Canada

Rivalry Corp Reports Record Third Quarter 2023 Results, Reaffirms H1 2024 Profit Guidance

Company achieves record Q3 against reduced marketing spend and flattened Opex, highlighting operating leverage; strongest customer KPI’s on a year-to-date basis in Rivalry Corp’s history; positioned to accelerate growth with recently announced $14M capital infusion

- Betting handle of $105.7 million, up 50% year-over-year, while reducing marketing spend 13%.

- Revenue of $8.7 million, a 22% increase year-over-year.

- Gross profit of $4.0 million, up 90% year-over-year.

- Casino has grown to approximately half of the company’s betting handle in Q3, demonstrating ability to cross-sell next generation bettors and drive growth against unseasonably low viewership in select Q3 eSports events.

- Year-to-date customer KPI’s the strongest in company history: all-time high average handle per customer, average revenue per user and record low cost of customer acquisition.

- Year-to-date betting handle has increased 127%, revenue by 70% and gross profit up 175% over the first nine months of 2022. Achieved while reducing marketing spend, highlighting the inherent operating leverage in the business.

- Subsequent to the quarter end, Rivalry Corp completed a $14 million capital infusion that strengthens the balance sheet and provides the company with capital to pursue growth and profitability at the same time.

- Company re-affirms guidance, anticipates achieving profitability in H1 2024.

- Announces virtual investor day to be held on January 17, 2024.

Rivalry Corp (TSXV: RVLY) (OTCQX: RVLCF) (FSE: 9VK), the leading sportsbook and iGaming operator for Millennials and Gen Z, today announced its financial results for the three and nine-month periods ended September 30, 2023. All dollar figures are quoted in Canadian dollars.

“We are proud to have delivered a record third quarter while exercising discipline on costs amidst a challenging capital markets environment for growth companies,” the co-founder and Chief Executive Officer for Rivalry Corp, Steven Salz, said. “Now, with our recently announced capital infusion, we will be able to go back on the offensive, while still maintaining our path to profitability.

“Years of consistent performance, flattened Opex multiple quarters in a row, demonstrated triple-digit growth year-over-year across core metrics year-to-date with all-time high average handle per customer, average revenue per user and record low cost of customer acquisition over that same period gives me high conviction in Rivalry Corp’s future. It is this proven operating leverage, supported by an improving sportsbook margin profile resulting in more revenue per dollar wagered now fuelled by growth capital, that is creating a significant opportunity set for Rivalry Corp. It is that combination which gives us confidence to reaffirm our first half 2024 profitability guidance.”

Third Quarter 2023 Highlights:

- Betting handle for Q3 2023 was $105.7 million, an increase of $35.4 million or 50% from $70.3 million in Q3 2022.

- Revenue was $8.7 million in Q3 2023, a record result for a third quarter, representing an increase of $1.6 million or 22% from $7.1 million of revenue in Q3 2022.

- Gross profit was $4.0 million in Q3 2023, an increase of $1.9 million or 90% from $2.1 million of gross profit in Q3 2022.

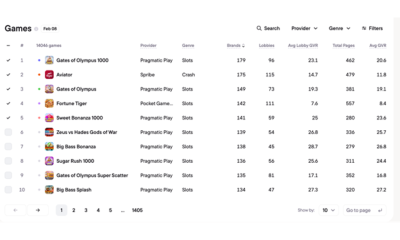

- The casino segment generated approximately half of total betting handle ($50.4 million). Recent casino product launches including a custom-branded slots category, a new original game Cash & Dash and the release of Casino.exe on our iOS mobile app in Ontario set the stage for continued growth and increased player wallet share.

- Modest decline in operating expenses sequentially continues the trend of effective cost management while still maintaining significant year-over-year growth rates at the company.

- Net loss was $5.6 million for Q3 2023, a 6% reduction from the net loss of $6.0 million in Q3 2022 and 12% decrease sequentially.

- Rivalry Corp launched an industry-first same-game parlay product for eSports within the quarter, supporting an improved sportsbook product mix and contributing to an enhanced margin profile.

- The company had $7.4 million of cash and no debt as at September 30, 2023.

- On November 15, 2023, Rivalry Corp strengthened its balance sheet with the announcement of a private placement offering of $14 million principal amount senior secured convertible debentures to scale several strategic verticals across marketing, product development and geographic expansion.

Year-to-Date 2023 Highlights:

- Betting handle for the nine-month period ended September 30, 2023 was $338.1 million, an increase of $189.2 million or 127% from $148.9 million in the comparable period of 2022 while marketing spend decreased by 8%.

- Revenue was $29.2 million in the first nine months of 2023, representing an increase of $12.0 million or 70% from $17.2 million of revenue the previous year.

- Gross profit was $13.2 million in the first nine months of 2023, an increase of $8.4 million or 175% from $4.8 million of gross profit a year earlier.

- Net loss of $15.2 million in the nine-month period ended September 30, 2023, a reduction of $3.6 million compared to a net loss of $18.8 million over the same period in 2022.

Investor Day:

Rivalry Corp is pleased to announce a virtual investor day to be held at 10:00am EST on January 17, 2024. The company will discuss its outlook for 2024, growth initiatives, upcoming product innovations and insights into the Gen Z consumer. More details will be revealed in the coming weeks.

Investor Conference Call:

Management will host a conference call at 10:00am EST on Wednesday, November 29, 2023 to discuss the company’s third quarter 2023 financial results.

- Dial-in: 888-886-7786 (toll free) or (+1) 416-764-8658 (local or international calls).

- Webcast: A live webcast can be accessed from the Events section of the company’s website at www. RivalryCorp .com. A replay of the webcast will be archived on the company’s website for one year.

Rivalry Corp’s financial statements and management discussion and analysis for the period ended September 30, 2023 are available on SEDAR+ at www. SedarPlus.ca and on the company’s website at www. RivalryCorp .com.

Stock Options:

The company also announces that it has approved a grant of stock options, pursuant to the terms of the company’s equity incentive plan, to an investor relations service provider. A total of 44,444 stock options have been awarded to such investor relations service provider. The stock options will be exercisable at an exercise price equal to the closing price of the subordinate voting shares on the TSX Venture Exchange two trading days following the issuance of this press release, for a period of five years from the date of the grant. The stock options vest in equal quarterly instalments over a period of twelve months, commencing on the three-month anniversary of the date of the grant.

Canada

St8 launches in Ontario through partnership with Tonybet

Casino games aggregator and full-service technology provider, St8 has officially gone live in Ontario’s regulated market through a new partnership with international brand Tonybet.

Through the partnership, Tonybet gains access to St8’s casino games aggregation platform, offering a wide range of premium titles from leading providers through a single API, alongside bonusing and promotional tools, compliance and licensing solutions, advanced reporting and data capabilities.

Built as a single scalable platform, St8’s products are designed to help operators launch and grow across regulated markets with fast, flexible technology solutions while maintaining full compliance.

The agreement marks a further step in St8’s global growth strategy as the company continues to expand its presence across regulated jurisdictions.

Vladimir Negine, CEO at St8, said: “Going live in Ontario is an important milestone for St8 and reflects our continued commitment to growth in regulated markets. Since receiving our Ontario licence, we have focused on building strong local partnerships and delivering a platform that combines scalability, speed and compliance.

“As a respected international brand, Tonybet shares our commitment to building reliable solutions for regulated markets, and we look forward to working closely together as we continue to expand our presence in regulated jurisdictions worldwide.”

Kiryl Liudvikevich, Head of Product at Tonybet, added: “As we expand our presence in Ontario, it is important for us to work with technology partners that support continued growth while meeting the highest regulatory standards.

“St8’s platform gives us the flexibility to integrate a wide range of content and tools through a single connection, helping us scale smoothly while maintaining a strong focus on player experience.”

St8 continues to lead the way as a partner of choice for regulated markets. In addition to its Ontario licence, the company holds licences in key regulated jurisdictions like the United Kingdom, Sweden and Romania, among others.

The post St8 launches in Ontario through partnership with Tonybet appeared first on Americas iGaming & Sports Betting News.

Canada

Rivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

Rivalry Corp. announced that its Board of Directors has approved a significant reduction in operating activity as the Company evaluates strategic alternatives in respect of its assets and operations.

The Company is engaged in discussions with third parties regarding potential transactions. However, in light of recent performance volatility, the Board has determined to materially reduce the scale of operations while assessing whether a strategic transaction or other alternative can be advanced.

Effective immediately, the Company is implementing substantial cost reductions, including a significant workforce reduction and reduced operating expenditures. The Company has paused player activity on its platform and is facilitating player withdrawals in the ordinary course.

The Company is assessing a range of potential alternatives, which may include asset-level transactions, corporate transactions, restructuring initiatives or other strategic outcomes.

Given the Company’s reduced operating scale and the ongoing evaluation process, there can be no assurance that any strategic alternative will be completed or that operations will continue in their current form.

The post Rivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives appeared first on Americas iGaming & Sports Betting News.

Alex Malchenko

Evoplay Strengthens Canadian Presence with BetMGM Partnership

Evoplay is celebrating another milestone in its regulated-market journey with a new launch in Ontario, teaming up with BetMGM to bring its games to one of Canada’s most dynamic and competitive jurisdictions.

The rollout introduces 18 Evoplay titles to BetMGM Casino in Ontario, carefully selected to deliver long-term engagement and appeal to a wide range of player preferences. The first wave includes proven performers such as:

• Hot Triple Sevens

• Hot Volcano

• Gold of Sirens Bonus Buy

• Inner Fire Bonus Buy.

These are games that have already demonstrated strong results across multiple regulated markets.

This launch marks another confident step in Evoplay’s Canadian expansion, reinforcing the company’s commitment to aligning its content with local market requirements, player expectations, and regulatory standards.

Alex Malchenko, Head of Sales at Evoplay, said: Ontario continues to set a high standard for regulated online casinos, making it a market where the right partnerships truly matter. Collaborating with BetMGM allows us to expand our reach with a portfolio that has already performed strongly across multiple areas and territories.

Oliver Bartlett, VP of Gaming at BetMGM, said: “Partnering with Evoplay adds a strong selection of proven, high-performing titles to our growing portfolio in Ontario.”

The post Evoplay Strengthens Canadian Presence with BetMGM Partnership appeared first on Americas iGaming & Sports Betting News.

-

ACMA5 days ago

ACMA5 days agoACMA Blocks More Illegal Online Gambling Websites

-

Aurimas Šilys5 days ago

Aurimas Šilys5 days agoREEVO Partners with Betsson Lithuania

-

CEO of GGBET UA Serhii Mishchenko5 days ago

CEO of GGBET UA Serhii Mishchenko5 days agoGGBET UA kicks off the “Keep it GG” promotional campaign

-

Canada4 days ago

Canada4 days agoRivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

-

Latest News4 days ago

Latest News4 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Central Europe5 days ago

Central Europe5 days agoNOVOMATIC Once Again Recognised as an “Austrian Leading Company”

-

Acquisitions/Merger4 days ago

Acquisitions/Merger4 days agoBoonuspart Acquires Kasiino-boonus to Strengthen its Position in the Estonian iGaming Market

-

Firecracker Frenzy™ Money Toad™4 days ago

Firecracker Frenzy™ Money Toad™4 days agoAncient fortune explodes to life in Greentube’s Firecracker Frenzy™: Money Toad™