Gaming

Unlocking games revenue: player behavior and payment trends in the west | Newzoo x Tebex Whitepaper

Tebex, the leading payments solution for gaming, reaching $1Bn in processed payments and powering over 30,000 web stores, is launching the first industry-wide look at payment trends in EU and NA with Newzoo on Tuesday, August 12 at 09:00 AM CEST.

Why This Data Matters

In a maturing Western games market with slowing payer growth (North America: +1.1% CAGR, Europe: +3.1% CAGR, 2023-2027), studios must shift from acquiring new players to maximizing value from existing ones. The data reveals critical insights into player motivations, spending patterns, and payment preferences, enabling developers to craft targeted monetization strategies that boost revenue, enhance retention, and align with player expectations.

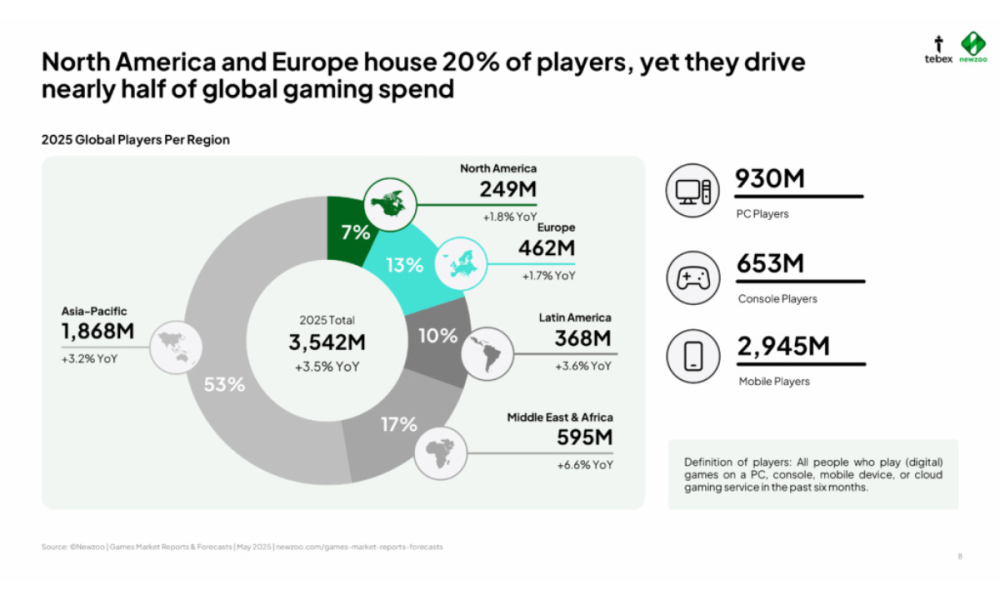

Global Market Snapshot (2025)

- Market Size: $188.9B (+3.4% YoY), with North America ($52.7B, 28%) and Europe ($33.1B, 18%) driving 46% of global spend despite housing only 20% of players (3.54B total).

- Payer Spending Power: North America leads with $324.9 avg. annual spend per payer; Europe averages $125.4 ($170.0 Western, $51.6 Eastern).

- Value: High per-payer spend in Western markets highlights the opportunity to deepen monetization through tailored strategies.

Spending Motivations Drive Strategy

- North America: 34% of payers spend to unlock exclusive content, 29% for personalization (character customization), reflecting a desire for self-expression. Studios can capitalize by offering unique cosmetics and content packs to drive engagement.

- Europe: 28% prioritize deals/offers, 21% value ad-free experiences, showing value-driven behavior. Discounted bundles and subscription models can increase conversion in this region.

- Value: Understanding regional motivations allows studios to align offerings with player priorities, enhancing loyalty and spend.

Diversified Spending Patterns

- North America: 27% of payers invest in content packs, power-ups, and in-game currencies, with subscriptions (24%) and battle passes (23%) also strong.

- Europe: In-game currencies and content packs lead (21% each), followed by subscriptions (20%) and gear/time-savers (18% each).

- Value: Diverse spending across virtual goods underscores the need for varied monetization options to capture a broad range of player preferences, boosting average transaction value (ATV).

Payment Methods Unlock Higher Spend

- ATV Trends (2025): Overall, ATV rose from $30 (2024) to $40. BNPL (North America: $85.0, Europe: $72.0) and crypto (North America: $94.8, Europe: $111.6) outperform cards (North America: $52.2, Europe: $42.7).

- Dual-Method Impact: Players using cards + BNPL/crypto maintain transaction frequency while spending more.

- Value: Offering alternative payment methods like BNPL and crypto can significantly increase ATV, especially in Western markets, without sacrificing transaction volume.

Revenue by Platform and Genre

- Microtransactions (MTX): Drive 49% of PC and 52% of console revenue in North America; 42% (PC) and 51% (console) in Europe. Mobile is near 100% in-game revenue.

- Top Genres: North America favors shooters, Europe prioritizes sports, with RPGs and puzzles strong in both.

- Value: High MTX revenue and genre preferences guide studios to focus on live services and region-specific content to maximize engagement.

Strategic Takeaways

- Deepen Monetization: With modest payer growth, studios must focus on existing players by offering personalized content and value-driven deals.

- Diversify Payment Options: Cards and wallet still dominate in volume, but integrating BNPL and crypto can unlock higher ATV, especially in Western markets.

- Align with Player Values: Transparency, fairness, and seamless payment experiences reduce churn and build loyalty in a competitive market.

- Understand the why and how players spend: NA players are more likely to spend for personalization and self-expression, while EU players are more value-conscious, prioritizing deals and an ad-free experience.

Quotes

Liam Wiltshire Head of Payments & Compliance at Tebex

“The future of gaming is about flexibility – meeting players where they are, with the methods they trust.”

This quote summarizes the importance of adapting to player-preferred payment methods like wallets, BNPL, and crypto to enhance accessibility and trust.

“Virtual currencies and microtransactions are no longer just revenue streams – they’re becoming strategic levers for retention and differentiation.”

This emphasizes the evolving role of microtransactions beyond revenue, focusing on engagement and player retention.

“Today’s players want to know what they’re paying for – and why. How you monetize matters more than ever.”

This highlights the need for transparency and fairness in monetization to build player trust and loyalty.

The post Unlocking games revenue: player behavior and payment trends in the west | Newzoo x Tebex Whitepaper appeared first on Gaming and Gambling Industry in the Americas.

Gaming

Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity

Soft2Bet has revealed the debut of MEGA11, a football management game aimed at enhancing sportsbook interaction and improving player loyalty. Acknowledging that football manager and fantasy games rank among the most favored genres with the longest typical gameplay durations, MEGA11 provides a progression-oriented and captivating football manager experience focusing on fantasy league team construction, allowing players to tactically oversee their own teams and make important choices while competing in leagues and matches.

Users of sportsbooks are inherently used to waiting before making their next wager. That inactivity naturally leads to a decrease in daily engagement, even among bettors who are very focused on football. MEGA11 addresses this issue by providing users with a football management game seamlessly connected to the sportsbook experience. Rather than waiting for the upcoming kickoff, players can remain engaged by forming their team, modifying lineups, and battling in their personal matchups or leagues. This establishes a distinctive two-way interaction cycle, effortlessly integrating real-money wagering with social, engaging gameplay, transforming these calmer times into organized activity with defined objectives, advancement, and a motivation to come back.

MEGA11 is developed as an independent game featuring its own soft-currency system, without any direct links to sportsbook deposits or casino operations. The main experience is free-to-play, enabling players to advance at their own speed. For players seeking to advance quickly or enhance their team, MEGA11 provides optional purchases, such as more powerful player cards and boosters that speed up progress and offer a strategic advantage.

The engagement of the sportsbook is fueled by a straightforward, quantifiable mechanism. Each wager allows players to accumulate points that enhance their advancement in the football manager game. This advancement, consequently, activates sportsbook bonuses, actively encouraging ongoing involvement and strengthening consistent engagement. Advancement is organized via a five-level loyalty and gamification framework that reflects a football career trajectory: Beginner, Amateur, Professional, World Class, and Legend. The tiering aims to maintain motivation over time, providing a consistent feeling of progress that fosters longer-term retention instead of brief spurts of engagement.

The new engine enhances Soft2Bet’s larger MEGA portfolio, which currently features mechanics like MEGA Chance, MEGA Round, and MEGA Clawee. It further enhances Soft2Bet’s sportsbook offering with instant payouts, 24/7 support, and over 200 pre-match football markets, by introducing a perpetual football format designed to maintain fan engagement beyond the live match calendar.

The design of the product continues to prioritize player protection and compliance. MEGA11’s soft-currency, non-deposit model promotes secure and compliant interactions, emphasizing entertainment and advancement while adhering to responsible gaming standards in regulated regions.

Yoel Zuckerberg, CPO at Soft2Bet, stated: “MEGA11 is built to keep football fans engaged between matchdays, pairing a manager-style progression loop with a soft-currency model that supports compliant, long-term sportsbook loyalty. Football manager games are renowned for having the highest player immersion and longest session times in the industry. By bringing this experience to our partners, we are combining real betting with social gameplay to deliver authentic player experiences that resonate with fans and drive sustainable engagement.”

The introduction of MEGA11 enhances Soft2Bet’s emphasis on product-driven engagement, merging game design, loyalty strategies, and a robust regulatory framework to assist operators in achieving more reliable retention during the football season. The technology has received significant industry awards and is eliciting a strong positive reaction from players, confirming its influence on engagement and long-term value generation.

The post Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

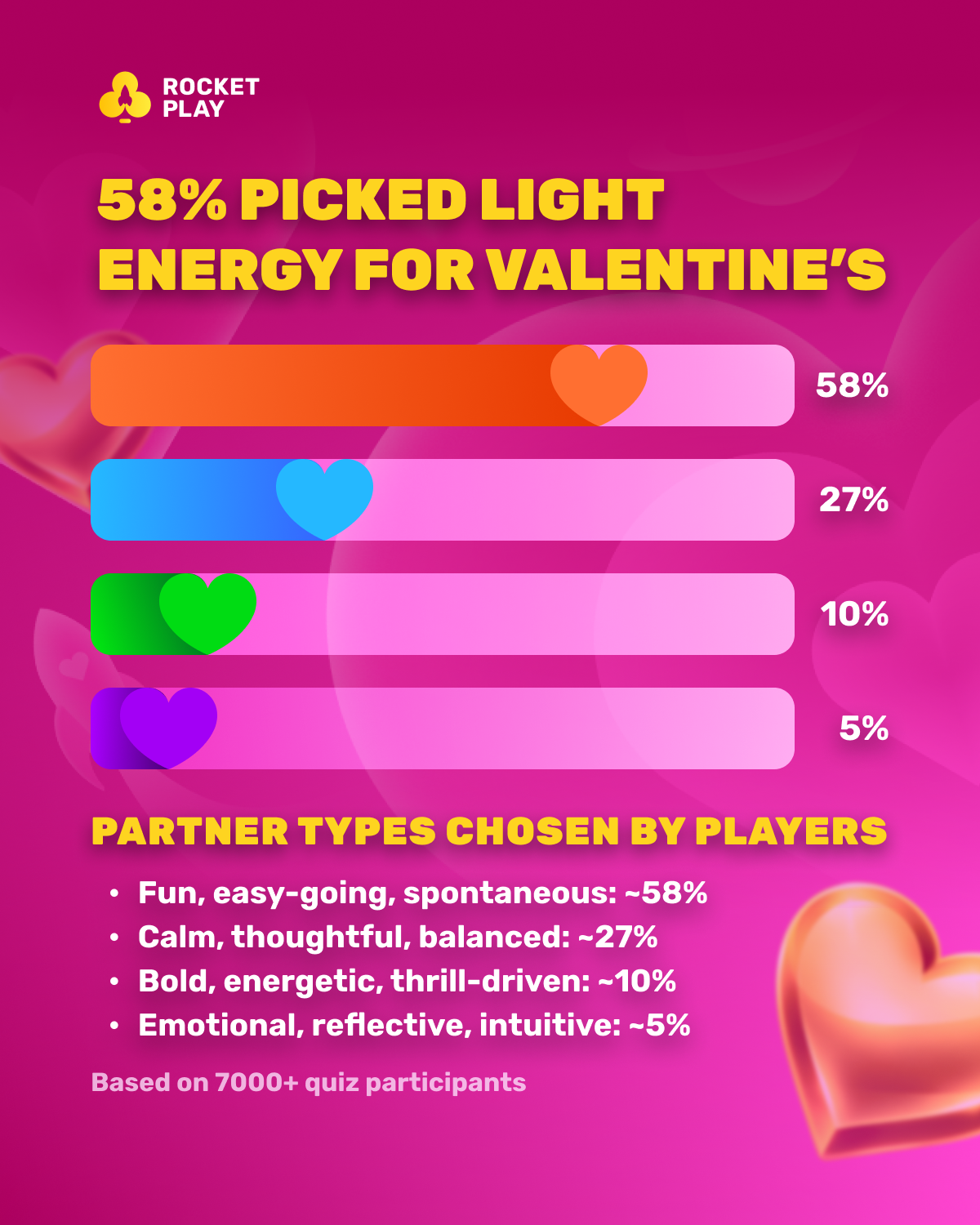

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

-

ACMA6 days ago

ACMA6 days agoACMA Blocks More Illegal Online Gambling Websites

-

CEO of GGBET UA Serhii Mishchenko6 days ago

CEO of GGBET UA Serhii Mishchenko6 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Aurimas Šilys6 days ago

Aurimas Šilys6 days agoREEVO Partners with Betsson Lithuania

-

Canada5 days ago

Canada5 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News5 days ago

Latest News5 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe6 days ago

Central Europe6 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Acquisitions/Merger5 days ago

Acquisitions/Merger5 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™5 days ago

Firecracker Frenzy™ Money Toad™5 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™