Gaming

Significant increase in the number of games companies in Germany

Judging from growth in the number of games companies, the mood in the German games industry appears to be very upbeat. Once again, the number of companies involved in the development and publishing of computer and video games rose sharply, posting a 20 per cent increase to 749 in just one year. These are the figures released today by game – the German Games Industry Association, based on data collected by gamesmap.de. Game developers are responsible for the lion’s share, with 314 companies currently fitting this description in Germany. A further 403 companies in Germany are active in both development and publishing. There are also another 32 companies that focus solely on game publishing, meaning that they fund the development of games and handle marketing and distribution.

A look at the number of people employed by developers and publishers reveals that most of the new companies are microenterprises and small companies –while the number of employees has grown, it has done so significantly more slowly than the number of companies. In 2021, 10,906 people are employed in the development and marketing of computer and video games. That number marks an increase of 8 per cent within a year. This also shows the positive impact of the wave of new companies here; after all, during the previous year, the number of employees in this field declined. The trend in employee numbers in the larger labour market has been less positive. Whilst employee numbers grew by 5 per cent a year ago, there has been a significant decline recently. The games industry’s extended labour market includes people employed by service providers, retailers, educational establishments, the media and the public sector – sectors that experienced at least some negative impacts of the Covid-19 pandemic, as well as areas that have been put under pressure by changing business models in the games industry. The decline of 11 per cent, to 16,115 employees, is therefore correspondingly stark. Consequently, the games industry in Germany provides a total of approximately 27,000 jobs.

The German games industry is increasingly optimistic about the future,’ says Felix Falk, Managing Director of game. ‘This is due not only to a new federal funding programme but also to other governmental efforts to support the games industry that include Germany’s state governments. For the first time, the conditions in which German games companies operate are competitive with those enjoyed by their international competitors. The wave of new companies being established in the games industry highlights the huge potential Germany offers for digital industries and as a business location. To ensure that we can take full advantage of this potential, we need further improvements in conditions in a variety of areas, including finance, start-ups, skilled personnel, research, regulations and digital infrastructure, to ensure that we can stay abreast of international developments. That is why it will be essential to see how Germany’s games strategy can be invigorated and advanced in concrete terms during the next legislative period – to ensure that the current upswing continues.’

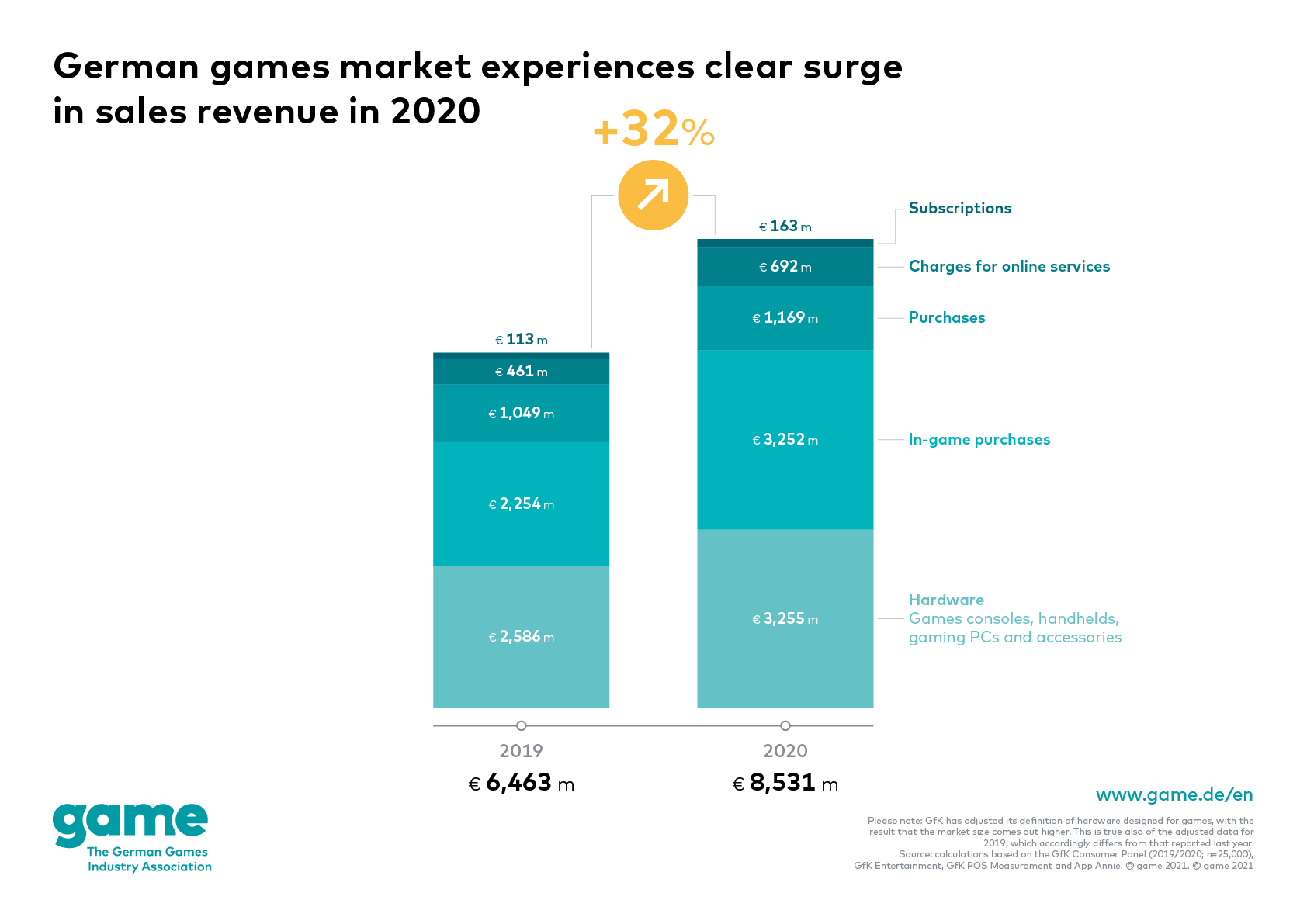

German games market: big jump in sales revenue in 2020

The German games market recorded a strong jump in sales revenue in the Covid-19 year 2020: total sales revenue of around 8.5 billion euros was achieved in computer and video games and associated hardware, as already reported by game. This is an increase of 32 per cent compared to the previous year. Sales of more than 3.2 billion euros were registered with games consoles, gaming PCs and the corresponding peripheral equipment. This is an increase of 26 per cent compared to 2019. The submarket for computer and video games saw even stronger growth, with revenues of 5.2 billion euros achieved through game purchases, in-game and in-app purchases, subscriptions and charges for online services. As a result, this part of the market managed to grow by 36 per cent compared to the previous year.

About the market data

The online directory gamesmap.de records developments in the German games industry on an ongoing basis. game continuously calculates the industry’s employment situation in Germany using detailed industry observations and research, together with appropriate projections and surveys of experts.

Powered by WPeMatico

Australia

Regulating the Game 2026 Draft Program Unveiled, Spotlighting the Issues Shaping the Sector

Regulating the Game has published the draft program for its 2026 Sydney conference, outlining a comprehensive agenda of keynotes, featured addresses, panels, and expert masterclasses examining the most consequential regulatory, policy and operational issues facing the global gambling sector.

Regulating the Game 2026 will be held 9–11 March 2026 at the Sofitel Sydney Wentworth and represents the sixth edition of the conference as a forum for rigorous, cross-jurisdictional engagement on gambling regulation and sector performance and uplift.

The draft program confirms that each conference day is anchored by keynote and featured speakers, whose addresses are designed to frame and contextualise the broader program of talks, panels and masterclasses that follow. These speakers bring senior executive leadership, policy and advisory insight, and deep subject-matter expertise, helping to frame the regulatory and operating environment, its trajectory, and the lenses through which the agenda is explored.

Across the three days, the program integrates:

- Context-setting sessions that frame the regulatory and operating environment and its direction, including examinations of where gambling regulation and policy are heading, how enforcement and sanctioning approaches are evolving post-inquiry, and how governments and markets are responding to persistent black-market and grey-market pressures. These sessions establish the policy, strategic and operating lenses through which the broader agenda is explored.

- Moderated panels that interrogate regulatory assumptions and reform outcomes in practice, including discussions on harm minimisation in increasingly data-driven environments, the limits and consequences of intensified regulation, and the interaction between market design, consumer behaviour and regulatory intent.

- Expert masterclasses, including a session led by Jay Robinson focused on embedding the Responsible Gambling Officer role with purpose, authority and practical impact, and a second masterclass convened by the International Masters of Gaming Law, with final scope and focus to be confirmed. Together, these sessions are designed to support practical capability uplift and address the implementation risks that sit between policy intent and operational reality.

- Industry Spotlight sessions, introduced in 2026, comprising tightly curated 15-minute presentations from incumbent organisations. These sessions provide a platform to articulate strategic direction, investment priorities and innovation pathways, and to examine what lies ahead for the sector as regulatory expectations, technology and market structures continue to evolve.

Collectively, the agenda addresses:

- The trajectory of gambling regulation, enforcement and sanctioning frameworks

- AML/CTF reform, financial crime risk and supervisory expectations

- Safer gambling governance, harm minimisation and behavioural insight

- Black market and grey market dynamics in increasingly regulated environments

- Technology, data governance and the use of AI in regulatory and compliance systems

- Leadership, accountability and the operational reality of reform delivery

While the program is deliberately broad, particular attention has been given to curating sessions and contributors that surface topical and often unresolved issues facing the sector. The agenda is designed to frame the current environment and its direction, provoke informed debate, stimulate curiosity, and act as a catalyst for new ways of thinking, innovation bets and next practice across regulation, policy and operations.

Paul Newson, Principal at Vanguard Overwatch and Founder of Regulating the Game, said the 2026 draft program reflects a deliberate architecture:

“The program is designed to open up the problem space, not to close it down. Early sessions are intended to frame the environment honestly and rigorously, so that the discussions that follow can interrogate options, trade-offs and solutions with clarity and discipline.”

He added:

“Regulating the Game is deliberately structured to move from context to analysis to application. The draft program makes that progression clear and intentional.”

The program is supported by flagship events including Pitch!, the RTG Global Awards Gala Dinner, and an expanded Exhibition Showcase, which together complement the formal agenda and support cross-sector engagement.

The draft program reflects the core structure of the conference, with final speaker confirmations and minor refinements to be completed in the coming week.

The post Regulating the Game 2026 Draft Program Unveiled, Spotlighting the Issues Shaping the Sector appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Adam Smart Director of Product Gaming at AppsFlyer

AppsFlyer State of Gaming Report: AI Is Flooding Mobile Gaming Marketing Channels and Raising the Cost of Standing Out

State of Gaming for Marketers 2026 reveals how AI-driven scale, global UA spend, and China-based publishers are reshaping mobile gaming competition

AppsFlyer, the Modern Marketing Cloud, today released the State of Gaming for Marketers 2026, an in-depth analysis of how AI, creative scale, and rising paid pressure reshaped mobile gaming marketing in 2025. Drawing on AppsFlyer data, the report examines how studios adapted as marketing activity expanded faster than player attention.

In 2025, AI-enabled production coincided with a sharp increase in advertising across iOS and Android. Creative output scaled rapidly across all spending tiers, with top gaming advertisers producing between 2,400 and 2,600 creative variations per quarter, up 25–30% YoY. That expansion increased pressure on paid acquisition channels. Paid install share rose 10% YoY across iOS and Android, while ad impressions increased 20%, indicating a significant rise in the number of ads competing for the same pool of players. To manage rising marketing volume and fragmentation, AI-enabled tools became a common part of daily workflows with 46% of AI assistant queries focused on reporting and performance breakdowns, reflecting the need for faster visibility as data volumes grew.

“AI has dramatically increased the speed and volume at which games and marketing assets reach the market,” says Adam Smart, Director of Product, Gaming at AppsFlyer. “The result is not a shortage of creativity, but a surplus of it. As paid activity and creative supply expand faster than player attention, marketing success depends on how effectively teams can measure, interpret, and act on an increasing volume of fragmented signals.”

Additional key insights from the State of Gaming for Marketers 2026

- Global gaming app UA spend reached $25B in 2025. Midcore UA spend increased 28% YoY on iOS, while Android spend remained largely flat.

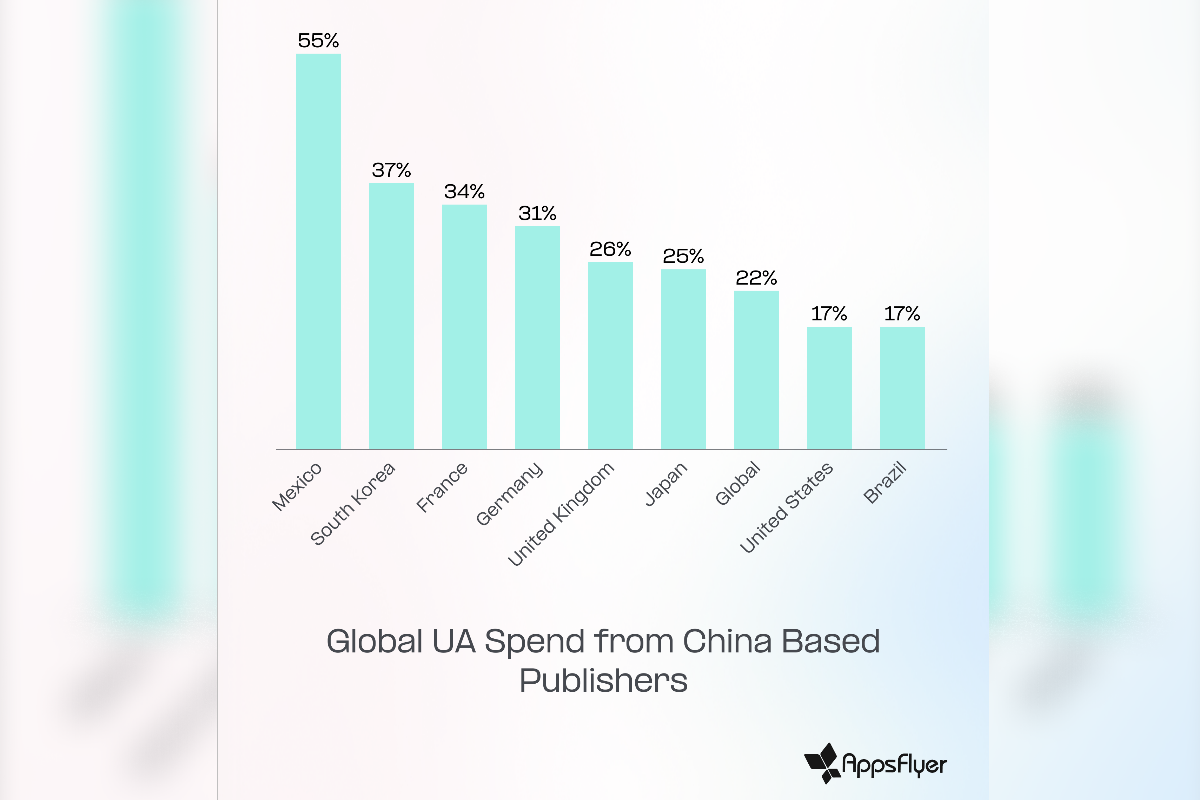

● China-headquartered publishers increased their share of global gaming UA spend. Their share grew by 26% YoY in the UK, and 22% globally, with gains strongest on Android.

● iOS paid installs reached record highs. Share in the UK rose across Casino (+13%), Hypercasual (+10%), and Midcore (+30%).

● iOS advertisers expanded media mix to find incremental scale. iOS gaming advertisers increased the number of media sources they used by up to 15% YoY, reflecting growing fragmentation and the need to diversify beyond core channels.

● AI is still used primarily to manage marketing scale, not strategy. With 46% of AI assistant queries focused on reporting and performance breakdowns, teams are using AI to keep pace with rising data volumes rather than replace decision-making, but some genres are already employing more complex tasks and asks.

Methodology

AppsFlyer’s State of Gaming for Marketers 2026 is based on anonymized, aggregated data from 9.6 thousand gaming apps worldwide, analyzing 24.8 billion total installs, including 14.1 billion paid installs, alongside ad spend, creative production, monetization, AI-assisted workflows, and media source usage across iOS and Android during 2025.

The full report is available at: appsflyer.com/resources/reports/gaming-marketers/

The post AppsFlyer State of Gaming Report: AI Is Flooding Mobile Gaming Marketing Channels and Raising the Cost of Standing Out appeared first on Americas iGaming & Sports Betting News.

Arena Racing Company

Arena Racing Company awarded United Arab Emirates Gaming-Related Vendor License

Arena Racing Company (ARC) has been granted a Gaming-Related Vendor license from the United Arab Emirates’ General Commercial Gaming Authority (GCGRA), an independent entity of the UAE Federal Government with exclusive jurisdiction to regulate, license, and supervise all commercial gaming activities.

The license, operational with immediate effect, affords ARC the opportunity to provide its products and services to licensed operators in the region. Notably, the Racing1 Markets service, an all-in-one horse and greyhound racing solution delivered in conjunction with Racing1 alliance media rights partners at 1/ST CONTENT, Racecourse Media Group (RMG), and Tabcorp, alongside technical partner Pythia Sports. ARC has been added to the list of licensed vendors as per the GCGRA website.

Jack Whitaker, Commercial Manager at ARC, said: “Obtaining this license is a great achievement for ARC and its Racing1 partners. The emerging regulated UAE market is incredibly exciting, and we look forward to showcasing our innovative products and services in the region.”

The post Arena Racing Company awarded United Arab Emirates Gaming-Related Vendor License appeared first on Gaming and Gambling Industry Newsroom.

-

Austria6 days ago

Austria6 days agoEU Court Ruling on Online Gambling Liability: Players Can Sue Foreign Operators’ Directors Under Their Home Country Law (Case C-77/24 Wunner)

-

Alex Baliukonis Game Producer at BGaming7 days ago

Alex Baliukonis Game Producer at BGaming7 days agoCrack the Vault in BGaming’s Mystery Heist

-

Latest News6 days ago

Latest News6 days agoSKIP THE QUEUE WITH THE MIDNITE SHUTTLE: MIDNITE TEAMS UP WITH SNOOKER LEGEND TO OFFER FANS A FREE SHUTTLE SERVICE FROM ALLY PALLY STATION

-

Continent 8 Technologies6 days ago

Continent 8 Technologies6 days agoContinent 8 and CEO Michael Tobin claim number one spot in GamblingIQ’s global ‘Security 10’ rankings

-

000x7 days ago

000x7 days agoPragmatic Play Sweetens Slots with Sugar Rush Super Scatter and Massive 50,000x Wins

-

10 Alebrijes Eternal6 days ago

10 Alebrijes Eternal6 days agoAmusnet Releases “10 Alebrijes Eternal” Slot

-

Latest News7 days ago

Latest News7 days agoXSOLLA LAUNCHES MERCADO PAGO IN URUGUAY GIVING DEVELOPERS ACCESS TO 60M+ ACTIVE USERS

-

CGCC6 days ago

CGCC6 days agoADVISORY: ILLEGAL GAMBLING OPERATION USING FORGED COMMISSION CREDENTIALS