Plota’s Impactful Participation

Throughout the Congress, Marek Plota – Founding Attorney at RM Legal & Gaming in Poland – played a leading role as both moderator and speaker. His contributions spanned Poland’s gambling framework, European lessons for CEE markets, and strategic taxation and licensing standards. He also brought legal depth to the IMGL Masterclass, adding critical clarity to one of the most pressing topics for operators in the region.

Marek’s widely respected presence across national and international gaming markets, combined with his years-long collaboration with HIPTHER as panelist, moderator, sponsor, and advisor, made this year’s Congress a natural moment to formalize the partnership.

Introducing the Ambassador of the HIPTHER Warsaw Summit

HIPTHER is proud to announce Marek Plota as the Ambassador of the HIPTHER Warsaw Summit, beginning with the 2026 edition.

In his own words: “It’s a real honor to serve as an ambassador for the Hipther Warsaw Summit and the European Gaming Congress. My collaboration with Zoltan Tundik and the Hipther team goes back many years as a panelist, moderator, sponsor, and above all, as a friend. These events are truly unique in the global gaming and gambling conference calendar — intimate, insightful, and refreshingly personal. Unlike the vast expos, Hipther events give people a genuine chance to meet, talk, and exchange ideas without walking 50,000 steps from one meeting to another. We are already looking forward to the next editions and to working together to make these conferences a true must-have for everyone in the industry.”

Marek is a founder and a head of the legal team at RM Legal Law Firm and Gaming In Poland, jointly providing multidisciplinary and multijurisdictional support for leading international gambling operators in the Polish, European Union, and African markets. His gambling practice includes regulatory support at the pre and post-licensing stage, IT, and taxation services, as well as the unique service of performing a function of a gambling representative. RM Legal is the only law firm in Poland representing offshore companies operating legally in the Polish gambling market. Apart from gambling Marek specializes in corporate commercial law and international investment projects.

A New Era for Warsaw, Europe, and the Global Market

The transition from EGC to the HIPTHER Warsaw Summit marks a strategic evolution with HIPTHER enhancing the region’s growing importance: Poland now stands as a crossroads of regulatory influence, iGaming innovation, and international market expansion – connecting Western Europe, CEE, and fast-emerging global markets, from Africa to LATAM.

In 2026, the HIPTHER Warsaw Summit will continue shaping the conversations and connections that define the future of gaming and tech.

HIPTHER looks forward to welcoming the industry back to Warsaw next year for an even bigger, more influential, and more globally connected event – assisted by the expertise and vision of its new Ambassador.

The post HIPTHER’s European Gaming Congress 2025 Marks Record Attendance and Announces Marek Plota as Ambassador of the HIPTHER Warsaw Summit appeared first on European Gaming Industry News.

ADMIRAL Pay

NOVOMATIC Italia Showcases Innovation and Responsible Growth at SiGMA 2025

Reading Time: 3 minutes

NOVOMATIC Italia played a key role at SiGMA Central Europe 2025, one of the leading international events for the gaming and digital technology industry, which was held in Rome from November 4 to 6. The Group showcased ADMIRAL Pay, the payment institution authorised by the Bank of Italy, and Quigioco, its online gaming brand, presenting an integrated and sustainable vision for the future of payments and digital entertainment.

The synergy between the Quigioco gaming platform and ADMIRAL Pay was at the heart of NOVOMATIC Italia’s presence at SiGMA Central Europe 2025 was. This integrated solution offers legal gaming operators a concrete response to the ongoing transformation of the market, particularly in terms of regulatory compliance.

The combined structure of Quigioco and ADMIRAL Pay ensures fully compliant financial flow management by providing operators with technologically advanced tools that are aligned with the latest Italian legislative requirements. This infrastructure represents an integrated payment system and a complete digital ecosystem that is designed to support operators in an increasingly regulated and competitive market. The model is complemented by B2C solutions, including APay E-Wallet and APay Card, which interface seamlessly with the B2B architecture to expand additional growth opportunities.

Driving the market with technology and security

The collaboration between ADMIRAL Pay and Quigioco marks a key milestone for the Italian market: by adopting integrated digital payment systems, online gaming platforms can now deliver increasingly personalized and secure experiences to their users.

ADMIRAL Pay technology enables rapid conversion between cash and digital currency, ensuring instant and secure transactions that meet the highest international standards. For PVRs (Punti Vendita Ricarica: venues authorised to sell recharges for online gaming) and operators, this means access to an advanced payment tool that simplifies operations and guarantees efficiency, even during peak periods.

Meeting new regulatory and market demands

The digital payments and gaming sector in Italy is now subject to increasingly stringent regulatory standards that are designed to ensure maximum security, traceability and transparency. The integration of Quigioco and ADMIRAL Pay fully meets these requirements, offering a unique solution that strengthens compliance while enhancing the customer experience. By managing financial flows in a compliant manner, operators can reduce risks and provide players with immediate and secure access to their funds. This model translates into trust and long-term loyalty, creating value across the entire supply chain.

Responsibility and leadership: the pillars of the future

SiGMA Central Europe 2025 was also an opportunity to highlight NOVOMATIC’s commitment to promoting responsible gaming and continuous product innovation. The target is to maintain industry leadership by investing in technologies that not only enhance the user experience but also ensure maximum player protection and operator transparency.

“Our goal is to extend the success and expertise that have always defined NOVOMATIC Italia in the land-based sector into the digital world. We want to offer operators and players an integrated ecosystem that combines technology, security, and innovation, reaffirming our Group’s leadership in online gaming,” said Markus Buechele, CEO of NOVOMATIC Italia.

This strategic vision was recognized when NOVOMATIC Italia received the “B2B Industry Leader Italy 2025” award at the SiGMA B2B Awards, in honour of the company’s excellence and ongoing commitment to an innovative, responsible and sustainable approach to development. The Group is not only addressing evolving market and regulatory challenges but also paving the way for a future in which innovation and sustainability move forward together.

Through ADMIRAL Pay, Quigioco and the major innovations showcased at SiGMA, NOVOMATIC Italia demonstrates how the convergence of digital payments and online gaming can drive growth, security, and long-term sustainability across the industry. By being built on innovation, responsibility and strategic vision, this model is positioning the company at the forefront of a tech-driven and sustainable future.

The post NOVOMATIC Italia Showcases Innovation and Responsible Growth at SiGMA 2025 appeared first on European Gaming Industry News.

2026 iGaming Trends Report

Presenting Industry Trends and Celebrating 100 Brands: SOFTSWISS Shines at SiGMA Central Europe

Reading Time: 2 minutes

SOFTSWISS, a global tech leader in iGaming solutions, has wrapped up a remarkable showcase at SiGMA Central Europe 2025. From the launch of the 2026 iGaming Trends Report to the live-built Alfa Romeo 4C handover, the company once again demonstrated why it stands as the industry’s leading technology provider and creative pioneer.

One of the main highlights of the event was the official release of the 2026 iGaming Trends Report. The fourth edition offers a data-driven overview of the macro- and microtrends shaping the future of iGaming – from the industrialisation of AI to regulatory shifts, cybersecurity evolution, and the rise of brand trust.

To mark the launch, SOFTSWISS hosted the 2026 iGaming Trends Marathon, a four-hour live event featuring global thought leaders. In the opening panel discussion, Ivan Montik, Founder of SOFTSWISS, Heathcliff Farrugia, COO of SiGMA, and Pierre Lindh, CEO of NEXT.io, arranged the ‘Ultimate Forecast Duel,’ exploring which trends will define the industry’s next chapter.

Another key moment was the Alfa Romeo 4C gifting, organised to celebrate the launch of the 100th brand powered by SOFTSWISS software in 2025. The sports car, assembled live during the expo at the SOFTSWISS stand, became a symbol of the company’s engineering precision and team spirit.

During a special ceremony, Ivan Montik handed over the keys to one of SOFTSWISS’ valued partners, Lottu, represented by Hugo Baungartner, Chief Business Officer, marking another milestone in a long-standing partnership based on trust and shared success.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Casino Platform, the Game Aggregator with over 36,700 casino games, Affilka Affiliate Platform, the Sportsbook Software and the Jackpot Aggregator. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

The post Presenting Industry Trends and Celebrating 100 Brands: SOFTSWISS Shines at SiGMA Central Europe appeared first on European Gaming Industry News.

-

Latest News4 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global4 days ago

Games Global4 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Compliance Updates6 days ago

Compliance Updates6 days agoDabble introduces GeoComply’s digital identity platform, achieving 90%+ KYC pass rates and gaining deeper fraud visibility through device and location intelligence

-

Amusnet4 days ago

Amusnet4 days agoWeek 4/2026 slot games releases

-

Asia6 days ago

Asia6 days agoInsurgence Gaming Company Expands Grassroots Vision with MOBA Legends 5v5 Discord Play-Ins

-

Africa6 days ago

Africa6 days agoSun International Appoints Nomzamo Radebe as COO

-

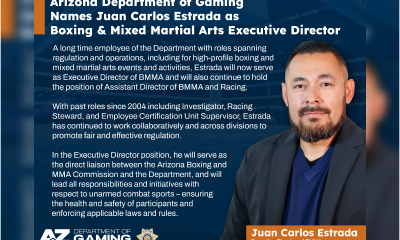

ADG5 days ago

ADG5 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt5 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt5 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat