Interviews

Q&A with Lana Meisak, VP, Business Development and Marketing, Gismart

Give us a quick overview of your entrance into the games industry and what made you decide to join it?

Before entering the gaming space, Gismart had earned a name as a top music entertainment app developer for an array of popular gamified music products such as Beat Maker Go, Piano Crush and many others. Looking for ways to grow and diversify our company portfolio, in 2019, we decided to add another business vertical and established an internal studio called Flime by Gismart. We dived deep into the development and publishing of mobile lightweight games, focusing on trendy hyper-casual genres and instant games for social platforms. The hyper-casual market was on the rise, not that saturated yet, so we saw it as a good opportunity to utilize our expertise in hypothesis testing which is crucial for this genre. Besides, we appreciated the simplicity of its mechanics and relevantly quick production so we had more room for trial and error. Within two years, we released a couple of dozen games for mobile and social platforms with many of them reaching the top gaming charts (ex. Cool Goal!, Body Race, Foil Turning 3D, etc.) and generating over 450 million downloads overall. Working in the hyper-casual market, the team built effective processes in a very short time, as well as tested a large number of hypotheses. In 2021 we made our next step moving towards the casual genre and decided to explore puzzle games. It is a busy and challenging market with some strong competition. However, we have had success with our first game Cross Logic and are now actively working on new titles. We consider puzzle games to be a better investment in the long run. We also recently established a new business related to blockchain gaming projects and NFTs.

What does your role as VP of Business Development and Marketing at Gismart entail?

I focus on sourcing, negotiating and executing strategic partnerships across Gismart business verticals mainly related to product branding and marketing. I also build and develop long term and quality relationships and lead communications at Gismart. My role includes mobile product marketing and monetization, app distribution partner management (Apple App Store, Google Play, Facebook Instant Games, Snap Gaming, TikTok Gaming), product branding, PR and HR branding. Some of my proudest milestones include nurturing flagship partnerships between Gismart and household name entertainment brands such as UMPG, Sony/ATV and Warner Chappell, as well as the collaboration between The Chainsmokers and Gismart’s hit Beat Maker Go music app.

Women remain largely underrepresented in the global games industry. How does Gismart approach this, and what advice would you give to women who want to work in the industry?

It is an issue especially if we talk about senior ranks of companies. I am glad that this subject is constantly raised in the media as it helps the change to happen faster. I believe there are two things to fight – stereotypes and company practices. However, speaking of the Gismart gender ratio it is very balanced. The ratio between males and females is 1:1.

Gismart is perhaps best known as a publisher of mobile games. What’s the recipe for a hit mobile game in 2022?

I can’t give a recipe but I can say how we approach building high-potential products at Gismart. We have an expert R&D team to explore global trends and conduct in-depth marketing research. Understanding the niche to find a gap for something fresh and exciting for users is an important task. After making sure that the game concept is relevant, we move on to creating a basic game prototype and perform a market test to understand the metrics. There are three key factors that most likely indicate that a game has a high potential – low CPI, high LTV and product scalability. The data-driven approach is what we stand by. Gismart has several analytical tools for in-depth market research, quick idea tests, and advanced product analytics that help us make a final decision.

How did Apple’s changes to marketing on iOS in 2021 affect Gismart?

Similarly to the rest of the market, we have been affected by the changes related to IDFA. This has significantly affected the traffic buying on iOS, and it has certainly become more difficult to evaluate the effectiveness of advertising campaigns. It also made it harder and more expensive to run product tests on Facebook. On the positive side, these changes forced us to delve into other purchasing channels, and change and improve approaches to testing new product ideas. We also definitely go for more technological experiments on the marketing side related to user acquisition through web traffic.

Many of your games are available on social media sites such as Snap and Facebook. Why do social networking apps want gaming content in general?

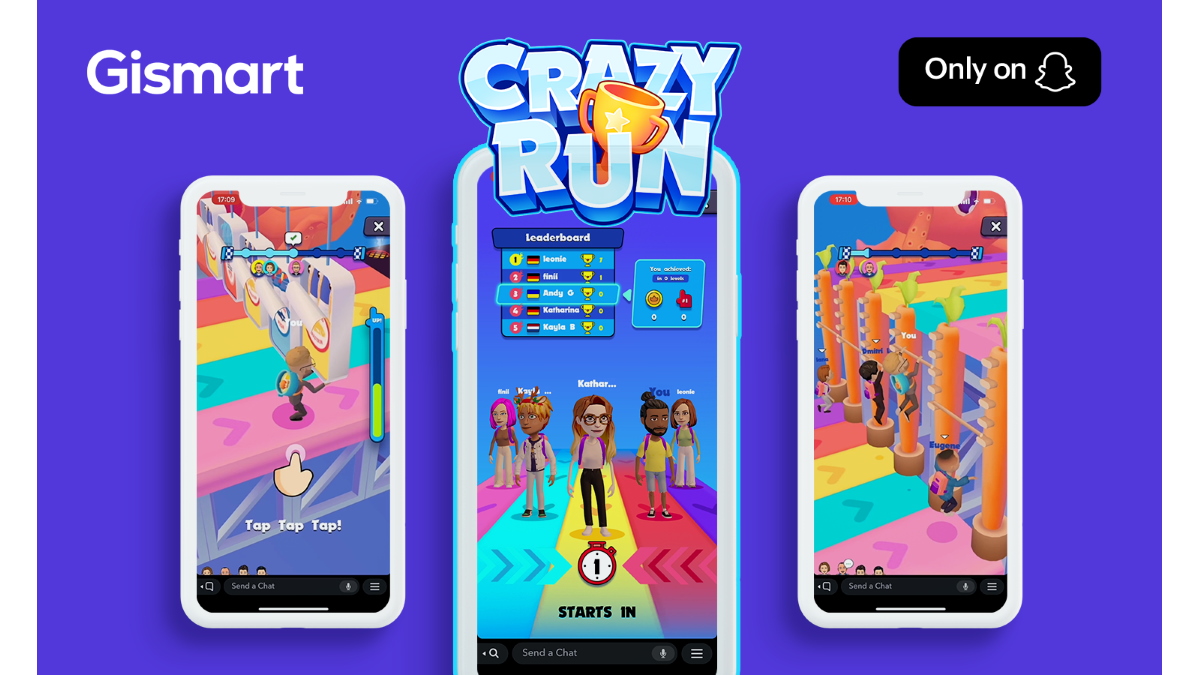

Social platforms have an undeniably huge audience and games are a new form of communication. We saw an opportunity for growth in this business and some of our team members who are now leading Flime by Gismart had the experience of building one of the first games for Facebook. Today we have over ten social platform games available on Facebook and Snapchat. Color Galaxy on Snap Games became one of the most successful games on the platform quickly after its launch and after two years still holding its position.

In general, social platforms see games as one of the instruments to entertain and retain the audience, increasing the time they spend on the platform. Besides retention, having quality games provides the platform with other benefits, such as improved user experience, new forms of communication and interaction between users, and, of course, additional monetization for social platforms.

Gismart also makes and publishes wider entertainment apps such as music and wellness. Why did the company decide to diversify its focus from mobile games?

We started with entertainment music apps. Alex, one of the company founders’ is a self-taught guitar player and the first Gismart app was a guitar app. After the successful launch of the first product, our portfolio of music entertainment apps has grown to over 15 different apps over time. Then came our expansion to games. Wellness, as well as the pet care vertical with flagship product Woofz, was established about a year ago. Both businesses are relatively new but already established their name on the market and have a substantial number of users. All of the verticals operate as independent businesses and Gismart provides them with consulting and mentorship, all kinds of resources and tools and infrastructure. So in a way, today Gismart operates as some sort of business incubator with some of the verticals having already outgrown the startup stage.

Last question – what can we expect to see from Gismart and from yourself during the remainder of 2022?

Gismart has very exciting and challenging plans across all verticals. Speaking of casual games, we’ll continue expanding our portfolio of HTML5 games on Facebook Instant and Snap Games. We also plan to introduce our mini-games on new major social platforms. Also, we plan to soft-launch our new blockchain project.

Speaking of apps, we will continue to upgrade and develop our products in music entertainment. We are working on expanding our music partners’ circle to bring more unique, fresh music to the table. As for wellness and pet care verticals – the focus is on product and working on features to enrich the user experience and facilitate product growth. We hope to see a few new products earning their spot on the top chart.

Powered by WPeMatico

AI

Why operators are choosing to buy in their AI strategy

In an industry where margins are thin and player loyalty is fleeting, customer experience has become a key differentiator for operators. As AI becomes a core operational requirement, leadership teams face a clear choice: build proprietary technology in house, or partner with purpose built AI CX providers.

Alex Gould, CTO at Conduet, explains why more operators are choosing the latter.

What industry-specific CX challenges can an exterior solution address ‘out of the box’ compared to a generic build?

Generic AI struggles in sports betting and iGaming because player inquiries are shaped by complex, domain-specific rules and edge cases. Questions about settlements, promotions, withdrawals, or cash outs are rarely straightforward. They depend on wager structure, timing, eligibility criteria, and operator-specific logic.

Over 80% of player inquiries require pulling live, account-specific information from the PAM and applying it correctly within that broader rule set. Without purpose-built logic to interpret both the data and the edge cases around it, responses quickly become incomplete or incorrect.

This limitation is reflected more broadly in enterprise AI adoption. Research from MIT found that 95% of enterprise AI initiatives fail to deliver measurable business impact, often because broadly trained models are pushed into live environments without the domain context needed to handle real-world variability. What appears to work in controlled testing breaks down once exposed to operational complexity.

Purpose-built platforms are designed around this reality. By training on gaming-specific data, workflows, and failure modes, they can interpret live PAM data in context and handle both common and complex inquiries accurately from day one, without relying on extensive rules, manual escalation, or post-deployment patchwork.

How would you characterise the current skills gap within operator teams regarding AI implementation?

Operator CX teams are closest to the customer and understand where friction exists. The challenge is not identifying opportunities, but delivering AI that performs reliably in production. Turning insight into production-ready capability requires technical depth, dedicated ownership, and sustained iteration that sit outside the remit of most CX organisations.

Deploying AI in gaming requires expertise across model evaluation, conversation design, failure handling, and real-time interaction with PAMs and ticketing systems. It also requires ongoing investment to monitor performance, manage edge cases, and improve outcomes as volumes and player behaviour change. CX teams are structured to run day-to-day operations, which makes sustaining this work in parallel difficult.

As a result, many internal AI CX efforts stall or remain narrow in scope, not because the opportunity is unclear, but because the execution burden is too high.

What is the average time to market using a specialist platform, versus a full in-house build?

In-house AI efforts typically take 18 to 36 months to reach enterprise-ready scale. The delay is driven by the need to coordinate across CX, product, data, and engineering while establishing new ownership and operating models inside live CX environments.

A specialist platform compresses this timeline materially. With gameLM, operators can move from concept to live inbound CX in six to 12 weeks. Operators achieve 60%+ resolution within 90 days, scaling toward 80%+ shortly thereafter.

Why does a purpose built partnership model matter in iGaming & OSB CX?

In iGaming and online sports betting, the challenge is not adopting AI, but making it work reliably at scale. Generic platforms often shift the burden onto operators after deployment, requiring significant time and internal effort to adapt the technology to gaming-specific realities. That effort compounds as complexity grows.

A purpose built partnership model changes that dynamic. Instead of operators spending months closing gaps, AI is deployed using operating patterns already proven in live gaming CX. Common failure modes, escalation paths, and performance tradeoffs are understood upfront, reducing the need for downstream rework and ongoing firefighting.

Conduet applies this approach through gameLM, informed by operating a 500+ agent gaming CX organisation. That operating knowledge functions as an embedded R&D capability, shaping how the platform is tuned, prioritised, and extended alongside each operator’s environment. Inbound CX performance today directly informs the development of additional, gaming-specific capabilities such as reactivation, payments optimisation, and fraud prevention.

The result is a partnership model that delivers strong outcomes without transferring the hidden cost of adaptation and maintenance back to the operator, allowing CX capability to keep pace as the industry evolves.

Alex Gould is the CTO at Conduet, where he leverages his technical and strategic background to guide technology strategy and innovation. He is also the Founder and CTO of Everyday AI and previously founded computer vision company ViewX. Alex’s earlier experience includes roles at Primary Venture Partners and Bain & Company, and he holds an MBA from Columbia Business School and a Bachelor of Engineering (Hons) from the University of Canterbury.

The post Why operators are choosing to buy in their AI strategy appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Interviews

Inside the Kongebonus Awards: What Norway’s Players Are Telling the iGaming Industry

As the only iGaming awards originating from Norway, the Kongebonus Awards are decided entirely by open player voting, offering a rare, unfiltered view into what truly resonates with a dedicated gaming community. Kongebonus Editor-in-Chief, David Nilsen, explains how this year’s results reflect shifting player expectations, highlight both emerging and established studios, and contribute to wider industry conversations around quality, innovation and long-term engagement.

The Kongebonus Awards are now in their fourth year. How have you seen them evolve since the first edition?

Since the first edition, the Kongebonus Awards have grown both in reach and in significance. What started as a way to highlight standout games for our Norwegian audience has developed into a recognised annual moment where player sentiment is clearly reflected back to the industry. Each year we see greater engagement from the community and more awareness among studios and suppliers about what the awards represent. The structure has also matured, with categories that better capture the diversity of modern game development. Most importantly, the awards have become a consistent reference point for which games and providers have truly connected with players over the past year, giving the results increasing weight within the wider iGaming conversation.

This year’s awards were presented in connection with ICE Barcelona. How important is it to connect a Norwegian, player-driven initiative with the wider international industry?

Connecting the awards to an international event like ICE Barcelona helps bring local player insight into the global industry spotlight. While the voting comes from Norwegian players, the studios and games involved operate across many markets. Presenting the results in that setting underlines that player preferences in Norway are part of wider trends in iGaming. It also allows international stakeholders to see how a Nordic audience responds to different styles of games, mechanics and themes. That perspective can be valuable for product planning and market strategy.

This year’s winners were decided through open public voting. Why is it important that the results reflect the voice of players so directly?

Having the winners decided through open public voting ensures the results are grounded in real player experience. The recognition comes directly from the people who have spent time with the games, formed opinions and chosen their favourites. That gives the awards a strong sense of authenticity. It moves the focus away from internal industry perspectives and places it firmly with the end users. For studios, this kind of recognition signals that their work has genuinely resonated with players, not just performed well commercially. Player-led results offer a clear and transparent indicator of which games and providers have built lasting appeal, and that makes the outcomes especially meaningful within the industry.

The awards focus not only on commercial performance, but also on quality, innovation and player experience. From this year’s winners, what stood out most to you?

What stood out most was the balance between creativity and accessibility. Players clearly reward innovation, but only when it is paired with strong execution and an enjoyable overall experience. Many of the recognised titles combine distinctive mechanics with clear game identity and smooth gameplay. There is also evidence that consistency matters. Studios that repeatedly deliver engaging, reliable experiences tend to build strong followings, and that loyalty is reflected in the voting.

How do categories such as Rising Star Game Developer and the Readers’ Hall of Fame help ensure the awards spotlight both emerging studios and more established names?

These categories make sure the awards reflect the full spectrum of achievement in the industry. The Rising Star category gives visibility to newer studios that are already making a strong impression with players through innovation and creativity, even if they do not yet have the scale of the largest providers. In contrast, the Readers’ Hall of Fame recognises games that have achieved lasting popularity and become long-term favourites. Including both perspectives shows that excellence is not limited to one stage of growth. It highlights that players value both fresh ideas and proven experiences.

Looking ahead, how do you expect the awards to continue growing, and what role do you see Kongebonus playing in shaping player-led conversations in the industry?

As player expectations continue to change, the awards will develop alongside them. The aim remains to document and highlight the studios and games that genuinely stand out from a player perspective. Over time, this may mean refining categories or exploring new ways to reflect emerging trends, while keeping open voting at the core. Kongebonus will continue to act as a bridge between players and the industry, translating community sentiment into insights that studios and suppliers can learn from. By keeping the focus on player experience and feedback, the awards can play a growing role in encouraging the industry to prioritise quality, innovation and long-term player engagement.

To find out more about this year’s Kongebonus Awards and see the full list of winners, visit: https://www.kongebonus.com/nyheter/vinnere-av-kongebonus-awards-2025/

The post Inside the Kongebonus Awards: What Norway’s Players Are Telling the iGaming Industry appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Interviews

Scaling innovation through the launch of Tequity Publishing

Following the announcement of its new publishing vertical and the successful debut of Royal Drop, we sat down with Tanja Bergman, Head of Growth RGS at Tequity, to discuss how this new arm is set to dismantle technical barriers for ambitious studios and why scalability is the new frontier for the ‘Burst Games’ genre.

Tequity has just officially launched its Publishing vertical. What was the primary catalyst behind this move?

The industry is currently in a fascinating place. There is no shortage of creative talent among studios, but there is a massive technical bottleneck. We have seen so many ambitious studios with incredible concepts – especially those moving beyond traditional slots – who have been getting bogged down in terms of getting those concepts out into the marketplace.

The catalyst for Tequity Publishing was simple. We wanted to break down those technical barriers. By handling the infrastructure, distribution, and compliance frameworks, we allow studios to do what they do best, which is build outstanding games. It’s about speed-to-market without compromising on the quality or the vision of their content.

The launch coincides with the release of Royal Drop. How does this game, and the partnership with Mirror Image Gaming and The Fortune Engine, showcase what Tequity Publishing is all about?

Royal Drop is the perfect proof of concept. It’s a collaboration that highlights three important pillars of modern game delivery. You have Mirror Image Gaming bringing that fresh, video-game-influenced Burst Games energy, The Fortune Engine provide the math tools and templates, and Tequity Publishing offers the global scale and distribution pathway.

It shows that when you remove operational friction, you can create a game-first experience that appeals to a new generation of players who want something more interactive than a standard 5×3 reel.

Tequity Publishing offers two models: RGSaaS and RGS-to-RGS. Can you walk us through the strategic benefits of each?

Flexibility is key, because no two studios are at the same stage of their journey. The RGSaaS model is our full-service offering. It’s designed for studios that want to focus 100% on the creative side. We provide the entire infrastructure and publishing framework and it is essentially a business-in-a-box for game creators.

The RGS-to-RGS model is a more streamlined, tech-first approach for studios that already have their own RGS but lack the distribution muscle. It allows them to plug into our growing operator and aggregator network instantly. Both models are built on the same philosophy: helping studios reach parts of the market they otherwise couldn’t access on their own.

You mentioned reaching new generations of players. How does this vertical specifically empower studios to innovate in ways they couldn’t before?

When a studio is concerned about how they are going to integrate with a multitude of different operators or how to navigate complex jurisdictional requirements, they tend to play it safe. They stick to what they know.

By taking that weight off their shoulders, we give them the opportunity to be brave. Studios like Mirror Image Gaming are pushing the boundaries of modern iGaming, taking influences from the video game world. This is exactly what the new generation of players is looking for. We provide the scalability so that these niche, innovative ideas can achieve mass-market impact.

It’s been a busy period for Tequity, following the success of your Originals series and the iBankroll partnership. How does the Publishing vertical fit into the broader Tequity roadmap for 2026?

It’s all part of becoming the ultimate technology partner for the gaming industry. Whether it’s our streamer-friendly Originals or our Bankroll-as-a-Service offering, the goal is to provide scalable, customisable solutions. Tequity Publishing is the natural evolution of that mission. We aren’t only providing the tools anymore, but also the pathway to the player. Looking ahead, you can expect a series of further launches through our three-way collaborations. We’re proving that the barrier to entry for innovation has never been lower.

Finally, for studios looking to scale quickly, what is your main message to them?

Don’t let technical noise drown out your creative signal. If you have a game concept that breaks the mould, you shouldn’t have to spend years building the distribution architecture to get it seen. That’s what we’re here for. We want to help you launch at a speed and scale that matches your ambition, so that you can make a significant splash in the industry.

The post Scaling innovation through the launch of Tequity Publishing appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Canada6 days ago

Canada6 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News6 days ago

Latest News6 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Acquisitions/Merger6 days ago

Acquisitions/Merger6 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™6 days ago

Firecracker Frenzy™ Money Toad™6 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™

-

Blueprint Gaming4 days ago

Blueprint Gaming4 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates5 days ago

Compliance Updates5 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming5 days ago

Big Daddy Gaming5 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Africa6 days ago

Africa6 days agoEveryMatrix gains South Africa licence with customer launch pipeline on the rise