Compliance Updates

Sweden’s government proposes increased gambling tax

Sweden’s government has today Wednesday proposed an increase in the gambling tax, from 18 percent of GGR to 22 percent of GGR. The reason, according to the government, is that the gambling market should have stabilized since the reregulation in 2019 and that channelization is said to be high.

BOS Secretary General Gustaf Hoffstedt comments:

The announcement from the government is deeply disappointing, above all because it shows that the government does not understand or has taken to heart what kind of market it is set to govern. Even less has the government understood the vulnerable position that market is in.

We were recently able to show that channelization in the Swedish gambling market is 77 percent. Some gambling verticals, including online casino, are as low as 72 percent. The trend is also declining, in other words the channeling decreases over time.

We are already far from the state’s goal of at least 90 percent channelization, and if this tax increase is approved by the Riksdag, we will soon be down to the channelization we had before Sweden reregulated its gambling market in 2019. A reregulation that took place because Sweden had such a low channelization at the time.

Sweden’s government must perform much better than this. There is still time to withdraw the proposal, concludes Gustaf Hoffstedt.

The government’s proposal can be found in Swedish on pages 289-290 here: https://www.regeringen.se/contentassets/e1afccd2ec7e42f6af3b651091df139c/forslag-till-statens-budget-for-2024-finansplan-och-skattefragor-kapitel-1-12- appendices-1-9.pdf

Below a Google translation of the same text:

Increased gaming tax

The government’s assessment: The excise tax on gambling should be increased from 18 to 22 percent of the balance for each tax period.

The upcoming proposal should enter into force on 1 July 2024.

The reasons for the government’s assessment: One of the purposes of today’s gambling regulation is to protect the surplus from gambling activities for the general public by contributing to the financing of government activities. With the exception of gambling that is reserved for public benefit purposes, licensed gambling is taxed according to the Act (2018:1139) on tax on gambling. According to this law, excise duty is levied at 18 percent of the balance for each tax period. The balance is made up of the difference between the total stakes and the total payouts. A taxation period consists of one calendar month.

An increase in the tax on gambling should be well balanced to avoid a major negative impact on the proportion of gambling that takes place at the companies that have a license for gambling in Sweden. From the bill A reregulated gambling market it appears that a tax of just over 20 percent can be considered compatible with an aim to achieve a channelization rate of at least 90 percent (prop. 2017/18:220 p. 258). In that bill, however, a lower tax level was proposed for precautionary reasons. The current tax rate of 18 percent has applied since the Swedish gambling market was reregulated in 2019. The gambling market has since stabilized and channelization has increased significantly. In addition, measures have been taken to exclude unlicensed gambling from the Swedish market, which came into effect 1 July 2023 (prop. 2022/23:33). The reasons for caution when setting the tax level should therefore not be as strong now as during the re-regulation. An increase from 18 to 22 percent is judged to be at a suitable level to strengthen the financing of government activities, without it leading to too great an impact on the companies and the size of the tax base. The excise tax on gambling should therefore be increased from 18 to 22 percent.

The upcoming proposal should enter into force on 1 July 2024. The government intends to return to the Riksdag in the spring of 2024 with a proposal according to the above. The upcoming proposal is estimated to increase tax revenue by SEK 0.27 billion in 2024 (half-year effect) and thereafter by SEK 0.54 billion per year.

Compliance Updates

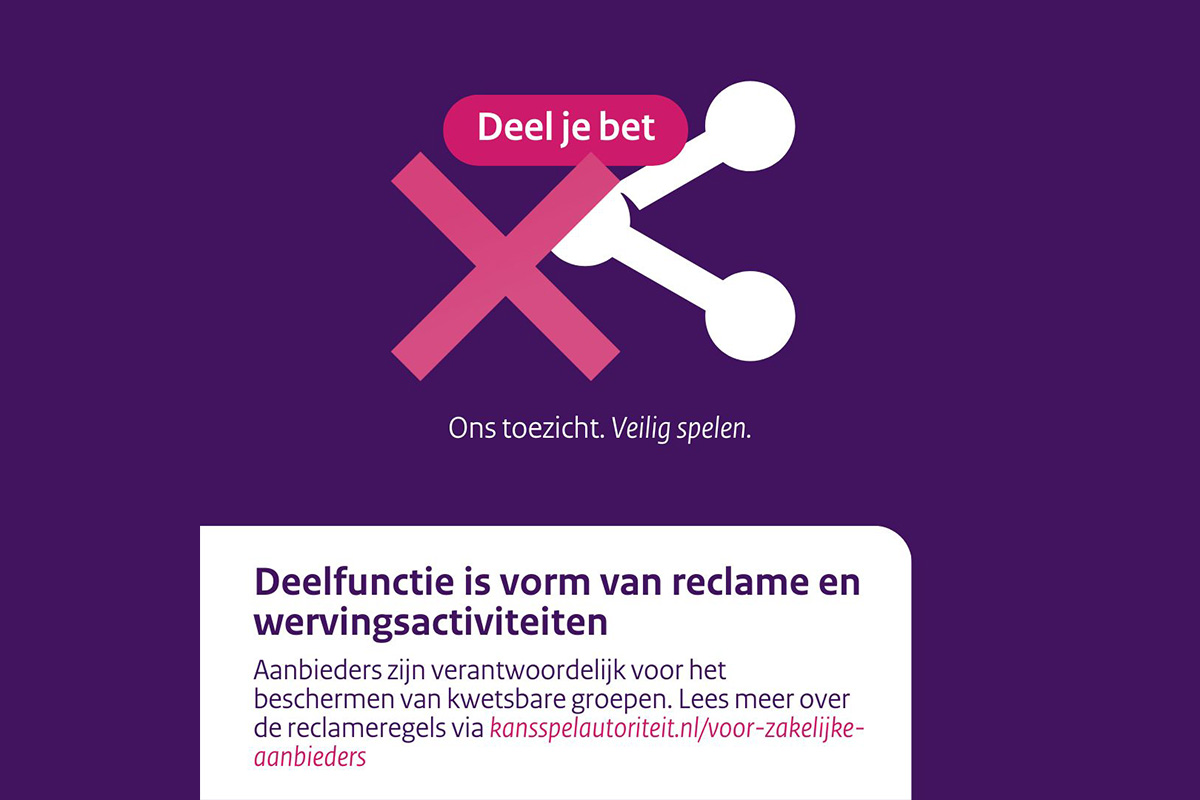

Dutch Regulator Urges Online Gambling Providers to Stop Using “Share Your Bet” Feature

The Dutch Gambling Regulator (KSA) has urged the online gambling providers to discontinue the “Share your bet” feature. This feature allows players to share their placed bets via social media or messaging apps such as WhatsApp, Facebook and email. The KSA investigated the functionality of this feature after receiving several signals and questions from the market.

“Share your bet” function

The “Share your bet” feature allows players to easily share their bets with others. It works like this: a player places a bet and sends it via a link to, for example, friends or family. The recipient can then immediately see the bet and, if they have an account, participate as well. This makes gambling easily shared, often via social networks.

Protection of vulnerable groups

The KSA points out that the “Share your bet” feature is a form of advertising and recruitment. It’s a way for providers to promote gambling, but indirectly through players themselves. According to the Decree on Recruitment, Advertising and Addiction Prevention in Gambling, providers must ensure that advertising does not reach vulnerable groups, such as minors, young adults and people with gambling problems.

Because players with the “Share your bet” feature decide who to send their bet to, providers have no control over who receives the shared messages. This means that gambling providers cannot guarantee that vulnerable groups will not unintentionally encounter gambling advertising. Therefore, offering features like “Share your bet” is not permitted.

In addition, the ease of sharing bets helps normalize gambling. This lowers the barrier to entry, especially among younger demographics.

Discontinue “Share your bet” functionality

The KSA is therefore calling on all online gambling providers using the “Share your bet” feature to immediately stop doing so. The KSA will continue to monitor any new developments in this area and will take enforcement action where necessary to ensure the protection of vulnerable groups.

The post Dutch Regulator Urges Online Gambling Providers to Stop Using “Share Your Bet” Feature appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Arshak Muradyan

Digitain Secures UKGC Certification for Sportsbook and Platform

Digitain has secured certification from the UK Gambling Commission (UKGC) for its Sportsbook and platform, alongside obtaining a UK betting licence for real and virtual events. This milestone confirms that Digitain’s technology meets the rigorous regulatory and technical standards required to operate in one of the world’s most demanding iGaming markets.

The UK is widely recognised as one of the most highly regulated and competitive jurisdictions globally. Securing UKGC approval is a clear marker of Digitain’s commitment to compliance, player protection and long-term operational reliability, while continuing to deliver performance-driven technology for ambitious operators.

Vardges Vardanyan, Founder of Digitain Group, said: “The UK is one of the most demanding regulatory environments in the global gaming industry. Meeting these standards is a strong endorsement of our technology, compliance capabilities, and operational maturity. This achievement enables us to support UK-licensed operators with confidence, delivering reliable, scalable, and future-ready solutions designed to perform in highly regulated markets.”

This certification further strengthens Digitain’s position as a trusted technology partner for regulated markets. The platform is designed to support sustainable growth, offering operators the flexibility to localise, optimise and scale within strict compliance frameworks. At the same time, Digitain’s UK-certified Sportsbook is built with control and transparency at its core, enabling operators to meet regulatory requirements without compromising on product depth, speed or engagement.

Arshak Muradyan, Group Chief Compliance Officer at Digitain, added: “Securing a UK betting licence alongside full Sportsbook and Platform certification is a clear validation of Digitain’s compliance-first approach. The UK market demands continuous oversight, robust controls, and absolute transparency, and this approval confirms that our systems, processes, and governance structures are built to meet those expectations.”

The post Digitain Secures UKGC Certification for Sportsbook and Platform appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Brasil on Track

ODDSGATE LAUNCHES “BRASIL ON TRACK”, A STRATEGIC PLATFORM FOR NAVIGATING BRAZIL’S REGULATED IGAMING MARKET

As Brazil’s regulated iGaming market completes its first year under Law 14.790/2023, Oddsgate today announced the launch of Brasil on Track, a strategic platform designed to help operators monitor legislation, understand compliance requirements, and make informed decisions in Latin America’s largest economy.

Brasil on Track provides live tracking of regulatory milestones, market indicators, and operational requirements,

connecting legal updates to their business impact and linking directly to official sources.

Brazil’s regulatory landscape has evolved rapidly over the past year. Law 14.790/2023 introduced clearer frameworks for licensing, taxation, and consumer protection, which accelerated international interest and positioned Brazil among the world’s most closely watched regulated iGaming markets.

According to Brazil’s Ministry of Finance, the sector generated an estimated R$36 billion in gross gaming revenue (January-September 2025) and R$3.3 billion in federal tax revenue over the same period, highlighting the market’s scale and momentum.

Source: Brazil’s Ministry of Finance, 2025.

“The regulation brought by Law 14.790/2023 was a major milestone for Brazil’s iGaming sector,” said Valter Delfraro Junior, Oddsgate’s Director of Regulatory Affairs. “It ended years of uncertainty and provided legal security and operational clarity. This new scenario places Brazil’s gaming industry on par with mature markets, increasing our international competitiveness and attractiveness to global investors and partners.”

During the first year of regulation, operators faced extensive requirements, including federal authorization processes, responsible gambling mechanisms, advertising restrictions, and new tax structures. Oddsgate expects the market to continue expanding throughout 2026, with early adopters well-positioned to benefit from greater credibility and market growth.

“We transform regulation into a practical, continuous guide for operating in Brazil with less risk and more clarity,” said Wagner Fernandes, Chief Marketing Officer at Oddsgate. “Brasil on Track helps teams entering, expanding, or optimizing operations decide with context, not guesswork.”

What “Brasil on Track” includes

– Live tracking of active regulation and pending bills;

– An operational roadmap mapping legal changes to required compliance actions;

– Market intelligence, including player demographics and key market indicators;

– Visibility into tax structures, licensing steps, and market-entry requirements;

– Focus areas include KYC, AML, self-exclusion tools, responsible gambling, and consumer protection requirements.

The post ODDSGATE LAUNCHES “BRASIL ON TRACK”, A STRATEGIC PLATFORM FOR NAVIGATING BRAZIL’S REGULATED IGAMING MARKET appeared first on Americas iGaming & Sports Betting News.

-

Book of Sobek5 days ago

Book of Sobek5 days agoHölle Games Releases Book of Sobek

-

Africa5 days ago

Africa5 days agoDive Into a Different Kind of Love This February with Springbok Casino’s ‘Whalentines Month’ and Claim 25 Free Spins

-

ACMA5 days ago

ACMA5 days agoACMA: Six Wagering Providers Breach Gambling Self-Exclusion Rules

-

Danske Spil5 days ago

Danske Spil5 days agoS Gaming lands in Denmark with Danske Spil

-

Australia5 days ago

Australia5 days agoFinalists Announced for Inaugural Regulating the Game Global Awards Following Strong Global Engagement

-

Latest News5 days ago

Latest News5 days agoThunderkick Unveils Pan’s Arcadia, a Utopian Wilderness

-

Colombia4 days ago

Colombia4 days agoZITRO INSTALLS OVER 70 MACHINES ACROSS GRUPO ALADDIN CASINOS IN COLOMBIA

-

Alex Baliukonis Game Producer at BGaming5 days ago

Alex Baliukonis Game Producer at BGaming5 days agoExperience Olympic Excitement in BGaming’s Winter Trophy Hold & Win