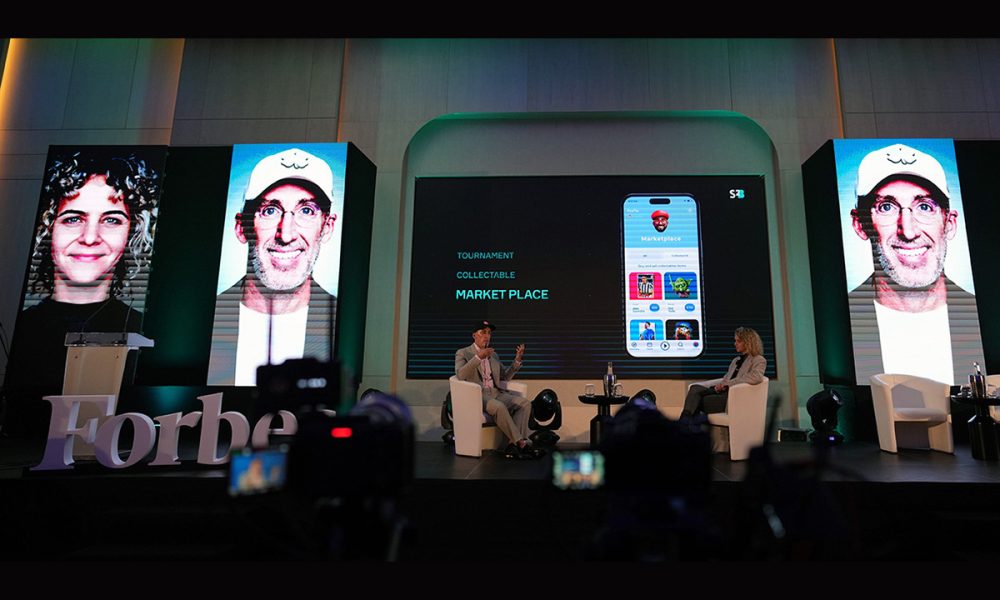

Forbes Future of Fintech Summit

Fintech Companies Learn Gamification Techniques from iGaming Industry Leaders

At the recent Forbes Future of Fintech Summit, industry leaders discussed emerging trends within the fintech sector, and how iGaming innovation can help disrupt financial services. One of the key takeaways was the potential for cross-industry application of gamification or motivational engineering techniques, a concept discussed in depth by Soft2Bet CEO Uri Poliavich at the Summit. His insights offered a broader perspective, suggesting that the principles of gamification, while prevalent in iGaming, have significant untapped potential in fintech, financial services, and beyond.

Gamification is often talked about in reference to social gaming, but it is also a key feature in real money gaming and is the feature that has enabled Soft2Bet to grow so strongly in the past year thanks to higher engagement and retention levels leading to sustaining revenue growth.

If the use of gamification in iGaming results in increased engagement, customer retention, and revenue, then applying similar gamification features in the fintech sector could yield comparable benefits. As Poliavich told Forbes fintech contributor Meaghan Johnson during the Summit, the success of Soft2Bet’s gamification technology, called Motivational Engineering Gaming Application (MEGA), serves as an example for the fintech sector to revolutionize its own engagement metrics by implementing gamification within its applications and products.

In Johnson’s article on the subject, Uri explained that, “Now fintech is about neo-banking, customization, and adapting to new technologies that are replacing retail branches. A generation of users prefers to gamify the experience, and this is where iGaming; specifically Soft2Bet, is at the junction of different niches.”

In addition to gamification, several strategies were discussed where fintech companies could learn from the iGaming industry, including localization, personalization, and the use of artificial intelligence to promote a relevant and engaging experience.

Soft2Bet COO Gilad Naim, when discussing the future of fintech, added to Uri’s comments, highlighting Soft2Bet’s MEGA innovations as an additional layer of entertainment for players that could seamlessly be integrated into the fintech space. The company even plans to launch a fintech product of its own, a gamified wallet, aiming to capture more user screentime and attention.

“With MEGA, we have created an additional layer of entertainment for players. The increases in engagement, revenues, and deposits are proof that players will engage if you provide them with the products,” Naim explained.

-

ACMA4 days ago

ACMA4 days agoACMA Blocks More Illegal Online Gambling Websites

-

CEO of GGBET UA Serhii Mishchenko4 days ago

CEO of GGBET UA Serhii Mishchenko4 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Aurimas Šilys4 days ago

Aurimas Šilys4 days agoREEVO Partners with Betsson Lithuania

-

Canada3 days ago

Canada3 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

AI4 days ago

AI4 days ago2026 Rewards AI Capability, Not AI Talk – HIPTHER Prague Summit Unveils the Next-Era HIPTHER Academy

-

Latest News3 days ago

Latest News3 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe4 days ago

Central Europe4 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Berlin4 days ago

Berlin4 days agoBLAST and Brawl Stars bring their first-ever joint Live event to Berlin as part of new global competitive ecosystem